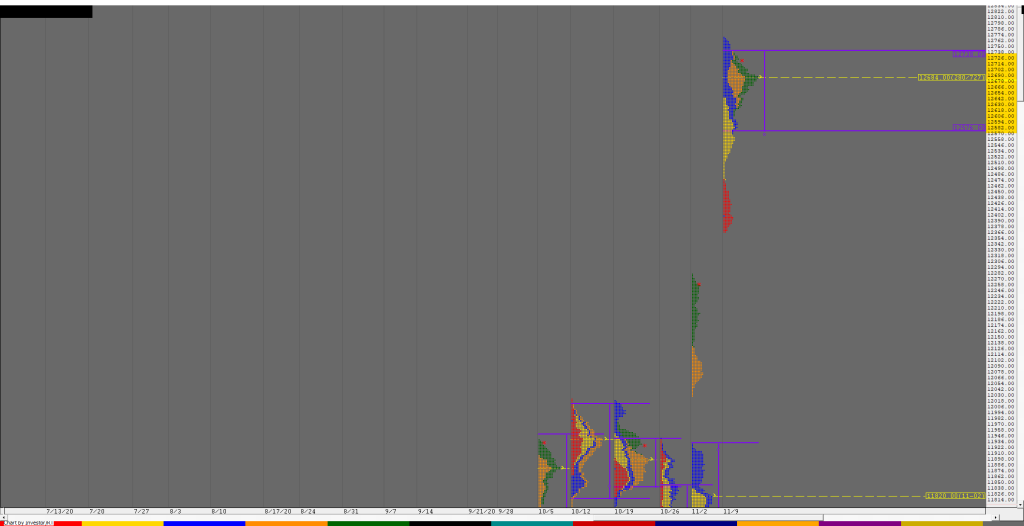

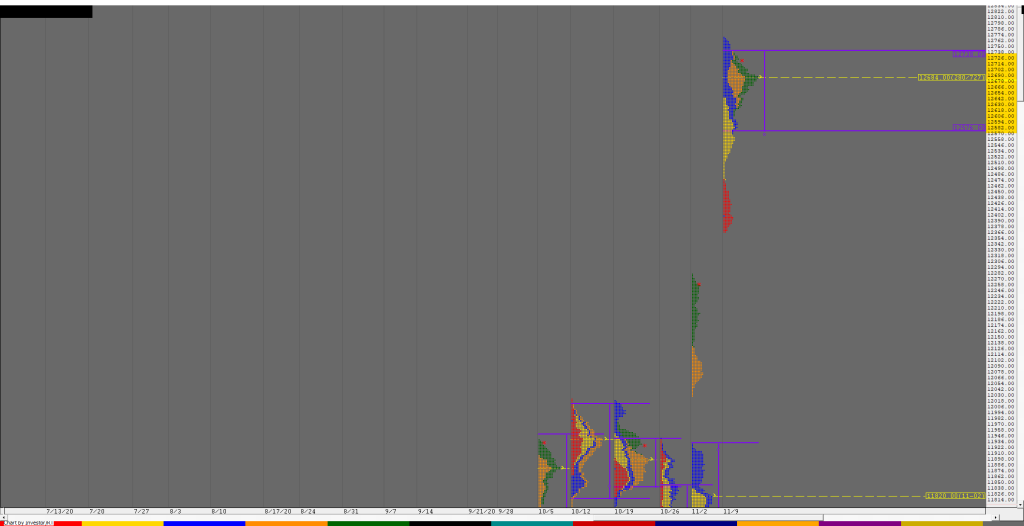

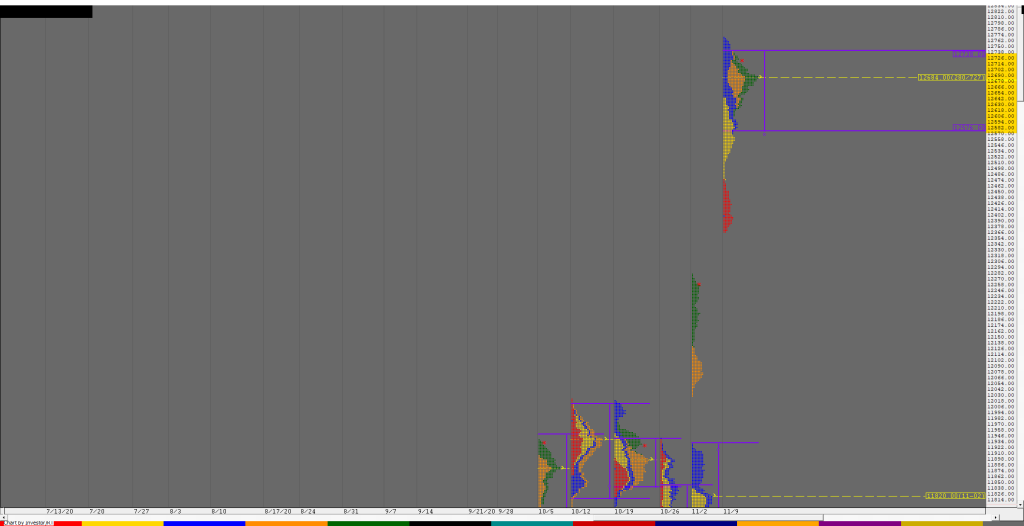

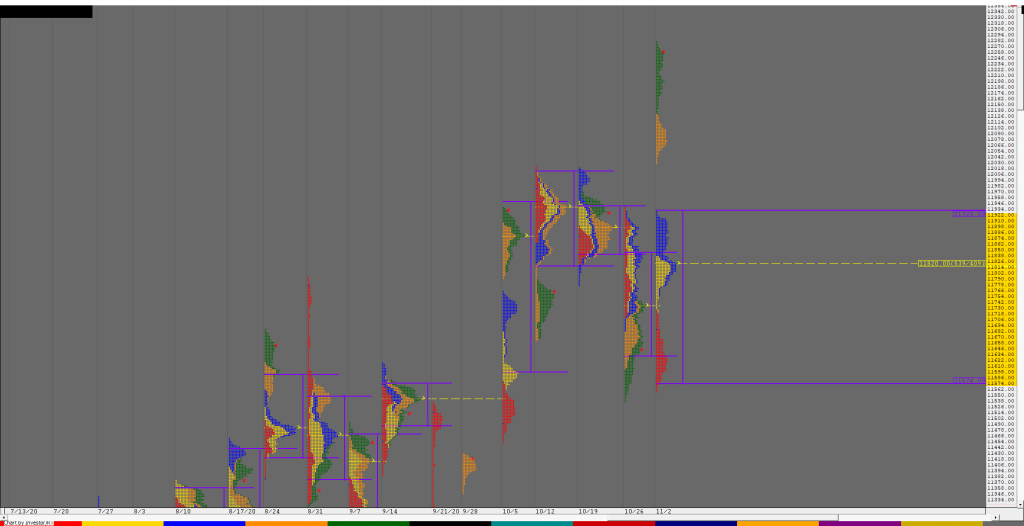

Order Flow charts dated 19th November 2020

The key to using Order Flow trading is to determine market depth. This describes the places where Market participants have taken positions or the zone they have transacted. The Order Flow is like a list of trades and helps to know how other traders are placed in the market. Vtrender helps you to stay on […]

Market Profile Analysis dated 18th November 2020

Nifty Nov F: 12957 [ 12966 / 12833 ] NF made a rare OAIR (Open Auction In Range) start and stalled right at PDH (Previous Day High) in the opening minutes after which it remained in a narrow 51 point range in the IB (Initial Balance) and continued to coil in the C period where […]

Order Flow charts dated 18th November 2020

Trading Order Flow allows a trader to see the specific price where a trade has hit the market, along with the volume of that trade. This information is extremely valuable and allows a trader to generate substantial revenue by using this information to trade. The way we see it is that Order Flow trading is […]

