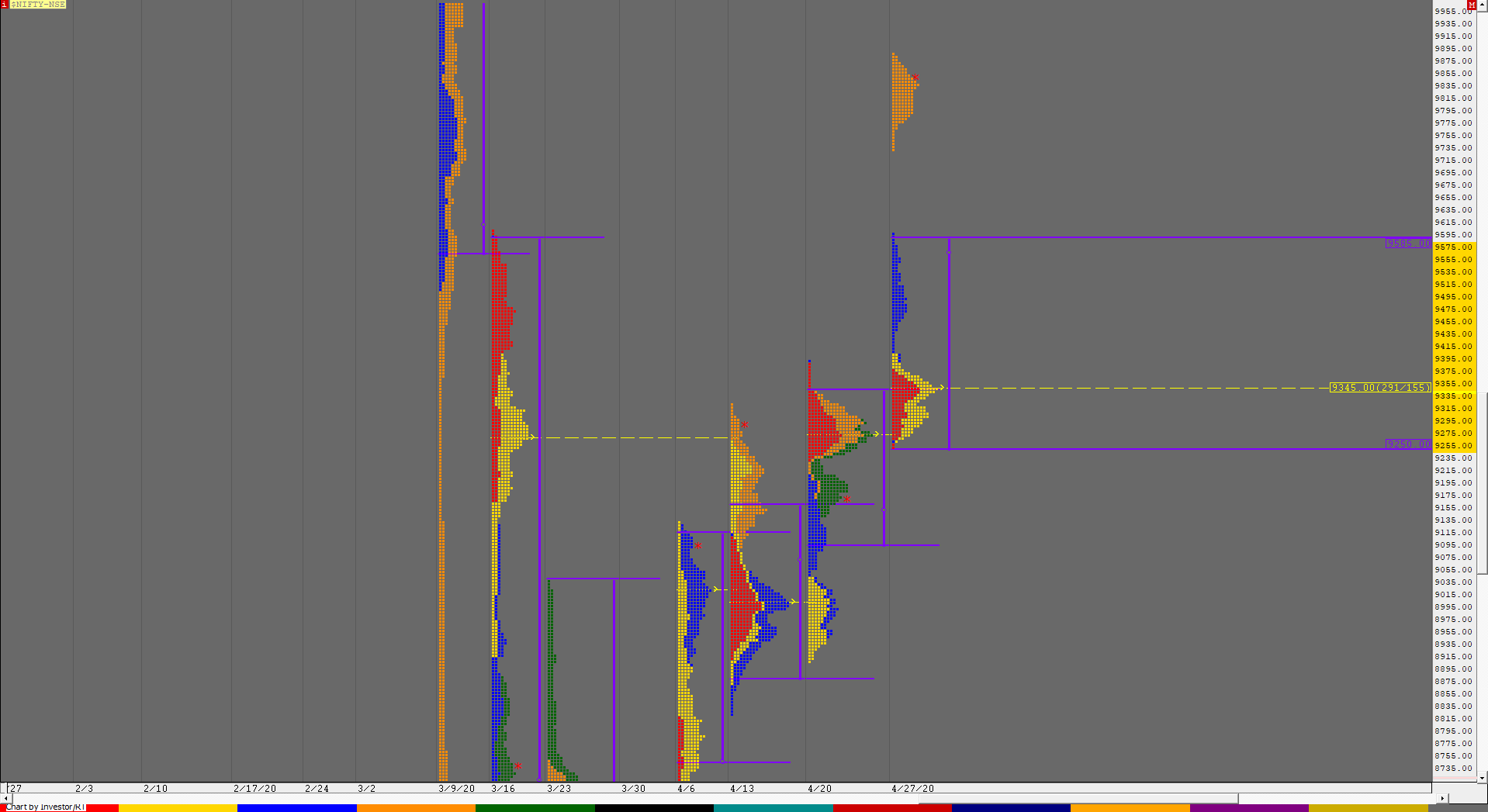

Nifty Spot Weekly Profile (27th to 30th Apr 2020)

Spot Weekly – 9860 [ 9889 / 9250 ]

Previous week’s report ended with this ‘the PLR for the coming week seems to be down with the VPOC of 9106 & the extension handle of 9044 being the immediate support levels and on the upside, the HVN of 9270 could act a tough resistance.‘

Nifty opened this week with a gap up and got accepted above the HVN and previous week’s POC of 9270 which was a sign that the PLR has reversed as it formed a 2-day balance with a prominent POC at 9349 and tested the previous week’s selling tail from 9342 to 9391 after which it even went on to tag the FA of 9404 on Tuesday. The auction moved away from this balance on Wednesday as it probed higher after leaving an initiative buying tail from 9444 to 9390 and went on to almost tag the higher FA of 9602. This weekly imbalance continued on Thursday as Nifty opened with a gap up of 200 points and made multiple REs (Range Extension) higher as it hit 9889 and formed a nice balance for the day leaving a Triple Distribution Trend Up weekly profile with a close at 9860. Value for the week was mostly higher than previous week at 9255-9345-9585 but the close was far away from Value means the auction could give a retracement in the coming week to enable the price to catch up with Value.

