Nifty Spot Weekly Profile (09th to 13th Mar 2020)

Spot Weekly – 9955 [ 10751/ 8555 ]

Previous week’s ended with this ‘the PLR remains to the downside for a test of 10746 / 10670 & 10600 which if broken can bring more downside.’.

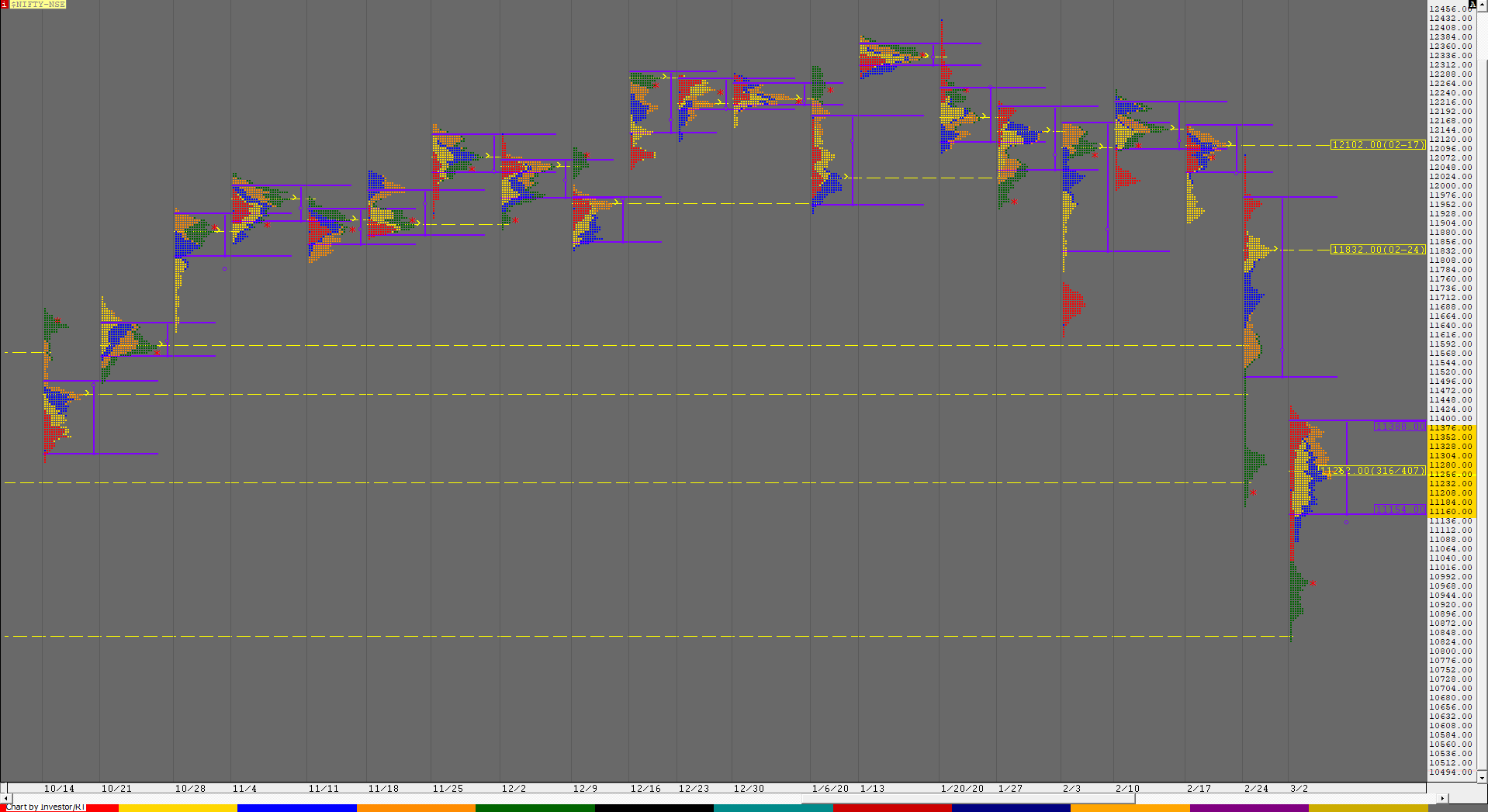

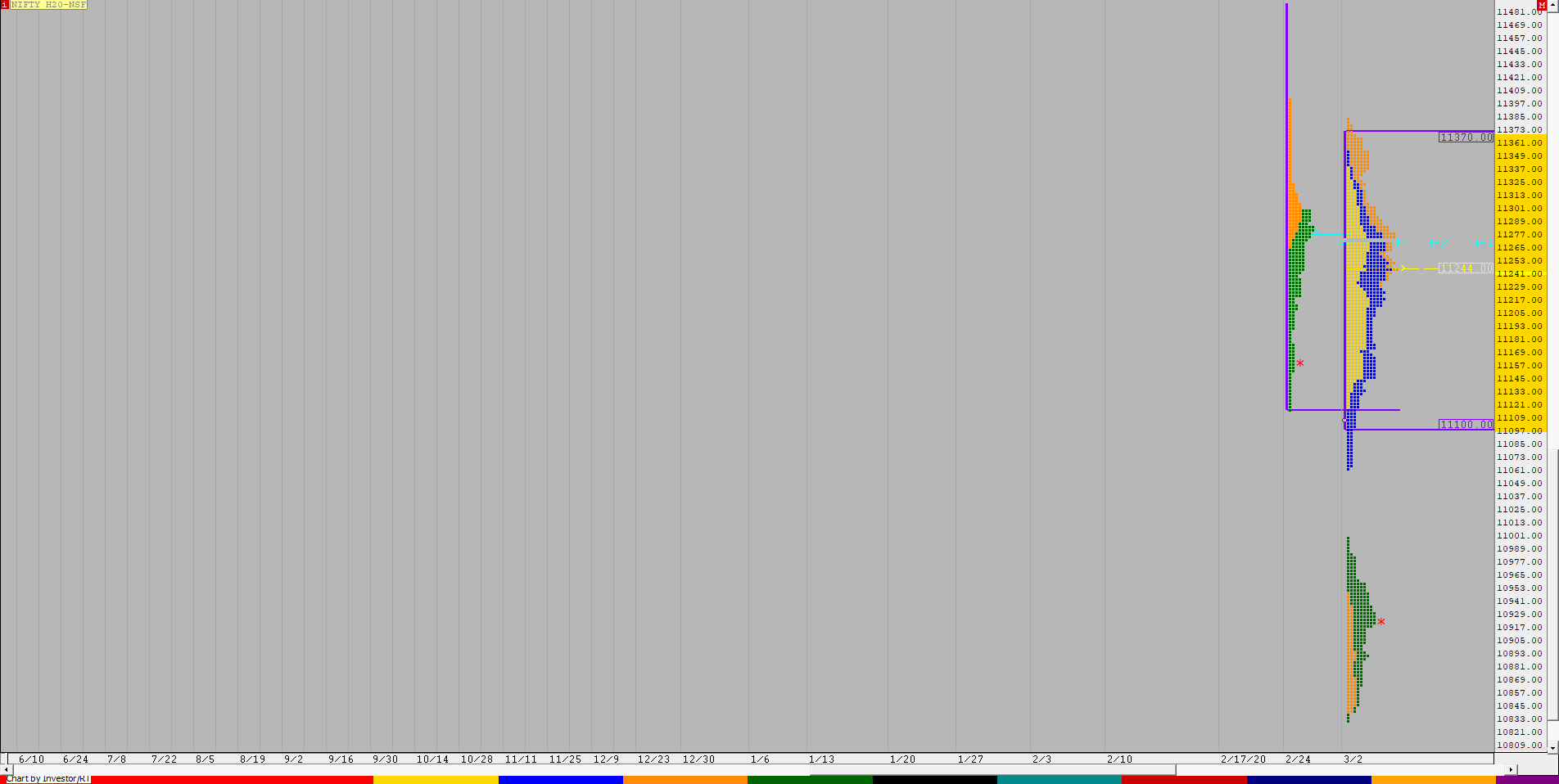

Nifty opened this week with a big gap down of almost 250 points & stayed below the first reference of 10746 as it left an initiative selling tail from 10751 to 10609 in the IB (Initial Balance) which set up for another trending week lower as Monday ended up giving a big range of 457 points while making lows of 10294. The auction then returned to balance on Wednesday after the holiday on Tuesday and though it gave a relatively big range of 211 points but stayed inside the Monday’s range with a failed attempt to break above the IBH of 10529 as it made highs of 10545 but made a similar close near 10450 forming a 2-day balance with the POC at 10469. Thursday saw another huge gap down of 440 points as Nifty made an OH (Open=High) start at 10040 not only confirming a multi-day FA (Failed Auction) at 10545 but completing the 2 ATR move down of 10150 as it went on to leave a Trend Day Down with the second highest daily range ever of 