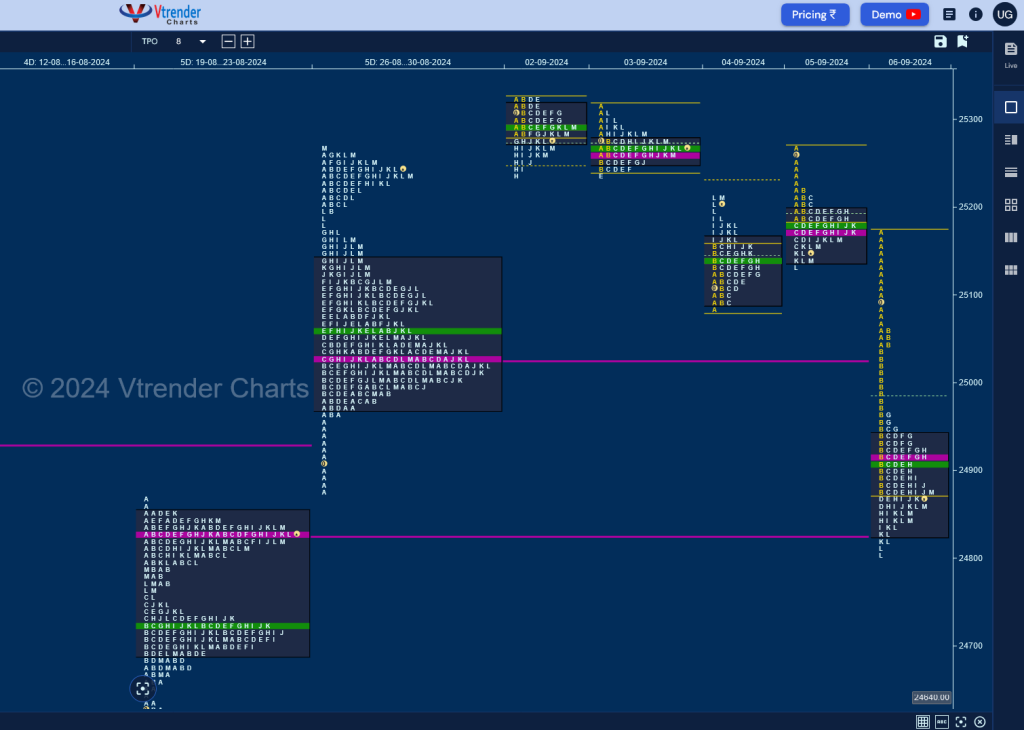

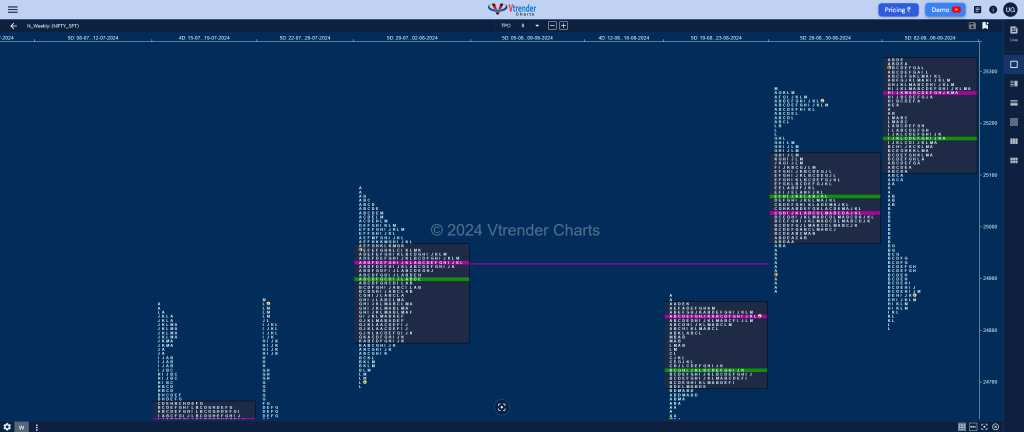

Nifty Spot: 24852 [ 25333 / 24801 ] Triple Distribution Trend (Down)

Previous week’s report ended with this ‘The weekly profile was shaping up to be a composite ‘p’ shape one over the first 3 days but has turned into a Double Distribution Trend Up one with an initiative buying tail from 24964 to 24867 along with completely higher Value at 24970-25024-25136 with the DD extension handle at 25174 with the upper HVN at 25240 which will be the immediate reference for the coming week and staying above it can expect the probe to continue towards 25332 & 25490 in the Bappa week‘

