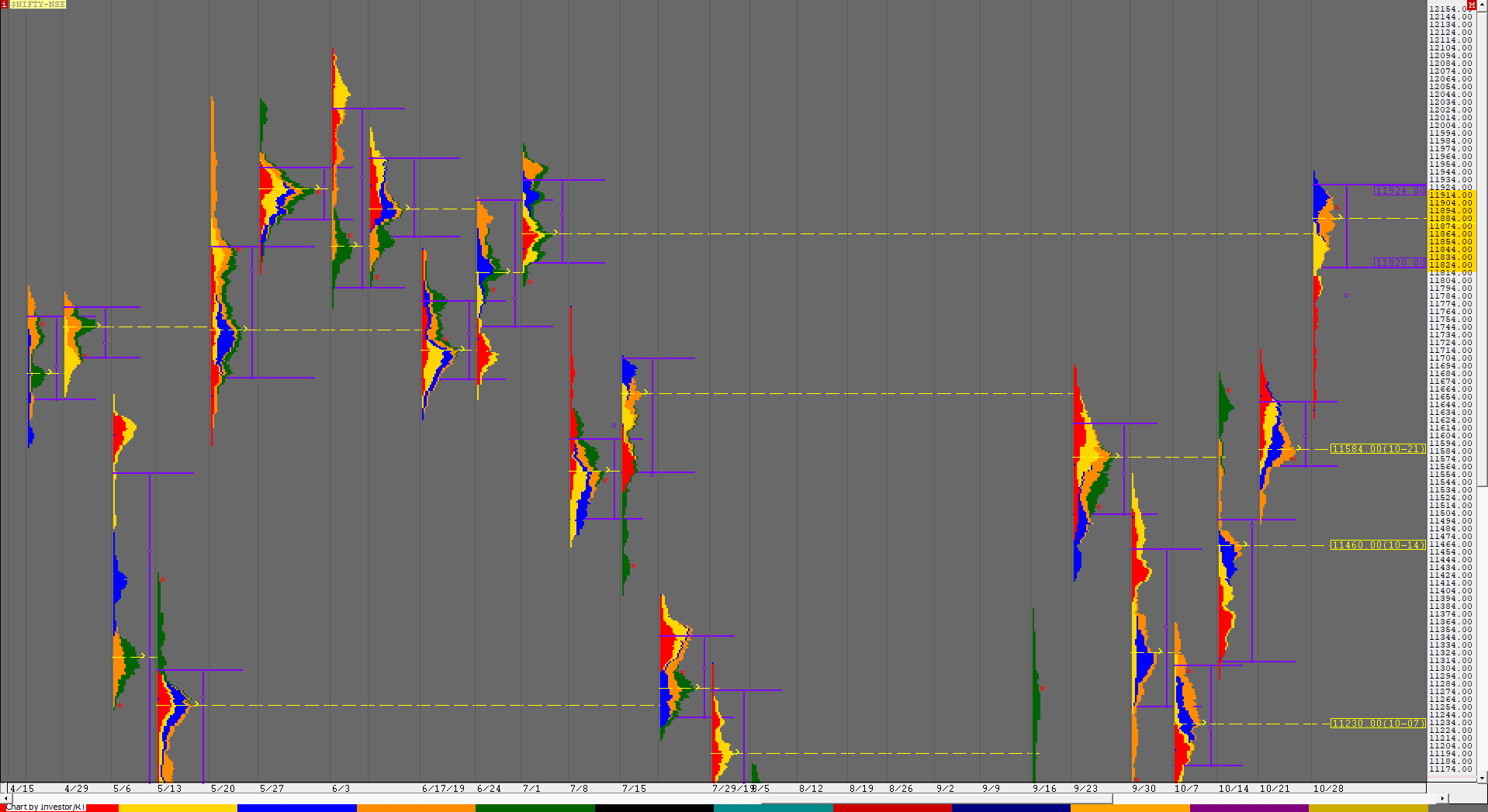

Nifty Spot Weekly Profile (29th October to 1st November)

Spot Weekly 11890 [ 11945 / 11627 ]

Previous week’s report ended with this ‘The weekly profile is a Gaussian one with higher Value at 11562-11584-11649 with a close at the prominent POC so can give a good move away from here in the coming expiry week with the PLR remaining to the upside’