Order Flow charts dated 18th November 2020 (5 mins)

The way we see it is that Order Flow trading is a mindset. Well, instead of just looking for technical patterns, Trader should go a step further and think about what other market participants might do. NF BNF

Market Profile Analysis dated 17th November 2020

Nifty Nov F: 12882 [ 12907 / 12801 ] NF opened with a huge gap up of 144 points continuing the Diwali Celebration as it moved away from the 3-day composite but did not find any fresh demand and settled down into yet another OAOR (Open Auction Out of Range) as it made a slow […]

Order Flow charts dated 17th November 2020

Many traders are used to viewing volume as a histogram beneath a price chart. This approach shows the amount of volume traded below the price Bar. The Order Flow approach is to see the Volume traded inside or within the price bar, an important distinction. Order Flow trading is thinking about what order market participants […]

Market Profile Analysis dated 13th November 2020

Nifty Nov F: 12753 [ 12765 / 12612 ] NF opened with a gap down of 81 points probing below PDL (Previous Day Low) as it hit a low of 12612 in the opening minutes but settled down into an OA (Open Auction) where it formed a narrow range IB (Initial Balance) of just 51 […]

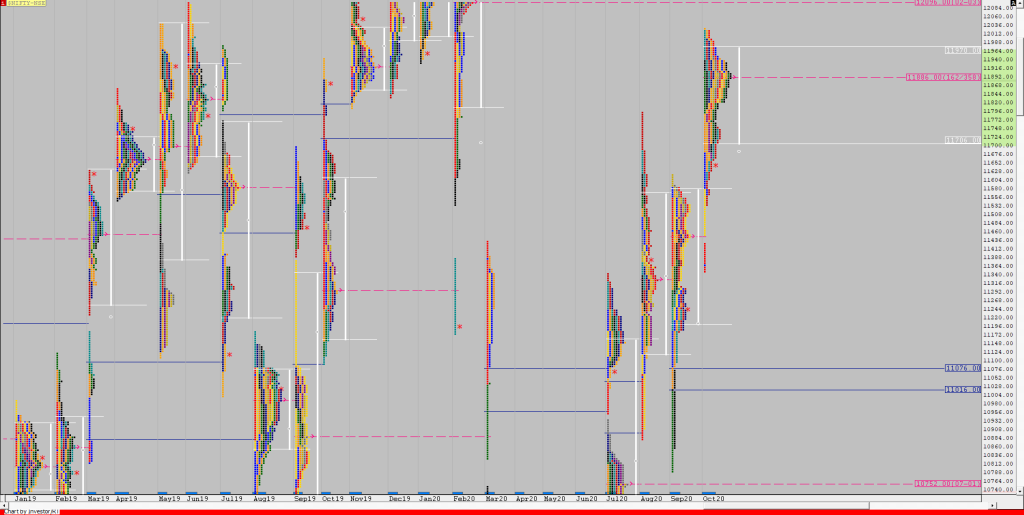

Weekly charts (09th to 13th November 2020) and Market Profile Analysis

Nifty Spot Weekly Profile (09th to 13th Nov 2020) Spot Weekly – 12720 [ 12769 / 12367 ] Previous week’s report ended with this ‘The weekly profile is that of a Trend Up one with overlapping Value at 11574-11820-11928 but the immediate reference in the coming week would be Friday’s POC of 12245 & the […]

Order Flow charts dated 13th November 2020

A good trader is a one who can make money consistently over a longer period of time. But how to become one such trader, who can make money in any type of market condition? A good trader keeps a close watch on the current information of the market and assesses it for change against previous […]

Market Profile Analysis dated 12th November 2020

Nifty Nov F: 12706 [ 12749 / 12638 ] NF opened lower for the first time in November and showed clear rejection from previous day’s POC of 12738 as it remained below it all day filling up the low volume zone of prior profile and for the second day running the sellers were able to […]