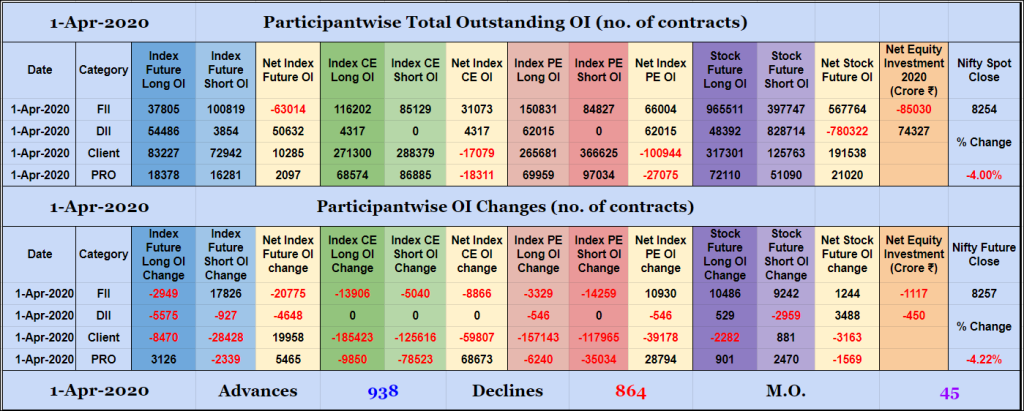

Participantwise Open Interest – 1st APR 2020

FIIs added 17K short Index Futures and net 1K long Stocks Futures contracts, liquidated 2K long Index Futures contracts and reduced exposure in Index Options. They were net sellers in equity segment for ₹1117 crore. Clients reduced exposure in Index Futures as well as Index Options. Nifty APR shed 3665 contracts in Open Interest, even […]

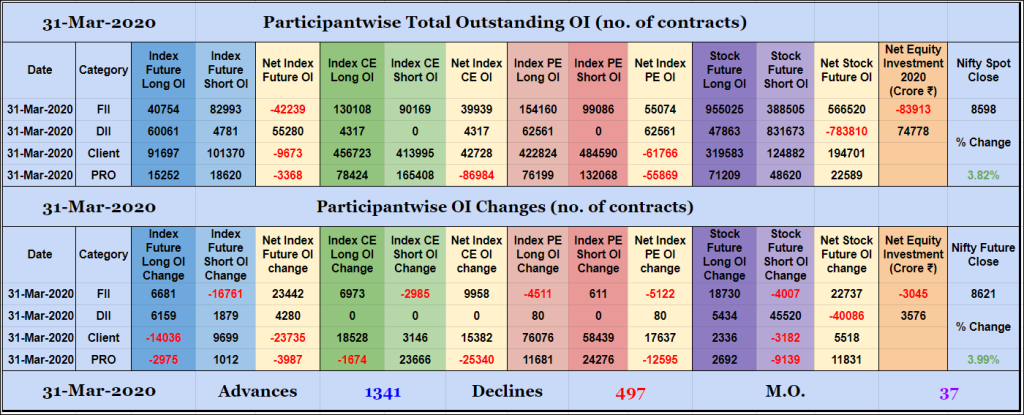

Participantwise Open Interest – 31st MAR 2020

FIIs added 6K long Index Futures, 6K long Index CE and 18K long Stocks Futures contracts while covering 16K short Index Futures, 2K short Index CE and 4K short Stocks Futures contracts and liquidating 4K long Index PE contracts. They were net sellers in equity segment for ₹3045 crore. Clients have added 9K short Index […]

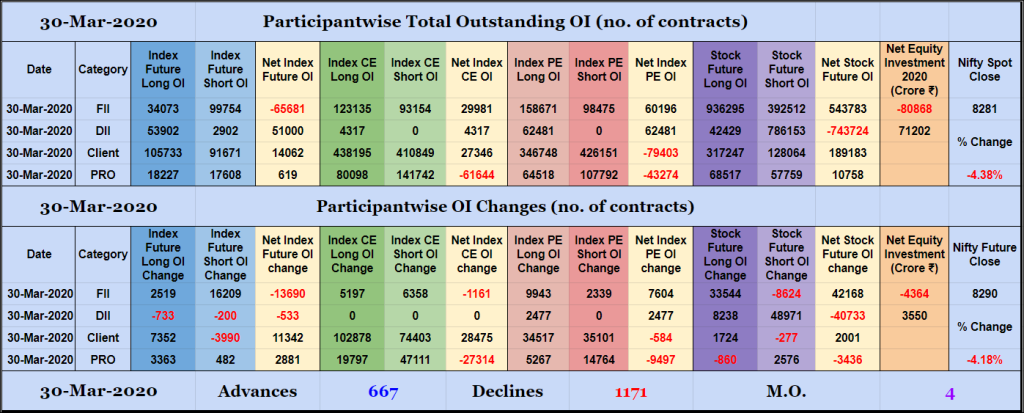

Participantwise Open Interest – 30th MAR 2020

FIIs added net 13K short Index Futures, net 1K short Index CE, net 7K long Index PE and 33K long Stocks Futures contracts today besides covering 8K short Stocks Futures contracts. They were net sellers in equity segment for ₹4364 crore. Clients added 7K long Index Futures, net 28K long Index CE and 1K long […]