533 points as it made new multi-year lows of 9508. The auction then proceeded to make the third big gap down for the week of 480 points on Friday as it opened at 9108 and went on to hit the lower circuit in the opening minutes as it made lows of 8555. However, once the market resumed after 45 minutes it showed completely opposite character as strong demand came in as Nifty left a buying tail from 9367 to 8555 and got back into previous day’s range as it went on to trend higher even negating the OH of Thursday as it made highs of 10158 getting stalled at that 2 ATR target objective from FA after which it gave a dip to 9733 before closing the day at 9955 leaving a Trend Day up. The weekly profile is an elongated one with a range of 2196 points with Value at 9560-10440-10730 and the close being well inside the Value so staying above 9920-50, the auction could fill up the low volume zone of 10120 to 10400 before making an attempt to tag the weekly POC of 10440 above which we have the major supply zone of 10609 to 10827. On the downside, acceptance below 9920 could lead to a test of 9800 & 9605 below which we have the weekly buying tail of 9365 to 9135.

Click here to view the couple of 2-day balances Nifty formed this week on MPLite

Nifty Spot Monthly Profile (Mar 2020) – Ongoing

The current monthly profile of Nifty is also showing the follow up of the last 2 monthly closes which were at lows as the developing profile of March has multiple extension handles starting from 11040 with the second one at 10950 & last one at 10050 so unless these extension handles are not taken out, the PLR for the rest of the month would remain lower. However, the current profile also has a long buying tail from 9508 to 8555 which could act as support for any dip(s) which come in the next couple of weeks.

Main Weekly Hypos for Nifty (Spot):

A) Nifty needs to sustain above 9961 for a move to 10001-050 / 10101-150 / 10202-252 & 10294-303

B) The auction staying below 9951 could test lower levels of 9901 / 9851-40 / 9801-9780 / 9738-02 & 9666-54

Extended Weekly Hypos

C) If 10303 is taken out, Nifty can probe higher to 10354 / 10396-404 / 10440-469* / 10536-545 & 10609

D) Break of 9654 could bring lower levels of 9604 / 9560-49 / 9500-9451 / 9408 & 9367-60

Additional Hypos*

E) Above 10609* , Nifty could start a new leg up to 10661 / 10713-730 / 10765 / 10813-827 & 10869

F) Below 9360*, Nifty can go down to 9310 / 9265-15 / 9166-133 / 9073 & 9025

NF (Weekly Profile)

9898 [10690 / 8299]

