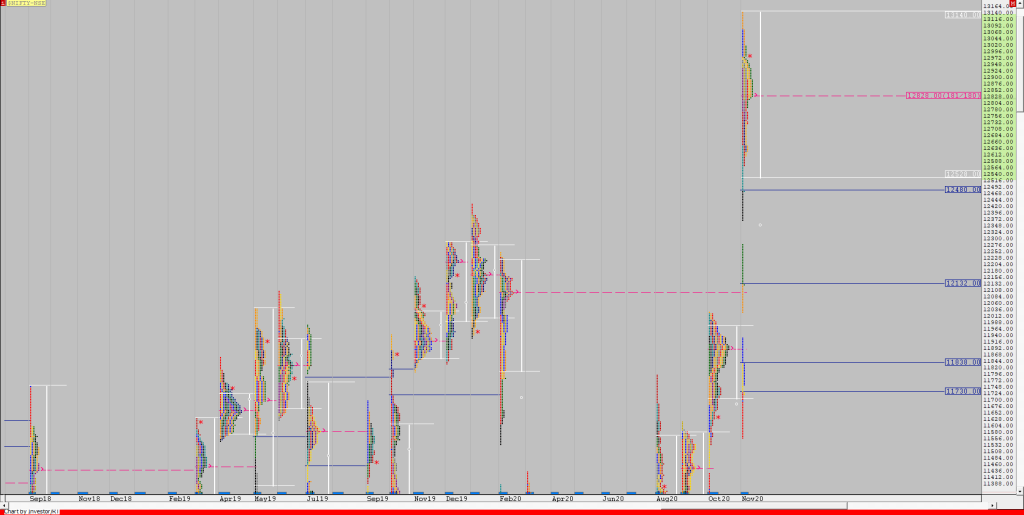

Performance update of MarketProfile strategies used in the Vtrender Trading Room

As 2020, came to a close, we kept up with our unique trading strategies which we have evolved through years in the application of the MarketProfile and the Orderflow. These strategies are explained in depth in the Training Library at – https://vtrender.com/traininglibrary/ There are 12 basic lessons which form the basis for all the strategies […]

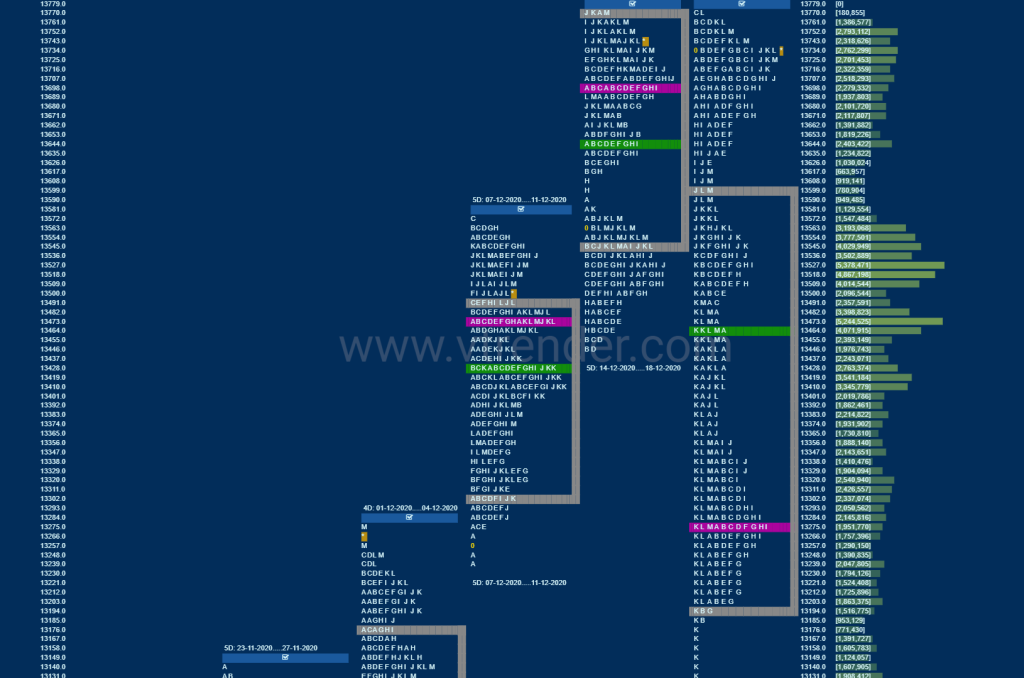

Monthly charts (December 2020) and Market Profile Analysis

Nifty Spot – 13982 [ 14025 / 12963 ] Monthly Profile (December 2020) Previous month’s report ended with this ‘The monthly profile once again represents a ‘p’ shape with a huge range of 1588 points which saw a trending move higher in the first half with multiple extension handles but formed a large composite in […]