Monday – 25278 [ 25333 / 25235 ] – Normal Variation (Down)

Tuesday – 25279 [ 25321 / 25235 ] – Normal (Inside Bar)

Wednesday – 25198 [ 25216 / 25083 ] – Normal Variation (Up)

Thursday – 25145 [ 25275 / 25127 ] Normal Variation (Down)

Friday – 24852 [ 25168 / 24801 ] – Trend (Down)

Nifty continued previous week’s imbalance with a higher open on Monday where it hit the first objective of 25332 as per above report but failed to sustain above it marking the end of the upside as it left a very tiny A period selling tail from 25322 to 25333 and probed lower tagging the HVN of 25240 while making a low of 25235 which was followed by an even narrower range inside bar on Tuesday where it left another A period selling tail from 25304 to 25321 and made similar lows of 25235 leaving a nice 2-day Gaussian Curve with a prominent POC at 25260.

The auction then gave a move away from balance with a big gap down of 188 points on Wednesday as it tagged the 29th Aug’s VPOC of 25098 but could not sustain leaving a small A period buying tail from 25089 to 25083 indicating support being validated which in turn not only resulted in couple of REs to the upside and a spike close from 25192 to 25216 but a higher open on Thursday as it made an attempt to get back into the 2-day Value but was swiftly rejected shaping the third initiative selling tail for the week from 25223 to 25275 and a probe down to 25127 into the close leaving a long liquidation ‘b’ shape profile with a prominent POC at 25172 which was right around previous week’s extension handle of 25174 displaying change of polarity.

Friday saw an ORR (Open Rejection Reverse) start as Nifty opened lower and gave a bounce to 25168 stalling just below the 25172 reference triggering a big drop of 289 points in the IB (Initial Balance) as it swiped through previous week’s value and entered the buying singles from 24964 to 24867 completely negating it while making a low of 24859 in the D TPO which was followed by a bounce of 100 points into the G where it left a PBH just below previous week’s VAL of 24970 showing that the PLR (Path of Least Resistance) remained to the downside effecting multiple REs lower from the H to the L TPOs as it tagged a major objective of the weekly VPOC of 24824 and hit 24801 leaving a Trend Day Down though the profile was more a long liquidation ‘b’ shape one.

The weekly profile is a Triple Distribution Trend one to the downside and an Outside Bar with the first 2 days forming a balance with a prominent POC at 25260 from where it gave a move lower with an extension handle at 25235 and formed another 2-day balance with the POC at 25172 from where the sellers made another probe lower with the second extension handle of the week at 25089 resulting in tagging the lower weekly VPOCs of 25025 & 24824 completing the profile with a small balance with the lowermost HVN at 24918. Value was overlapping to higher at 25106-25260-25323 but the close has been around the lows suggesting that the downside imbalance could continue into the next week towards the HVNs of 24722 & 24582 (19-23 Aug) along with the buying extension handle of 24472 (12-16 Aug) whereas on the upside, the immediate zone of singles from 24960 to 25043 will need to be taken out by the buyers for a probe to the upper HVNs of 25172 & 25260.

Click here to view this week’s MarketProfile of Nifty on Vtrender Charts

Hypos for 09th Sep – 24852 [ 25168 / 24801 ] – Trend (Down)

| Up |

| 24862 – M TPO h/b 24918 – POC (06 Sep) 24960 – PBH (06 Sep) 25001 – B TPO tail mid 25063 – Sell Tail (06 Sep) 25124 – 2-day VAL (04-05 Sep) |

| Down |

| 24821 – Buy tail (06 Sep) 24775 – Buy Tail (23 Aug) 24722 – 2-day VPOC (20-21 Aug) 24672 – Buy Tail (21 Aug) 24625 – SOC (19 Aug) 24581 – VPOC (19 Aug) |

Hypos for 10th Sep – 24936 [ 24957 / 24753 ] – Normal Variation (Up)

| Up |

| 24938 – Spike low (09 Sep) 24985 – 06 Sep Halfback 25031 – Weekly 1.5 IB 25064 – Sell Tail (06 Sep) 25124 – 2-day VAL (04-05 Sep) 25172 – VPOC (05 Sep) |

| Down |

| 24924 – L TPO h/b (09 Sep) 24888 – POC (09 Sep) 24837 – PBL (09 Sep) 24799 – A TPO h/b (09 Sep) 24753 – Weekly IBL 24722 – 2-day VPOC (20-21 Aug) |

