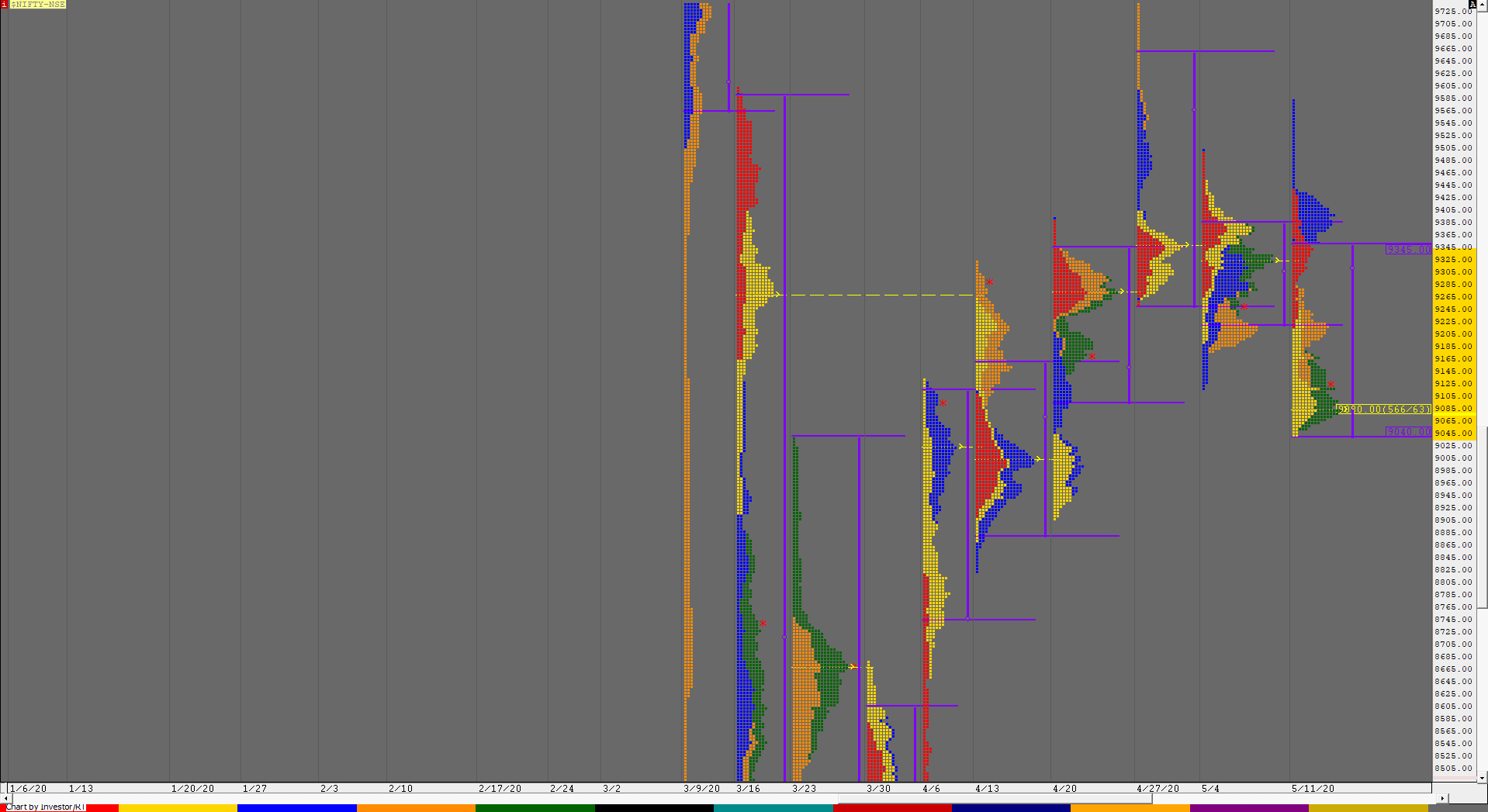

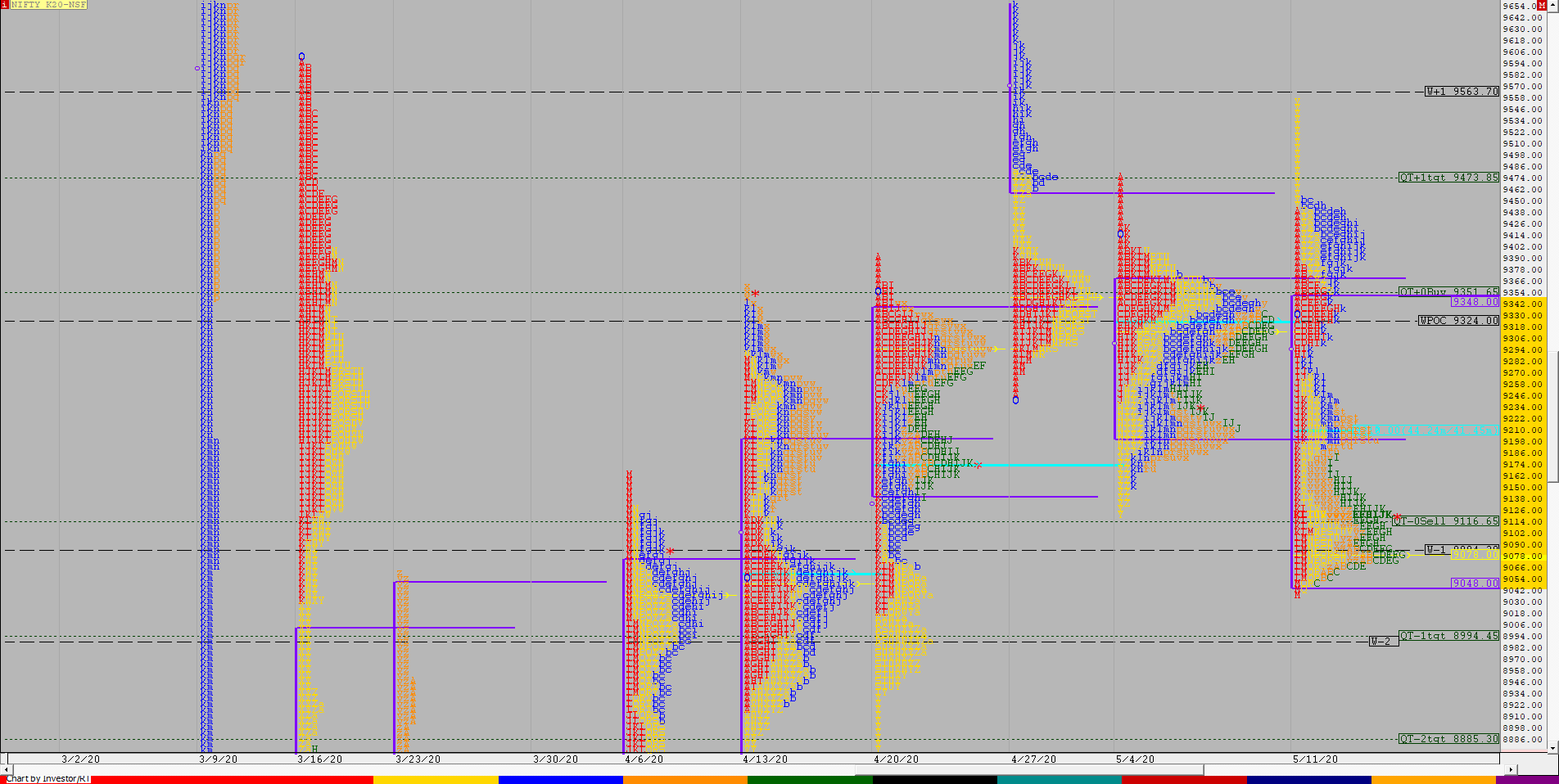

Nifty Spot Weekly Profile (11th to 15th May 2020)

Spot Weekly – 9136 [ 9584 / 9044 ]

