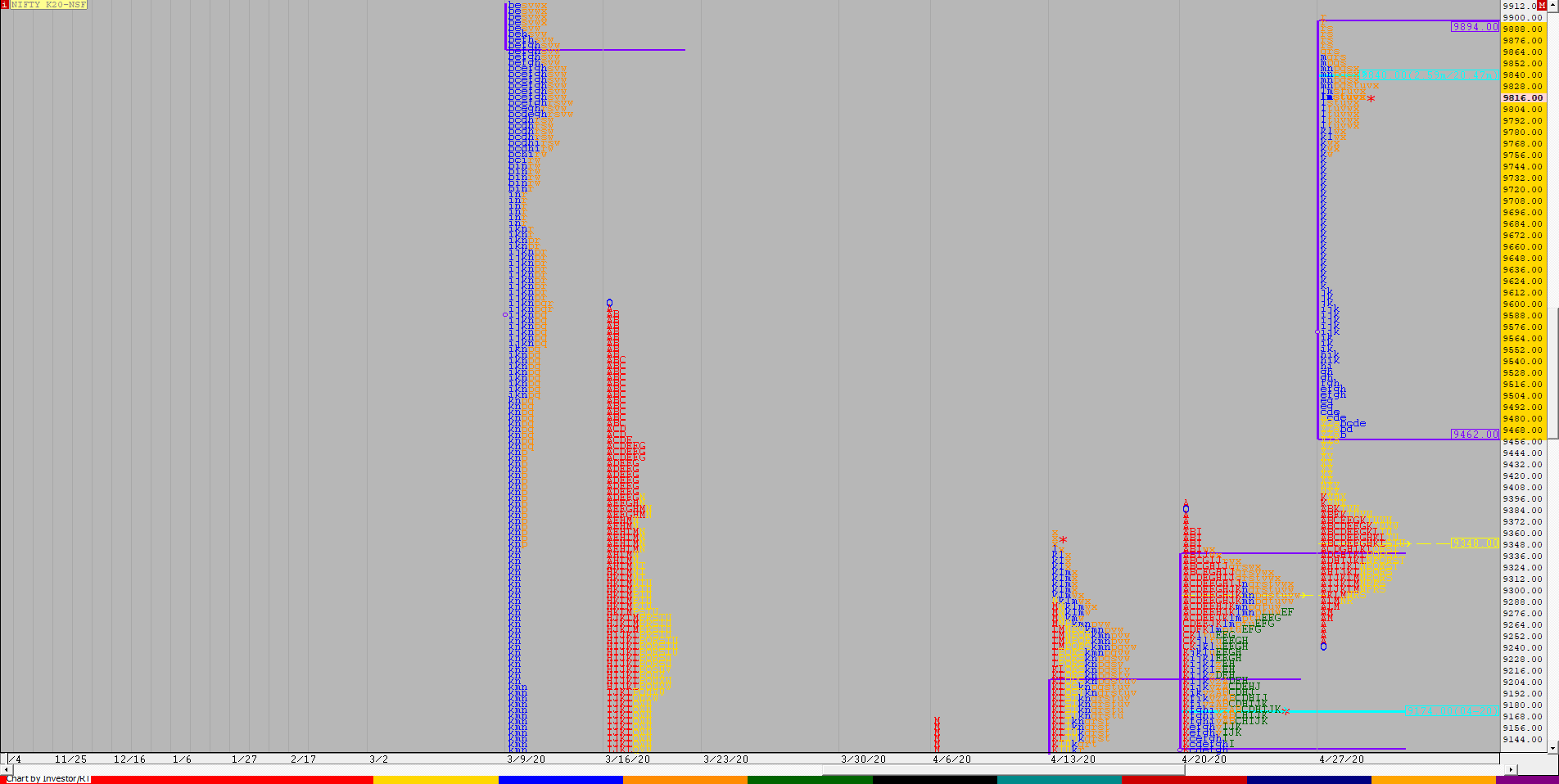

Nifty Spot Weekly Profile (04th to 08th May 2020)

Spot Weekly – 9251 [ 9383 / 9116 ]

Previous week’s report ended with this ‘Value for the week was mostly higher than previous week at 9255-9345-9585 but the close far away from Value means the auction could give a retracement in the coming week to enable the price to catch up with Value‘

