Nifty Spot: 19653 [ 19675 / 19333 ]

Previous week’s report ended with this ‘The weekly profile is a well balanced Gaussian Curve and a Neutral one which had overlapping Value for all the 5 days of the week resulting in an ultra prominent POC at 19675 forming Value overlapping to lower at 19617-19675-19718 and looks all set to give a move way from this zone as the new month of October gets underway with the downside objectives starting with Thursday’s VPOC of 19542 below which we have the weekly 2 ATR objective of 19416 from 19766 and finally the lower VPOC at 19335 (28th Aug to 01st Sep) whereas on the upside, Nifty will first need to scale above 19718 and find initiative buying for a probe towards the selling tail of 19812 from 21st Sep and the daily VPOC of 19953 from 20th‘

Monday

Holiday

Tuesday

Nifty opened with a move away from previous week’s balance with a Drive Down as it broke below 28th Sep’s VPOC of 19542 and went on to make a low of 19479 in the Initial Balance (IB) but could not extend any further as it remained in a narrow range for the rest of the day forming a ‘b’ shape long liquidation profile with a close around the prominent POC of 19529 and an initiative selling tail from 19567 to 19623 forming completely lower Value

Wednesday

The auction continued the downside imbalance with a gap down below the 04th Sep extension handle of 19458 and went on to tag the objective of 19417 as mentioned above in the IB while making a low of 19375 and after a brief pause made multiple REs (Range Extension) lower tagging an important objective of 19335 (again given above) and stalling there marking the return of demand which triggered a short covering squeeze back to 19452 into the close

Thursday

opened with a similar gap as previous session but to the upside as it settled down into an OAOR forming a narrow 39 point range IB between 19508 to 19547 after which sellers made an attempt to extend lower but could only manage similar lows of 19487 in the C & D periods suggesting that the buyers were not letting go forcing a RE to the upside but there also could only manage almost similar highs of 19573 & 19577 and settling near the prominent dPOC of 19554 leaving a Neutral Centre Day with completely higher Value

Friday

Nifty opened higher making it a hat-trick of opening with a similar gap as it made an attempt to get back into previous week’s Value but for the second consecutive session formed an OAOR and remained in a mere 35 point range in the IB which was still a bullish signal as the auction was getting accepted in Monday’s initiative selling tail clearly showing that the sellers were losing their grip and more confirmation of this came with multiple REs to the upside triggering the 80% Rule in the weekly Value and tagging the ultra prominent POC of 19675 to the dot and closing yet again around the dPOC of 19651

The weekly profile is a Neutral Extreme One to the upside which started off with an imbalance to the downside in the first part where it tagged the lower weekly VPOC of 19335 (28th Aug to 01st Sep) and having met the swing objective not only stalled the move lower but reversed to the upside with last week’s prominent POC of 19675 acting as a magnet which got hit into the close forming overlapping to lower Value with a prominent POC at 19480-19529-19655 and has left couple of extension handles lower at 19573 & 19452 which will be the levels to watch for on the downside with the immediate reference being at 19623 whereas on the upside, Nifty will need to stay above 19675 for a test of the weekly selling tails of 19750 & 19812 along with the extension handle at 19885

Click here to view this week’s MarketProfile of Nifty on Vtrender Charts

Hypos for the week 09th to 13th Oct 2023

| Up |

| 19669 – Tail from 06 Oct 19718 – Weekly VAH 19766 – Weekly FA (28 Sep) 19812 – Selling Tail (21 Sep) 19871 – Gap mid (21 Sep) 19953 – VPOC (20 Sep) 20017 – Selling Tail (20 Sep) 20057 – Gap mid (20 Sep) |

| Down |

| 19623 – Ext Handle (06 Oct) 19574 – Weekly Ext (02-06 Oct) 19529 – Weekly POC 19479 – Weekly Ext (02-06 Oct) 19420 – VPOC from 04 Oct 19369 – SOC from 04 Oct 19333 – Monthly IBL 19288 – Buying Tail (01 Sep) |

