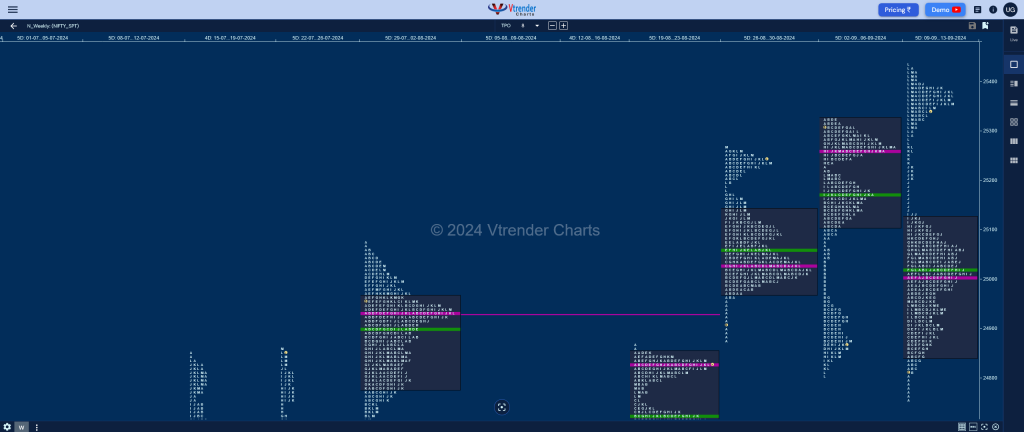

Nifty Spot: 25356 [ 25433 / 24753 ] Double Distribution (Up)

Previous week’s report ended with this ‘Value was overlapping to higher at 25106-25260-25323 but the close has been around the lows suggesting that the downside imbalance could continue into the next week towards the HVNs of 24722 & 24582 (19-23 Aug) along with the buying extension handle of 24472 (12-16 Aug) whereas on the upside, the immediate zone of singles from 24960 to 25043 will need to be taken out by the buyers for a probe to the upper HVNs of 25172 & 25260‘

Monday – 24936 [ 24957 / 24753 ] – Normal Variation (Up)

Tuesday – 25041 [ 25130 / 24896 ] – Double Distribution (Up)

Wednesday – 24918 [ 25113 / 24885 ] – Neutral Extreme (Down)

Thursday – 25388 [ 25433 / 24941 ] Neutral Extreme (Up)

Friday – 25356 [ 25430 / 25292 ] – Normal

Nifty opened the week with a probe below previous lows hitting 24753 where it took support just above the HVN of 24722 and left an important A period buying tail with the halfback at 24799 signalling return of initiative demand as it went on to form a ‘p’ shape kind of profile with a small spike to 24957 into the close which was followed with a Double Distribution Trend Day Up on Tuesday as the auction got accepted in the selling zone from 24960 to 25043 and went on to make a high of 25130 but was unable to sustain above the 2-day VAL of 25125 (04-05 Sep).

Sellers then made an attempt to come back on Wednesday with a Neutral Extreme Day after the buyers failed to take out the yPOC of 25118 and went on to tag Monday’s VPOC of 24888 while making a low of 24885 but left a small responsive tail at lows showing profit booking at an important demand level and more confirmation of buyers being back in control came with a gap up open on Thursday which did stall at previous IBH of 25073 triggering a probe lower along with an attempt to extend in the E period but was swiftly rejected from 24941 as the buyers not only confirmed a FA but went on to make a trending move higher not only completing the 2 ATR objective of 25311 but went on to scale above 02nd Sep Swing High of 25333 to hit new ATH of 25433 into the close leaving a Neutral Extreme Day Up and this imbalance of 492 points was followed by an 138 point range inside bar and a Normal profile on Friday as Nifty held above the extension handle of 25269 but left a selling tail at top from 25293 to 25430 building a prominent POC at 25363.

The weekly profile is a Double Distribution (DD) Trend one to the upside and an double outside bar in terms of range with an initiative buying tail from 24809 to 24753 with the POC at 24888 above which it formed a 3-day balance with Value at 24962-25000-25101 with a FA at 24941 followed by the DD zone from 25130 to 25256 and a small balance at the top with a close around the upper HVN of 25363 which will be the opening reference for the coming week for a probe towards the higher objectives of 25490 & 25905.

