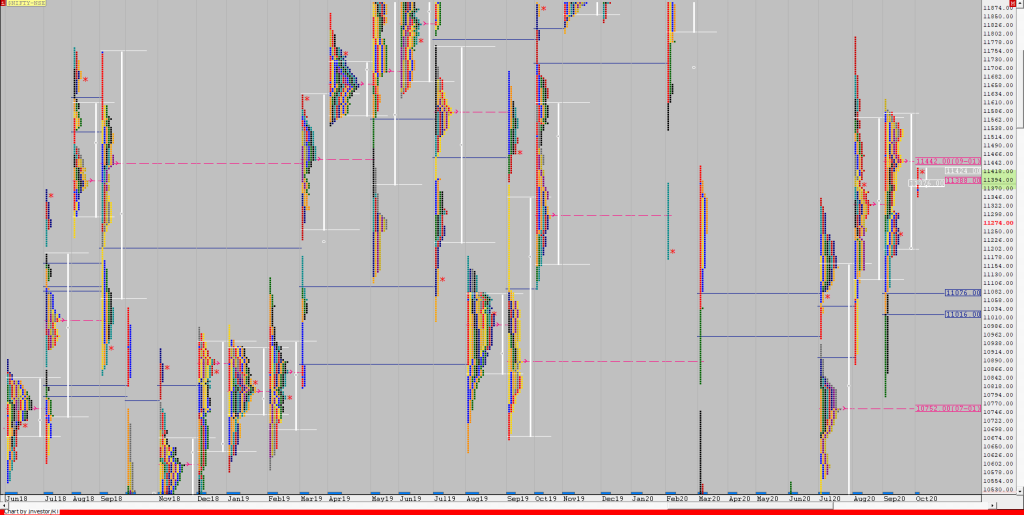

Market Profile Analysis dated 02nd November 2020

Nifty Nov F: 11681 [ 11735 / 11560 ] NF opened with a drive down on good volumes after making an almost OH (Open=High) start at 11685 as it fell by 125 points in the IB (Initial Balance) making a low of 11560 in the ‘B’ period. This drive down however got negated in the […]

