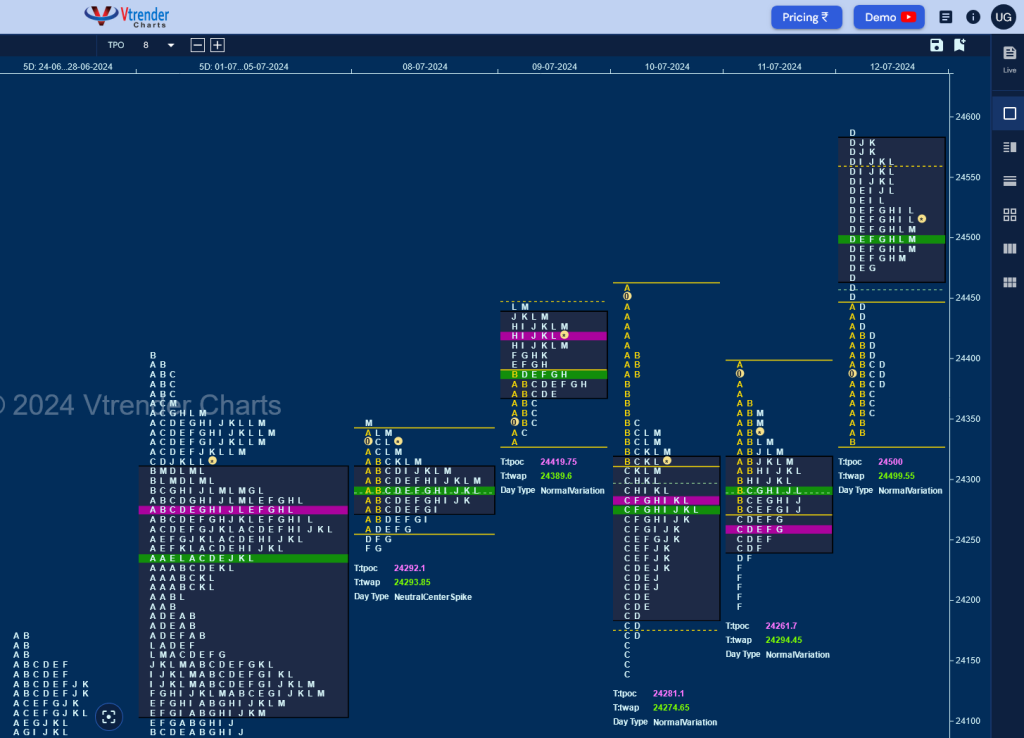

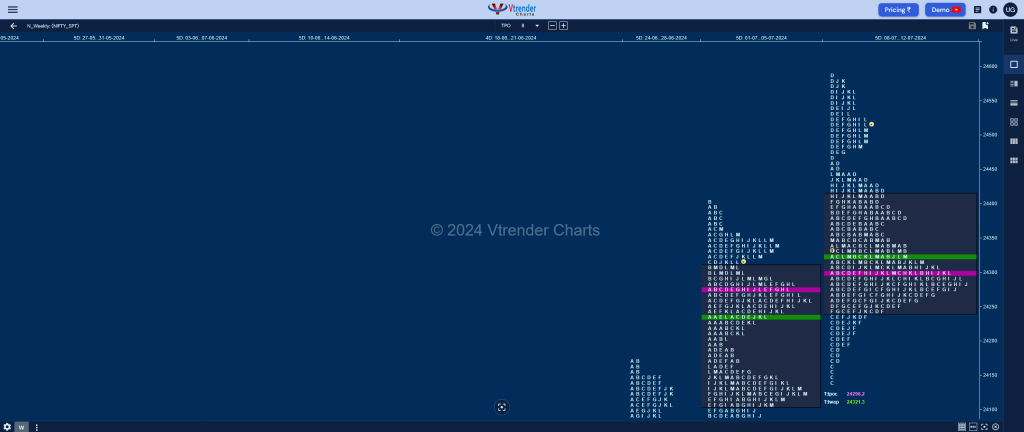

Nifty Spot: 24323 [ 24401 / 23992 ]

Previous week’s report ended with this ‘The weekly profile is a Normal Variation one to the upside with completely higher Value at 24104-24277-24309 though the range was relatively narrow at 408 points and has 3 important HVNs at 24351, 24277 & 24137 which will be on watch in the coming week for continuation of the uptrend or a start of a new balance‘

