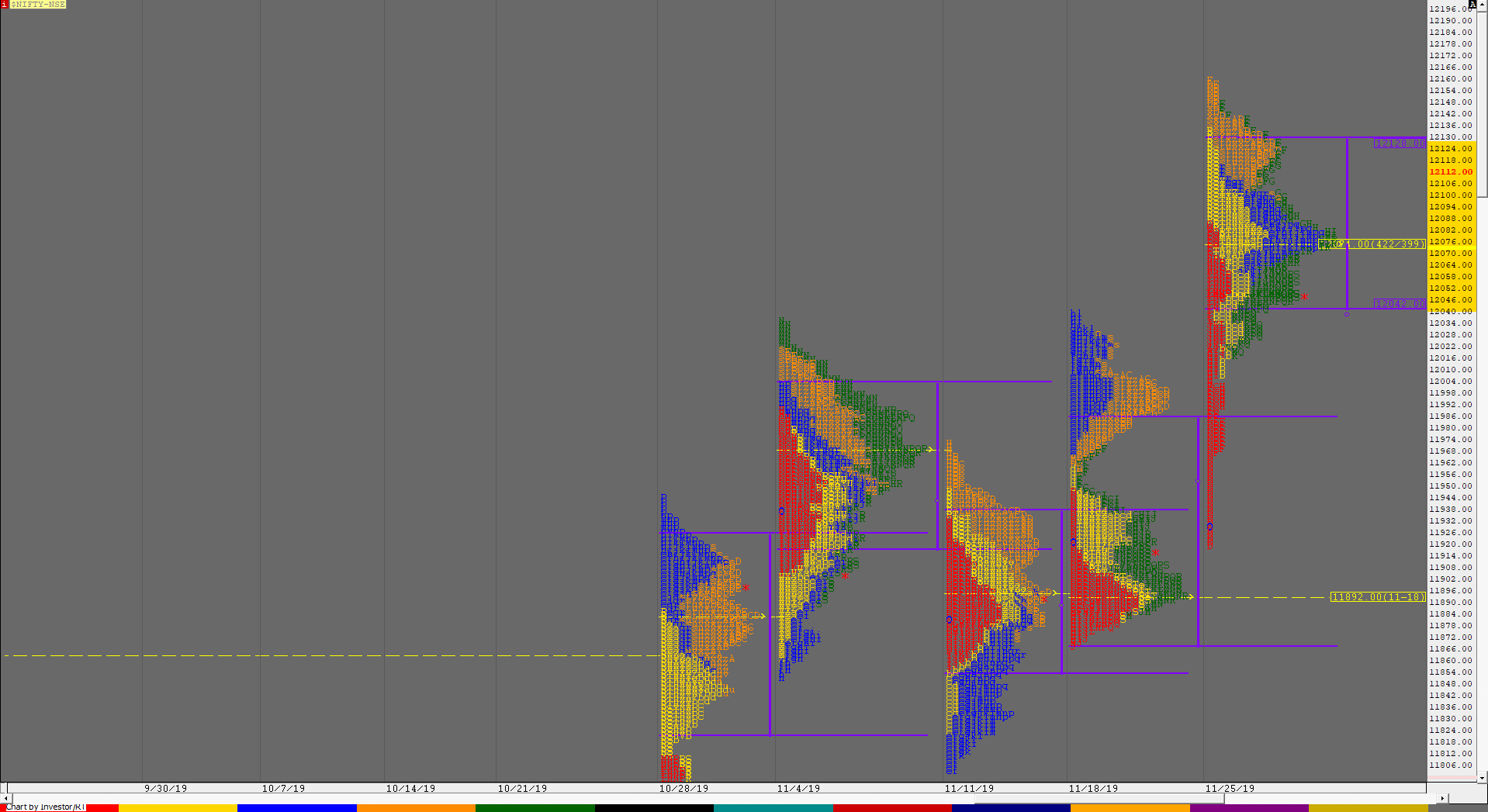

Nifty Spot Weekly Profile (02nd to 6th December)

Spot Weekly 11921 [ 12137 / 11889 ]