The first reference on the downside would be the HVN of 9835 below which there is a big zone of singles from 9767 to 9600 which separates the top & the middle distributions of the weekly profile. The middle distribution has a HVN at 9485 below which the next zone of singles which are from 9444 to 9404 could come into play below which we have this week’s POC of 9345 which would be an important level to watch and if broken can lead to further downside.

Click here to view this week’s auction in Nifty with respect to previous week’s profile on MPLite

Main Weekly Hypos for Nifty (Spot):

A) Nifty needs to sustain above 9851 for a probe to 9906-61 / 10001-50 / 10101-50 / 10252 & 10294-303

B) The auction gets weak below 9835-01 for a test of lower levels of 9765-51 / 9653-9599 / 9555-9485* / 9444-04 & 9361-45*

Extended Weekly Hypos

C) If 10303 is taken out, Nifty can probe higher to 10354 / 10396-404 / 10440**-469 / 10536-545 & 10609

D) Break of 9345 could bring lower levels of 9313-01 / 9260-55 / 9216-09 / 9169-41 & 9106*-9085

-Additional Hypos`-

E) Above 10609`, Nifty could start a new leg up to 10661 / 10713-730 / 10765 / 10813-827 & 10869

F) Below 9085`, the auction can fall further to 9044-14 / 8939-12 / 8887-36 / 8790 & 8748*