Nifty opened with a gap up above previous week’s prominent POC of 11584 as it left a buying tail at the weekly VAH to give a Trend Day Up on the first day as it scaled above previous week’s high tagging highs of 11809 on Tuesday displaying fireworks after the Diwali holiday. The auction continued to rise higher as it made new highs on the next 2 days hitting 11945 on Thursday where the imbalance of more than 360 points began to take a toll leading to a month end profit booking liquidation move of almost 100 points before Nifty closed the day & month at 11877. Friday then made a narrow range day of just 75 points which was almost an inside bar on the daily as the auction filled up the low volume zone of the weekly profile which was taking the shape of a composite ‘p’. Value for the week was higher with a huge gap at 11820-11884-11924 with a close yet again near the weekly POC so the ability to stay above this would mean more upside to come in the next session(s) and on the downside the first zone of support would be at 11843 to 11820 in the coming week which if broken could give a bigger drop.

Weekly Hypos for Nifty (Spot):

A) Nifty needs to get above 11920-937 & sustain for a move to 11976-991/ 12018-025 & 12042-46

B) Immediate support is at 11881 below which the auction could test 11843-825 & 11784-773

C) Above 12046, Nifty can probe higher to 12070-77 / 12101-105 & 12138

D) Below 11773, lower levels of 11740-716 & 11665-650 could come into play

E) If 12138 is taken out & sustained, Nifty can have a fresh leg up to 12155-161 / 12182 & 12205-211