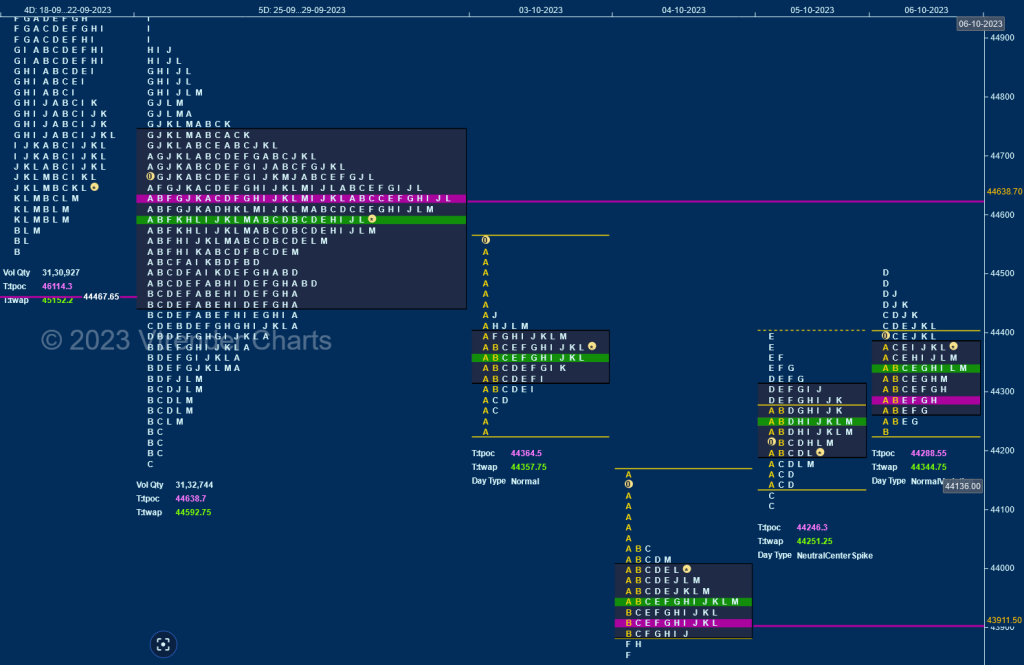

BankNifty Spot: 44360 [ 44566 / 43857 ]

Previous week’s report ended with this ‘The weekly profile is a nice Gaussian Curve with completely lower Value at 44446-44638-44741 with an ultra prominent POC at 44638 which will act like a magnet unless we get an initiative move away from this zone with the FA at 44756 being the immediate reference on the upside whereas on the downside, this week’s VAL which coincides with the daily buying tail from 44488 will be the first level to watch below which the FA of 44182 will be the important one to watch‘

Monday

Holiday

Tuesday

BankNifty opened with an almost OH (Open=High) start at 44561 and confirmed a Drive Down moving away from previous week’s Value as it dropped further by 323 points in the A period itself making a low of 44243 but could not extend any further forming a ‘b’ shape long liquidation profile with an initiative selling tail from 44435 to 44566 and a prominent POC at 44370

Wednesday

The auction continued the downside imbalance with a gap down open of 290 points as it remained below the FA of 44182 and continued to probed lower making a low of 43900 in the IB and made couple of REs but could only manage to hit 43867 taking support just above the weekly HVN of 43863 (14th to 18th Aug) leaving another ‘b’ shape profile for the day with the dPOC shifting down to 43911 indicating that the downside was getting exhausted

Thursday

The sellers doing a bad job was further confirmed with a higher open of 217 points but BankNifty settled down into an OAOR forming a very narrow 129 point range IB which was followed by a typical C side extension lower to 44108 getting swiftly rejected and triggering a quick bounce back to Monday’s VPOC of 44364 confirming a FA at lows but could not get above the VAH of 44397 closing as a Neutral Centre Day with a prominent POC at 44246

Friday

saw another higher open but once again the auction stalled at Monday’s VAH and made a probe lower to 44243 taking support at yPOC and made couple of attempts to extend higher making a high of 44500 but could not take out this week’s initiaitve selling tail forming a Gaussian Curve with overlapping to higher value giving a nice 2-day composite balance with a close right at it’s POC of 44289 and Value at 44226 to 44374 with a good chance to move away from here in the coming session

The weekly profile is a Normal Variation one to the downside which remained below previous week’s prominent POC of 44638 forming mostly lower Value at 44181-44364-44471 taking support at the prominent weekly HVN of 43863 (14th to 18th Aug) for the third time leaving a daily VPOC at 43911 & a small zone of singles from 44044 to 44108 which would be the support zones to watch for in the coming week as the structure also represents a Double Distribution with a close right at the upper HVN of 44364 which will be the opening reference for the coming week

Click here to view this week’s MarketProfile of BankNifty on Vtrender Charts

Hypos for the week 09th to 13th Oct 2023

| Up |

| 44374 – 2-day VAH (05-06 Oct) 44500 – Monthly Selling Tail (Oct) 44638 – Weekly POC 44756 – FA from 28 Sep 44838 – VPOC from 25 Sep 45039 – Ext Handle (21 Sep) 45137 – VPOC from 21 Sep) 45222 – Selling Tail (21 Sep) |

| Down |

| 44328 – Closing PBL (06 Oct) 44225 – 2-day VAL (05-06 Oct) 44108 – FA from 05 Oct 44026 – SOC from 04 Oct 43911 – VPOC from 05 Oct 43830 – Swing Low (01 Sep) 43672 – 1 ATR from FA (44108) 43541 – Weekly FA (26 Jun) |