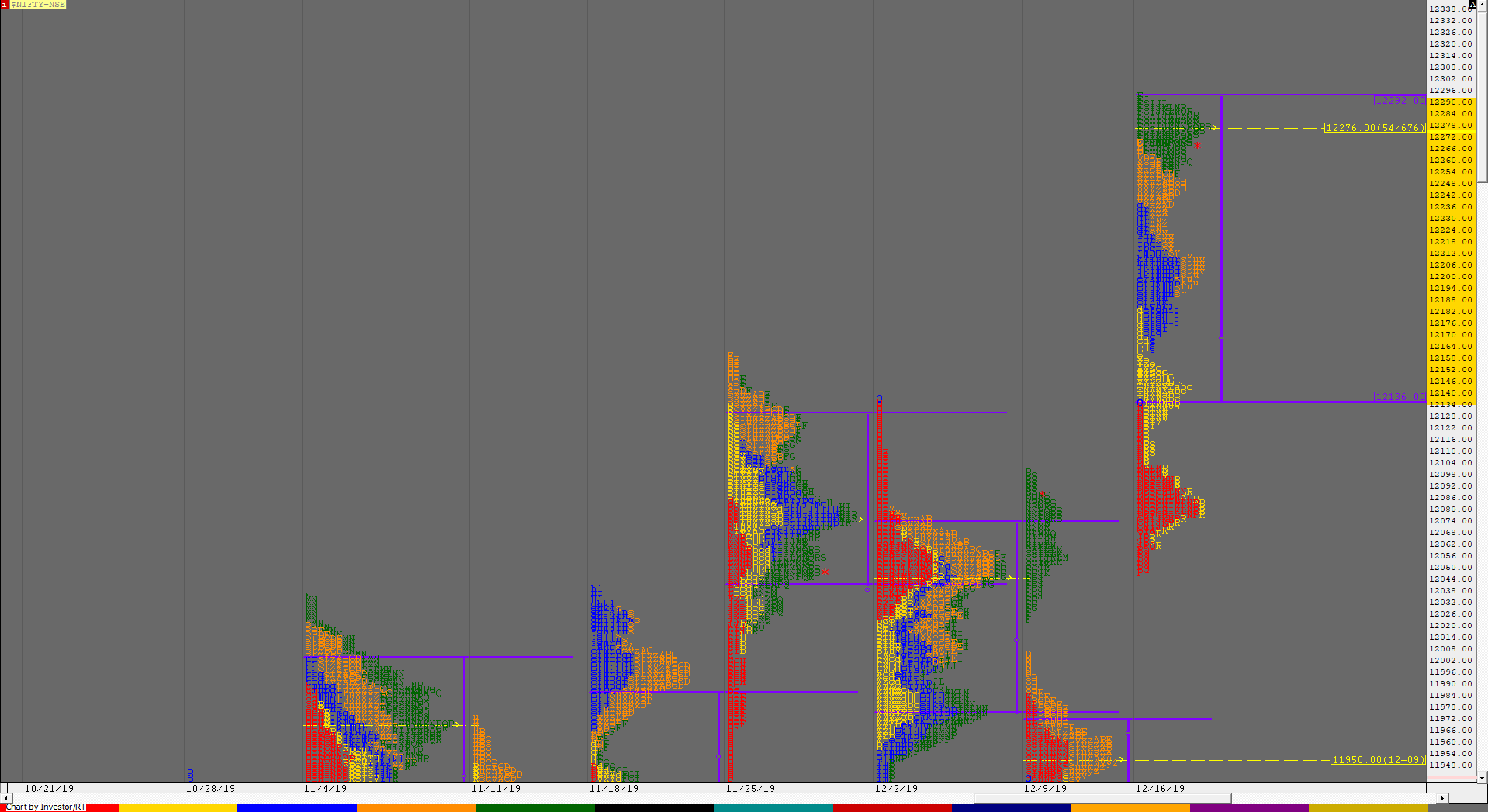

Nifty Spot Weekly Profile (16th to 20th December)

