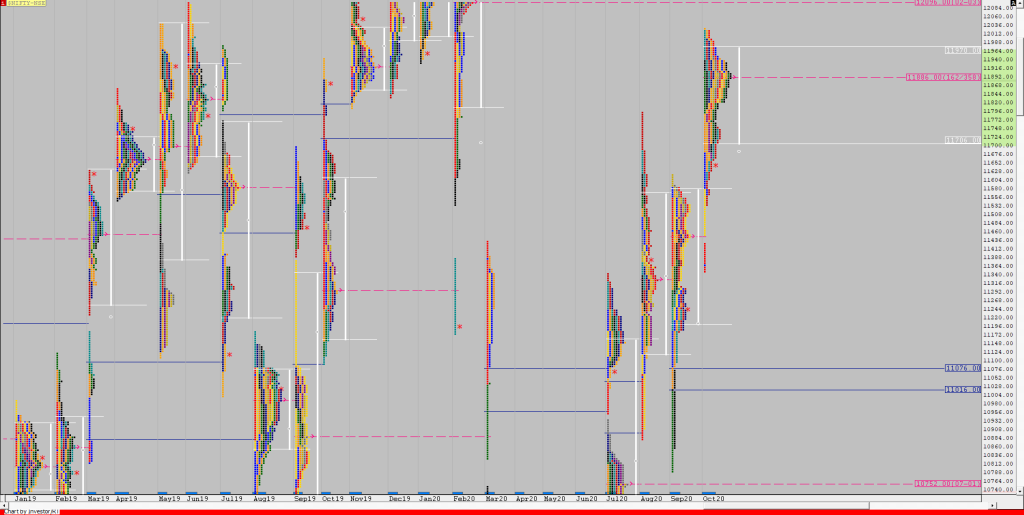

Market Profile Analysis dated 25th November 2020

Nifty Nov F: 12859 [ 13138 / 12844 ] NF made a hat-trick of gap up opens this week as it tagged 13137 at open almost completing the 2 ATR objective of 13141 from Monday’s FA of 12825 and remained in a very narrow 41 point range in the IB (Initial Balance) indicating poor trade […]