F) Break of 11650 could bring lower levels of 11610-584 & 11553-540

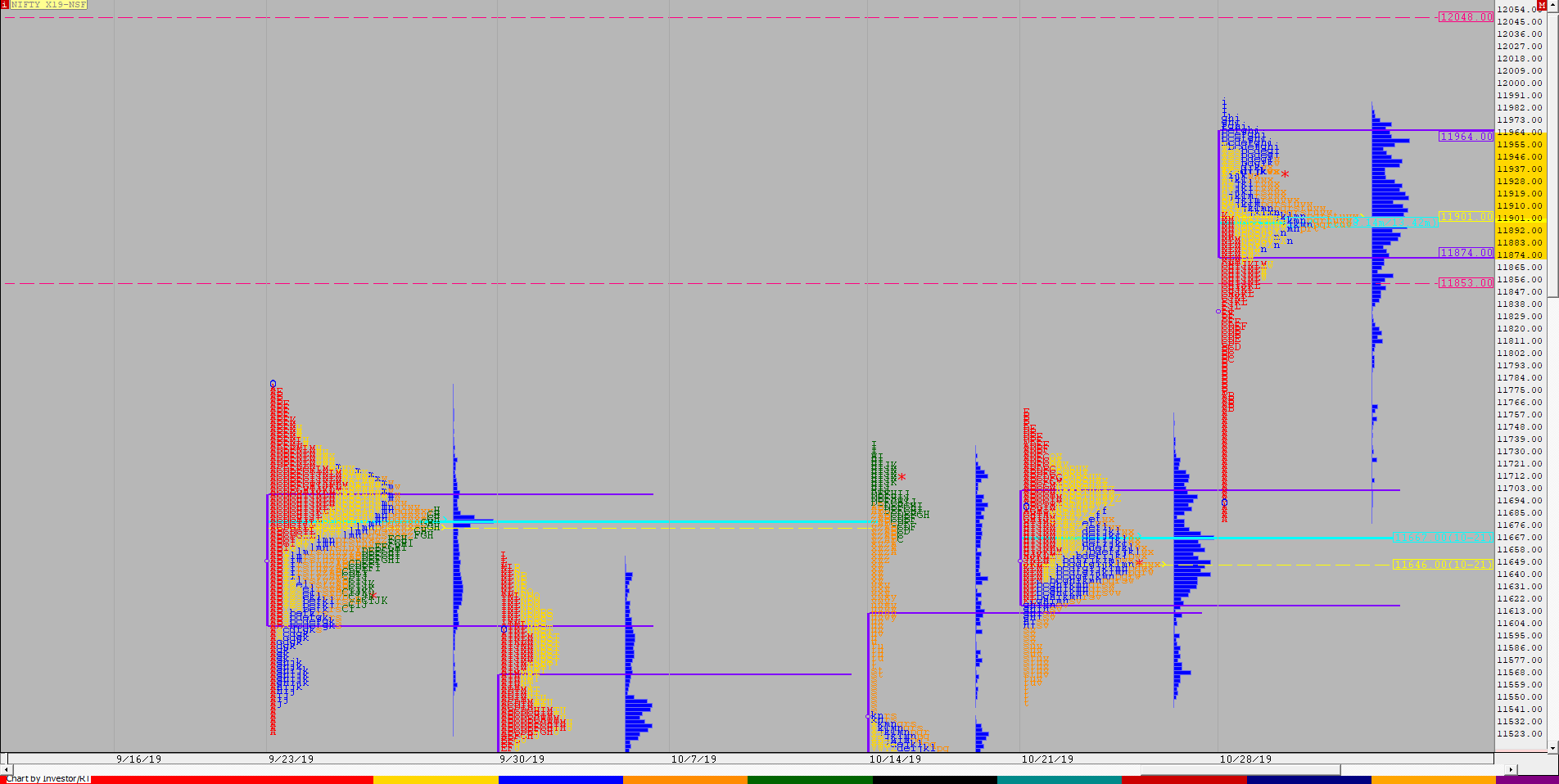

NF (Weekly Profile)

11928 [11985 / 11680]

NF gave an initiative move away from previous week’s balance on Tuesday with a buying tail from 11680 to 11749 with a Trend Day Up as it got above the weekly VPOC of 11853 and continued the upside probe as it made higher highs on the next 2 days as it hit 11985 but the range began to contract as it ended the week with a 67 point day on Friday to leave a composite ‘p’ shape profile for the week with a prominent POC at 11901. The weekly Value was higher at 11874-11901-11964 so the PLR remains up as long as the auction stays above 11901.