Previous week’s report ended with this ‘The weekly profile resembles a 3-1-3 profile with rejections at both the ends and a nice balance underway between them. The Value as well as the POC for this week was overlapping at 9220-9320-9380 with a good chance of a move away from here if it can take out one of the 2 extremes of this week. On the downside, 9220-9207 would be the important zone to be held where as for a probe higher, Nifty would need to first get accepted above 9320 and then made a decisive move above 9380 for a fresh probe higher.‘

Nifty opened with a gap up of almost 100 points on Monday and it not only got accepted above 9320 but scaled above the weekly VAH of 9380 too continuing the probe higher as it went to make a high of 9440 in the IB (Initial Balance) but got stalled in the selling tail of previous week. The auction then went on to get back below 9380 post IB which triggered the 80% Rule in previous week’s Value and was completed to the dot on the same day as it made a low of 9220 & closed around the lows as well. This imbalance continued on Tuesday as Nifty not only opened lower but continued the trending move on the downside breaking below previous week lows as it hit 9044 in the IB which was also the bullish extension handle it had left on 20th April 2020. Nifty then started to form a balance as it made another similar low of 9044 in the afternoon but was unable to extend any further leaving poor lows indicating that the demand was coming back in this zone & that the sellers were getting exhausted. Further confirmation of this came in the form of a RE (Range Extension) as Nifty spiked higher into the close closing the gap as it made a high of 9241 and continued this imbalance with a huge gap up of 387 points on Wednesday at 9584 but was also an OH start right and once again saw swift rejection from that gap zone of previous week as it made a quick fall of 233 points in the IB and closed the day as a Normal Day with a ‘b’ shape ‘Long Liquidation’ profile which had a selling tail of 150 points from 9431 to 9584 clearly indicating that the upside probe was over & now the PLR had reversed. Thursday opened with a big gap down of 170 points as the auction closed the previous day’s gap while making a low of 9197 in the IB and gave a retracement to 9281 in the ‘A’ period and followed it up with a similar high in the ‘B’ period showing that the bounce is also getting exhausted which was an important reference as this also confirmed a weekly FA at 9584 after which Nifty left an extension handle at 9186 to make a late RE on the downside & went on to tag 9120. Friday saw a slightly higher open but once again was an OH start at 9182 which was just below the previous day’s extension handle of 9186 which reinforced the fact that the PLR is still to the downside resulting in a trending move in the first half of the day as the auction made a low of 9050 stalling once again near the well established demand zone of 9044 which led to a short covering rally till 9165 into the close before Nifty closed the week at 9136.

Nifty tested both extremes of the previous week’s profile leaving an outside bar along with a Neutral Extreme Down with a long selling tail at top with Value was at 9045-9090-9345. This week’s profile is also part of a nice 4-week composite in Nifty which has Value at 9145-9316-9427 (view the MPLite chart of the composite here) and the close below the VAL along with the weekly FA has set up the auction for a good move away from here to the downside towards the 1 ATR target of 8805 in the coming week(s) once it takes out the 9044 level. The immediate reference on the upside would be the zone of 9169-9186 above which we could get a fresh leg upto 9316-9386

Click here to view this week’s auction in Nifty with respect to previous week’s profile on MPLite

Main Weekly Hypos for Nifty (Spot):

A) Nifty has immediate resistance at 9169 above which it rise to 9214* / 9265-81 / 9316**-86* / 9427-58 / 9497-9507 & 9555

B) The auction would get weaker below 9121-16 for a probable test of 9069-44 / 9010-8978 / 8931-10 / 8884-54 / 8805-8790 & 8748*-22

Extended Weekly Hypos

C) If 9555 is taken out, Nifty can probe higher to 9605 / 9654-81 / 9703-52 / 9801-51 & 9906-61

D) Break of 8722 could bring lower levels of 8696 / 8649-34 / 8599-40 / 8510-8445* / 8413-8394 & 8363-25

NF (Weekly Profile)

9137 [ 9577 / 9037 ]

NF has also given a Neutral Extreme profile with weekly FA at 9557 along with a selling tail at top with overlapping to lower Value at 9048-9348. The TPO POC of the week is at 9078 where as the volume POC stands at 9210 and till the auction remains below these 2 levels, the PLR for the coming week would be down for a probable first target of 8760.