Monday – 24320 [ 24344 / 24240 ] – Neutral

Tuesday – 24433 [ 24443 / 24332 ] – Double Distribution (Up)

Wednesday – 24324 [ 24461 / 24141 ] – Outside Day (b shape)

Thursday – 24315 [ 24402 / 24193 ] – Normal Variation (Down)

Friday – 24502 [ 24592 / 24331 ] – Double Distribution (Up)

Nifty opened the week with a narrow 104 point range Neutral profile on Monday as it probed below previous week’s POC of 24277 but could only manage similar lows of 24240 & 24244 triggering a move above the higher HVN of 24351 on Tuesday where it formed the first of the DD (Double Distribution) day of the week hitting new ATH of 24443 completing the weekly 2 IB objective of 24437.

The auction continued the upside imbalance with a higher open on Wednesday recording new ATH of 24461 but was swiftly rejected confirming an ORR (Open Rejection Reverse) start as it not only swiped through the current week’s range but also through the low volume zone of previous week while making a low of 24141 completing the weekly 2 IB target on the downside in the C TPO stalling just above the lowest of the 3 HVNS of 24137 as mentioned above marking the end of the downside after which it formed a balance leaving a ‘b’ shape profile for the day with the POC at 24281 and formed an inside bar on Thursday leaving a 3-1-3 profile as it continued to build TPOs around 24281.

Nifty saw a higher open on Friday as it got accepted in the selling zone from Wednesday for the first couple of hours before making an initiative move to the upside leaving a daily extension handle at 24440 in the D TPO where it went on to complete the upside weekly 3 IB goal of 24535 and continued to give a melt up to 24592 marking the highs for the week as after that it got back to balance more staying inside the D period range for the rest of the day leaving the second DD of the week but saw some profit booking coming in as it closed around the day’s POC of 24500.

The weekly profile is a Neutral Extreme one to the upside with a small responsive buying tail at lows from 24173 to 24141 and has formed overlapping to higher Value at 24242-24296-24415 which is a nice balance and has given a move away from this zone on the last day with an extension handle at 24461 which will be the level to hold if Nifty has to continue higher towards 24751 in the coming week.

Click here to view this week’s MarketProfile of Nifty on Vtrender Charts

Hypos for 15th July – 24502 [ 24592 / 24331 ] – Double Distribution

| Up |

| 24525 – L TPO h/b (12 Jul) 24564 – K TPO h/b (12 Jul) 24605 – Monthly 1.5 IB 24651 – 1 ATR (EH 24461) 24690 – 1 ATR (yPOC 24500) |

| Down |

| 24500 – POC (12 Jul) 24461 – Ext Handle (12 Jul) 24415 – Weekly VAH 24354 – 7-day VAH (03-11 Jul) 24312 – L TPO h/b (11 Jul) |

Hypos for 16th July – 24586 [ 24635 / 24522 ] – Normal Variation (Up)

| Up |

| 24608 – VAH (15 Jul) 24645 – 1 ATR (EH 24461) 24684 – 1 ATR (VPOC 24500) 24731 – 1 ATR (PBL 24547) 24769 – 1 ATR (yPOC 24586) |

| Down |

| 24585 – POC (15 Jul) 24547 – PBL (15 Jul) 24500 – VPOC (12 Jul) 24461 – Ext Handle (12 Jul) 24415 – Weekly VAH |

Hypos for 18th July – 24613 [ 24661 / 24587 ] – Neutral Day

| Up |

| 24628 – POC (16 Jul) 24677 – 1 ATR (VPOC 24500) 24724 – 1 ATR (PBL 24547) 24762 – 1 ATR (VPOC 24585) 24809 – Monthly 2 IB |

| Down |

| 24585 – VPOC (15 Jul) 24547 – PBL (15 Jul) 24500 – VPOC (12 Jul) 24461 – Ext Handle (12 Jul) 24415 – Weekly VAH |

Hypos for 19th July – 24800 [ 24837 / 24504 ] – Neutral Extreme

| Up |

| 24811 – M TPO high (18 Jul) 24858 – 2 ATR (FA 24504) 24906 – 1 ATR (24722) 24945 – 1 ATR (24761) 25006 – 2 ATR (yPOC 24638) 25046 – 2 ATR (EH 24678) |

| Down |

| 24793 – M TPO h/b (18 Jul) 24761 – J TPO h/b (18 Jul) 24722 – SOC (18 Jul) 24678 – Ext Handle (18 Jul) 27638 – POC (18 Jul) 24560 – SOC (18 Jul) |