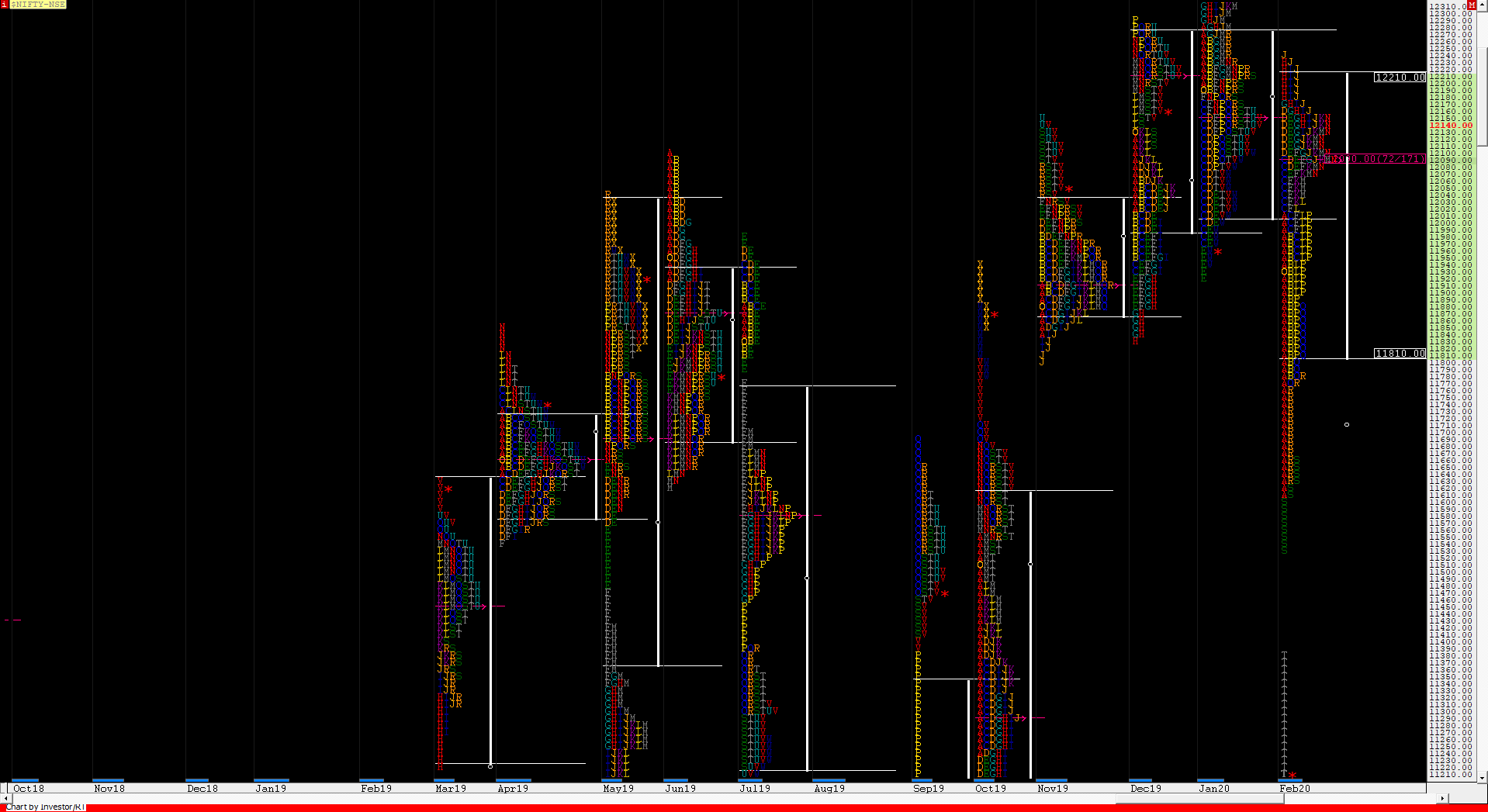

NF made 2 balances on the first 2 & the last 2 days of this 4-day week which saw 3 big gap downs as it left a Double Distribution profile on the weekly with a prominent POC in the upper distribution at 10440 and the singles separating the 2 distributions from 10301 to 10085 which will be the immediate zone to watch in the coming week. Value for the week was at 9680-10440-10660.