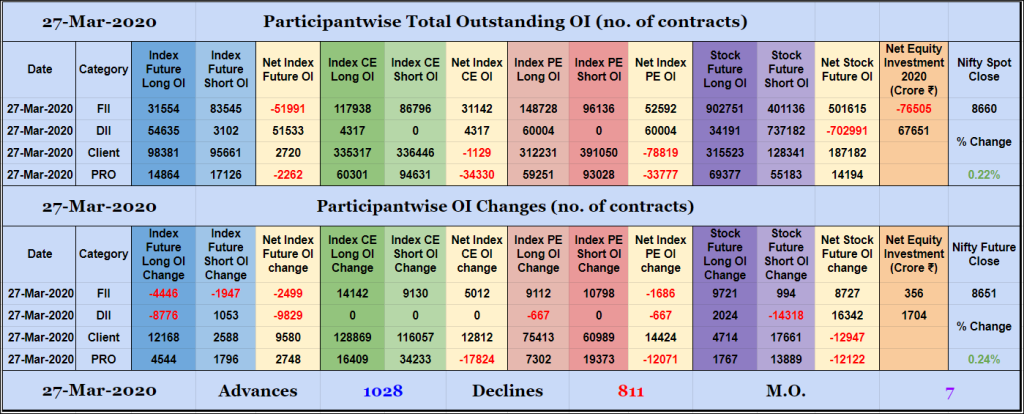

Participantwise Open Interest – 27th MAR 2020

FIIs added net 5K long Index CE, net 1K short Index PE and net 8K long Stocks Futures contracts today but reduced exposure in Index Futures. They were net buyers in equity segment for ₹356 crore. Clients added net 9K long Index Futures, net 12K long Index CE, net 14K long Index PE and net […]

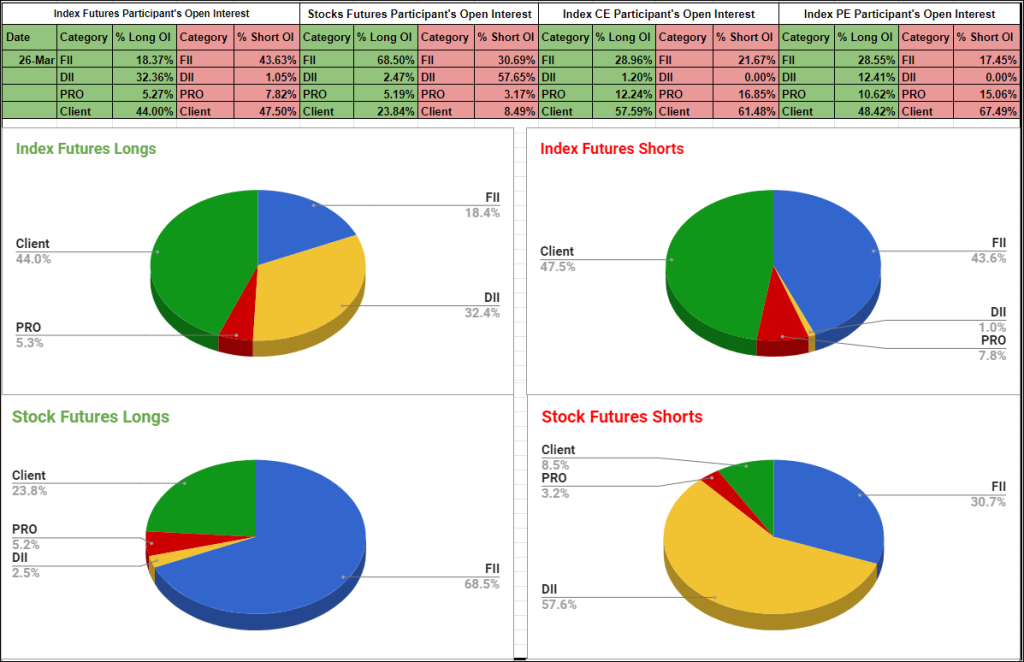

Participantwise Open Interest – 26th MAR 2020

Series view At the close of MAR series FIIs are holding 18% of long Open Interest and 44% of short Open Interest in Index Futures, they are back to net shorts in Index Futures after just two days. In Stocks Futures, however, FIIs are holding 69% of long and 31% of short Open Interest. Clients are […]

