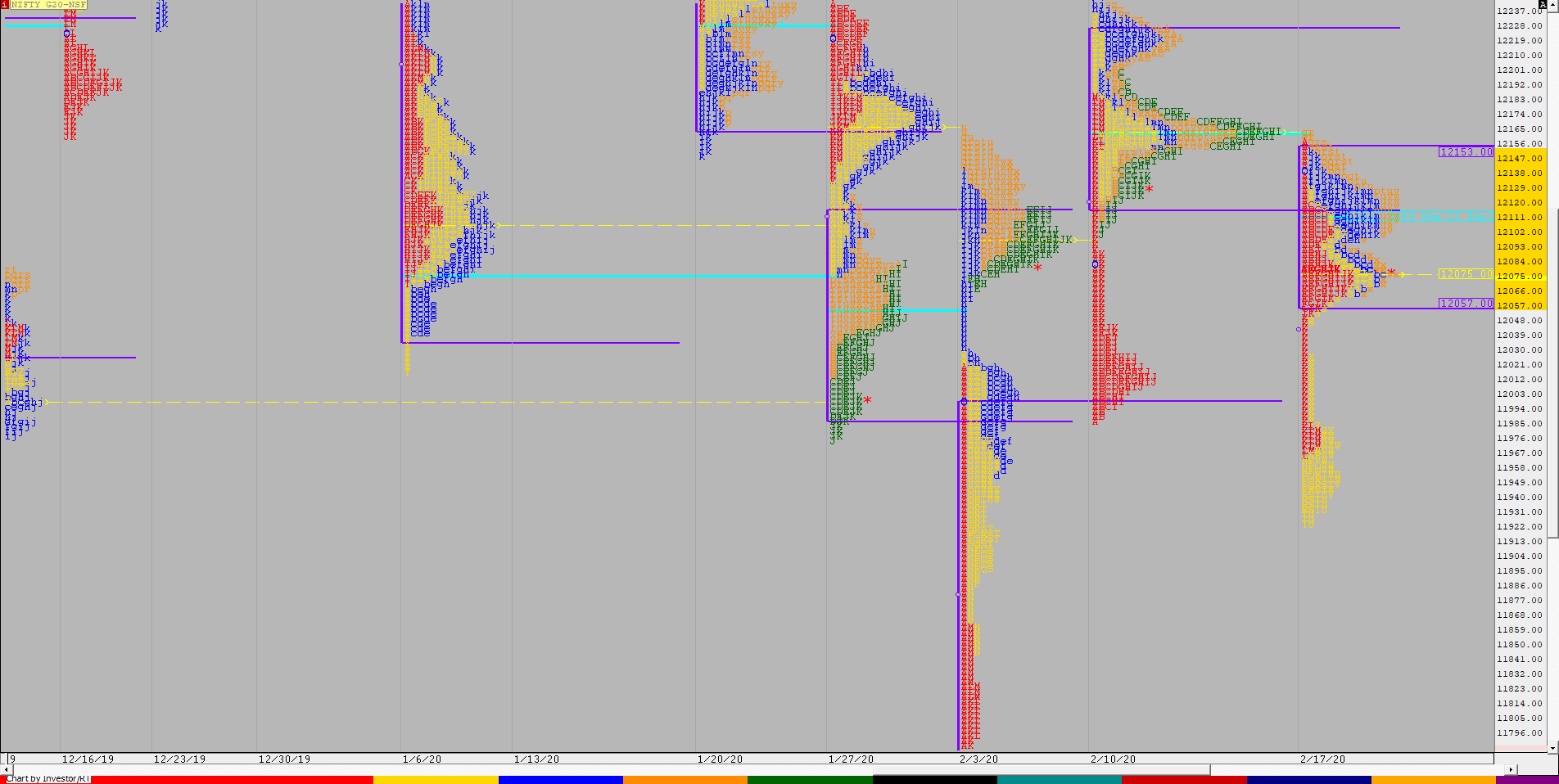

Nifty Spot Weekly Profile (17th to 20th Feb 2020)

Spot Weekly – 12081 [ 12159/ 11908 ]

Previous week’s report ended with this ‘Nifty has formed a 4-day balance with the POC at 12157 which would be the level to cross for more upside. The weekly Value is at 12096-12148-12208 which is overlapping to higher compared to the previous week and has 3 distributions with sinlges of 12091 to 12031 seperating the mid & the lowest distribution and would be the immediate reference in the coming week it Nifty stays below 12096. On the upside, staying above 12096 could get the 80% Rule into play in the nice distribution from 12096 to 12172 which has a prominent POC at 12148.‘