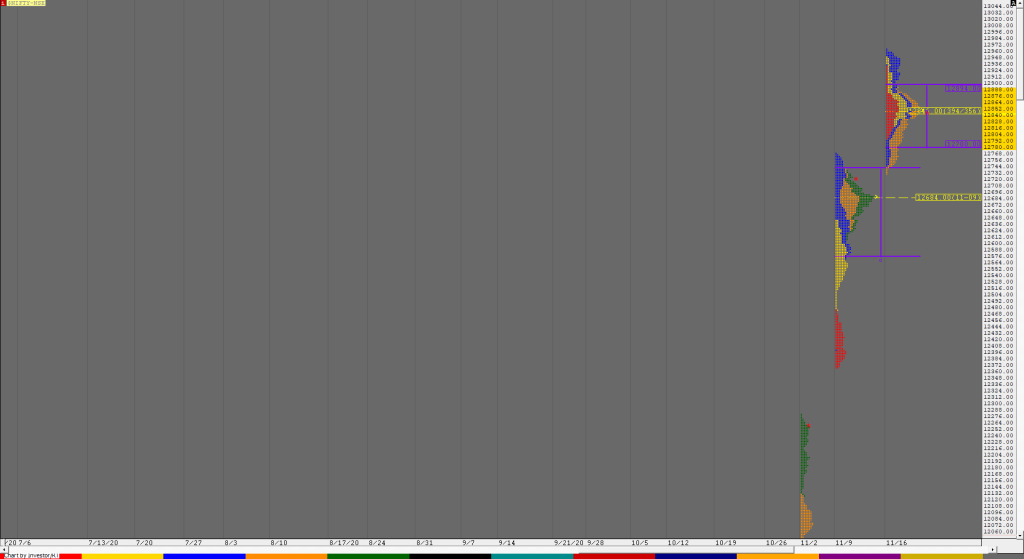

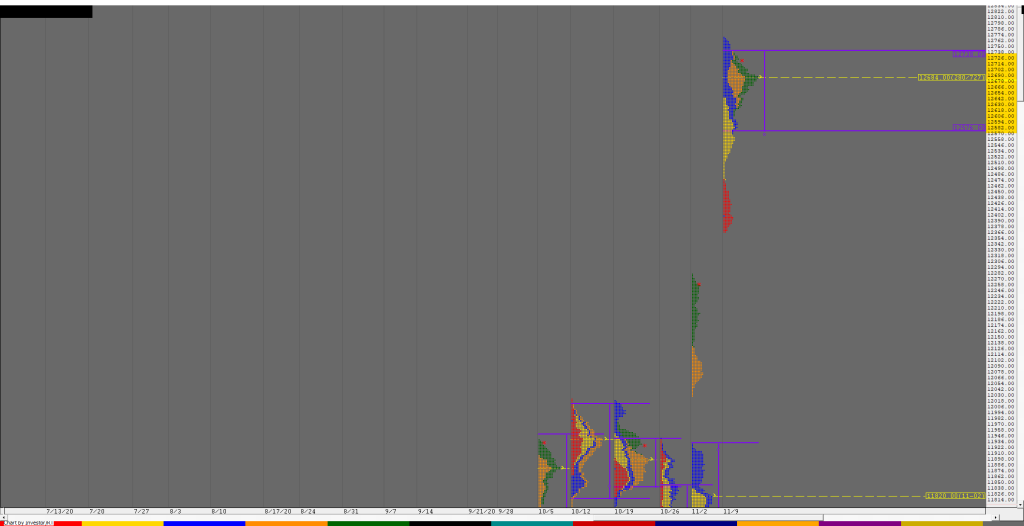

Order Flow charts dated 25th November 2020

Many traders are looking for information on how to use market conditions to find good trades. Order Flow is best understood as a way to see existing bias in the markets. Order Flow helps us understand who is in control of the market and who is ‘upside down’ and likely to make exits from that […]

Market Profile Analysis dated 24th November 2020

Nifty Nov F: 13062 [ 13081 / 12965 ] NF opened higher and got rejected when it probed back into previous day’s range indicating presence of initiative buyers which was further confirmed by a buying tail the acution left in the IB as it made new highs for the series at 13039. NF then made […]

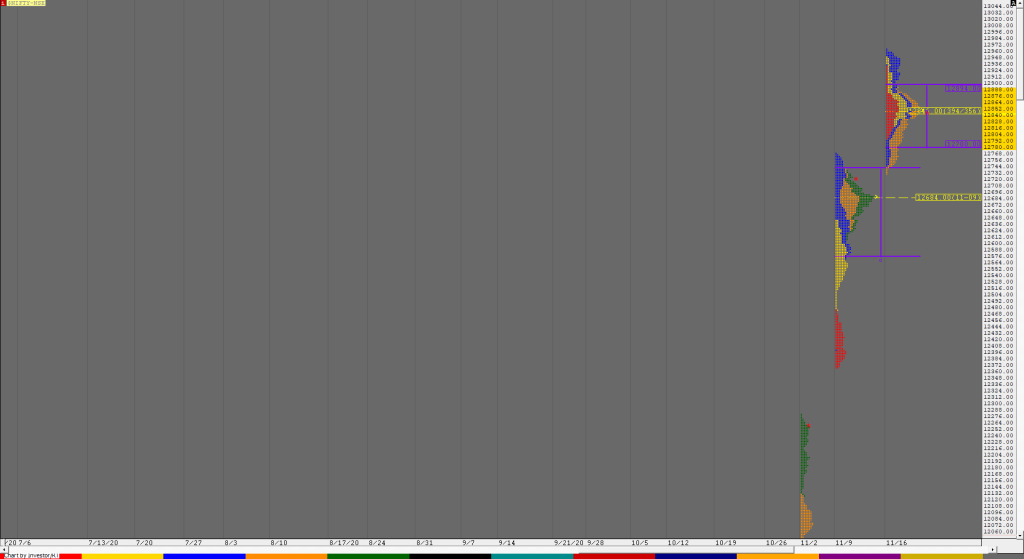

Order Flow charts dated 24th November 2020

Many traders are used to viewing volume as a histogram beneath a price chart. But the Order Flow approach shows the amount of volume traded during each price bar, and also it breaks this volume down into the Volume generated by the Buyers and the Volume generated by the sellers again at every row of […]

Market Profile Analysis dated 23rd November 2020

Nifty Nov F: 12934 [ 12978 / 12825 ] NF opened higher but reversed the probe to the downside after making a high of 12955 in the opening minutes as it formed a relatively big IB (Initial Balance) range of 105 points taking support just above Friday’s extension handle of 12849. The auction then had […]