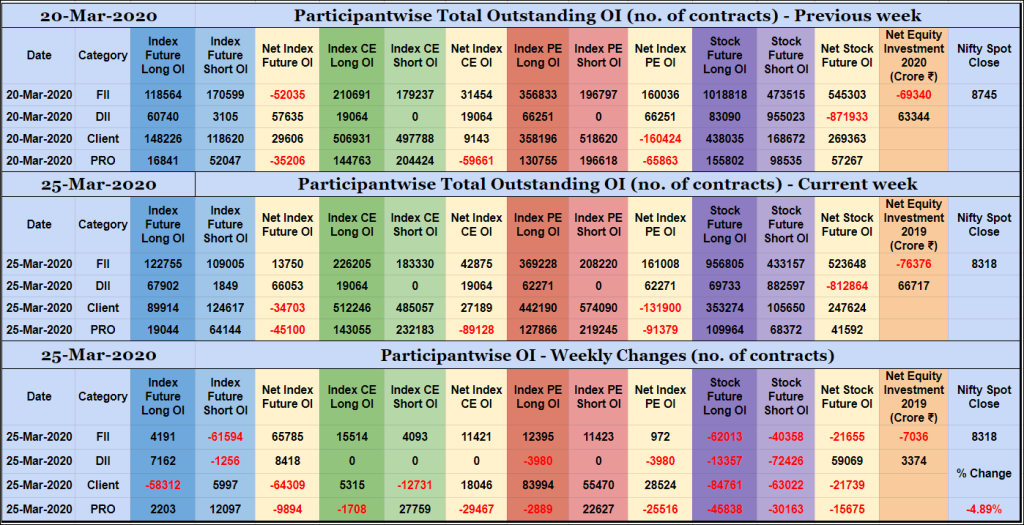

Participantwise Open Interest – 25th MAR 2020

Mid-week view FIIs have added 4K long Index Futures and net 11K long Index CE contracts this week, covered 61K short Index Futures contracts and reduced exposure in Stocks Futures. They have been net sellers in equity segment for ₹7036 crore during the week. Clients have added 6K short Index Futures, 5K long Index CE […]

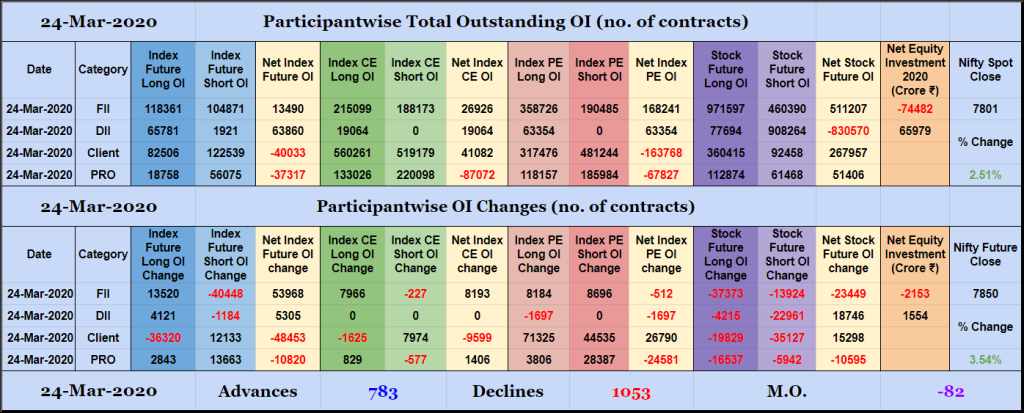

Participantwise Open Interest – 24th MAR 2020

FIIs added 13K long Index Futures and 7K long Index CE contracts, covered 40K short Index Futures contracts and reduced exposure in Stocks Futures. They were net sellers in equity segment for ₹2153 crore. FIIs are net long in Index Futures after a gap of more then two months. Clients added 12K short Index Futures, […]