Spot Weekly 12272 [ 12994 / 12046 ]

Previous week’s report ended with this ‘a buying tail from 12024 to 11982. On the upside, we have the selling tail from 12108 to 12137 as the immediate reference which if taken out could pave the way for new All Time Highs before the year 2019 ends.‘

Nifty opened with a big gap up on Monday above previous week’s high but was almost an OH (Open=High) start just below the 12137 level after which it probed lower closing the gap forming a ‘b’ shape profile for the day which ended in a spike down from 12062 to 12046. The auction then rejected this spike on Tuesday by opening higher & went on to drive higher negating the previous day’s selling tail and scaling above that 12137 level forming new All Time Highs and in the process confirmed a weekly FA at 12046. Nifty did a reverse of the Monday auction as it formed a ‘p’ shape profile for most part of the day & closed once again in a spike but this time it was to the upside from 12157 to 12183. Wednesday saw yet another higher opening but was also an OH after which it probed lower and even went on make a RE to the downside in the ‘C’ period but got rejected from the spike zone as it made a low of 12163 which reversed the day’s auction to the upside as it went on to make a successful RE to the upside which confirmed another FA but this time on the daily time frame to confirm that the PLR (Path of Least Resistance) remains to be Up and rightly so the day closed as a Neutral Extreme profile after making new highs of 12237. Nifty then made an OAIR start on Thursday with another OH start following the norm of a Neutral Extreme not getting a follow up as it started to form a balance staying within a narrow range of just 34 points till the C period after which made a RE to the upside as it not only negated the OH of 12225 but went on to make new highs for the week completing a 2 IB move higher as it made highs of 12268 which was also the 1 ATR objective from the daily FA of 12163. Friday was a consolidation day as Nifty matched the narrowest range for the year 2019 (Previous lowest was on 8th March which started a new leg to the upside) to remain in a range of just 41 points forming a rare Normal Day as it stayed within the IB but like all other days in the week made new highs of 12294 before closing the week at 12272 which was also the POC of the weekly profile which is an elongated one with multiple distributions and the Value also jumping higher with a big gap compared to the previous week at 12136-12276-12292. Nifty has an immediate objective of 12337 & 12365 on the upside and would need to stay above 12276 in the coming week. Acceptance below 12276 could bring a test of 12242 and 12211 in the coming session(s).

Weekly Hypos for Nifty (Spot):

A) Nifty needs to stay above 12276 & sustain for a move to 12320-337 / 12365-377 & 12433-441

B) Immediate support is at 12265-242* below which the auction could test 12211-192 / 12155-140* & 12101

C) Above 12441, Nifty can probe higher to 12489-500 & 12540-544

D) Below 12101, lower levels of 12062-46 & 11991-982 could come into play

E) If 12544 is taken out & sustained, Nifty can have a fresh leg up to 12601-622 & 12657