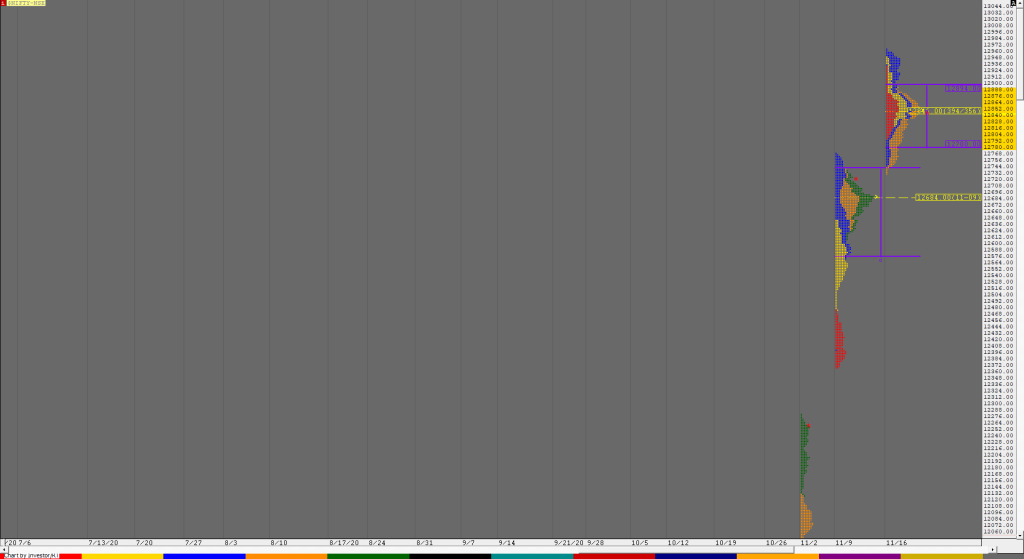

Order Flow charts dated 23rd November 2020

When we think about how to measure volume in the market one of the keys is Order Flow. It plays a role by telling us what the other traders have done in the market and are currently doing and this provides valuable clues and potential opportunities to trade. An Order Flow trader can actually see […]

Market Profile Analysis dated 20th November 2020

Nifty Nov F: 12871 [ 12910 / 12744 ] NF opened in the NeuX zone of 12753 to 12860 but was unable to get above it as it made a typical C side extension getting rejected at 12849 which triggered a move lower resulting in couple of REs (Range Extension) in the D & E […]

Weekly Charts (17th to 20th November 2020) and Market Profile Analysis

Nifty Spot Weekly Profile (17th to 20th Nov 2020) Spot Weekly – 12859 [ 12963 / 12730 ] Previous week’s report ended with this ‘The weekly profile is a well balanced one with completely higher Value at 12576-12684-12738 looking like a composite ‘p’ and would need initiative volumes to move away here in the coming […]

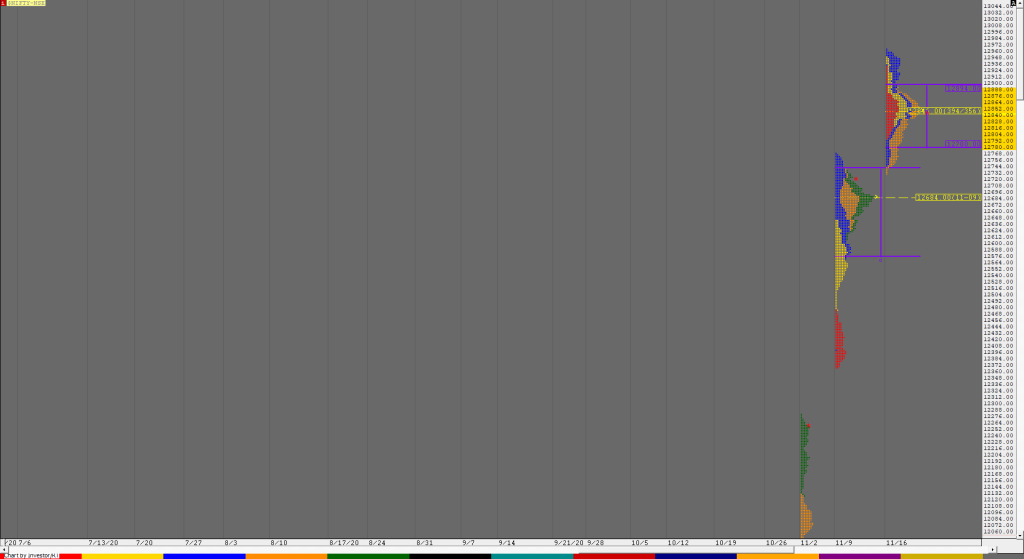

Order Flow charts dated 20th November 2020

Timing is the key to successfully trade the markets in the shorter time frame. Order Flow is one of the most effective methods to time your trades by seeing exactly what the other traders are trading in the market and positioning your bias accordingly. Order Flow is the most transparent way to trade and takes […]

Market Profile Analysis dated 19th November 2020

Nifty Nov F: 12793 [ 12976 / 12753 ] NF rejected previous day’s NeuX close as it opened with a gap down of 100 points but made an OL (Open=Low) start at 12857 after which it drove higher from yPOC of 12870 in the IB (Initial Balance) to retrace the entire gap as it made […]