Click here to view this week’s MarketProfile of Nifty on Vtrender Charts

Hypos for 16th Sep – 25356 [ 25430 / 25292 ] – Normal

| Up |

| 25363 – POC (13 Sep) 25412 – Sell tail mid (13 Sep) 25459 – Monthly 1.5 IB 25490 – Monthly ATR (24323) 25548 – 1 ATR (yPOC 25363) 25584 – Monthly 2 IB |

| Down |

| 25350 – VAL (13 Sep) 25310 – L TPO tail (12 Sep) 25277 – Monthly SOC (Sep) 25236 – K TPO h/b (12 Sep) 25187 – 12 Sep Halfback 25130 – Weekly Ext Handle |

Hypos for 17th Sep – 25383 [ 25445 / 25336 ] – Normal Variation (Down)

| Up |

| 25393 – POC (16 Sep) 25435 – Sell tail (16 Sep) 25490 – Monthly ATR (24323) 25547 – 1 ATR (2-day POC 25363) 25584 – Monthly 2 IB 25645 – 2 ATR (SOC 25277) |

| Down |

| 25375 – VAL (16 Sep) 25321 – Buy Tail (13 Sep) 25277 – Monthly SOC (Sep) 25236 – K TPO h/b (12 Sep) 25187 – 12 Sep Halfback 25130 – Weekly Ext Handle |

Hypos for 18th Sep – 25418 [ 25441 / 25352 ] – Normal Variation (Up)

| Up |

| 25427 – POC (17 Sep) 25459 – Monthly 1.5 IB 25490 – Monthly ATR (24323) 25550 – 1 ATR (3-day POC 25366) 25584 – Monthly 2 IB 25645 – 2 ATR (SOC 25277) |

| Down |

| 25414 – 3-day VAH (13-17 Sep) 25366 – 3-day POC (13-17 Sep) 25321 – Buy Tail (13 Sep) 25277 – Monthly SOC (Sep) 25236 – K TPO h/b (12 Sep) 25187 – 12 Sep Halfback |

Hypos for 19th Sep – 25377 [ 25482 / 25285 ] – Neutral

| Up |

| 25384 – 18 Sep Halfback 25422 – 4-day VAH (13-18 Sep) 25462 – POC (18 Sep) 25500 – Weekly 1.5 IB 25552 – 1 ATR (4-day POC 25366) 25584 – Monthly 2 IB |

| Down |

| 25366 – 4-day POC (13-18 Sep) 25321 – Buy Tail (18 Sep) 25277 – Monthly SOC (Sep) 25236 – K TPO h/b (12 Sep) 25187 – 12 Sep Halfback 25130 – Weekly Ext Handle |

Hypos for 20th Sep – 25415 [ 25612 / 25376 ] Normal Variation (Down)

| Up |

| 25430 – M TPO h/b (19 Sep) 25467 – PBH (19 Sep) 25494 – 19 Sep Halfback 25555 – SOC (19 Sep) 25605 – Sell tail (19 Sep) 25655 – 2 ATR (SOC 25277) |

| Down |

| 25405 – POC (19 Sep) 25366 – 4-day VPOC (13-18 Sep) 25321 – Buy Tail (18 Sep) 25277 – Monthly SOC (Sep) 25236 – K TPO h/b (12 Sep) 25187 – 12 Sep Halfback |