F) Break of 11982 could bring lower levels of 11950-936 & 11910-881

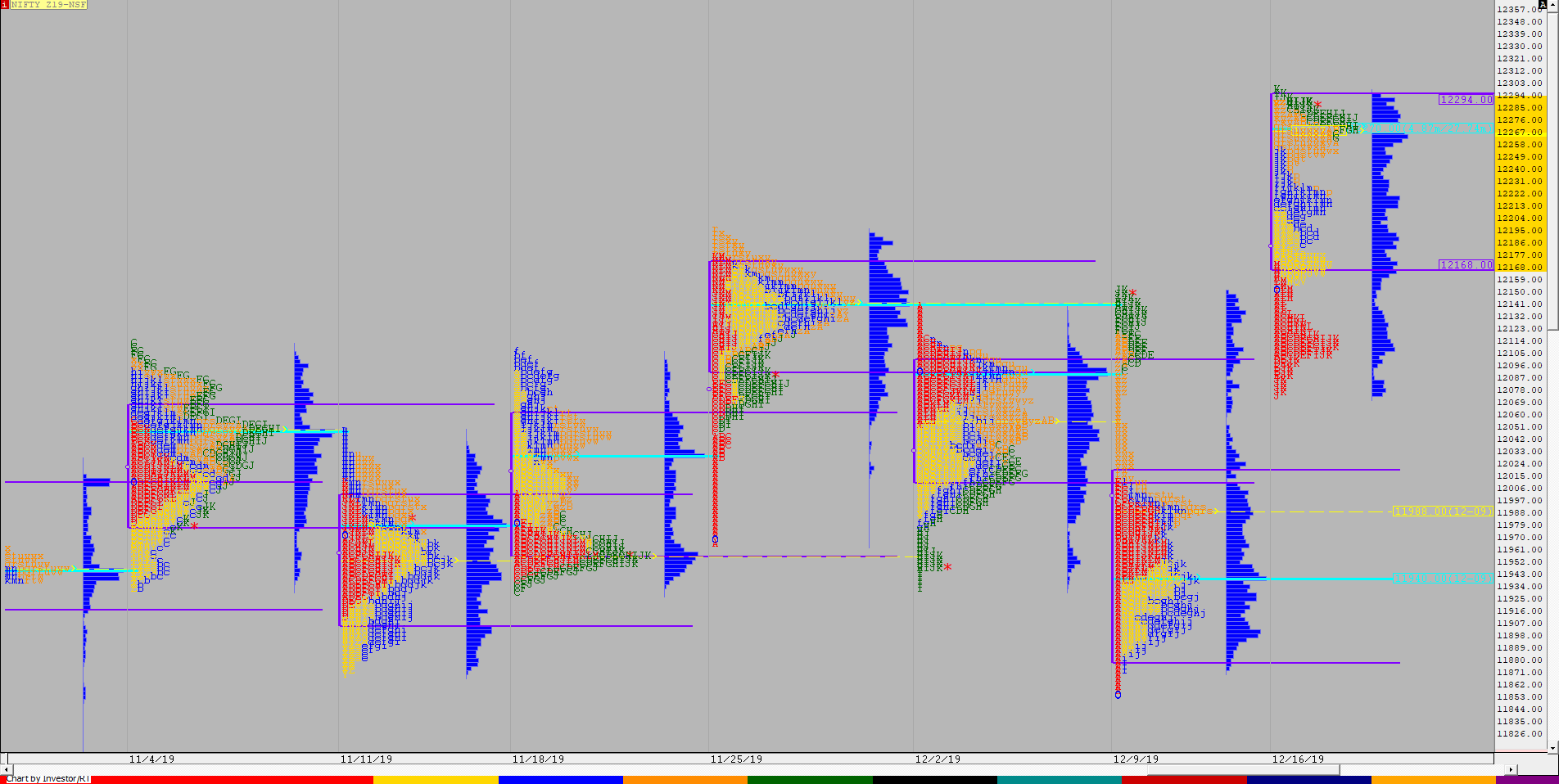

NF (Weekly Profile)

12290 [12299 / 12074]

NF has made a Trending profile for the week giving multiple distributions as it made higher highs & higher lows on all days of the week in-spite of starting the week with an OH (Open = High) right at previous week’s high of 12152 on Monday but scaled above it on Tuesday confirming a weekly FA at 12074 in the process which set up the slow trending move higher all week which also saw a hat-trick of FAs on the daily time frame at 12177, 12207 & 12255 which would act as important references for the coming week. The auction made highs of 12299 on Friday before closing at 12290 with the weekly Value completely higher at 12168-12270-12294. The PLR (Path of Least Resistance) is to the upside for the coming week towards the 1 ATR objective of 12362 from the weekly FA of 12074 with 12170 being the immediate support.