Hypos for 11th Sep – 25041 [ 25130 / 24896 ] – Double Distribution(Up)

| Up |

| 25049 – M TPO h/b 25092 – K TPO h/b (10 Sep) 25128 – Sell tail (10 Sep) 25172 – VPOC (05 Sep) 25235 – Weekly Ext Handle (02-06 Sep) 25277 – 03 Sep Halfback |

| Down |

| 25014 – DD Ext Handle (10 Sep) 25984 – SOC (10 Sep) 24934 – C TPO h/b (10 Sep) 24888 – POC (09 Sep) 24837 – PBL (09 Sep) 24799 – A TPO h/b (09 Sep) |

Hypos for 12th Sep – 24918 [ 25113 / 24885 ] – Neutral Extreme (Down)

| Up |

| 24925 – M TPO h/b (11 Sep) 24967 – J TPO tail (11 Sep) 25011 – SOC (11 Sep) 25063 – POC (11 Sep) 25118 – VPOC (10 Sep) 25172 – VPOC (05 Sep) |

| Down |

| 24888 – POC (09 Sep) 24837 – PBL (09 Sep) 24799 – A TPO h/b (09 Sep) 24753 – Weekly IBL 24722 – 2-day VPOC (20-21 Aug) 24672 – Buy Tail (21 Aug) |

Hypos for 13th Sep – 25388 [ 25433 / 24941 ] Neutral Extreme (Up)

| Up |

| 25417 – Sell tail (12 Sep) 25459 – Monthly 1.5 IB 25490 – Monthly ATR (24323) 25548 – 1 ATR (25363) 25584 – Monthly 2 IB 25647 – 2 ATR (SOC 25277) 25691 – 1 ATR (WVAL 25106) |

| Down |

| 25363 – M TPO h/b (12 Sep) 25310 – L TPO tail (12 Sep) 25277 – Monthly SOC (Sep) 25236 – K TPO h/b (12 Sep) 25187 – 12 Sep Halfback 25130 – Weekly Ext Handle 25085 – Monthly IBL |