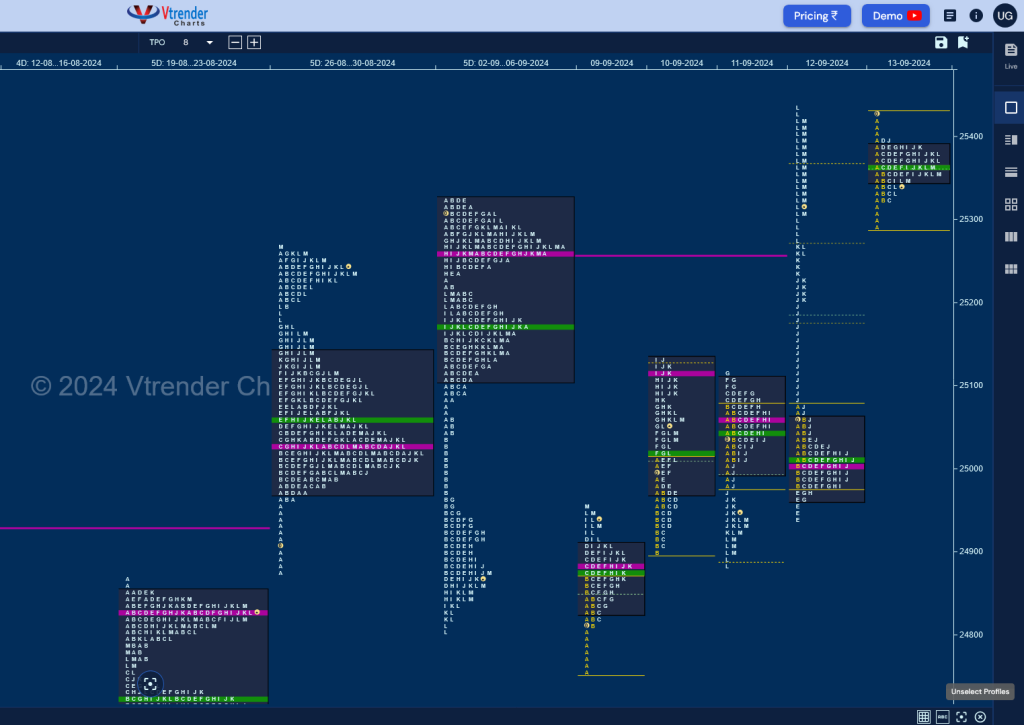

BankNifty Spot: 51938 [ 51994 / 50367 ] Triple Distribution (Up)

Previous week’s report ended with this ‘The weekly profile is a Neutral Extreme one to the downside forming an outside bar in terms of range with overlapping to higher Value at 51306-51404-51528 with a confirmed weekly FA at 51750 in previous month’s selling tail (51608 to 51877) and couple of extension handles at 51178 & 50740 which will be the upside references to watch for in the coming week apart from the prominent 5-day VPOC of 51419 which will now be a swing supply point whereas on the downside, the closing singles from 50569 to 50447 will be the zone to be overcome by the sellers for a probe to the weekly FA’s 1 ATR objective of 50223 along with the weekly VPOC of 49733 (12-16 Aug)‘

Monday – 51117 [ 51192 / 50369 ] Normal Variation (Up)

Tuesday – 51272 [ 51366 / 50958 ] – Normal

Wednesday – 51010 [ 51420 / 50947 ] – Neutral Extreme (Down)

Thursday – 51772 [ 51878 / 51025 ] – Neutral Extreme (Up)

Friday – 51938 [ 51994 / 51644 ] – Normal

BankNifty opened the week with a test of August’s POC of 50415 as it made new lows of 50369 for the current month in the A period on Monday but confirmed swift rejection in shape of an initiative buying tail till 50535 after which it went on to negate the extension handles of 50740 & 51178 while making a high of 51192 into the close and continued this imbalance on Tuesday where it got into previous week’s Value but got rejected from 51317 at the open triggering a probe lower and a test of the extension handle of 50971 in the B period where it left an important buying tail till 51046 marking the end of the downside for the day but could only manage a Normal Day after making an unsuccessful attempt to extend the IB with marginal new highs of 51366.

The auction opened lower on Wednesday but took support just above Tuesday’s buying tail and went on to scale above previous highs with a dreaded C side extension to 51420 which was clearly mentioned as the Swing Supply point for this week and sellers did come back at this level confirming a FA and dropping by 472 points into the close completing the 1 ATR target of 51022 and making a look down below previous buying tail while making marginal new lows of 50947 leaving a Neutral Extreme Day (NeuX). It came as no suprise to see NeuX not giving a follow up on Thursday where it opened with a gap up of 261 points but stalled just below previous IBH of 51317 as the sellers made an attempt to push it down again and even made a hat-trick of REs from the C to the E TPOs but all of them were marginal ones tagging 51025 which was taken advantage of by initiative buyers who not only left an extension handle at 51307 confirming a new FA but went on to negate the FA of 51420 displaying change of polarity and a run up to the 1 ATR target to the upside which was at 51819 while making a high of 51878.

Friday gave a rare follow up to a NeuX day with a higher open but formed a Normal Day and a balanced profile hitting new highs for the month at 51994 before closing around the prominent POC of 51930 leaving a Triple Distribution Trend Up profile for the week which started with a test of previous month’s POC of 50415 where it left a good initiative buying tail from 50535 to 50369 along with the POC at 50765 which was followed by a nice 3-day balance with Value at 51091-51186-51313 and couple of FAs at 51420 & 51025 along with an extension handle at 51549 above which it formed the upper most distribution with an A period buying tail from 51672 to 51644 which along with Friday’s halfback of 51819 will be the immediate demand side references for the coming week whereas on the upside, BankNifty will need to stay above 51930 for a probe towards July’s VPOC of 52333 & the weekly one at 53100 in the coming week.