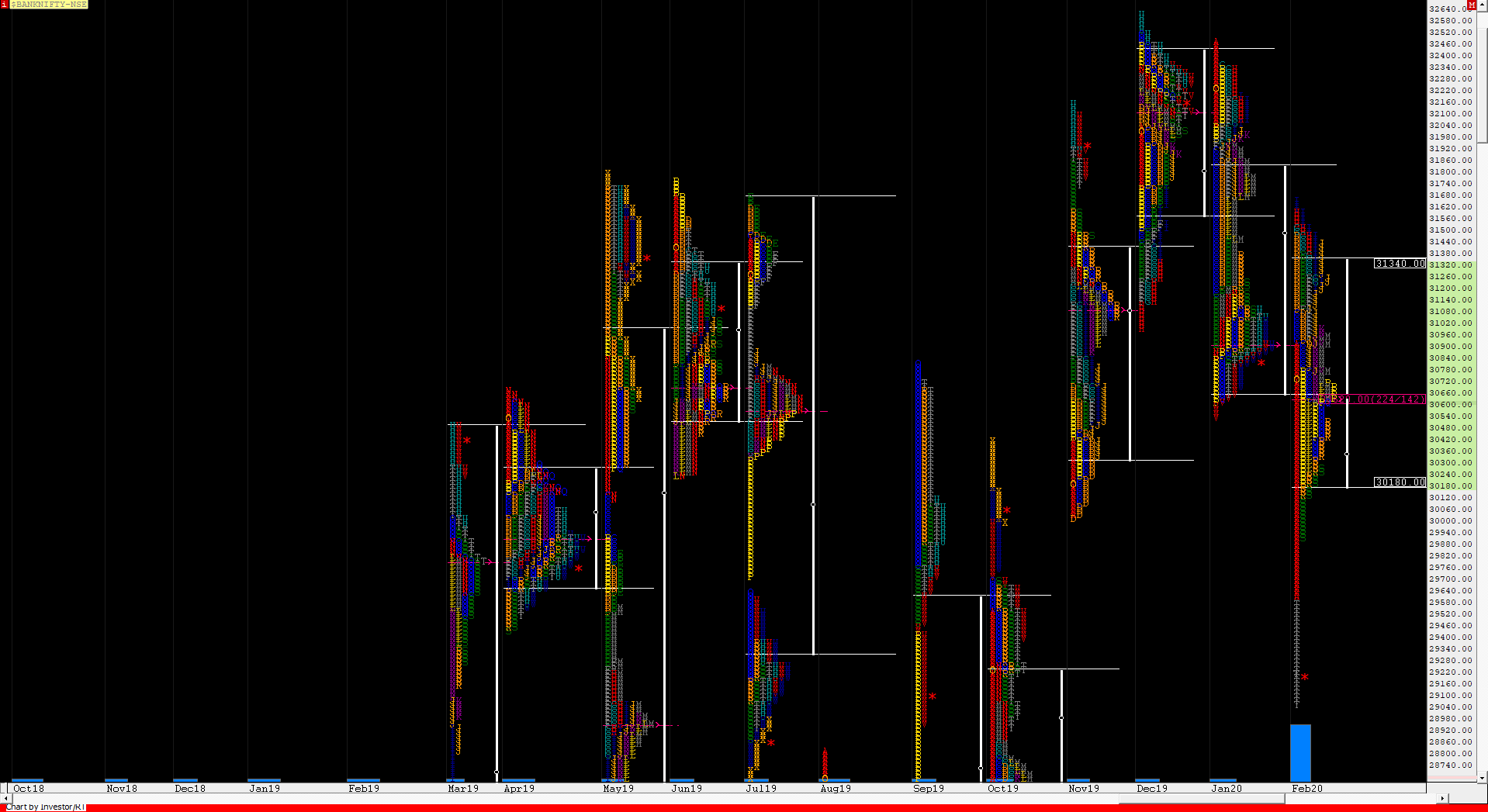

BankNifty Spot Weekly Profile (09th to 13th Mar 2020)