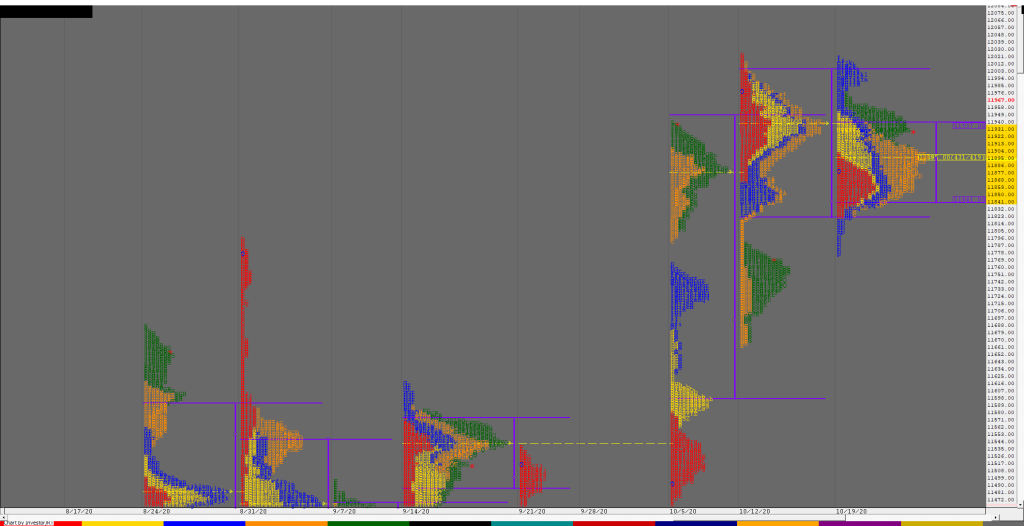

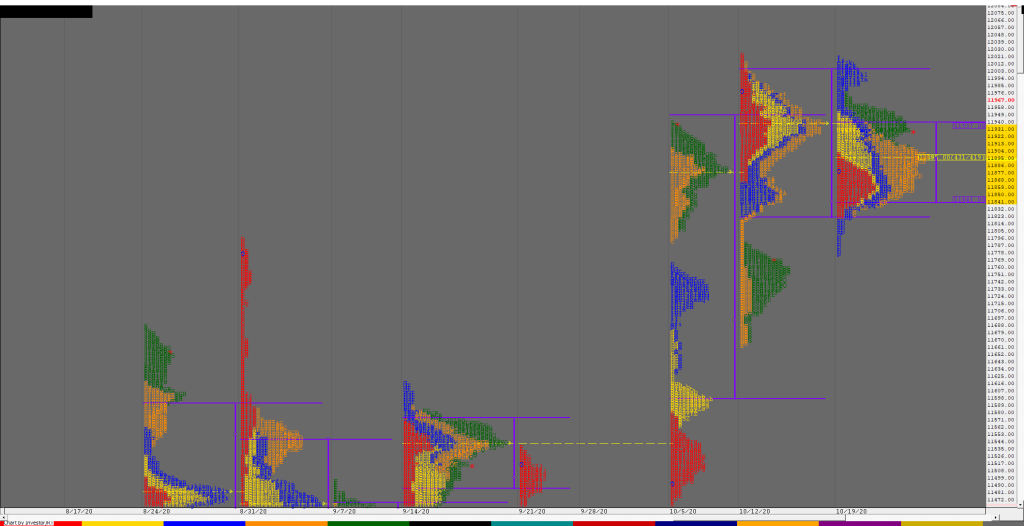

Order Flow charts dated 02nd November 2020

Many traders are looking for information on how to use market conditions to find good trades. Order Flow is best understood as a way to see existing bias in the markets. Order Flow helps us understand who is in control of the market and who is ‘upside down’ and likely to make exits from that […]

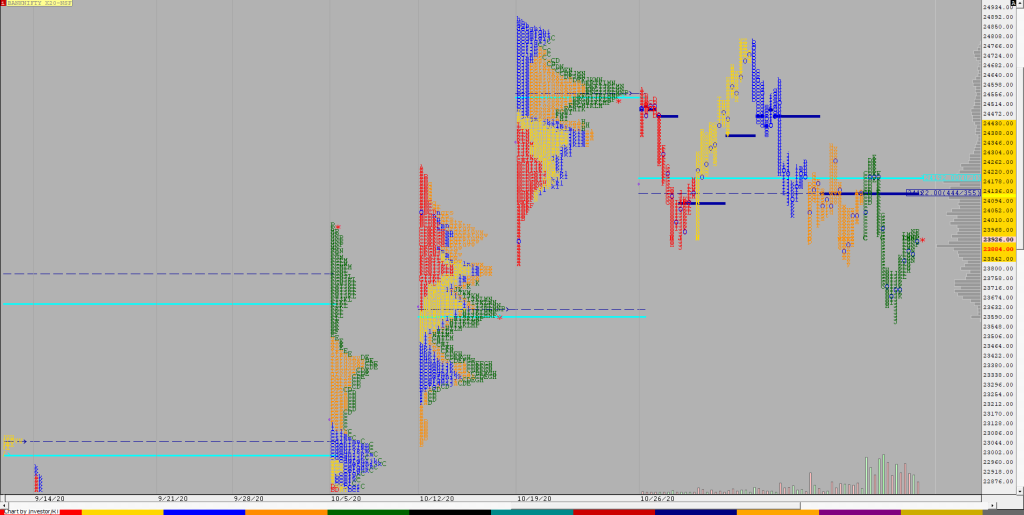

Market Profile Analysis dated 30th October 2020

Nifty Nov F: 11638 [ 11746 / 11515 ] NF made a drive like open on the upside as it seemed to give a move away from previous Value even leaving a buying tail from 11708 to 11632 in the IB (Initial Balance) where it made a high of 11746 but could not get above […]