Order Flow charts dated 01st January 2021

A good trader is a one who can make money consistently over a longer period of time. But how to become one such trader, who can make money in any type of market condition? A good trader keeps a close watch on the current information of the market and assesses it for change against previous […]

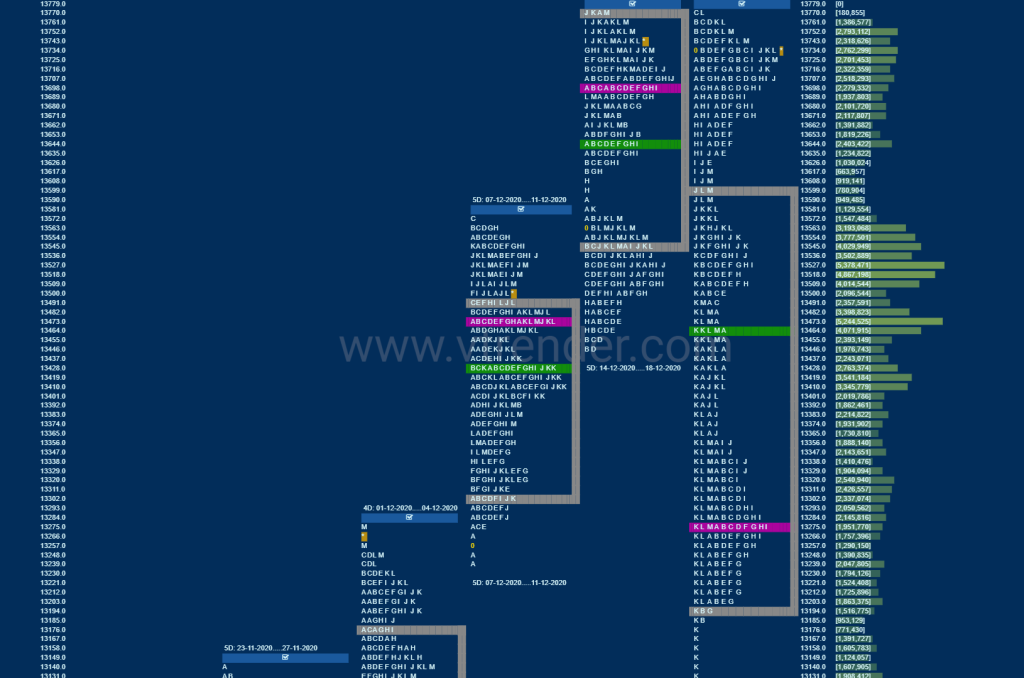

Market Profile Analysis dated 31st December 2020

Nifty Jan F: 14009 [ 14053 / 13955 ] NF did close 2020 on all time highs but has also left a FA (Failed Auction) at 14053 along with a buying tail on the downside from 13985 to 13955 leaving a Neutral Day with a prominent POC at 14026. The auction has also formed a […]

Order Flow charts dated 31st December 2020

Many traders are used to viewing volume as a histogram beneath a price chart. This approach shows the amount of volume traded below the price Bar. The Order Flow approach is to see the Volume traded inside or within the price bar, an important distinction. Order Flow trading is thinking about what order market participants […]