The week started with a big gap up as Nifty probed above the previous week’s VAH but got rejected as it gave a OH (Open=High) start at 12137 indicating that the upside could be limited after which it completed the 80% Rule in previous week’s well balanced Value as it made lows of 12023 leaving a ‘b’ shape profile for the day as it closed at the day’s POC of 12048 suggesting long liquidation had began. Tuesday open saw a move away from this POC as the auction continued the probe down to make a similar range as the previous day after making a RE (Range Extension) lower as it made lows of 11956 stalling right at the start of the buying tail of the Trend Day profile of 25th Nov which was also the stem of the previous week’s ‘p’ shape profile as Nifty once again closed around the day’s POC of 11999 forming yet another ‘b’ shape daily profile. The next day saw a lower opening as the auction made new lows at 11951 but was swiftly rejected giving an ORR (Open Rejection Reverse) start which led to a good move higher in the IB as it made highs of 12025 which was also the Monday lows and the inability to scale above this led to a bigger move to the downside as Nifty negated the ORR and went on to make new lows for the day at 11935 but once again took support in that buying tail of 11914 to 11960 which meant that the demand was coming back in this zone which led to huge inventory adjustment move higher as the auction made a 120 point move in the last couple of hours of the day as it made new highs of 12055 leaving a Neutral Extreme profile on the daily. Nifty continued this imbalance on Thursday open as it opened higher and tagged 12079 but could not extend much on the upside as it remained in a narrow range of just 34 points in the IB (Initial Balance) which indicated poor trade facilitation and an attempt to probe higher in the ‘D’ period failed as it made a marginal new high of 12081 and this empowered the sellers to take control as they drove the price lower to complete a 2 IB day down as it made lows of 11999 and in the process confirmed a FA (Failed Auction) at day’s high to leave consecutive Neutral Extreme days but this time on the downside. Friday saw a higher opening by Nifty but once again without any follow up as it gave one of the narrowest IB range of 29 points indicating that a big FRY-day move was on and the PLR (Path of Least Resistance) was to the downside as the auction stayed below the yPOC of 12066 plus there was also the FA of 12081 which had to be negated for any move higher. The expected move started in the ‘C’ period itself as Nifty made a RE to the downside and completed almost a 6 IB Trend Day down as it made lows of 11889 hitting the weekly POC pf 11892 and almost tagging the 2 ATR objective from the FA of 12081 before closing the week at 11918. The weekly profile has made overlapping to lower Value at 11976-12046-12070 but as the close has been far away from the Value, the PLR would remain down for the coming week. On the upside, the immediate reference is at 11935 above which 11976 & 12046 would be the supply levels to watch out for.

Weekly Hypos for Nifty (Spot):

A) Nifty needs to get above 11936 & sustain for a move to 11976-991 / 12046 & 12081

B) Immediate support is at 11881-878 below which the auction could test 11827-802 & 11772

C) Above 12081, Nifty can probe higher to 12114 / 12155 & 12208-211

D) Below 11772, lower levels of 11719 / 11665 & 11611-584** could come into play

E) If 12211 is taken out & sustained, Nifty can have a fresh leg up to 12240-265 / 12320 & 12377-380