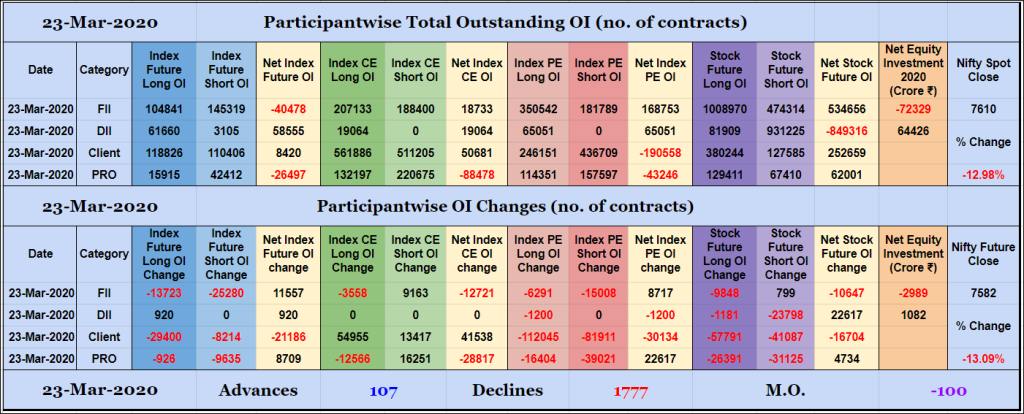

Participantwise Open Interest – 23rd MAR 2020

FIIs added 9K short Index CE contracts while reducing exposure in Index Futures, Index PE and Stocks Futures. They were net sellers in equity segment for ₹2989 crore. Clients added net 41K long Index CE contracts but reduced exposure in Index Futures, Index PE and Stocks Futures. Nifty MAR shed 37529 contracts in Open Interest, […]

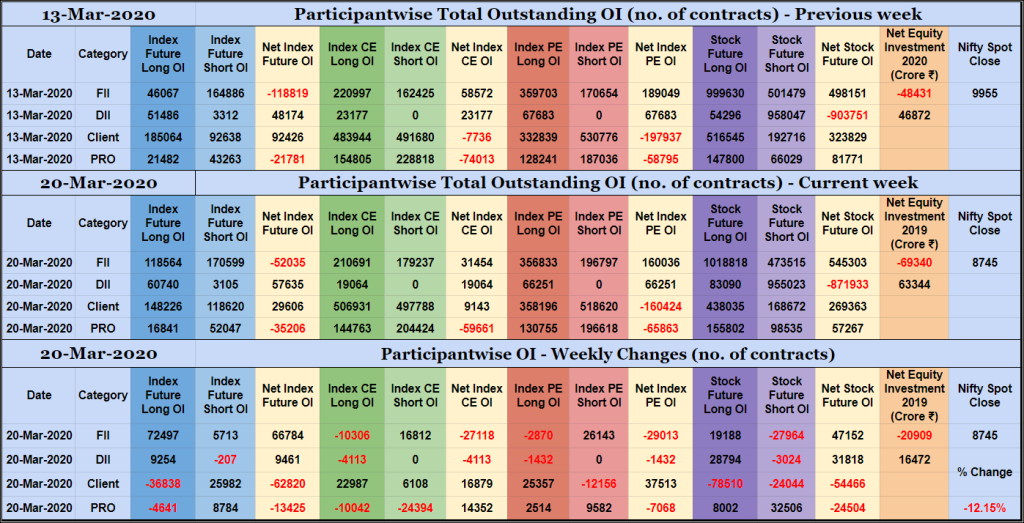

Participantwise Open Interest – 20th MAR 2020

Weekly view FIIs have added net 66K long Index Futures, 16K short Index CE, 26K short Index PE and 19K long Stocks Futures contracts this week besides liquidating 10K long Index CE, 2K long Index PE and covering 27K short Stocks Futures contracts. They have been net sellers in equity segment for ₹20909 crore during the […]

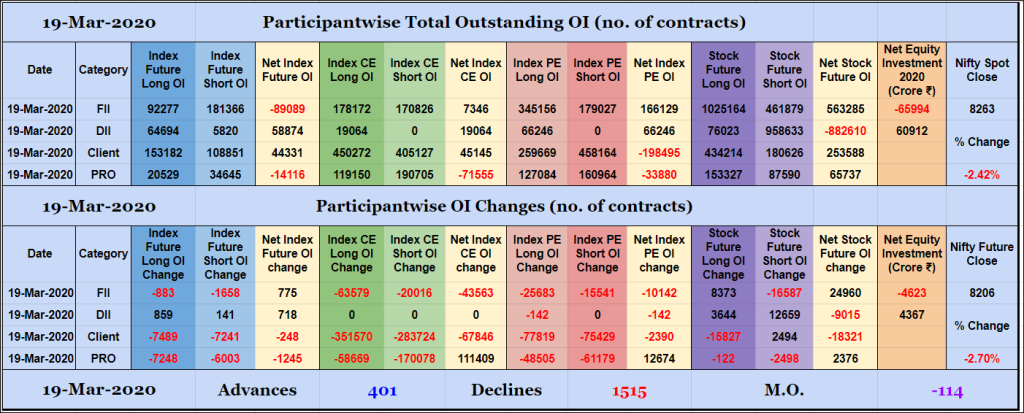

Participantwise Open Interest – 19th MAR 2020

FIIs added 8K long Stocks Futures contracts while reducing exposure in Index Futures and Index Options. They were net sellers in equity segment for ₹4623 crore. Clients also reduced exposure in Index Futures and Index Options while adding 2K long Stocks Futures contracts. Nifty MAR shed 11696 contracts with APR/MAY OI going up by 4963 […]