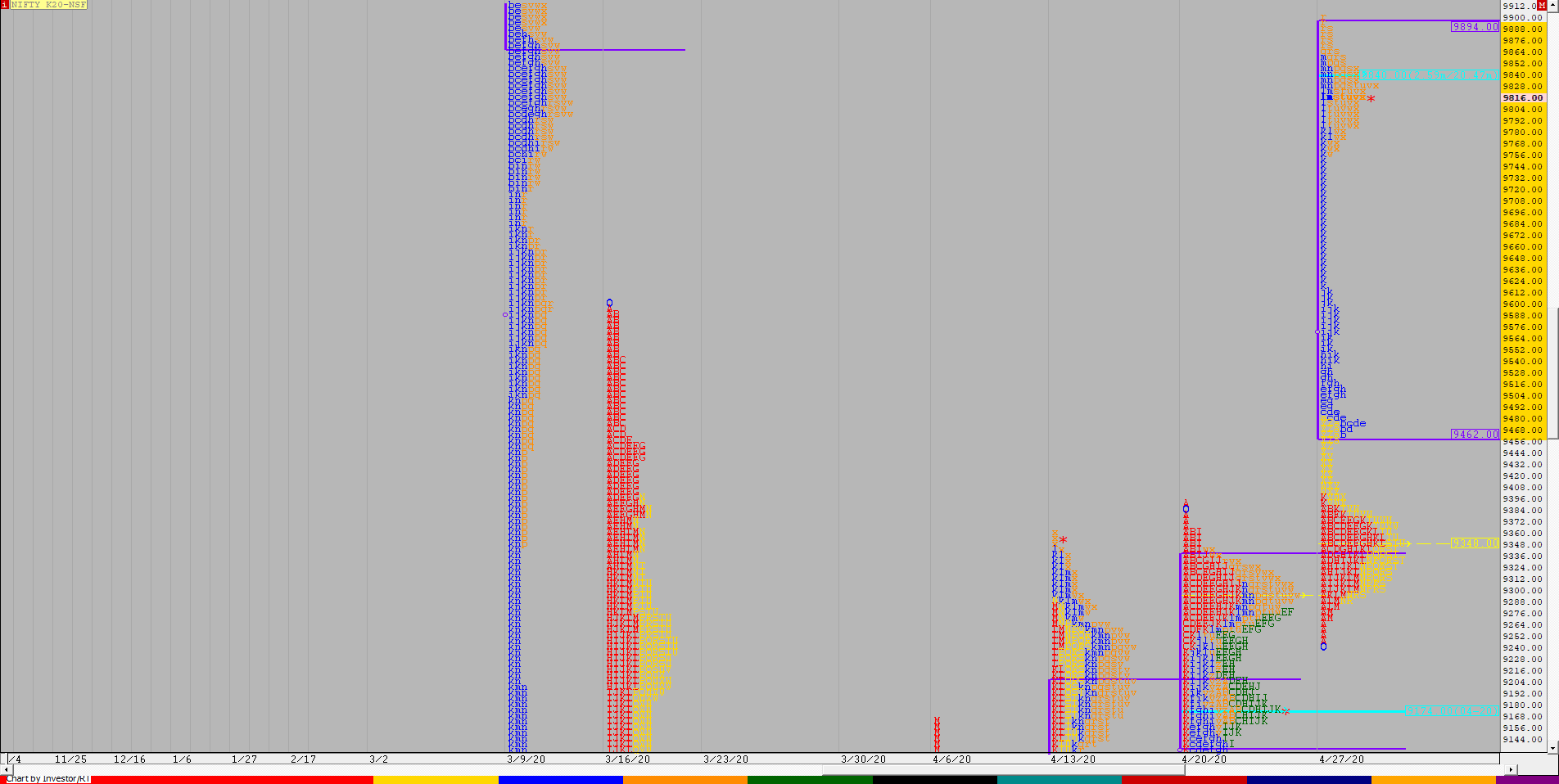

NF (Weekly Profile)

9831 [ 9904 / 9240 ]

NF opened this week with an OL start at 9240 and formed a 2-day balance on the first 2 days with a composite POC at 9348 from where it gave a move away on Wednesday in the form of an initiative tail in the IB from 9452 to 9402 and ended up with an irregular Trend Day as it made highs of 9616. The auction then opened with a huge gap up on Thursday which was also the last day of the week and continued to probe higher tagging 9904 in the afternoon but ended up forming a nice balance leaving a 3-1-3 profile for the day with a close near the POC of 9840. The weekly profile resembles a DD (Double Distribution) with completely higher Value at 9462-9840-9894 and NF remains weak below 9840 which is the HVN of the upper distribution for a test of 9345, which is the HVN of the lower distribution as we have a very low volume zone from 9760 to 9400 which could be zipped through very quickly.