F) Break of 11584 could bring lower levels of 11525-503 & *11460*

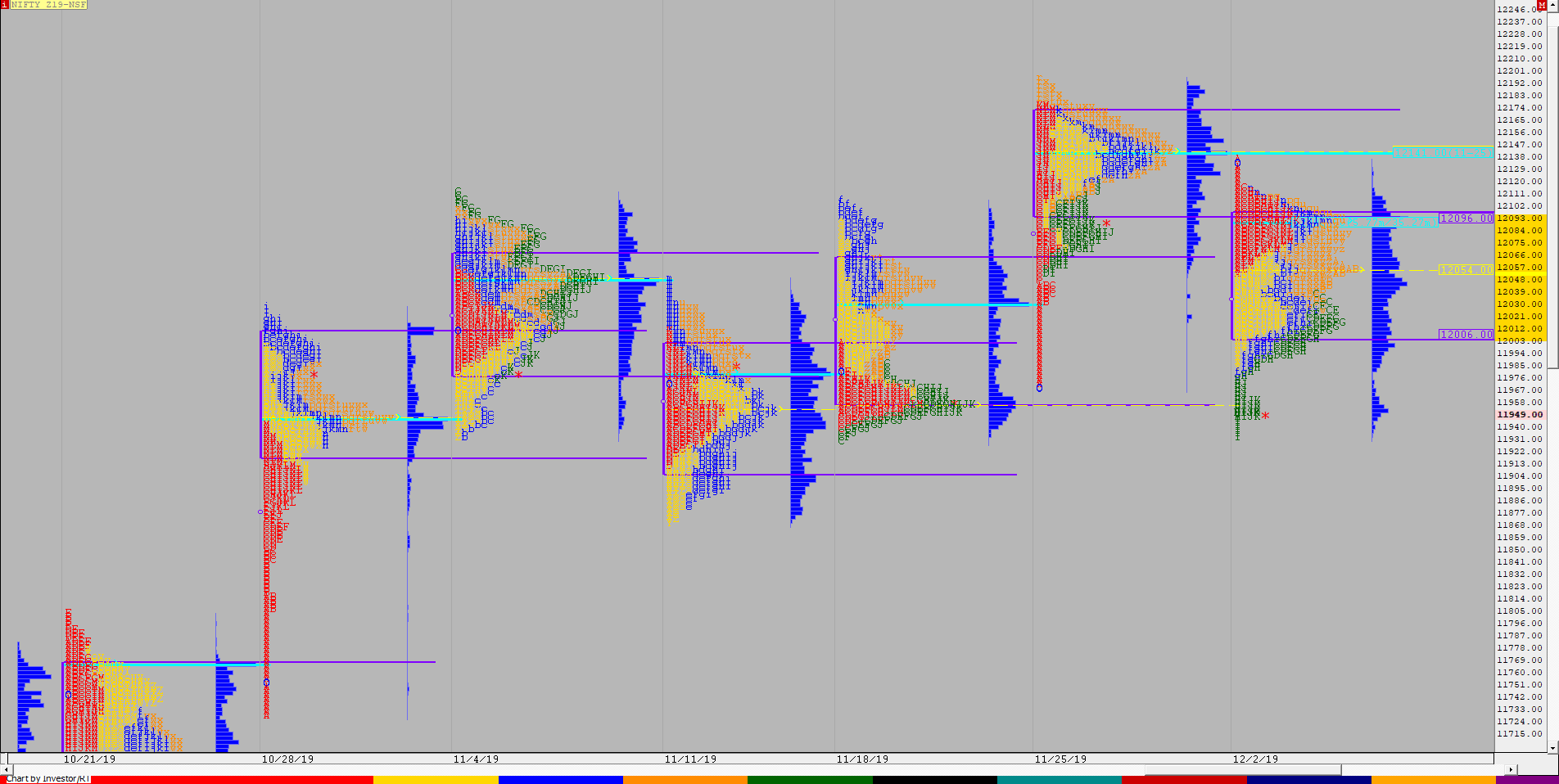

NF (Weekly Profile)

11956 [12138 / 11931]

NF made an almost OH start to the week at 12133-12135 on Monday which got tested again in the IB as it made a new high at 12138 but got rejected indicating that the previous week’s prominent POC of 12141 was being defended by the sellers after which it made a probe lower breaking below the weekly VAL to make a ‘b’ shape profile with a small stem from 12115 to 12138. The auction continued to probe lower the next 2 days making new lows but left a FA at 11977 on daily time frame on Wednesday which gave a good move higher as the auction completed the 1 ATR objective of 12072 on the same day while making a high of 12098 leaving a Neutral Extreme Up day. Thursday saw a rare occurrence as the the Neutral Extreme was accepted & NF continued to probed higher even making a RE to the upside as it made highs of 12116 but was rejected right at the PBH of Monday (12115) which meant that the supply was coming back in this zone. Further confirmation of this came as auction went on to make a RE to the downside too as it confirmed a new FA this time at 12116 and almost tagged the 1 ATR move of 12020 as it made lows of 12026 to give yet another Neutral Day with the PLR now firmly to the downside. Friday started as an OAIR with a very narrow IB range of just 30 points which was a good set up for a big range day coming and once it broke below the IBL of 12052 NF trended lower giving the biggest daily range of the week of 151 points and in the process completing a 5 IB down day as the auction made lows of 11931 to stop just above an earlier weekly FA of 11930 before closing the week at 11956. The weekly profile is a well balanced one with lower Value at 12006-12054-12096 and a spike close from 11977 to 11931 which would be the first reference in the coming week above which there is the all important supply zone of 12006 to 12027 which includes the Trend Day VWAP, weekly VAL & friday’s PBH. On the downside, NF could test the weekly extension handle of 11868 and the Trend Day VWAP of 11848 (29th Oct) below 11930 and should that break more downside could be expected.