Nifty opened the week with an Open Test Drive down as it got above previous week’s POC of 12148 & tagged that 4-day composite POC of 12157 but was swiftly rejected from there in the IB (Initial Balance) as it left a selling tail from 12125 to 12159 to trend lower all day after breaking below previous week’s VAL (Value Area Low) of 12096 as it made lows of 12037 getting accepted in the previous week’s buying tail of 12091 to 12031 which was a bearish signal. The auction continued the probe lower on Tuesday as it stayed below 12031 leaving yet another selling tail in the IB from 11977 to 12031 making another day of OTF (One Time Frame) move lower in the first half of the day as it made lows of 11909 in the ‘G’ period completing the weekly 1 ATR move down which was where the OTF move down also stopped indicating that the imbalance to the downside could be ending. Nifty then attempted to make new lows in the ‘I’ period but could only make a marginal new low of 11908 as it left poor lows which confirmed the exhaustion of the move lower as it began to form a ‘b’ shape profile for the day with a prominent POC at 11934 but saw a sharp short covering move into the close as it spiked into the morning selling tail and continued this probe on Wednesday as it opened with a huge gap up of almost 100 points and continued higher as it tagged 12119 in the ‘A’ period but left a selling tail in the IB to suggest longs booking out which led to a ‘C’ side RE to the downside as it made lows of 12042 which was rejected after which Nifty went on to confirm a FA (Failed Auction) there to leave a Neutral Extreme profile as it made new highs of 12134 into the close. Thursday saw the auction make an OAIR (Open Auction In Range) start as it left just a 39 points range in the IB which was the lowest of the year 2020 post the first 3 days of Jan which is known for low ranges and low volumes but ended up giving REs on both sides as Nifty gave a second successive Neutral Extreme Day but this time to the downside as it closed the day & week at 12081. The weekly profile is that of a Double Distribution which also resembles a composite ‘p’ shape with 3 days of the week forming a nice balance in the upper part which filled up previous week’s low volume area below the prominent POC and the lower part being a low volume profile of Tuesday. The weekly Value was overlapping to lower at 12036-12101-12148.

Click here to view the MPLite chart of this week’s auction in Nifty

Main Weekly Hypos for Nifty (Spot):

A) Nifty needs to scale above 12101 & sustain for a move to 12132-157 / 12192-211 / 12248-266 & 12295*-321

B) The auction would get weak below 12048-042 for a test of 11991 / 11954-934* / 11905-884 & 11852-822

Extended Weekly Hypos

C) If 12321 is taken out, Nifty can probe higher to 12355-377 / 12417-433 & 12458-485

D) Break of 11822 could bring lower levels of 11773-749 / 11721 & 11686*-664

NF (Weekly Profile)

12079 [12163 / 11923]

NF too has made a composite ‘p’ shape weekly profile with 3 days of the week forming a nice balance in the upper part with Value at 12057-12075-12153 which also has a HVN at 12111 and a low volume zone from 12048 to 11985 which will be the zone to watch on the downside in the coming week if it gives an open away from this week’s POC of 12075 on Monday. On the upside, supply was seen coming back at previous week’s prominent POC of 12162 which would be the level to watch if NF manages to get above the high volume zone of 12111 to 12130.

BankNifty Spot Weekly Profile (17th to 20th Feb 2020)

Spot Weekly – 30835 [ 31649 / 30776 ]

Previous week’s report ended with this ‘the PLR for the coming week would be towards that weekly VPOC of 30675 below which there is a big low volume zone from 30574 to 30105.‘

As expected, BankNifty gave a weak open on Monday as it left a selling tail in the IB from 30867 to 30998 staying below previous week’s Value and continued to probe lower tagging that weekly VPOC of 30675 as it made a low of 30630. The auction gave another bearish start on Tuesday in form of an Open Test Drive and continued to trend lower as the auction entered that low volume zone from 30574 to 30105 but made poor lows at 30252 to indicate exhaustion in the downside probe and went on to give a retracement to 30630 while leaving a prominent POC at 30383. Similar to Nifty, there was a big gap up open on Wednesday of almost 350 points after which BankNifty made highs of 30947 in the ‘A’ period but could not get above the Monday high of 30998 which led to a probe lower resulting in a C side extension which was rejected at 30606 as the auction got back into the IB and stayed there all day making a nice balanced profile for the day. The auction opened in this range on Thursday and continued to smoothen the previous day’s balance in the IB where it left a small buying tail from 30809 to 30702 and for the second consecutive day made a C side extension but this time followed it up with multiple REs in the next 4 periods as BankNifty confirmed a multi-day FA at 30606 and promptly went on to complete the 1 ATR objective of 31059 as it made highs of 31085 and this also confirmed a FA on the weekly timeframe. However, as the probe to the downside ended with poor lows, the auction to the upside also got stalled by an exhaustion signal which came in the form of poor highs as BankNifty got rejected from just above the weekly VAL of 31055 giving a dip to 30914 into the close leaving a ‘p’ shape profile for the day. The weekly Value was completely lower at 30640-30700-31030 which would be the zone to watch for the coming week with that FA of 30606 being the important reference on the downside while on the upside, BankNifty needs to get accepted above this week’s Value to attempt a probe towards the weekly VPOC of 31315 and above it tag the 1 ATR objective of 31568 from the weekly FA it has confirmed this week.

Click here to view the BankNifty action this week with respect to the previous week’s Value on MPLite

Main Weekly Hypos for Bank Nifty (Spot):

A) BankNifty needs to scale above 30976-998 & sustain for a probe to 31050-065 / 31155-180 / 31241-268 / 31319-330 & acceptance above 31330, it could further rise to 31377 / 31425-436 / 31507-511 / 31568-596 & 31649-685

B) Immediate support is in the zone of 30910-889 below which the auction could test 30809-801 / 30726-692* / 30630-606 and staying below 30606, it could further fall to 30538-520 / 30451 / 30381-364 & 30275-252

Extended Weekly Hypos

C) Above 31685, BankNifty can probe higher to 31774 / 31860 / 31924-952 & 32041-056*

D) Below 30252, lower levels of 30190-154 / 30102-021 / 29950-930 & 29881*-845 could come into play

BNF (Weekly Profile)

30939 [ 31098 / 30282 ]

BNF has made a ‘p’ shape profile on the weekly with overlapping to lower Value at 30672-30752-31040 with a HVN at 30848 which will be the immediate reference on the downside in the coming week below the next reference would be the daily FA of 30652 which also marks the start of the low volume zone in the weekly profile. On the upside, the auction would need acceptance above the weekly HVN of 31080 to start a fresh leg higher.