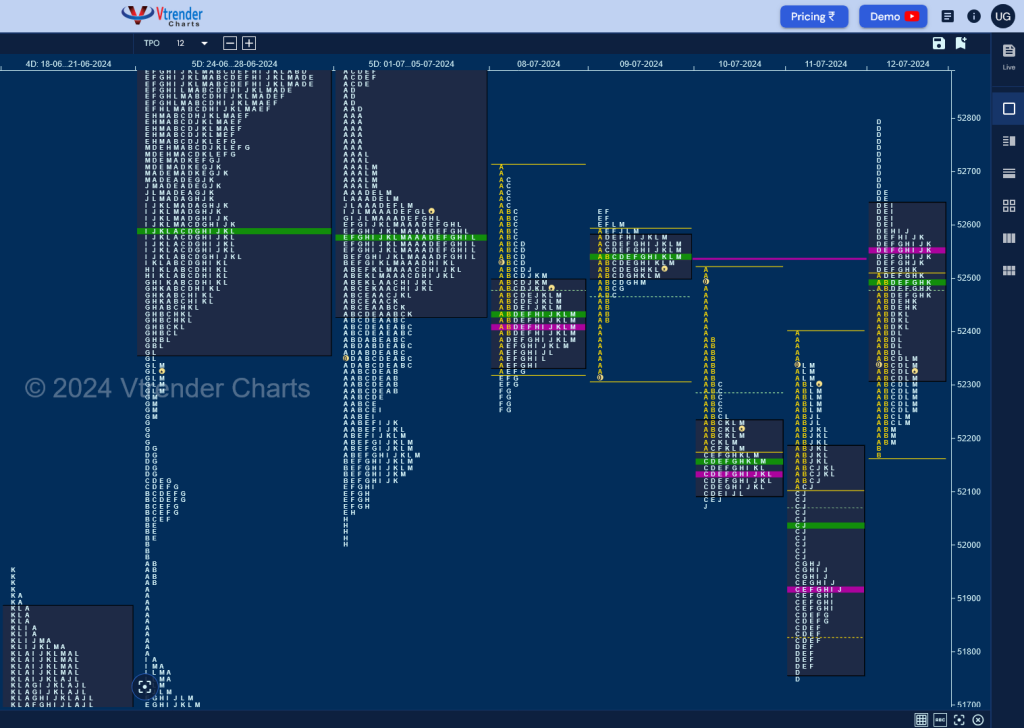

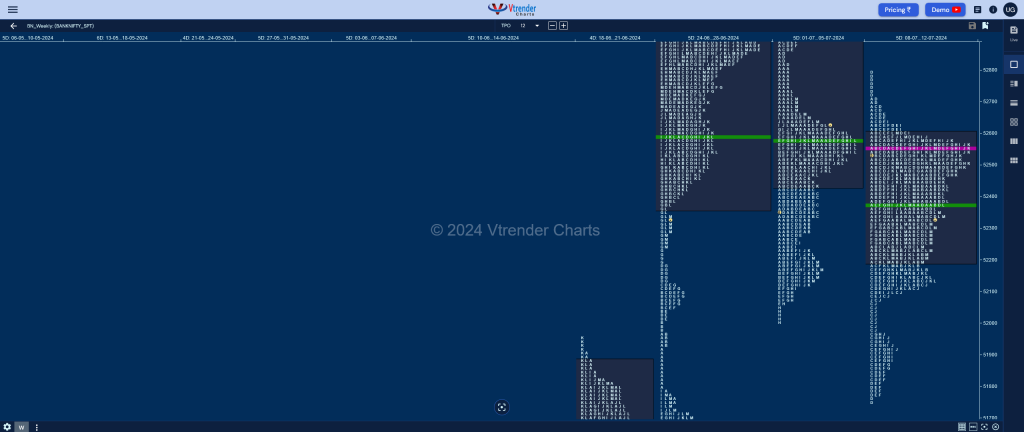

BankNifty Spot: 52279 [ 52794 / 51749 ]

Previous week’s report ended with this ‘BankNifty made a Neutral set up for the week with mostly overlapping value at 52436-53100-53225 with a close near the HVN of 52558 which will be the immediate support for the coming week staying above which it could fill up the zone upto 53100 before giving a move away from this balance‘