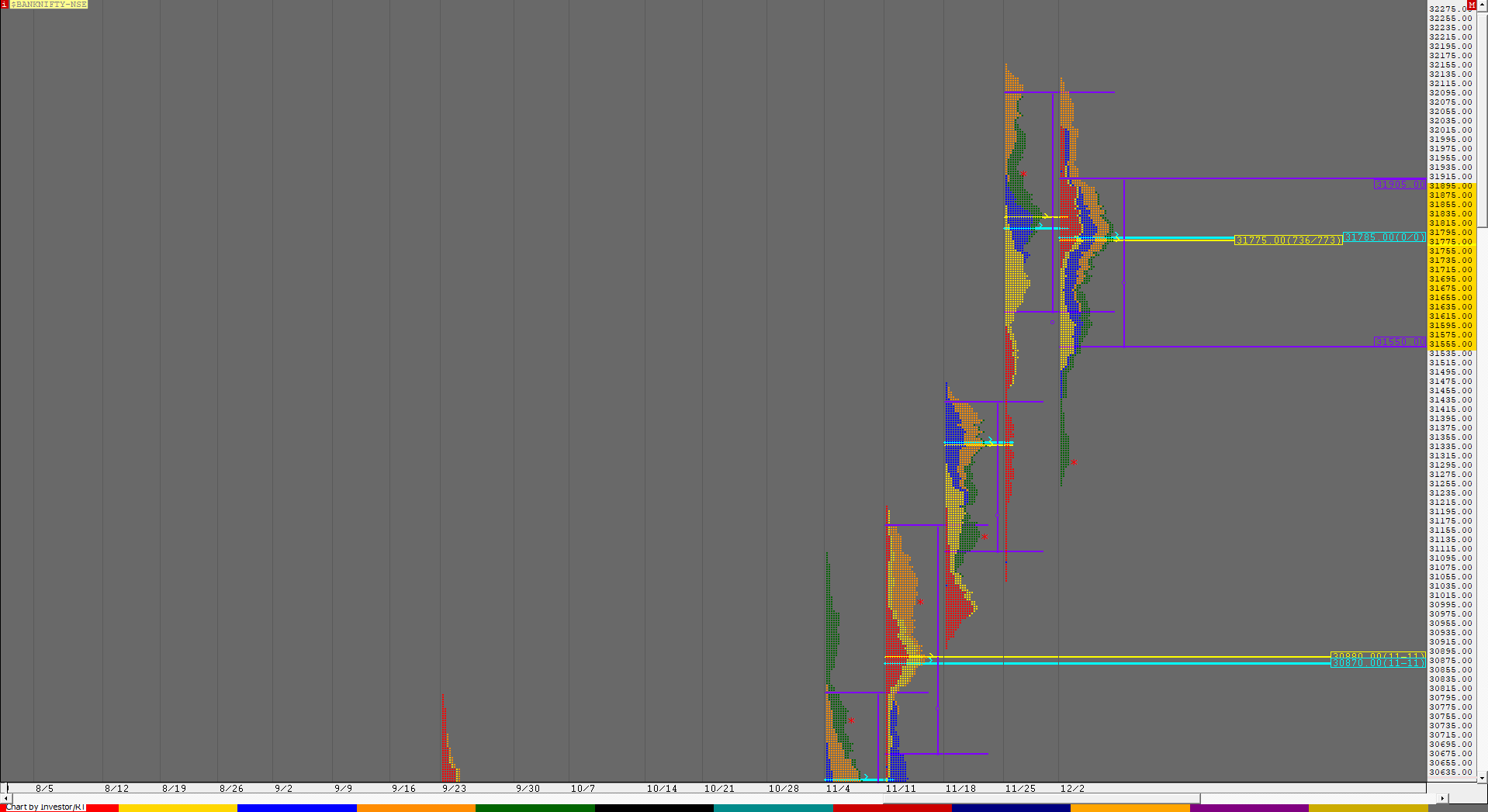

BankNifty Spot Weekly Profile (02nd to 6th December)

31946 [ 32157 / 31049 ]

BankNifty began the week in previous week’s Value as it made a high of 32024 in the IB on Monday after which it probed lower breaking below the weekly POC of 31825 as it made a low of 31720 leaving a ‘b’ shape profile. The auction opened with a freak OH the next day at 31937 and gave a drive lower to make yet another RE to the downside as it broke below the weekly VAL and went on to make new lows for the week at 31503. BankNifty continued this imbalance move to the downside by opening lower on Wednesday as it made lows of 31444 in the ‘A’ period but gave a later ORR (Open Rejection Reverse) as it got back into the previous day’s range and the weekly Value and started to form a balance and a ‘p’ shape profile for the day but spiked higher into the close from 31875 to 32018 almost tagging the highs of the week. This spike seemed to have been accepted as the auction opened with a gap up on Thursday and even went on to scale above previous week’s VAH as it tagged 32127 in the IB but was stuck in a narrow range of just 126 points which as in the Nifty indicated poor trade facilitation. BankNifty then made a RE to the downside and went on to make a big 4 IB move lower as it completed the 80% Rule in previous week’s Value to the dot as it made a low of 31628 and in the process confirmed a weekly FA at 32127. The imbalance of a 500 point move lower led to a retracement as there was a gap up on Friday and a brief probe higher as BankNifty tagged 31884 where it got rejected right from where it had spiked on Wednesday suggesting that sellers had taken over this zone now as we had another similar IB range of 126 points for the second consecutive day and this