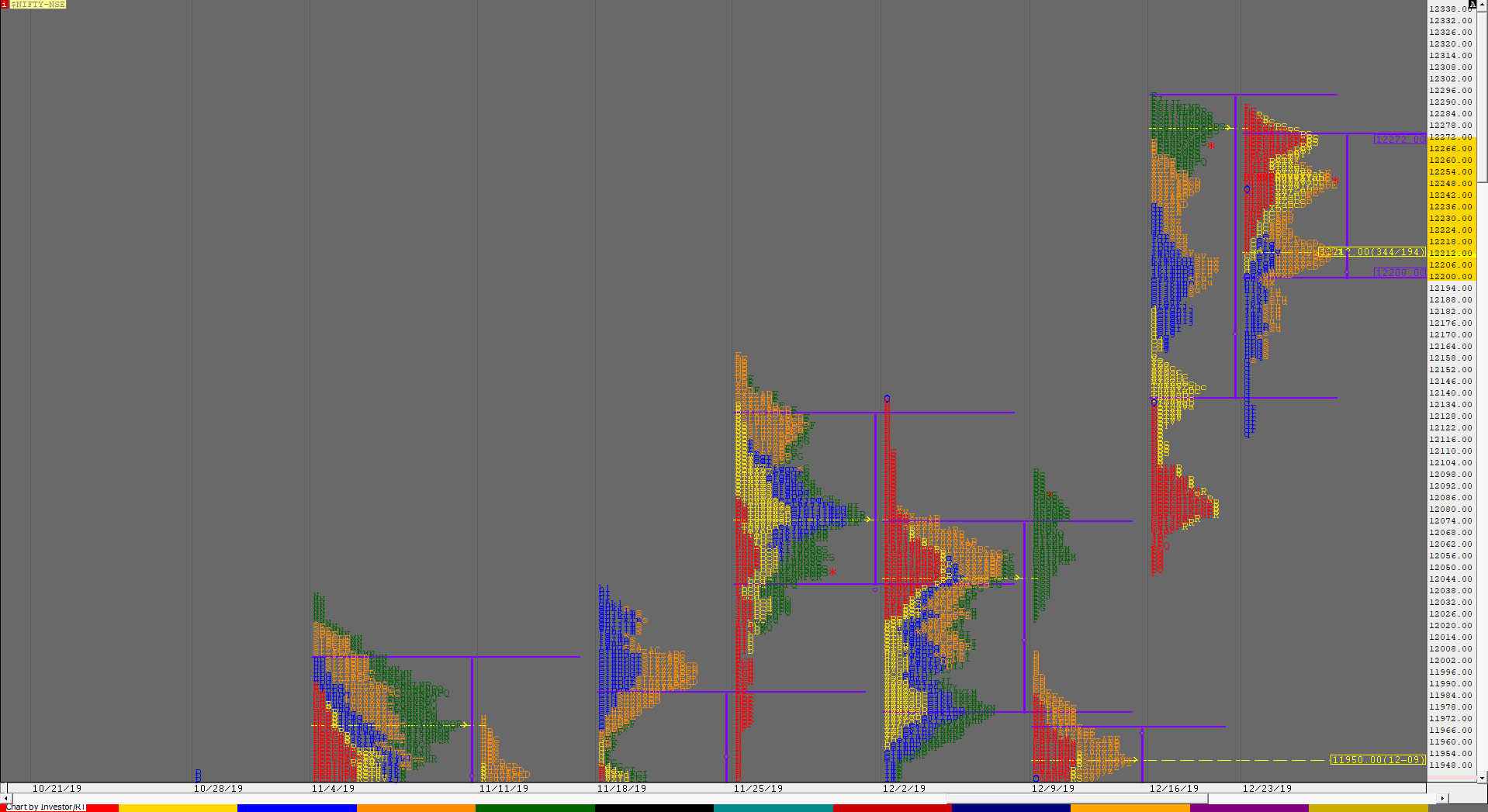

Nifty Spot Weekly Profile (23rd to 27th December)

Spot Weekly 12246 [ 12287 / 12118 ]