Nifty not opened the week with a big gap down of over 300 points but was also an OH (Open-High) start after which it continued to drive lower all day on Monday as it not only tagged that weekly POC of 9345 but went on to make lows of 9267 before closing the day at 9293. There was a retracement on Tuesday open as the auction opened higher but was rejected from previous day’s selling tail after which it resumed the initiative trend of Monday and went on to make new lows for the week at 9190 as it closed in a spike lower and around the lows for the second concecutive day. This imbalance continued on Wednesday as Nifty seemed to make an ORR (Open Rejection Reverse) from the spike high of 9279 triggering a new leg to the downside as it made lows of 9116 in the ‘A’ period but saw some good demand coming in as the ‘B’ period got back into the previous day’s range indicating the failure of the strong bearish open and saw a good short covering move till the weekly POC of 9345 before it closed the day at 9271 leaving a ‘p’ shape profile for the day with a prominent TPO POC at 9280. The auction opened lower on Thursday & remained below the 9280 level all day but a very narrow range of just 102 points which meant that the sellers were not able to do a good job as it left a ‘b’ shape profile with yet another prominent POC, this time at 9207 and closed around it. Nifty then made a big gap up open on Friday much above the weekly POC of 9345 but gave an almost OH start at 9377-9382 and left a selling tail at top from 9342 to 9382 in the IB which displayed that there was no demand coming in at these higher levels. The auction did made a ‘C’ side attempt to get into this selling tail but got rejected leaving an early PBH (Pull Back High) at 9348 after which it began to form a ‘b’ shape profile for most part of the day as it remained in the IB range before giving a late RE in the ‘J’ period leaving an extension handle at 9298 after which it went on to make lows of 9238 stalling just above VAH of previous day & failing to tag that prominent POC of 9207 as it closed the week at 9251.

The weekly profile resembles a 3-1-3 profile with rejections at both the ends and a nice balance underway between them. The Value as well as the POC for this week was overlapping at 9220-9320-9380 with a good chance of a move away from here if it can take out one of the 2 extremes of this week. On the downside, 9220-9207 would be the important zone to be held where as for a probe higher, Nifty would need to first get accepted above 9320 and then made a decisive move above 9380 for a fresh leg to the upside.

Click here to view this week’s auction in Nifty with respect to previous week’s profile on MPLite

Main Weekly Hypos for Nifty (Spot):

A) Nifty needs to sustain above 9265 for a probe to 9298-9321 / 9368-80 / 9409-26 / 9460-9510 & 9555-9605

B) The auction remains weak below 9220-07 and could test 9169-16 / 9073-44 / 9010-8978 / 8945-31 & 8884-54

Extended Weekly Hypos

C) If 9605 is taken out, Nifty can probe higher to 9654-81 / 9703-52 / 9801-51 / 9906-61 & 10001-50

D) Break of 8854 could bring lower levels of 8836-8790 / 8748-22 / 8696-49 / 8599-40 & 8510-8445*

NF (Weekly Profile)

9236 [ 9477 / 9125 ]

Value for the week was completely lower at 9204-9312-9366 with a nice balance being formed so we have a good chance of this balance leading to an imbalance in the coming session(s).