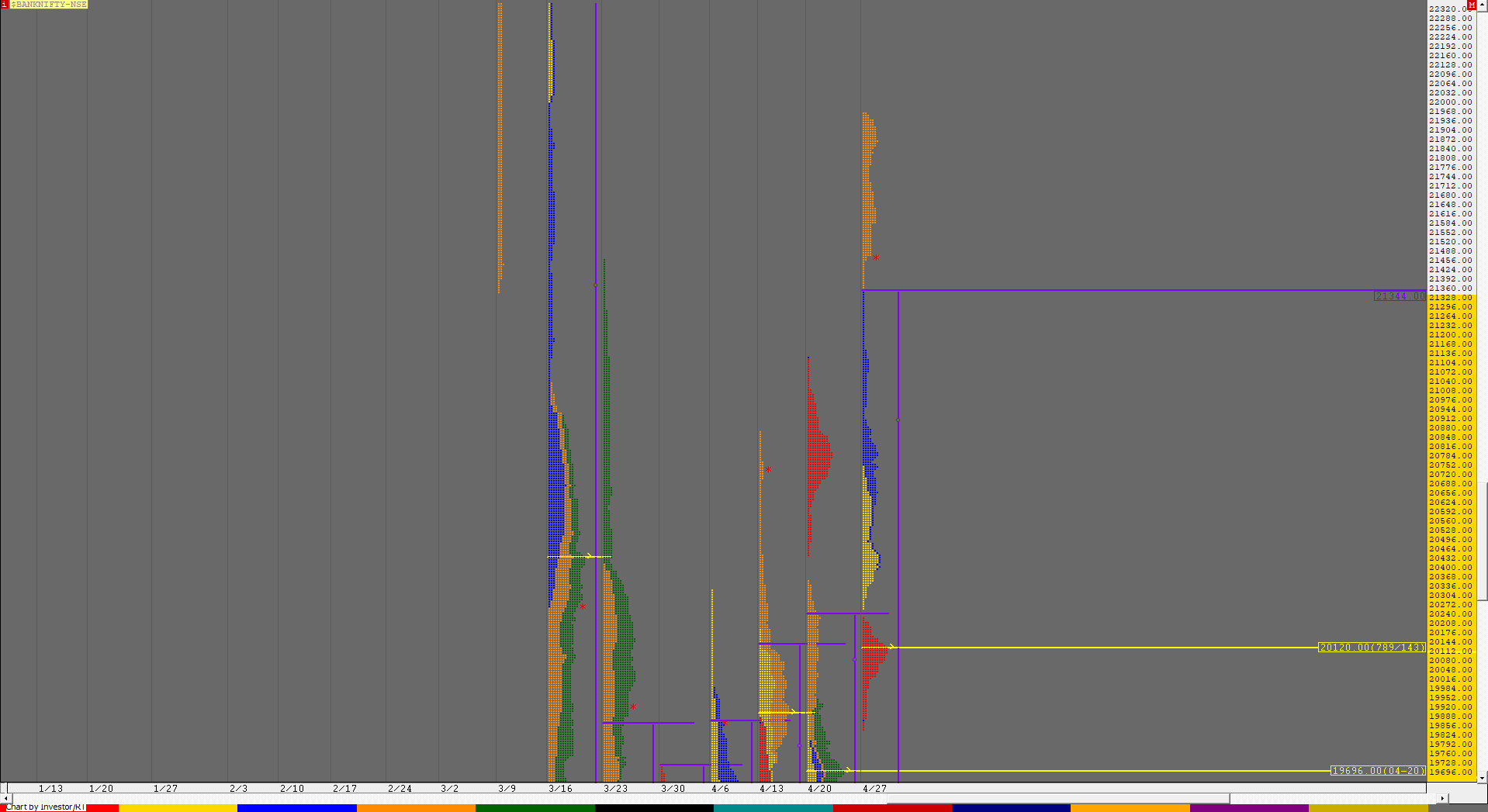

BankNifty Spot Weekly Profile (27th to 30th Apr 2020)

Spot Weekly – 21534 [ 21967 / 19847 ]

Previous week’s report ended with this ‘Value for the week is at at 19248-19696-20248 which was mostly overlapping to higher compared to the previous week and the close was right at the POC of the 2-week composite so a move away from here in the coming week is on the cards.’

BankNifty opened the week above both the 2-week composite POC of 19553 as well as the weekly POC of 19696 giving an almost OL start at 19871-19847 after which it went on to make a high of 20225 forming a ‘p’ shape profile on Monday suggesting that the shorts were being removed. The auction made another gap up open on Tuesday and stayed above PDH as it made a low of 20260 which confirmed an extension handle at 20225 on the weekly chart giving more evidence that the PLR was now firmly to the upside as it was getting acceptance above previous week’s VAH. The day saw multiple REs on the upside in the second half as it made highs of 20751 but closed off the highs to indicate that a retracement could be on the cards because of the almost 1200 point rise from previous week’s close. BankNifty opened lower on Wednesday but gave a Open Test Drive higher as it moved away from the yPOC of 20438 via a buying tail which meant that new demand was entering and this led to a trending move higher all day as it left an extension handle at 20909 and got above previous week’s high of 21122 to hit 21348 closing in a spike. This imbalance continued on Thursday in the form of a big gap up of 500 points where once again the auction left a buying tail in the IB from 21785 to 21353but for the first time in the week, it was not able to make a successful RE higher inspite of 3 attempts where it extended the IB by a mere 26 points and even formed poor highs which was a clear indication that the upmove is getting exhausted and this resulted in a long liquidation break in the second half of the day as BankNifty broke into the morning buying tail and even went on to make a RE lower confirming a FA at top. It then gave a pull back to 21759 where it got rejected which confirmed that the morning demand was not coming back and this triggered a fresh fall into the close as it made new lows of 21353 confirming a Neutral Extreme profile before it closed the week at 21534.

The weekly profile resembles a Triple Distribution shape with a daily FA at top confirming the end of auction to the upside. On the downside, the profile has the first zone of singles from 21353 to 21149 which separates the upper & the middle distributions and if broken could lead to a test of the extension handle at 20909 and the HVN at 20797. We have a second zone of singles in the weekly profile from 20296 to 20224 below which the main HVN & weekly POC of 20120 would come into play which would also mark the completion of the 2 ATR objective of the FA at 21967. This week’s Value is overlapping to higher at 19850-20120-21344.