Nifty opened the week with a gap down but took support at 12229 in the IB (Initial Balance) on Monday after which it probed higher and even made a small C side RE (Range Extension) as it made new day highs of 12287 but was immediately rejected back from just below the weekly VAH of 12292 which indicated that the PLR (Path of Least Resistance) could change to the downside. The auction then then went on to confirm a FA (Failed Auction) at 12287 as it made new lows of 12213 but once again saw a swift rejection from the important level of 12211 as it left a small tail at lows and played out the 45 degree rule giving a close at the dPOC of 12265. Tuesday saw Nifty making another attempt towards the weekly VAH but once again it got rejected leaving a lower low at 12284 in the A period along with a small tail at the top in the IB and began to form a balance in the previous day’s range till the ‘K’ period. With the FA of 12287 still in play, the auction spiked lower into the close as it made new lows for the week at 12202 falling just short of the 1 ATR target of 12192. Nifty then opened in the spike zone on Thursday after the X Mas break and got rejected right below the spike high of 12222 which set up the day and we got a trending move to the downside in the form of multiple REs and the day finally ended with yet another spike to the downside which saw the auction completing the 80% Rule in previous week’s Value of 12292 to 12136 as it left a spike from 12158 to 12118 closing in an imbalance for the second consecutive day. Friday’s open was a big gap up which indicated that the profile was too stretched & the previous day’s spike was more an emotional one as the auction opened above the spike and took support right at the spike high of 12158 in the IB which meant that the PLR would be to the upside and rightly so Nifty not only reversed the entire down move of previous day but gave a hat-trick of spike closes but for the first time in the week it was on the upside as it spiked from 12230 to 12258 falling just short of that HVN & VPOC of 12265. The weekly range as well as the Value was completely inside previous week’s range at 12200-12212-12272 and to continue the probe higher, the auction will need to get above that vPOC of 12265 & negate the FA of 12287 in the coming week whereas the immediate support is in the zone of 12230-12210.

Watch this week’s daily auction in Nifty relative to previous week’s profile here

Weekly Hypos for Nifty (Spot):

A) Nifty needs to get above 12265 & sustain for a move to 12287-294 / 12321-339 & 12378

B) Immediate support is at 12230-210 below which the auction could test 12179-156 / 12129-125 & 12101