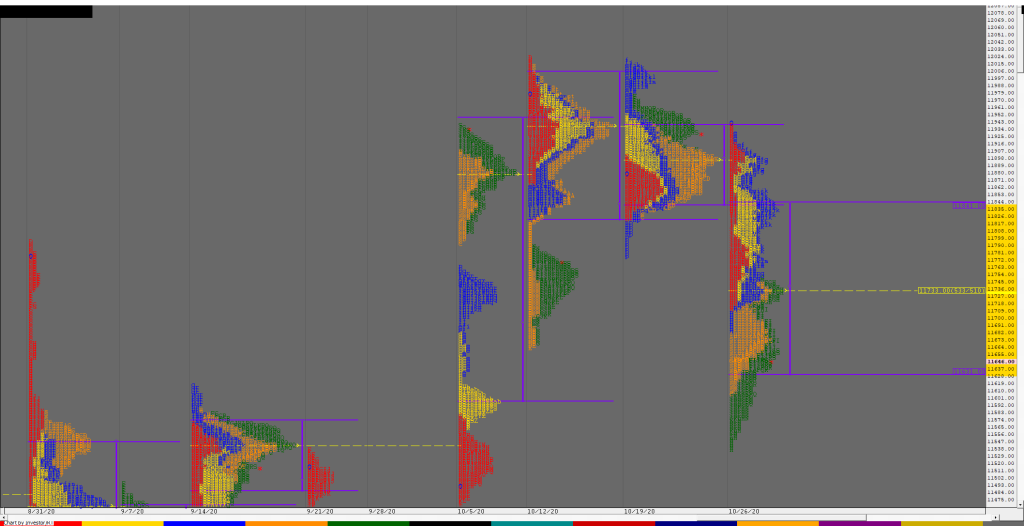

Weekly charts (26th to 30th October 2020) and Market Profile Analysis

Nifty Spot Weekly Profile 26th to 30th Oct 2020) Spot Weekly – 11642 [ 11943 / 11535 ] Previous week’s report ended with this ‘The weekly profile with Value at 11841-11895-11937 is a well balanced one with both the Range & Value prevailing inside previous week. On the smaller time frame, the auction is stuck […]

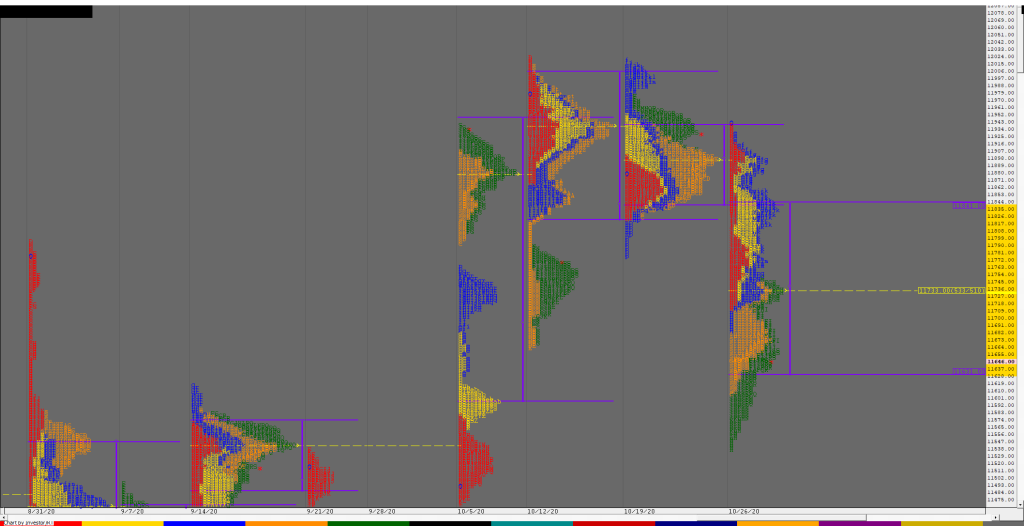

Monthly charts (October 2020) and Market Profile Analysis

Nifty Spot – 11642 [ 12025 / 11347 ] Monthly Profile (October 2020) Previous month’s report ended with this ‘The monthly Value was mostly inside previous month’s Value at 11202-11559-11580 and even the range was mostly inside except for the 2 days where it it was swiftly rejected leaving daily extension handles at 11015 & […]

Order Flow charts dated 30th October 2020

Many traders are used to viewing volume as a histogram beneath a price chart. But the Order Flow approach shows the amount of volume traded during each price bar, and also it breaks this volume down into the Volume generated by the Buyers and the Volume generated by the sellers again at every row of […]

Market Profile Analysis dated 29th October 2020

Nifty Nov F: 11668 [ 11747 / 11610 ] NF opened with a big gap down as it made new lows for the week at 11627 but turned into an OAOR (Open Auction Out of Range) as it got back into previous day’s range in the ‘B’ period where it made a high of 11715 […]

Order Flow charts dated 29th October 2020

When we think about how to measure volume in the market one of the keys is Order Flow. It plays a role by telling us what the other traders have done in the market and are currently doing and this provides valuable clues and potential opportunities to trade. An Order Flow trader can actually see […]

Market Profile Analysis dated 28th October 2020

Nifty Oct F: 11721 [ 11918 / 11675 ] NF did the opposite of previous day’s open as it probed higher scaling above PDH (Previous Day High) but got rejected confirming a late ORR (Open Rejection Reverse) as it left a small but important selling tail in the IB (Initial Balance) outside previous day’s range […]

Order Flow charts dated 28th October 2020

Timing is the key to successfully trade the markets in the shorter time frame. Order Flow is one of the most effective methods to time your trades by seeing exactly what the other traders are trading in the market and positioning your bias accordingly. Order Flow is the most transparent way to trade and takes […]