Spot Weekly – 25166 [ 27092 / 21351 ]

Previous week’s profile ended with this ‘The weekly profile is a triple distribution trending one to the downside with 2 extension handles at 29322 and 28125 and a huge range of 2629 points and completely lower Value at 28410-28950-29520. On the downside, 27698 would be the level to watch for and if broken could being the buying tail of Friday which is from 27440 to 27162’

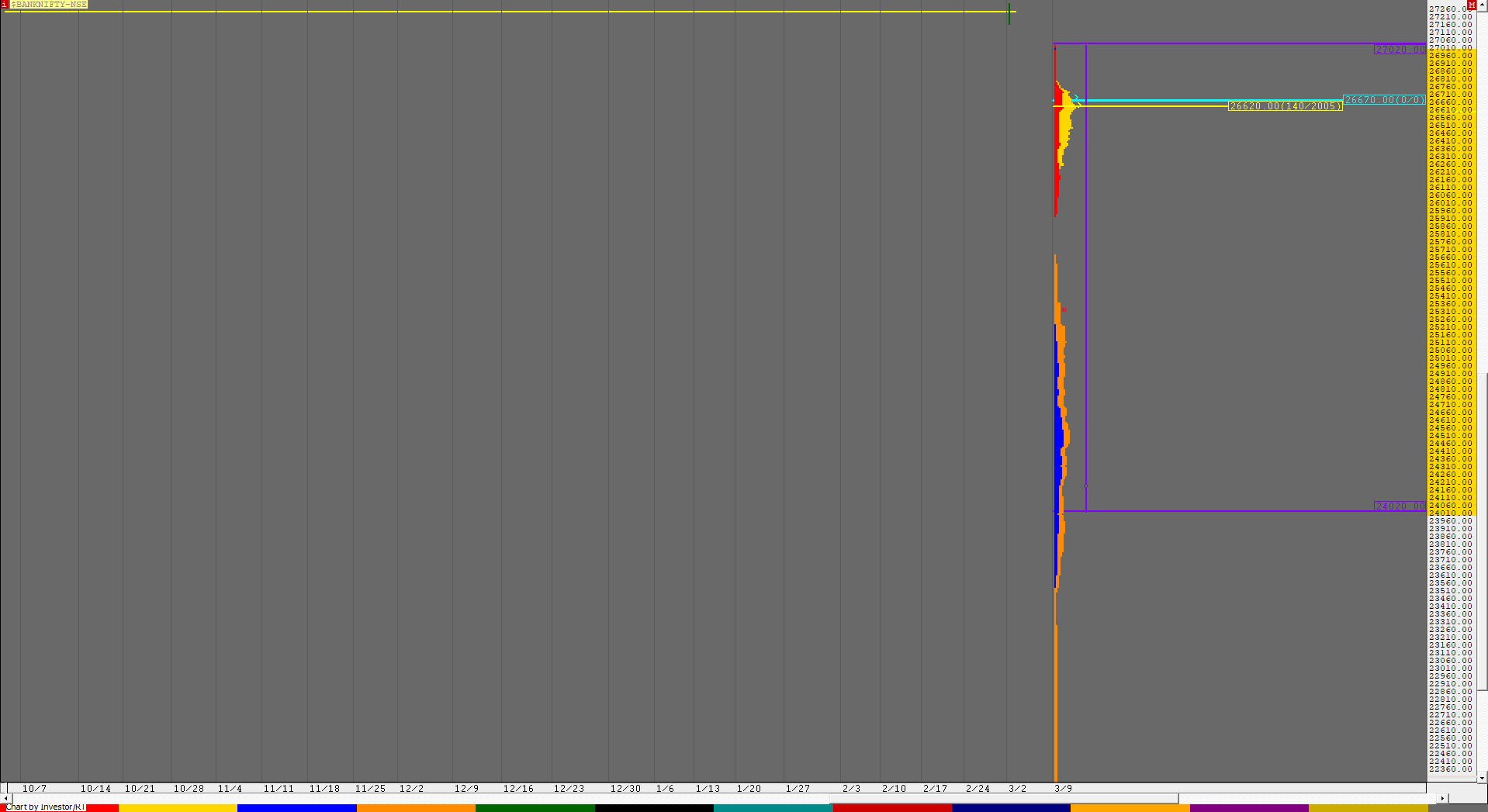

This week, BankNifty opened with a huge gap down of 750+ points as it stayed below the reference of 27162 leaving a selling tail from 26787 to 27092 in the IB confirming that the PLR for the week remains to be on the downside which was confirmed as it made multiple REs to the downside hitting lows of 25923 before closing higher at 26462 on Monday. Tuesday saw balance returning as BankNifty not only made an OAIR start but also remained all day in the IB range to leave a 2-day balance with the composite POC at 26691. The auction then made a big gap down open of more than 1300 points on Thursday as the balance turned to imbalance and continued to trend lower all day as it made new multi-year lows of 23536 but recovered to close the day at 23971. Friday saw a repeat of another huge gap down of more than 1250 points but that was not all as it fell by another similar margin making lows of 21351 as the market opened after the lower circuit pause and similar to Nifty, started a trending probe to the upside once it got above the morning highs of 22830 leaving a buying tail till 23501 after which it not only got back into previous day’s range but went on to scale above PDH of 25223 while hitting highs of 25670. This imbalance of more than 4300 points from lows then led to a retracement as BankNifty gave a PBL of 24259 in the afternoon which will be the important reference point in the coming week before it gave a close at 25166 just