C) Above 12378, Nifty can probe higher to 12405 & 12433-441

D) Below 12101, lower levels of 12062-46 & 11991-982 could come into play

E) If 12441 is taken out, Nifty can have a fresh leg up to 12470-489 & 12540-545

F) Break of 11982 could bring lower levels of 11950-936 & 11910-881

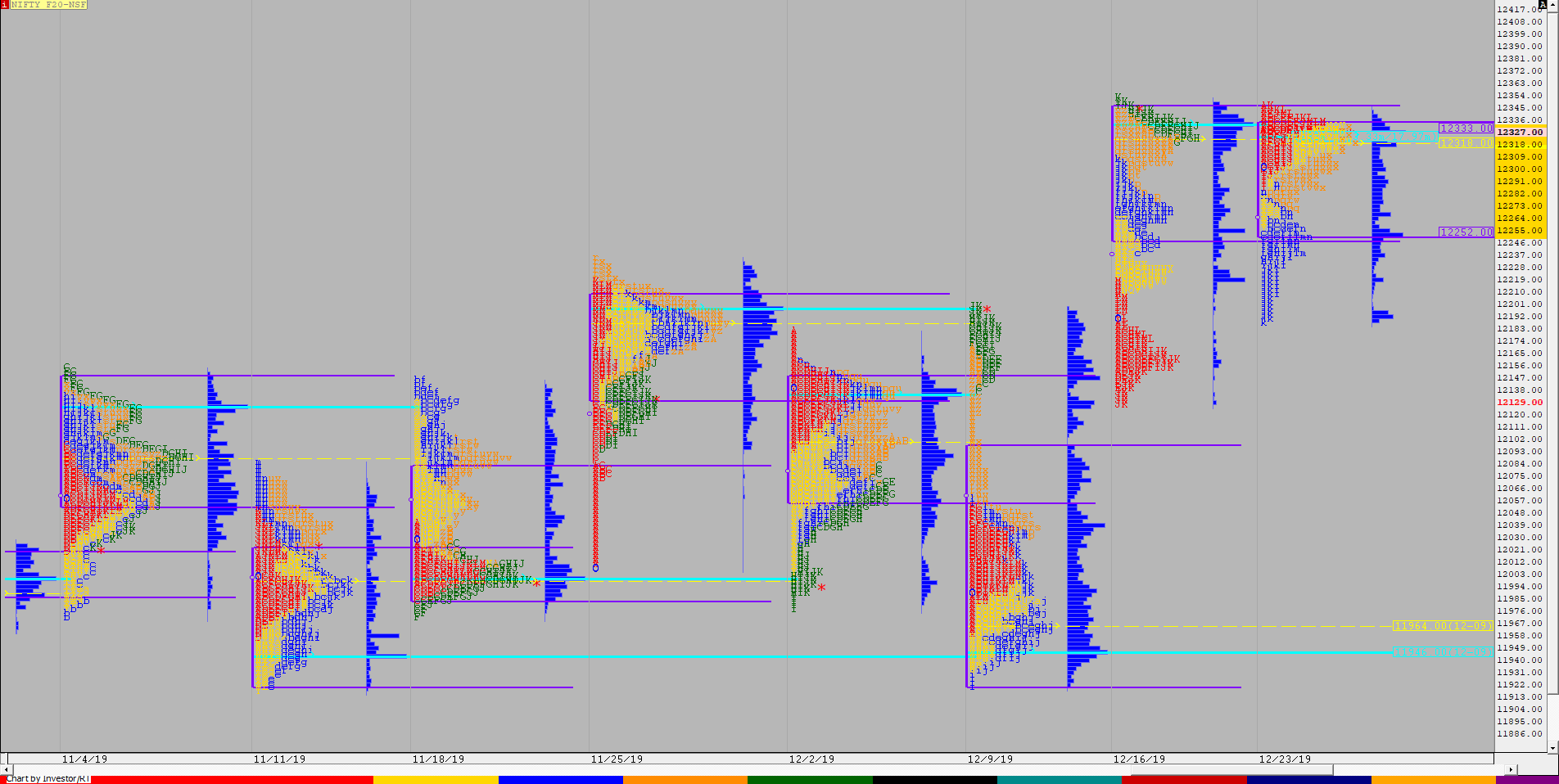

NF (Weekly Profile)

12319 [12346 / 12188]

The Trending profile of previous week led to a narrow range inside week with Value also completely inside previous week’s Value at 12252-12318-12333. This week’s profile has poor highs and a FA at 12346 and has closed at the overlapping weekly POC at 12318 which will be the important references in the coming week.