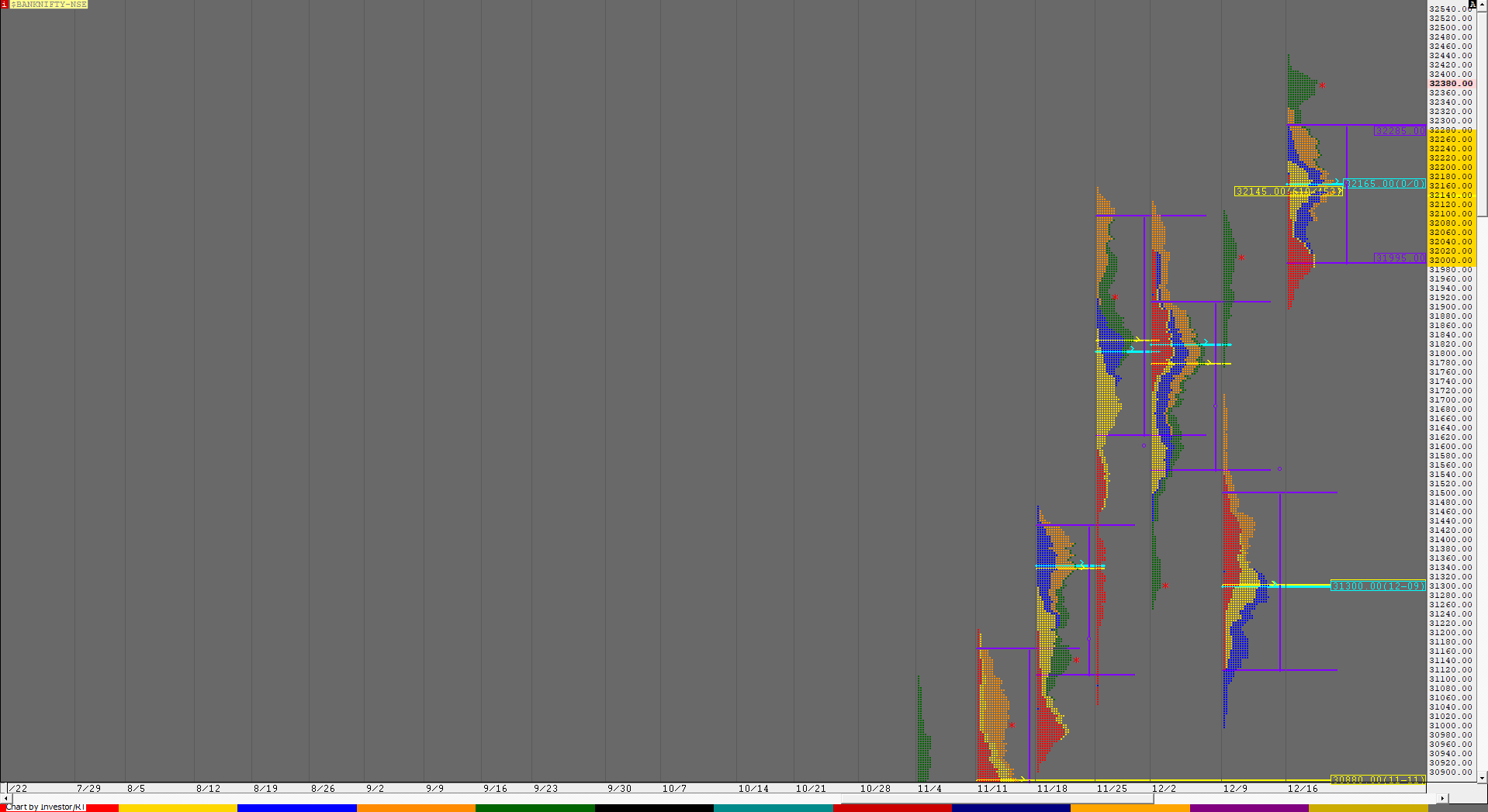

BankNifty Spot Weekly Profile (16th to 20th December)

32385 [ 32443 / 31897 ]