Main Weekly Hypos for Bank Nifty (Spot):

A) BankNifty needs to get above 21609-630 & sustain for a probe to 21758 / 21835-853 / 21905-967 / 22050-125 / 22200-275 & 22350-425

B) The auction remains weak below 21530 for a test of 21460-340 / 21240-103 / 21021-20953 / 20909-881 / 20797* & 20735-670

Extended Weekly Hypos

C) Above 22425, BankNifty can probe higher to 22501-575 / 22650-726 / 22796 / 22848-875 & 22953-23040

D) Below 20670, lower levels of 20623-593 / 20540-438 / 20375-357 / 20307-224 / 20165-107* & 20022-19950 could come into play

-Additional Hypos*-

E) Above 23040`, BankNifty could start a new leg up to 23109-138* / 23180-266 / 23333-407 / 23449-565 & 23640-716

F) Below 19950`, the auction can go down to 19881-780 / *19696*-676* / 19600-531 / 19460-424* / 19380-321 & 19248-171

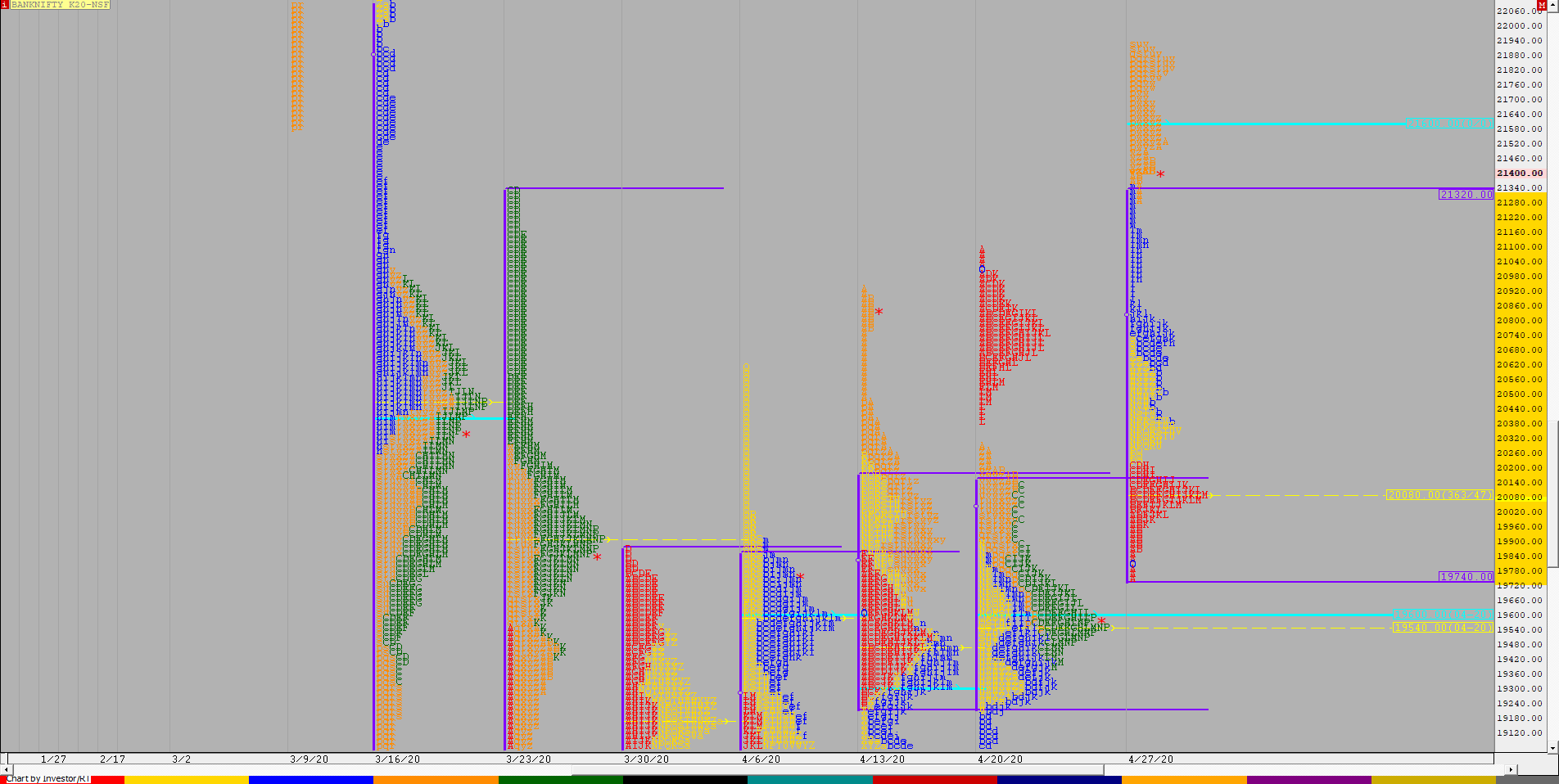

BNF (Weekly Profile)

21431 [ 21932 / 19750 ]

BNF has made an elongated weekly profile with with HVNs of 21600 & 20080 at the 2 extremes which would be the levels to watch as the new series unfolds. The weekly Value is at 19740-20080-21320