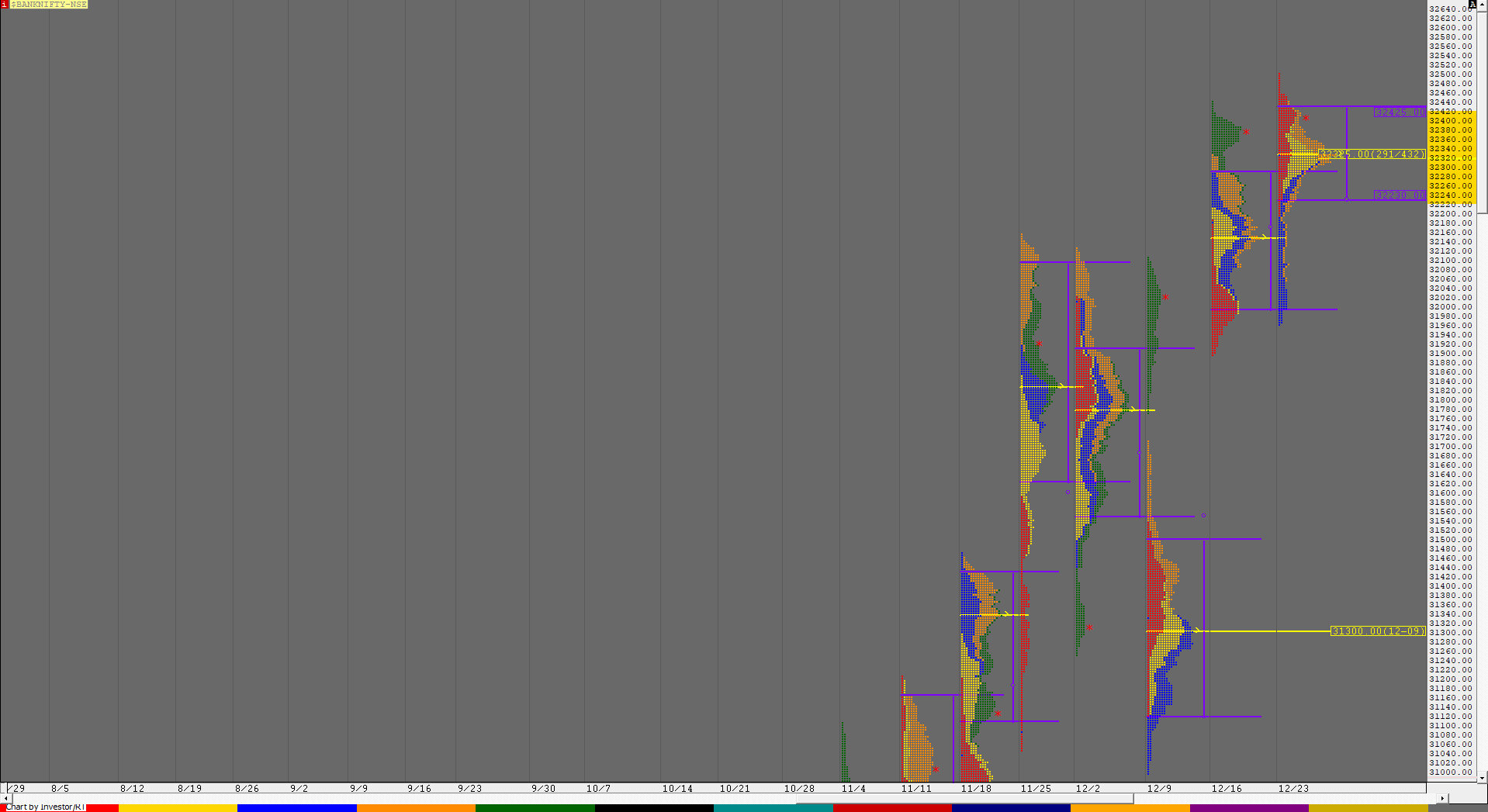

BankNifty Spot Weekly Profile (23rd to 27th December)

32412 [ 32503 / 31963 ]

BankNifty opened the week on a strong note as it left a buying tail from 32370 to 32311 & got above previous week’s high in the IB (Initial Balance) on Monday but the auction changed character once it made a C side RE (Range Extension) higher but was immediately rejected to get back into the IB leaving an small excess at all time highs from 32458 to 32503 which led to a downside probe for the rest of the day as BankNifty not only got into the morning singles but also made multiple REs to the downside thereby confirming a classic FA (Failed Auction) at 32503 and seemed like would tag the 1 ATR objective of 32139 on the same day itself but saw a small buying tail at lows from 32196 to 32220 in the ‘K’ period which triggered a move back to the dPOC of 32385 into the close of the day leaving a Neutral Centre profile. Tuesday saw an attempt being made at open to probe higher after an OAIR (Open Auction In Range) start but BankNifty got rejected from the yPOC of 32385 as it made highs of 32390 but remained in a very narrow range of just 144 points for the day as it left an inside bar with a nice Gaussian profile which had a prominent POC at 32315. The auction then gave an OTD (Open Test Drive) to the downside on Thursday as it checked this prominent POC and made a OTF (One Time Frame) move all day leaving a Trend Day to the downside as it left poor lows at 31963 which gave a small hint that the move lower was getting exhausted as even the dPOC of the day had shifted lower to 32020. This observation got more strength on Friday as BankNifty opened with a big gap up of almost 150 points and left a huge buying tail from 32196 to 32056 in the IB which led to a successful C side RE higher in the form of an extension handle at 32271 as the auction stalled once again at that zone of 32385 (where it faced resistance on Tuesday) but went on to take it out as it spiked higher into the close leaving another extension handle at 32395 which would be the immediate reference on the downside in the coming week. The weekly profile looks like a ‘p’ with a prominent POC at 32325 and mostly higher Value at 32230-32325-32425 with a close near the VAH but BankNifty will need to negate that FA of 32503 to continue higher.

Watch this week’s daily auction in BankNifty relative to previous week’s profile here

Weekly Hypos for Bank Nifty (Spot):

A) BankNifty needs to sustain above 32425 for a move to 32491-503 / 32581 & 32650-670

B) Immediate support is at 32395 below which the auction could test 32325-311 / 32230-221 & 32160-131

C) Above 32670, BankNifty can probe higher to 32750-760 & 32810

D) Below 32131, lower levels of 32087 & 32040-020* could come into play

E) If 32810 is taken out, BankNifty could rise to 32855-865 / 32943 & 33000-034

F) Break of 32020 could trigger a move lower to 31960-952 & 31874-858

G) Sustaining above 33034, the auction can tag higher levels of 33125 / 33190-215 & 33300-310

H) Staying below 31858, BankNifty can probe down to 31810-774 / 31685 & 31620-595