Report to be updated…

Weekly Hypos for Bank Nifty (Spot):

to be updated…

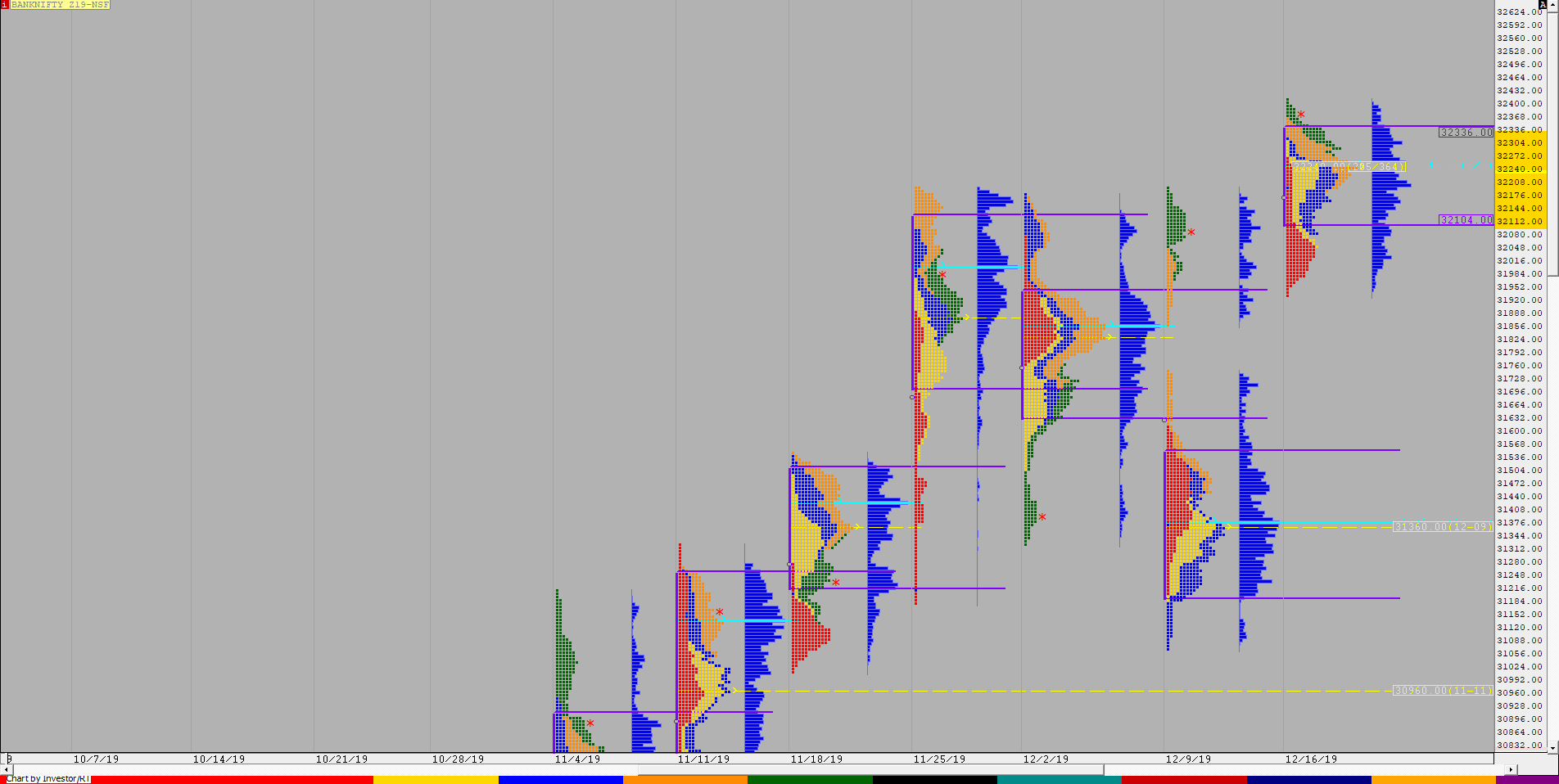

BNF (Weekly Profile)

32378 [ 32440 / 31848 ]

BNF has made a nice Gaussian profile on the weekly with higher Value at 32104-32248-32336 in a narrow range of 592 points and could lead to a bigger range move coming in the expiry week ahead.