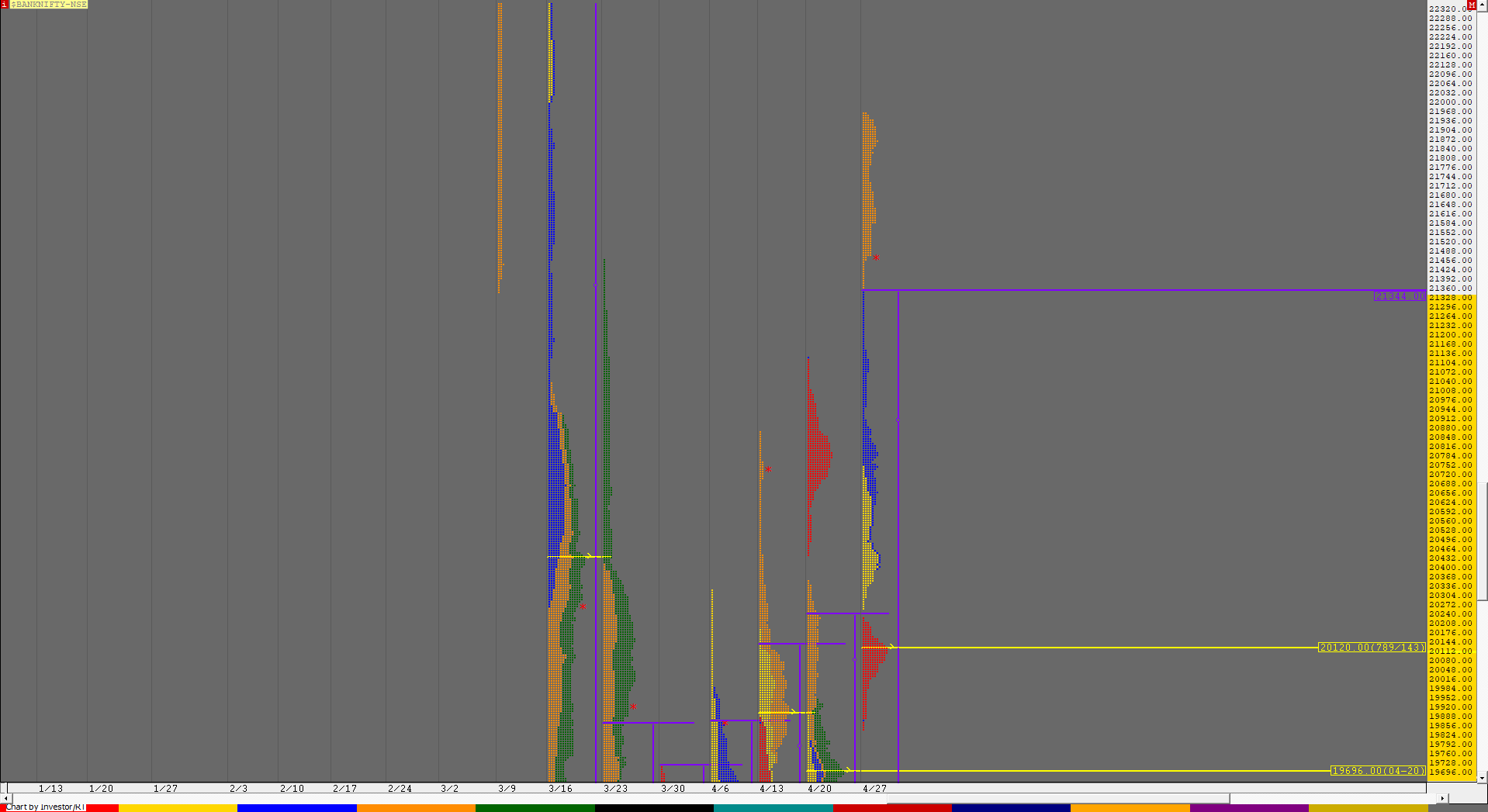

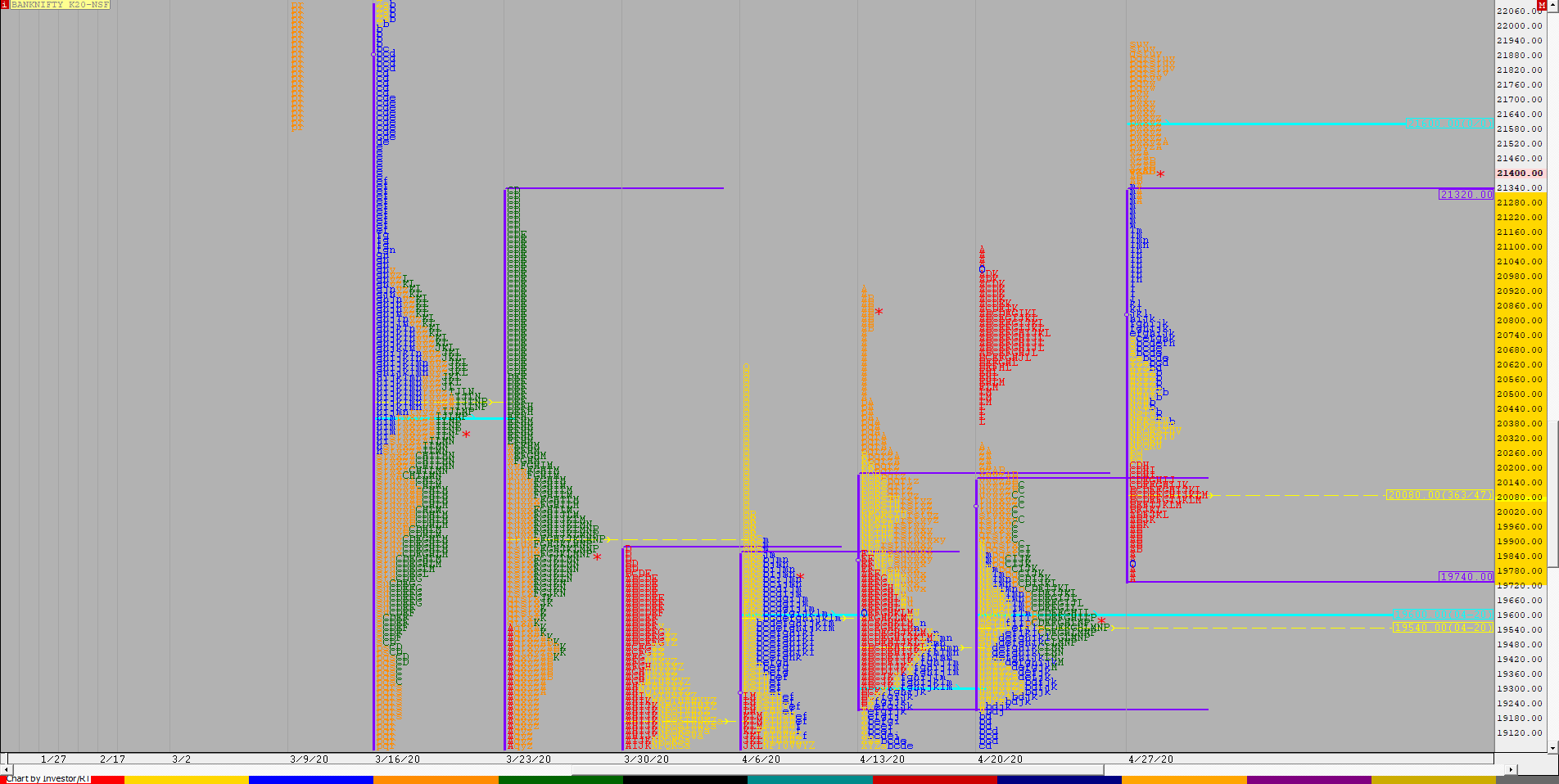

BankNifty Spot Weekly Profile (04th to 08th May 2020)

Spot Weekly – 19353 [ 20530 / 18941 ]

BankNity opened the week with a huge gap down of 1000 points and not only completed the 2 ATR move of 20120 but continued to probe lower for the first 3 days as it made lower lows but finally got some rejection in the IB on Wednesday after which it remained in a narrow range for the rest of the week forming a ‘b’ shape profile with a nice balance & Value at 19420-19700-19960. The close this week is below the VAL so the PLR remains to the downside but the auction would break below the zone of 19212 to 18941 to start a new leg lower. On the upside, BankNifty has a good chance to complete the 80% Rule above 19420 with the HVN of 19480 as a minor hurdle above which it could tag the weekly POC of 19700 & the VAH of 19960. The selling tail at top starts from 20141 which would be the positional level on watch on any upside above 19960 in the coming week.

Main Weekly Hypos for Bank Nifty (Spot):

A) BankNifty needs to get above 19420 & sustain for a probe to 19480-537 / 19600-710 / 19775-831 / 19881-960 / 20022-094 & 20141-165

B) The auction remains weak below 19321 for a test of 19248-171 / 19110-045 / 18975-900 / 18838-768 / 18700-675 & 18595-540

Extended Weekly Hypos

C) Above 20165, BankNifty can probe higher to 20238-310 / 20380-461 / 20521-595 / 20650-730 / 20809-880 & 20950-21030

D) Below 18540, lower levels of 18498-412 / 18272 / 18225-184 / 18094-009 / 17954-890 / 17825-750 & 17680 could come into play

BNF (Weekly Profile)

19284 [ 20600 / 18900 ]

BNF has made a nice ‘b’ shape profile on the weekly with a selling tail from 20078 to 20600 and a nice balanced Value area at 19420-19640-19860 and similar to the Spot has a good chance of doing the 80% Rule in the coming week once it gets above 19420.