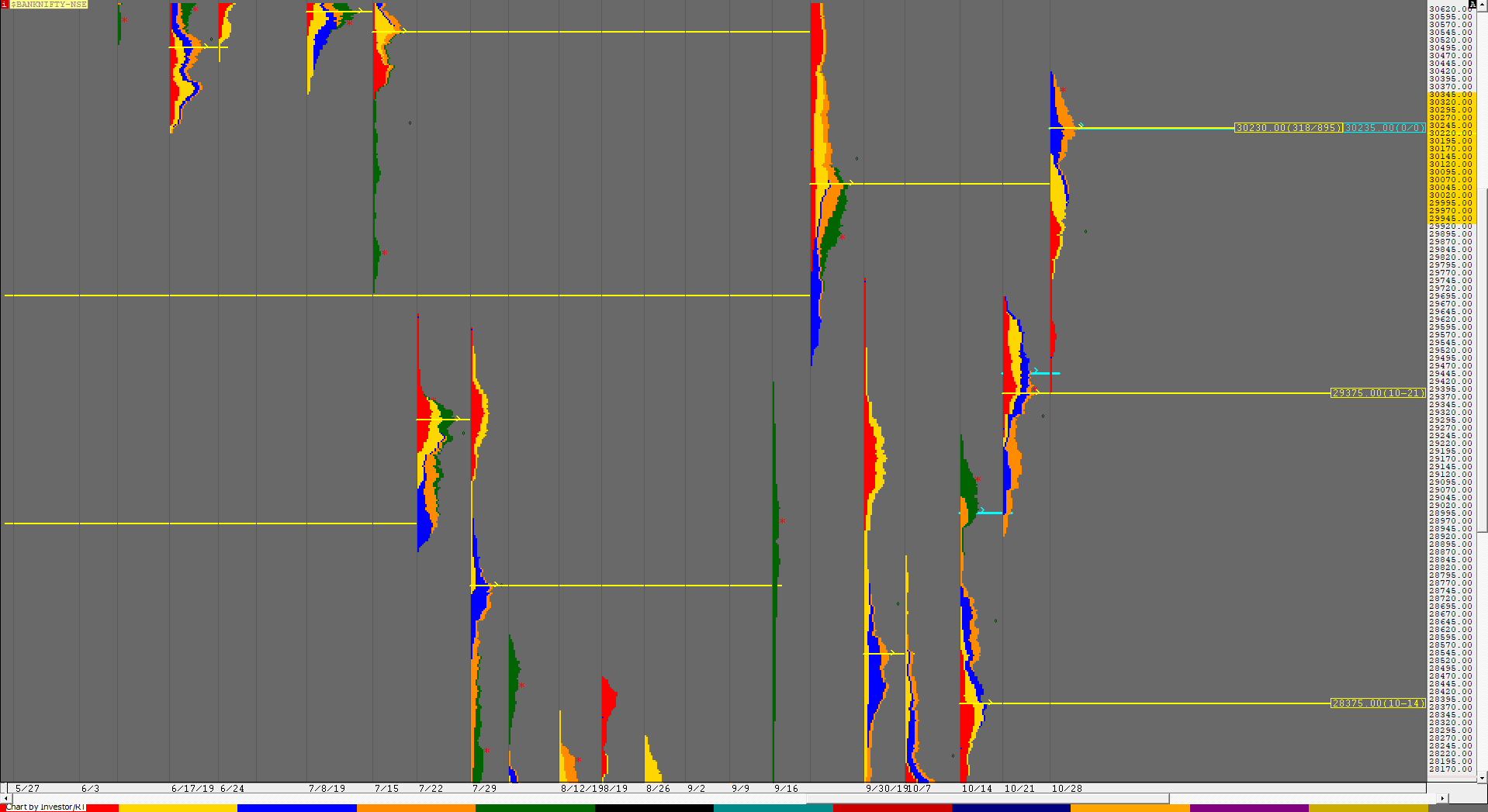

BankNifty Spot Weekly Profile (29th October to 01st November)

30330 [ 30415 / 29385 ]

Last week’s report ended with this ‘the PLR is still to the upside but will need to sustain above 29500 and negate that weekly FA of 29693 to continue higher where it could get into the 5-day (23rd-27th Sep) composite Value of 29730-29875-30396 (can view the profile here) in the coming week. On the downside, there is a low volume zone between 29395 to 29130 which would be the immediate reference’

BankNifty gave an initiative move higher after testing the high of the above mentioned low volume zone as it left a buying tail from 29501 to 29385 in the first hour on Tuesday which was a bullish sign which was further confirmed as the auction went on to negate the previous week’s FA of 29693 and entered that composite mentioned above and tagging the POC of that balance as it made highs of 29997. This probe higher continued for the next 2 days as the auction completed the 80% Rule by tagging the VAH of 30396 on Thursday as it made highs of 30415 but got swiftly rejected which led to a quick retracement to 29987 before closing the month at 30066. The last day of the week then saw a consolidation as BankNifty made an inside bar on the daily timeframe building volumes around the 30200 zone before closing the week at 30330 leaving an elongated weekly profile with completely higher Value at 29945-30230-30345. PLR is still to the upside but the auction will need to stay above 30330 for a probable probe to 30800 and BankNifty would get weak if it stays below 30230-200.

Weekly Hypos for Bank Nifty (Spot):

A) BankNifty needs to sustain above 30345-360 for a move to 30415-451 / 30538-570 & 30625

B) Immediate support is at 30290-275 below which the auction could test 30200-190 / 30130-100 & 30028-15

C) Above 30625, BankNifty can probe higher to 30690-718 / 30772-801 & 30875-890

D) Below 30015, lower levels of 29945-930 / 29840-810 & 29770-757 could come into play

E) If 30890 is taken out, BankNifty could rise to 30960-977 / 31040 & 31090-105

F) Break of 29757 could trigger a move lower to 29690-671 / 29610-585 & 29540-500

G) Sustaining above 31105, the auction can tag higher levels of 31160 / 31241-250 & 31323-345

H) Staying below 29500, BankNifty can probe down to 29415-*375* / 29325-320 & 29240