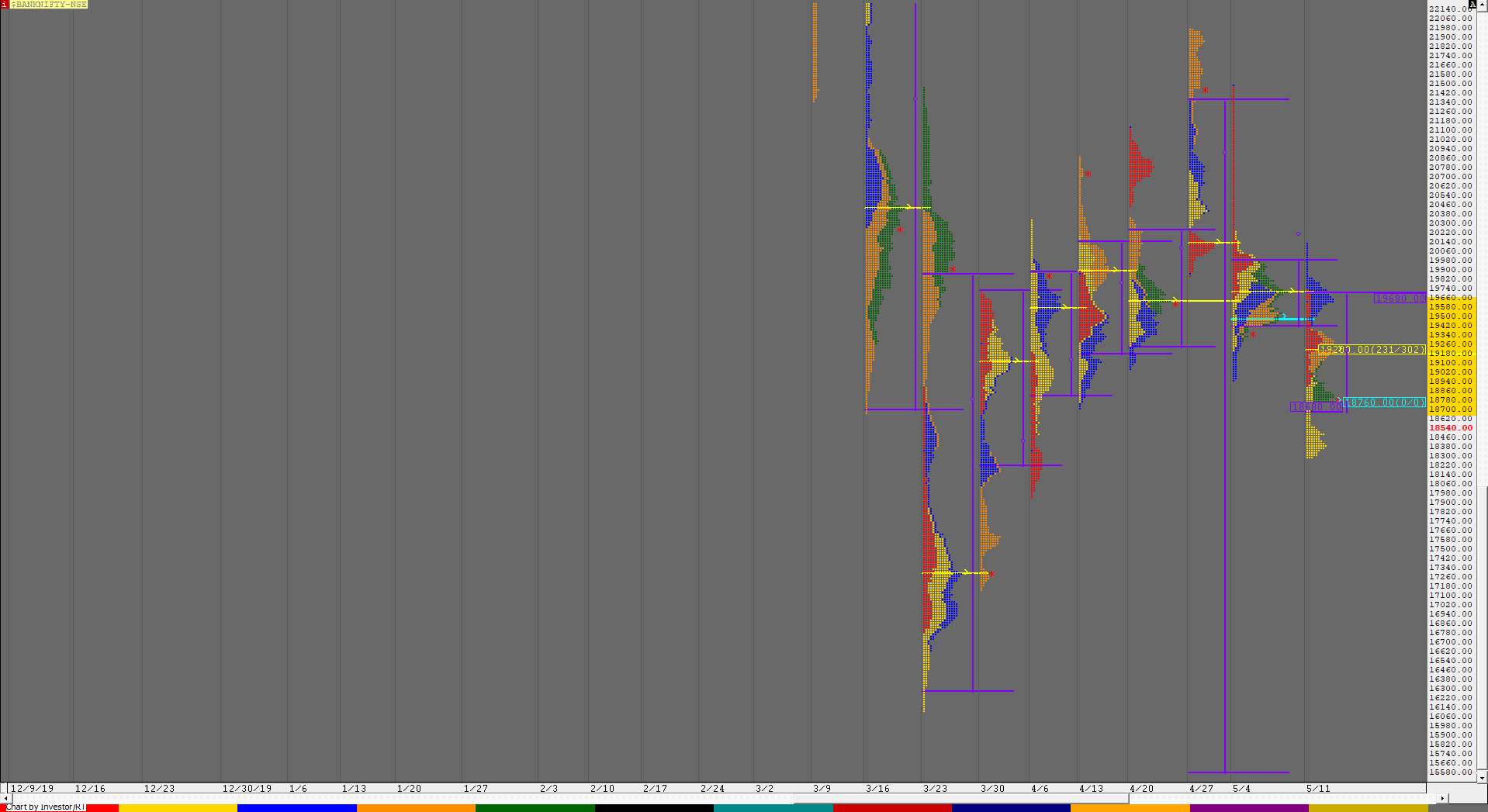

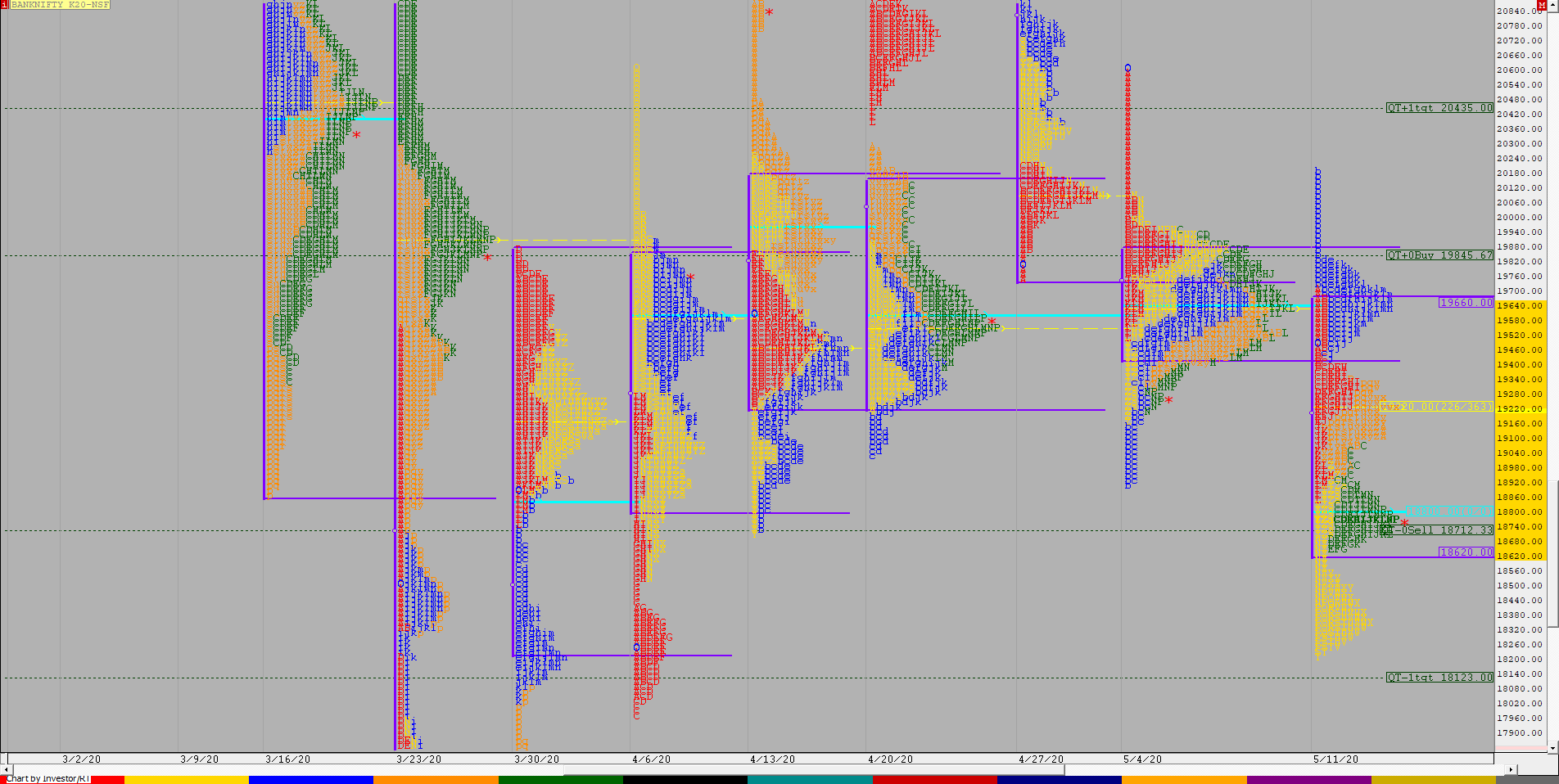

BankNifty Spot Weekly Profile (11th to 15th May 2020)

Spot Weekly – 18834 [ 20122 / 18287 ]