meant we were in for another multiple IB session and this happened in the form of a Trend Day down as the auction did one better than the previous day giving a 5 IB move lower as it marked lows of 31250 before closing the week at 31341. BankNifty has made a weekly inside bar though the profile is that of a Neutral Extreme Down with the Value overlapping to lower at 31550-31775-31905 with the Neutral Extreme reference at 31444 to 31250. The PLR remains down for the coming week with immediate support at the weekly buying tail of 31215 to 31049 below which the weekly VPOC of 30880 could come into play which is also the 1 ATR objective from the weekly FA of 32127.

Weekly Hypos for Bank Nifty (Spot):

A) BankNifty needs get above 31410-445 & sustain for a move to 31505 / 31550-585 & 31670-680

B) Immediate support is at 31325 below which the auction could test 31250-215 / 31155-118 & 31065-49

C) Above 31680, BankNifty can probe higher to 31775 / 31825 & 31885-905

D) Below 31049, lower levels of 30977-953 / 30889-870 & 30801 could come into play

E) If 31905 is taken out, BankNifty could rise to 31955 / 32024-42 & 32127

F) Break of 30801 could trigger a move lower to 30750-713 / 30625* & 30550-538

G) Sustaining above 32127, the auction can tag higher levels of 32165-168 / 32221 & 2310-330

H) Staying below 30538, BankNifty can probe down to 30450 / 30364-335 & 30277

BNF (Weekly Profile)

32004 [ 32200 / 31178 ]

BNF made an inside bar on the weekly with overlapping to lower Value at 31624-31856-31928 and a spike close from 31511 to 31323 and has also confirmed a weekly FA at 32173 (refer to 5th Dec daily report) which has a 1 ATR objective of 30947 on the weekly time frame and is also a weekly VPOC hence will be an important reference in the coming week on the downside.