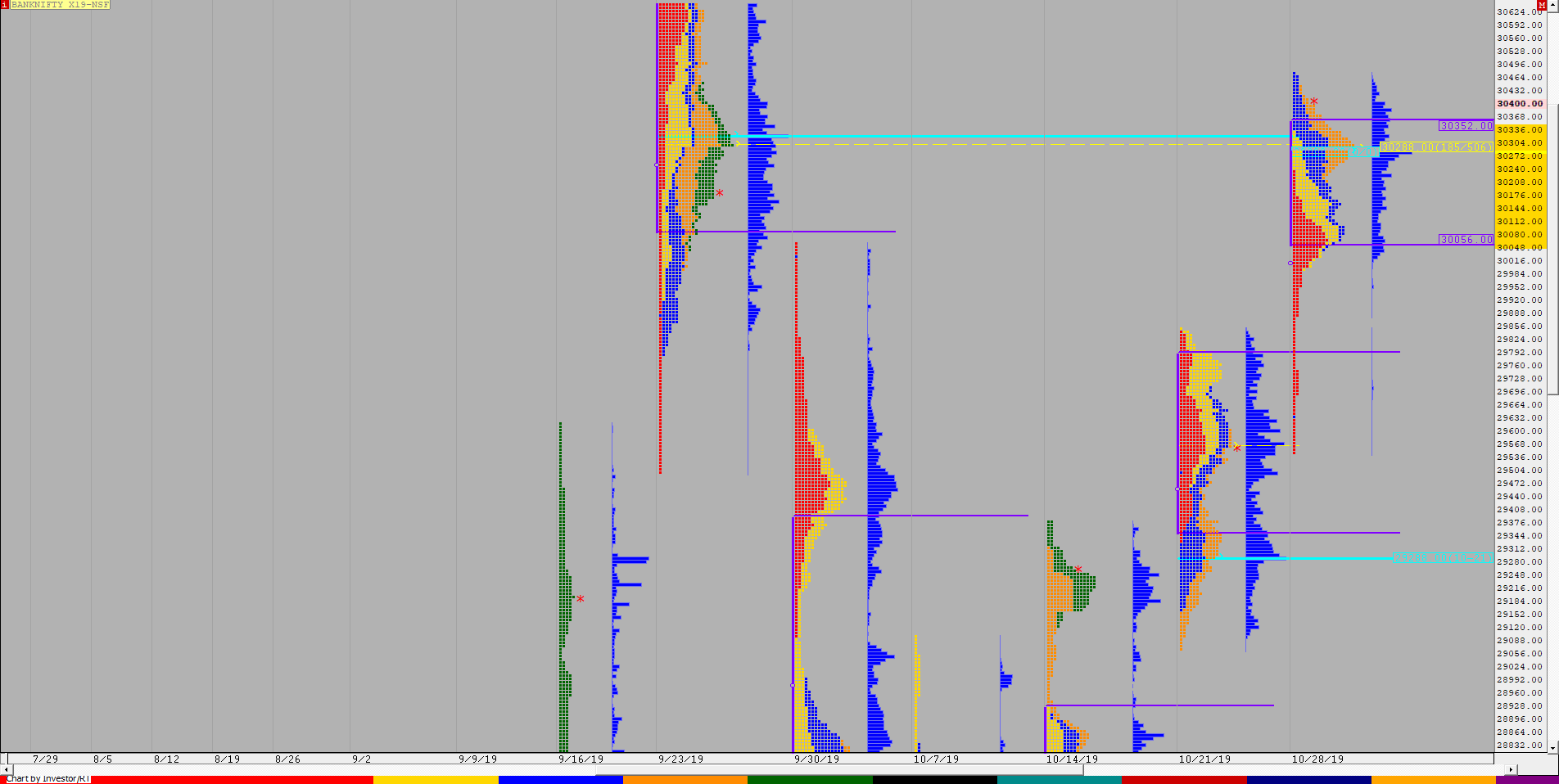

BNF (Weekly Profile)

30374 [ 30475 / 29525 ]]

BNF did give a move away from previous week’s POC at open on Tuesday as it first left a buying tail from 29635 to 29525 after which made an extension handle at 29749 to give a trending move up for the first 3 days as it made higher highs tagging 30475 on Thursday which was also the highs of 27th Sep from where a trending move to the downside had started. The auction then made an inside day on Friday consolidating the week’s rise of 949 points as it closed at 30374 and just like NF has given a composite ‘p’ shape weekly profile with higher Value at 30056-30288-30352. The PLR is still up as the auction has closed above the weekly VAH & the important reference in the coming week would be the prominent POC of 30288.