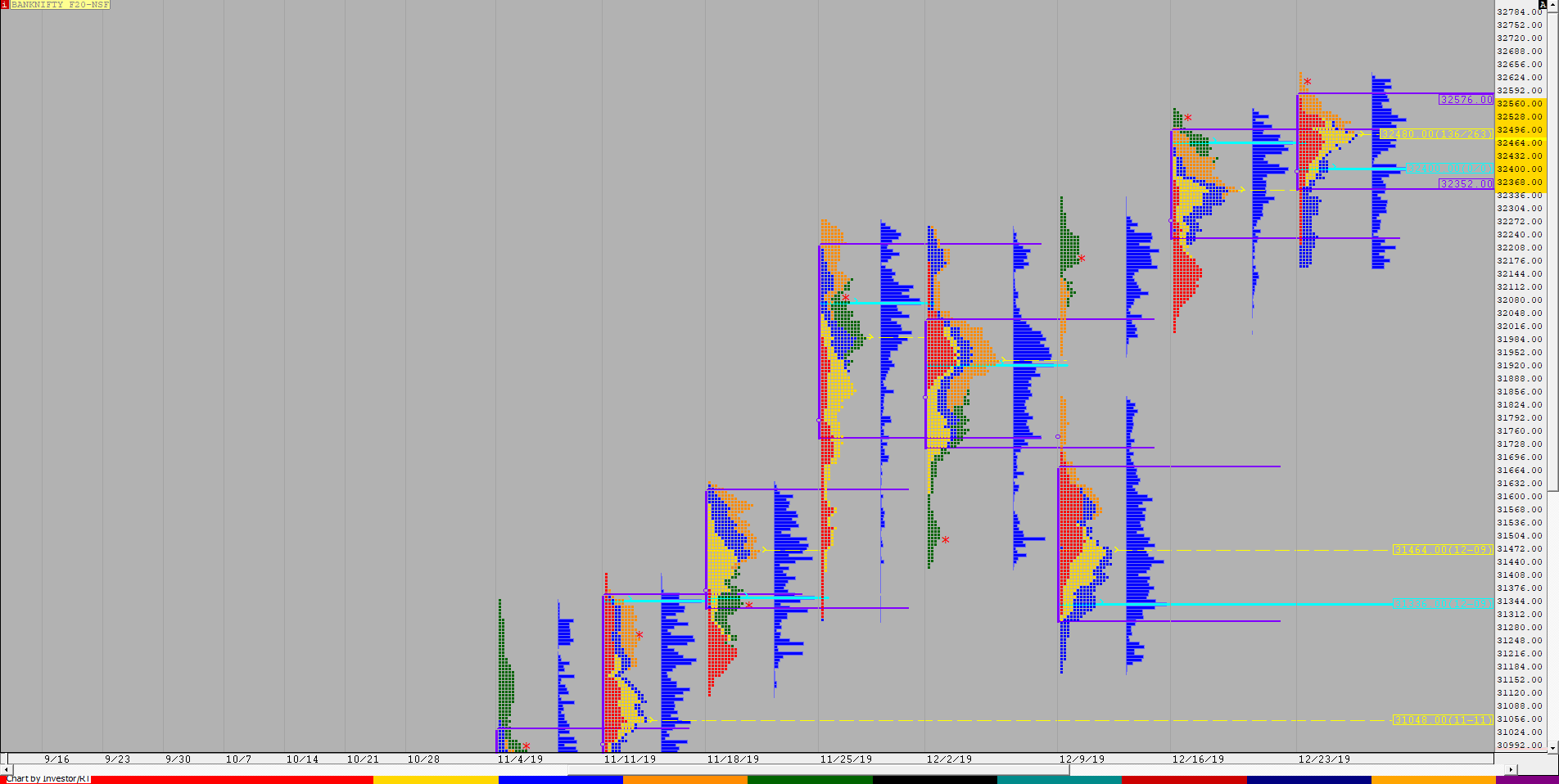

BNF (Weekly Profile)

32605 [ 32634 / 32160 ]

BNF started the week by confirming 2 daily FAs on Monday & Tuesday at 32569 & 32529 which set up for a downside probe as it left a slow Trend Day Down on Thursday but ended up with poor lows at 32160 which indicated exhaustion and the trend day was negated on Friday as the auction not only got above Thursday’s OH (Open=High) of 32450 but went on to negate both the FAs as it spiked into the close making all time new highs of 32634 and looking good for more. The weekly range was even more narrower at 474 points with overlapping to higher Value at 32352-32480-32576 with a ‘p’ shape profile so the prominent POC of 32480 will be the important reference for the coming week.