Previous week’s report ended with this ‘The close this week is below the VAL so the PLR remains to the downside but the auction would break below the zone of 19212 to 18941 to start a new leg lower. On the upside, BankNifty has a good chance to complete the 80% Rule above 19420 with the HVN of 19480 as a minor hurdle above which it could tag the weekly POC of 19700 & the VAH of 19960. The selling tail at top starts from 20141 which would be the positional level on watch on any upside above 19960 in the coming week‘

BankNifty was the weaker of the 2 indices in spite of the gap up on Monday as it confirmed an Open Drive Down after which it broke below the weekly VAL post IB & went on to make new lows for this month at 18900 leaving a Trend Day Down and continued this imbalance on Tuesday as it not only opened lower by 200 points but went on to fall further in the IB as it hit 18304 which marked the end of the probe down as the auction started to form a balance for most part of the day with a failed attempt to make a RE lower in the ‘F’ period where it made a new low of 18287 but was swiftly rejected from just above the important VPOC of 18272 of 7th April, the day when BankNifty had confirmed a FA at 17954 which is now positional support. The importance of this rejection became more evident as the auction spiked higher into the close on Tuesday confirming a FA at 18287 and went on to tag the 1 ATR target of 18982 on the same day. This new imbalance on the upside continued on Wednesday with an unexpected huge gap up of 1150 points after which BankNifty made a high of 20122 and got rejected from this important reference (earlier weekly POC plus the 2 ATR objective from last FA of 21967 of 30th April – refer to that week’s report here) as it left a long selling tail from 20122 to 19830 and went on to make lows of 19430 leaving a ‘b’ shape profile indicating long liquidation. Thursday continued this week’s trend of gap opens as the auction opened at 19197 and remained below PDL to leave poor highs in the IB at 19380 before making a RE lower as it tagged 19024 confirming a weekly FA in BankNifty also at 20122. Friday was the first day of the week when there was no gap open but the the auction confirmed an Open Drive Down and probed lower for the first 4 periods as it tested the bullish extension handle it had left on 12th May and was rejected from that zone leaving a PBL (Pull Back Low) at 18683 which marked the end of this leg down. BankNifty then formed a balance for the rest of the day with one failed attempt to get into the morning selling tail where it left a PBH at 18945 before closing the day at 18834 leaving another ‘b’ shape profile.

The weekly profile is an elongated trending one down with multiple distributions and a selling tail at top with mostly lower Value at 18680-19200-19680. The multiple distributions have ensured couple of other HVNs at 18760 & 19631 which would be important references for the coming week with the PLR being to the downside but BankNifty would need a decisive break of 18680 first and then needs to take out this week’s low for probable targets of 17980 and 17594 which is the 1 ATR objective from the weekly FA of 20122. On the upside, 18945 & 19085 would be the important supply points above which the auction could probe higher to 19182 & 19650.

Main Weekly Hypos for Bank Nifty (Spot):

A) BankNifty needs to sustain above 18840 for a probe to 18910-945 / 19044-119 / 19182*-252 / 19321-391 / 19461-531 / 19600-650* & 19710-741

B) The auction gets weaker below 18773-760 for a test of 18680-630 / 18557-472 / 18420-395* / 18272*-184 / 18094 / 18009-17954 & 17890

Extended Weekly Hypos

C) Above 19741, BankNifty can probe higher to 19793-930 / 19882-952 / 20022-165 / 20238-310 / 20380-461 / 20521-595 & 20650-665

D) Below 17890, lower levels of 17825-750 / 17680-596* / 17510-425 / 17360-280 / 17220-143 / 17095-27* & 16966 could come into play

BNF (Weekly Profile)

18808 [ 20199 / 18209 ]

BNF has given a Neutral profile on the weekly with a tail at top from 20199 to 19835 along with multiple distributions as BNF was all over the place this week and closed at the POC of 18800. We have a weekly FA confirmed here as well at 20199 and 1 ATR objective down comes to 17589 which would be the probable target if the VPOC of 18350 & the daily FA of 18207 is taken out in the coming week.