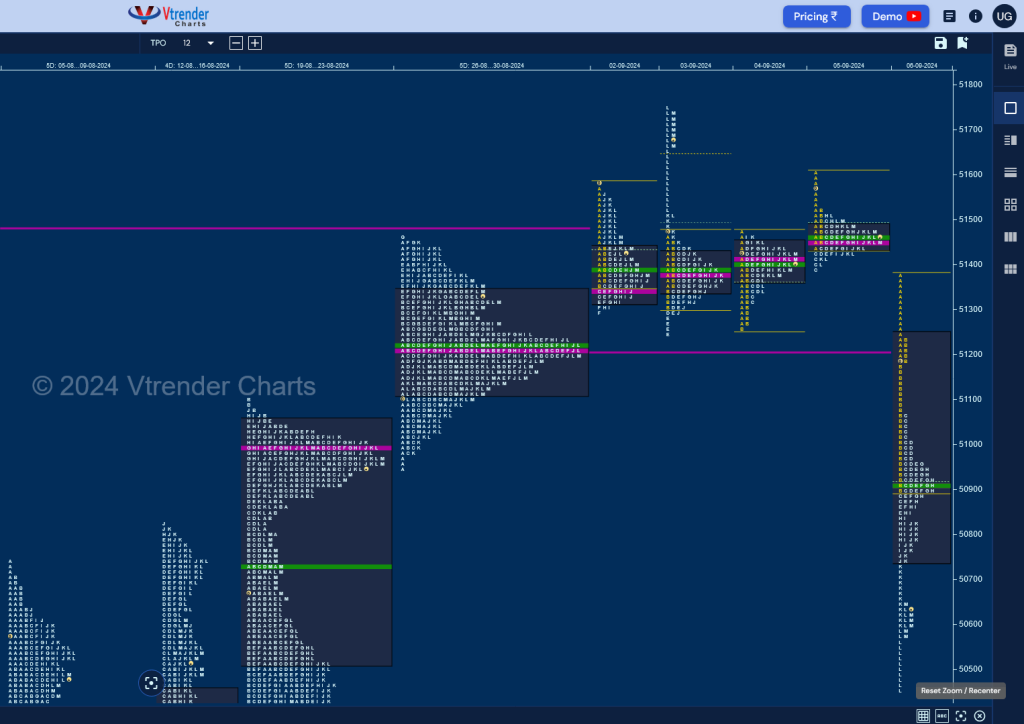

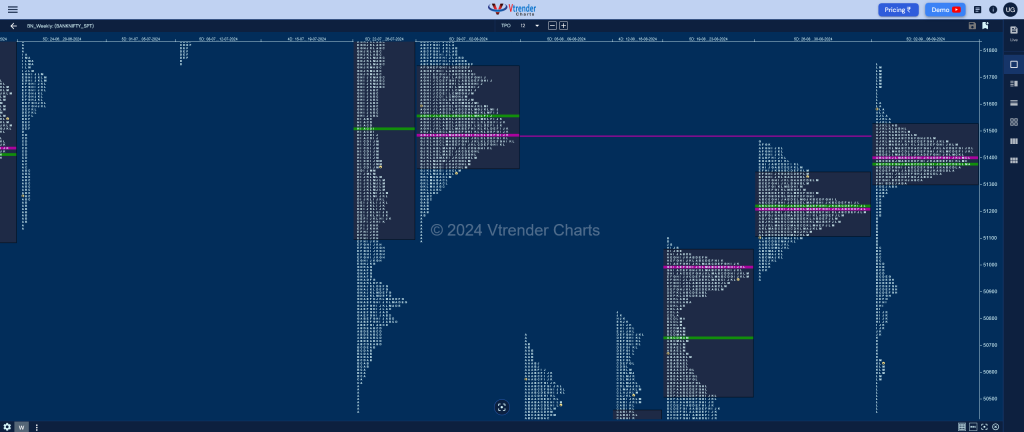

BankNifty Spot: 50576 [ 51750 / 50447 ] – Neutral Extreme (Down)

Previous week’s report ended with this ‘The weekly profile is also a Neutral one and a Gaussian Curve with completely higher Value at 51112-51214-51338 with a close above VAH which means the PLR (Path of Least Resistance) for the coming week will be to the upside but the auction will need to negate the FA of 51466 & sustain above the weekly VPOC of 51486 towards the 2 ATR objective of 51929 from the weekly FA of 50283 and the July VPOC of 52133 as the immediate objectives in the coming week above which the weekly FAs of 52547 & 52794 could come into play whereas on the downside, this week’s prominent POC of 51214 will be the immediate support below which the swing zone of 50984 to 50934 will need to be broken by the sellers for a probable drop to the lower daily VPOCs of 50520 & 49950 with the weekly FA of 50283 being a reference in between‘

Monday – 51439 [ 51579 / 51295 ] Normal

Tuesday – 51689 [ 51750 / 51240 ] – Neutral Extreme (Up)

Wednesday – 51400 [ 51503 / 51260 ] – Normal (Inside Bar)

Thursday – 51473 [ 51636 / 51389 ] – Normal (‘b’ shape)

Friday – 50576 [ 51380 / 50447 ] – Trend (Down)

BankNifty opened higher well above the weekly VPOC of 51486 but made an OH (Open=High) start at 51579 triggering a drop down to 51355 in the IB which was followed by couple of marginal REs lower to 51334 & 51295 in the C & E periods indicating lack of supply at the entry into previous week’s value resulting in a short covering bounce back to 51555 as it closed around the halfback on Monday and made an OAIR start on Tuesday continuing the balance in previous value for the first couple of hours after which it made an attempt to extend lower in the E making new lows for the week at 51240 but took support right above the support of 51214 and went on to confirm a FA leading to a Neutral Extreme Day Up completing the 1 ATR objective of 51670 while making a high of 51750 incidentally completing the 80% Rule in the weekly Value from 29th Jul to 02nd Aug.

The auction however rejected the closing imbalance of Tuesday with a big gap down open of 325 points on Wednesday forming a narrow 244 point range Normal Day taking support just above the FA of 51240 forming overlapping value for the third consecutive day and made another attempt to move away with a gap up on Thursday but left an A period selling tail from 51526 to 51636 constructing another 248 point range Normal Day and a ‘b’ shape profile making it clear that the upside is getting sold into and completing a 4-day balance with value at 51342-51404-51467 looking ready for an attempt to move away to the downside.