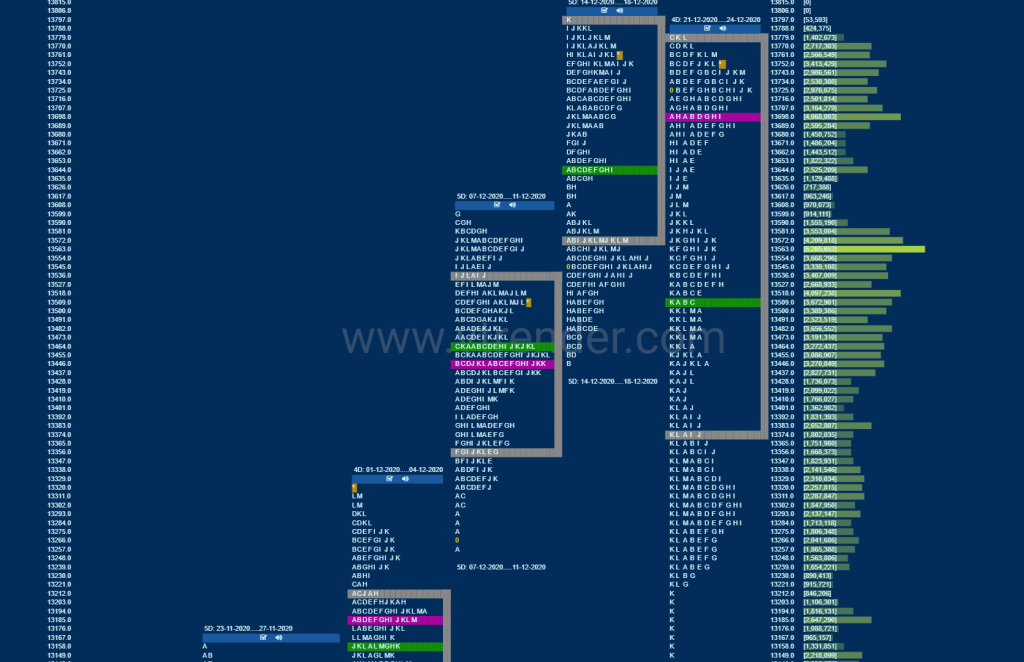

Market Profile Analysis dated 30th December 2020

Nifty Dec F: 13977 [ 13985 / 13871 ] NF continued the trend of opening higher with the fourth consecutive gap up as it tagged the 2 ATR objective of 13983 from the FA of 13641 but was swiftly rejected from 13985 as it not only got back into previous day’s range but completed the […]

Order Flow charts dated 30th December 2020

Many traders are looking for information on how to use market conditions to find good trades. Order Flow is best understood as a way to see existing bias in the markets. Order Flow helps us understand who is in control of the market and who is ‘upside down’ and likely to make exits from that […]

Market Profile Analysis dated 29th December 2020

Nifty Dec F: 13935 [ 13965 / 13868 ] NF made a hat-trick of gap up opens and stayed well above PDH (Previous Day High) while making a low of 13926 in the opening minutes but could not tag the 2 ATR target of 13983 from the FA of 13641 & formed a very narrow […]

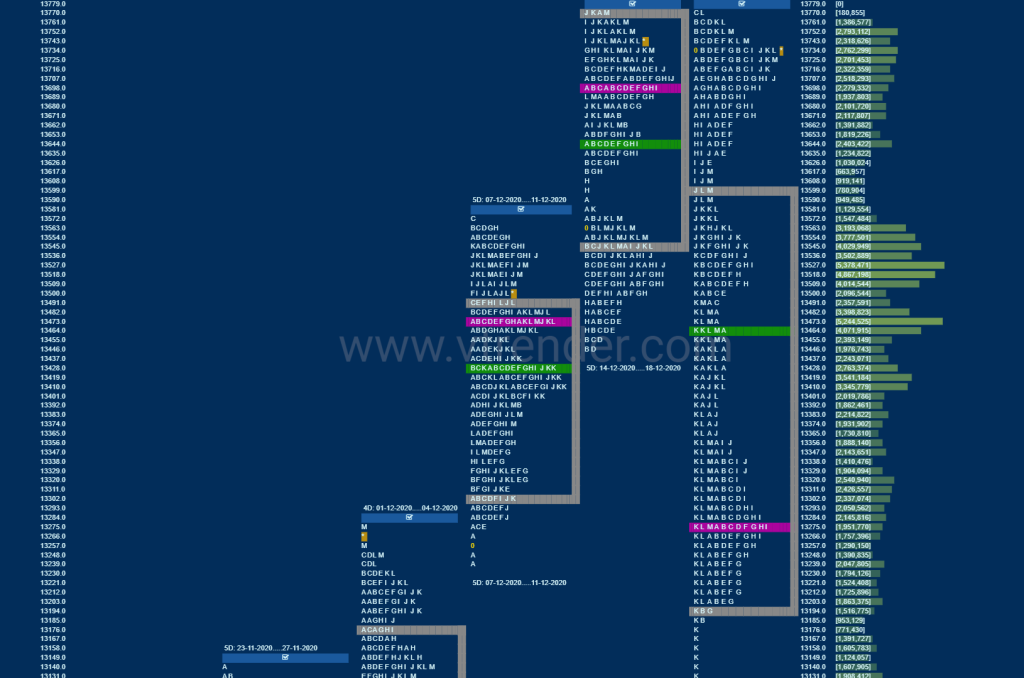

Order Flow charts dated 29th December 2020

Many traders are used to viewing volume as a histogram beneath a price chart. But the Order Flow approach shows the amount of volume traded during each price bar, and also it breaks this volume down into the Volume generated by the Buyers and the Volume generated by the sellers again at every row of […]

Market Profile Analysis dated 28th December 2020

Nifty Dec F: 13890 [ 13903 / 13802 ] NF made a big gap up open and stayed above the negated FA and previous swing high of 13785 as it left a buying tail in the IB (Initial Balance) from 13827 to 13802 confirming that the PLR (Path of Least Resistance) for the day remained […]