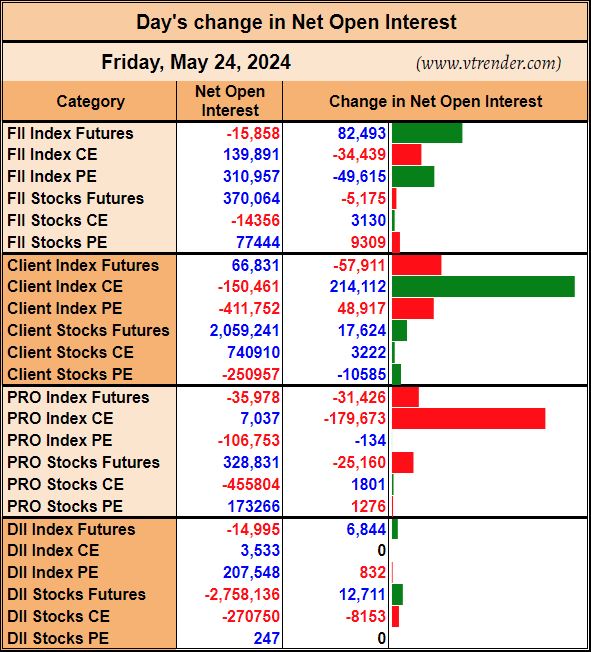

Weekly changes in Participantwise Open Interest

-

FIIs have added 149K long Index Futures, net 97K short Index CE, 154K short Index PE and net 96K long Stocks Futures contracts this week besides covering 81K short Index Futures contracts and liquidating 57K long Index PE contracts.

-

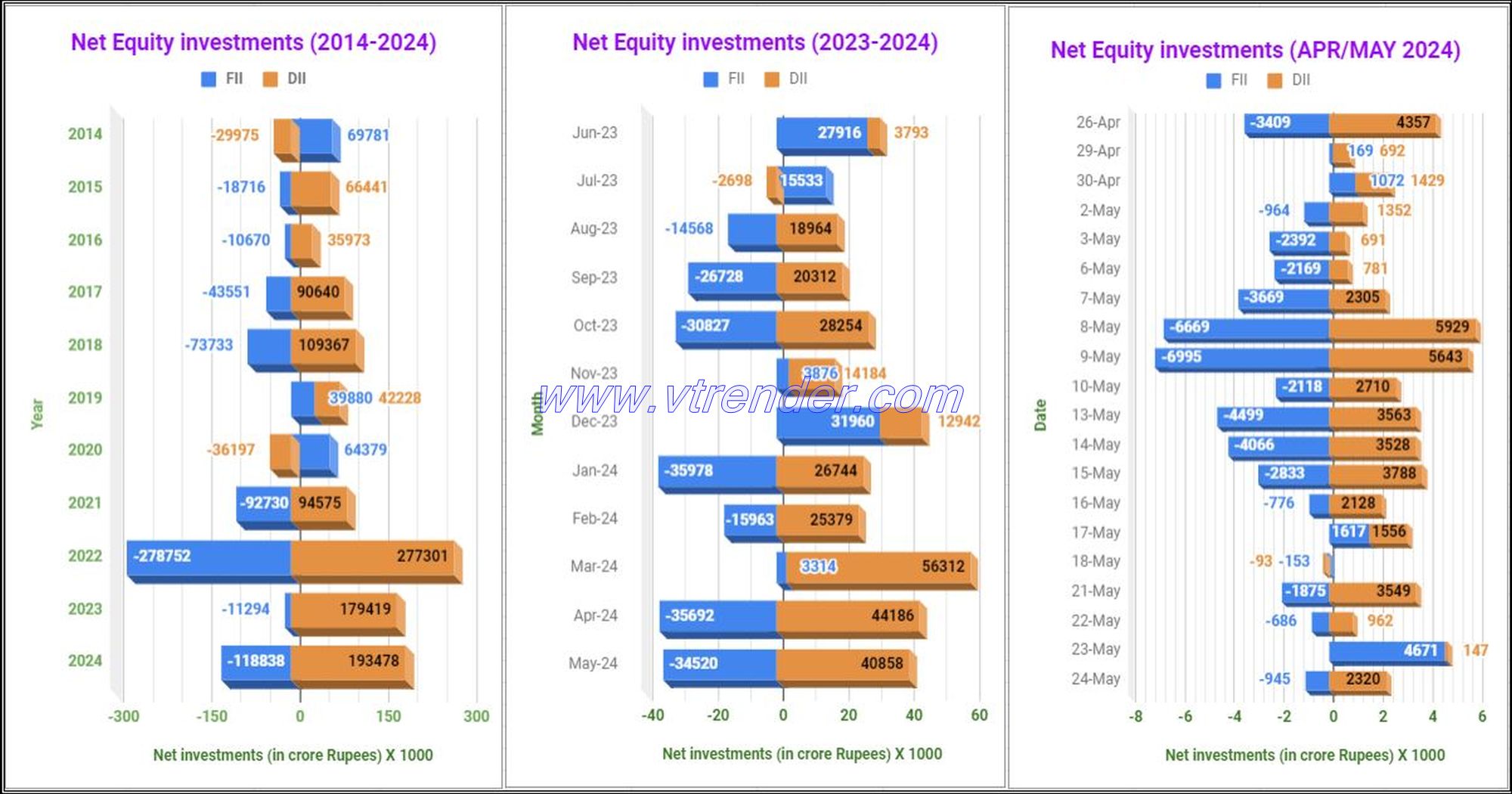

FIIs have been net buyers in equity segment for ₹1166 crore during the week.

-

Clients have added 136K short Index Futures, 127K long Index CE, 376K long Index PE and 13K short Stocks Futures contracts this week besides liquidating 66K long Index Futures and 45K long Stocks Futures contracts. They have also covered 88K short Index CE and 25K short Index PE contracts.

-

Proprietary traders (PRO) have added 32K short Index Futures and 82K short Stocks Futures contracts this week besides liquidating 2K long Index Futures and 34K long Stocks Futures contracts. They have shed Open Interest in Index Options during the week.