above the 2-day composite VAH of 25111. The weekly profile is an elongated one in a range of 5740 points with Value at 24072-26616-27024 having a small distribution at top with the HVN at 26688 and a selling tail from 25923 to 25622 which separates the lower distribution from 25511 to 23716. BankNifty has also left a big buying tail from 23501 to 22830 which could act as an important demand zone in the week(s) to come.

Click here to view the twin 2-day balances BankNifty formed this week on MPLite

BankNifty Spot Monthly Profile (Mar 2020) – Ongoing

BankNifty stayed below previous month’s VAL as it left a small tail at top to give a trending move lower on the monthly timeframe as it made multi year lows and in the process has left couple of extension handles at 28535 & 26234 with respective selling tails from 28535 to 26792 and 26234 to 25223 which would be the references on any upside in the coming week. On the downside, the developing monthly profile for now has a long buying tail from 23501 to 21351 which could act as support.

Main Weekly Hypos for Bank Nifty (Spot):

A) BankNifty needs to get above 25202-220 & sustain for a probe to 25282 / 25368 / 25441-522 & 25601-622 and acceptance above 25622 could go for 25670-681 / 25760 / 25841 & 25923

B) Immediate support is at 25123-111 below which the auction could test 25044 / 24964 / 24885 & 24807-798 and staying below 24798 could further fall to 24728 / 24650-631 / 24571 / 24501-493 & 24415

Extended Weekly Hypos

C) Above 25923, BankNifty can probe higher to 26000-085 / 26165 / 26245 / 26326-337 & 26405

D) Below 24415, lower levels of 24335 / 24259 / 24180 / 24103-072 / 24025 & 23950 could come into play

Additional Hypos*

E) Above 26405* , BankNifty could start a new leg up to 26488 / 26570-615 / 26680-690* / 26744 & 26815-897

F) Below 23950*, the auction can go down to 23870 / 23794 / 23716 / 23640-565 & 23501-486