Monday – 52425 [ 52710 / 52246 ] Normal

Tuesday – 52568 [ 52626 / 52293 ] – Normal (p shape)

Wednesday – 52189 [ 52528 / 52075 ] – Normal (b shape)

Thursday – 52270 [ 52400 / 51749 ] – Normal Variation (Down)

Friday – 52279 [ 52794 / 52171 ] – Normal Variation (Up)

BankNifty opened the week with a 2-day balance forming a ‘b’ shape profile on Monday with poor lows at 52252 & 52246 followed by an inside bar and a ‘p’ shape on Tuesday with the composite POC at 52545 from where it made a move away to the downside on Wednesday repairing the poor lows of Monday but once again saw exhaustion making similar lows of 52077 & 52075 closing as a ‘b’ shape profile with a prominent POC at 52139 and completely lower value.

The auction opened higher on Thursday but got stopped right at the 2-day (Mon-Tue) VAL of 52418 indicating that the PLR was still to the downside which got further confirmed with a big C side extension to 51824 and a further follow down to 51749 in the D as it tested the weekly extension handle of 51784 while completing the weekly 2 IB objective resulting in profit booking by the sellers as BankNifty made a sharp bounce back to 52244 into the close and continued the upside imbalance on Friday as it remained above previous Value in the IB (Initial Balance) then made a big RE in the D period hitting new highs for the week at 52794 but was swiftly rejected as seen in the responsive selling tail confirmed till 52659 paving the way for a liquidation drop down to 52193 into the close.

The weekly profile is a Neutral One with overlapping to lower Value at 52192-52550-52607 and will remain weak if stays below 52192 in the coming week for a test of the lower VPOCs of 51923 & 51635 along with the Swing one of 51136 whereas on the upside, staying above 52350 the upside VPOCs of 52554 & 52961 could come into play which if taken out can trigger a fresh imbalance towards new ATH

Hypos for 15th July – 52279 [ 52794 / 52171 ] – Normal Variation

| Up |

| 52350 – M TPO high (12 Jul) 52482 – 12 Jul halfback 52554 – POC (12 Jul) 52659 – Sell Tail (12 Jul) 52794 – PDH 52961 – VPOC (04 Jul) |

| Down |

| 52271 – M TPO h/b (12 Jul) 52193 – Buy Tail (12 Jul) 52072 – 11 Jul H/B 51923 – VPOC (11 Jul) 51768 – Buy tail (11 Jul) 51635 – VPOC (24 Jun) |

Hypos for 16th July – 52456 [ 52662 / 52154 ] Neutral Extreme (Up)

| Up |

| 52486 – M TPO high (15 Jul) 52623 – Sell tail (15 Jul) 52773 – 1 ATR (FA 52154) 52865 – Tail (04 Jul) 52961 – VPOC (04 Jul) 53100 – Weekly VPOC (01-05 Jul) |

| Down |

| 52444 – IBH (15 Jul) 52321 – POC (15 Jul) 52154 – FA (15 Jul) 52072 – 11 Jul H/B 51923 – VPOC (11 Jul) 51768 – Buy tail (11 Jul) |

Hypos for 18th July – 52396 [ 52619 / 52331 ] – Normal (Double Inside)

| Up |

| 52408 – 3-day POC (12-16 Jul) 52540 – A TPO h/b (16 Jul) 52662 – Weekly IBH 52794 – Swing High (12 Jul) 52961 – VPOC (04 Jul) |

| Down |

| 52365 – 3-day VAL (12-16 Jul) 52245 – Anomaly (15 Jul) 52154 – FA (15 Jul) 51996 – Monthly tail 51844 – F TPO h/b (11 Jul) |

Hypos for 19th July – 52620 [ 52782 / 52168 ] – Normal (Outside Day)

| Up |

| 52662 – Weekly IBH 52794 – Swing High (12 Jul) 52961 – VPOC (04 Jul) 53100 – Weekly VPOC (01-05 Jul) 53256 – Jul Sell tail 53391 – 2 ATR (FA 52154) |

| Down |

| 52616 – 4-day VAH (12-18 Jul) 52476 – 18 Jul Halfback 52338 – 4-day VAL (12-18 Jul) 52154 – FA (15 Jul) 51996 – Monthly tail 51844 – F TPO h/b (11 Jul) |