Friday gave an ORR (Open Rejection Reverse) confirming the start of a fresh imbalance as BankNifty not only broke the FA of 51240 and the POC of 51214 effectively but put in place a Trend Day Down swiping through the last 2 week’s value area zones and almost hit the HVN of 50411 while making a low of 50447 where it left a responsive buying tail before closing at 50576.

The weekly profile is a Neutral Extreme one to the downside forming an outside bar in terms of range with overlapping to higher Value at 51306-51404-51528 with a confirmed weekly FA at 51750 in previous month’s selling tail (51608 to 51877) and couple of extension handles at 51178 & 50740 which will be the upside references to watch for in the coming week apart from the prominent 5-day VPOC of 51419 which will now be a swing supply point whereas on the downside, the closing singles from 50569 to 50447 will be the zone to be overcome by the sellers for a probe to the weekly FA’s 1 ATR objective of 50223 along with the weekly VPOC of 49733 (12-16 Aug)

Click here to view this week’s MarketProfile of BankNifty on Vtrender Charts

Hypos for 09th Sep – 50576 [ 51380 / 50447 ] – Trend (Down)

| Up |

| 50629 – Aug VWAP 50740 – Ext Handle (06 Sep) 50913 – POC (06 Sep) 51070 – B TPO tail (06 Sep) 51178 – Ext Handle (06 Sep) 51281 – A TPO h/b (06 Sep) |

| Down |

| 50569 – Buy tail (06 Sep) 50411 – Weekly HVN (19-23 Aug) 50283 – Weekly FA (19 Aug) 50130 – SOC (16 Aug) 50020 – SOC (16 Aug) 49950 – VPOC (16 Aug) |

Hypos for 10th Sep – 51117 [ 51192 / 50369 ] Normal Variation (Up)

| Up |

| 51131 – Sell tail (09 Sep) 51281 – A TPO h/b (06 Sep) 51419 – 5-day VPOC (30Aug-05Sep) 51526 – Sell Tail (05 Sep) 51627 – L TPO h/b (04 Sep) 51750 – Swing High (04 Sep) |

| Down |

| 51101 – M TPO h/b (09 Sep) 50971 – Weekly IBH 50895 – J TPO h/b (09 Sep) 50782 – 09 Sep Halfback 50657 – H TPO h/b (09 Sep) 50531 – A TPO h/b (09 Sep) |

Hypos for 11th Sep – 51272 [ 51366 / 50958 ] – Normal

| Up |

| 51285 – M TPO h/b 51419 – 5-day VPOC (30Aug-05Sep) 51526 – Sell Tail (05 Sep) 51627 – L TPO h/b (04 Sep) 51750 – Swing High (04 Sep) 51875 – Weekly ATR |

| Down |

| 51253 – POC (10 Sep) 51162 – 10 Sep Halfback 51046 – Buy Tail (10 Sep) 50895 – J TPO h/b (09 Sep) 50765 – VPOC (09 Sep) 50657 – H TPO h/b (09 Sep) |

Hypos for 12th Sep – 51010 [ 51420 / 50947 ] – Neutral Extreme (Down)

| Up |

| 51048 – IBL (11 Sep) 51121 – POC (11 Sep) 51240 – SOC (11 Sep) 51420 – FA (11 Sep) 51526 – Sell Tail (05 Sep) 51627 – L TPO h/b (04 Sep) |

| Down |

| 51007 – M TPO h/b 50895 – J TPO h/b (09 Sep) 50765 – VPOC (09 Sep) 50657 – H TPO h/b (09 Sep) 50531 – A TPO h/b (09 Sep) 50411 – Weekly HVN (19-23 Aug) |

Hypos for 13th Sep – 51772 [ 51878 / 51025 ] – Neutral Extreme (Up)

| Up |

| 51819 – 1 ATR (FA 51420) 51958 – SOC (29 Jul) 52064 – 2 ATR (yPOC 51186) 52177 – Weekly 3 IB 52244 – Sell tail (29 Jul) 52333 – July VPOC |

| Down |

| 51745 – M TPO h/b (12 Sep) 51635 – L TPO tail (12 Sep) 51515 – J TPO tail (12 Sep) 51401 – Weekly Ext Handle 51313 – 3-day VAH (10-12 Sep) 51186 – POC (12 Sep) |