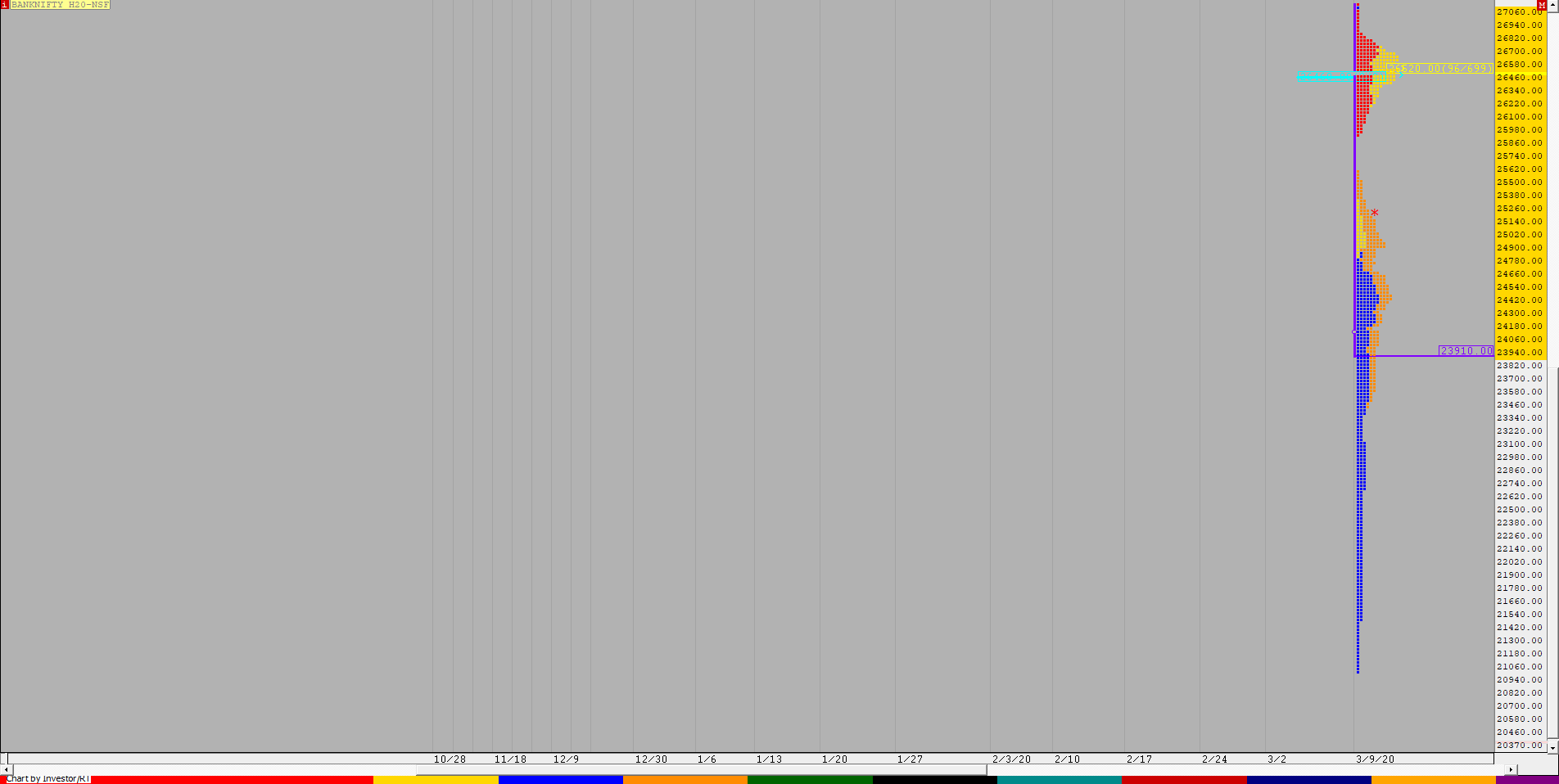

BNF (Weekly Profile)

25029 [ 27244 / 21000 ]

Similar to NF, BNF began the week with an initiative tail at top from 26879 to 27244 after which it has formed an elongated DD profile with a prominent POC in the upper distribution at 26520 and another selling tail from 25956 to 25522 separating the 2 distributions which would be an important supply zone to watch in case of a bounce in the coming days. The weekly Value is at 23910-26520-27240 with a low volume zone from 23316 to 21505 along with a buying tail from 21505 to 21000.