Click here to view this week’s MarketProfile of BankNifty on Vtrender Charts

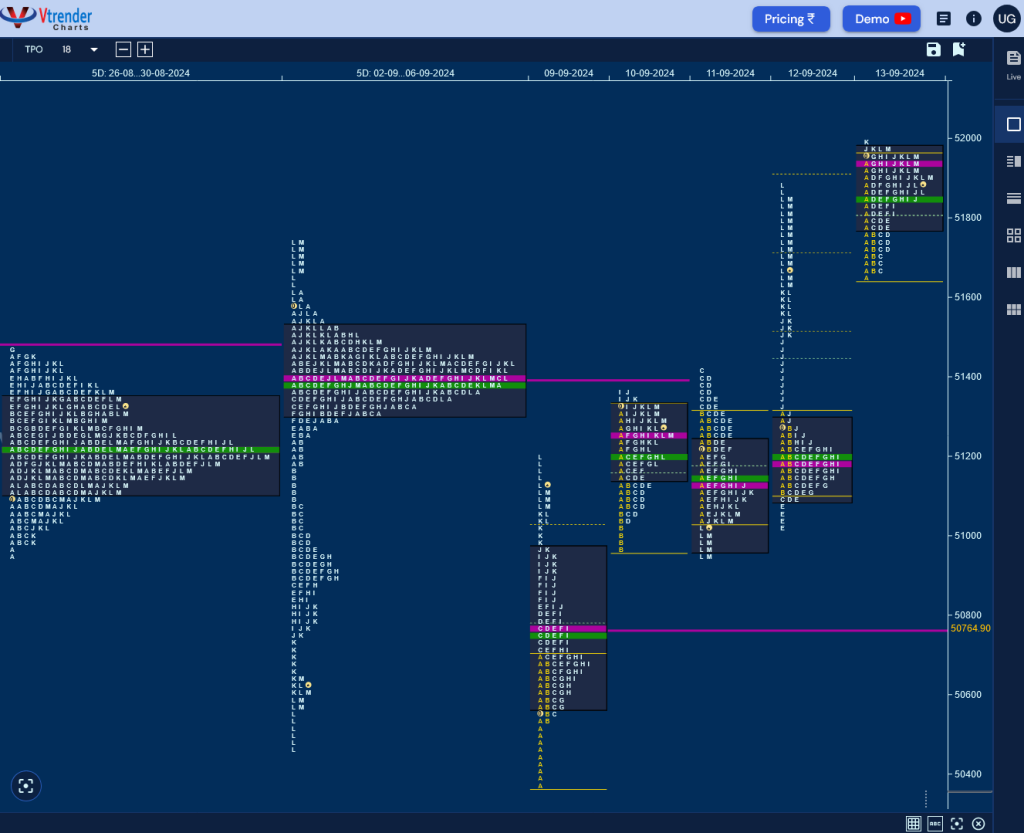

Hypos for 16th Sep – 51938 [ 51994 / 51644 ] – Normal

| Up |

| 51952 – IBH (13 Sep) 52076 – 2 ATR (yPOC 51186) 52218 – 2 ATR (FA 51420) 52333 – July VPOC 52427 – Sell Tail (23 Jul) 52547 – Weekly FA (23 Jul) |

| Down |

| 51930 – POC (13 Sep) 51819 – 13 Sep Halfback 51672 – Buy Tail (13 Sep) 51549 – Ext Handle (12 Sep) 51420 – Weekly Ext Handle 51313 – 3-day VAH (10-12 Sep) |

Hypos for 17th Sep – 52153 [ 52208 / 51921 ] Normal (‘p’ shape)

| Up |

| 52162 – POC (16 Sep) 52260 – Monthly 2 IB 52345 – Weekly 1.5 IB 52486 – Weekly 2 IB 52609 – 1 ATR (yPOC 52162) 52770 – Monthly 3 IB |

| Down |

| 52139 – M TPO low (16 Sep) 52007 – Buy Tail (16 Sep) 51930 – POC (13 Sep) 51819 – 13 Sep Halfback 51672 – Buy Tail (13 Sep) 51549 – Ext Handle (12 Sep) |

Hypos for 18th Sep – 52188 [ 52284 / 52085 ] – Normal

| Up |

| 52221 – POC (17 Sep) 52333 – Jul VPOC 52486 – Weekly 2 IB 52604 – 12-day VAH (05-23 Jul) 52770 – Monthly 3 IB 52863 – Tail (04 Jul) |

| Down |

| 52185 – 17 Sep Halfback 52065 – 16 Sep Halfback 51930 – POC (13 Sep) 51819 – 13 Sep Halfback 51672 – Buy Tail (13 Sep) 51549 – Ext Handle (12 Sep) |

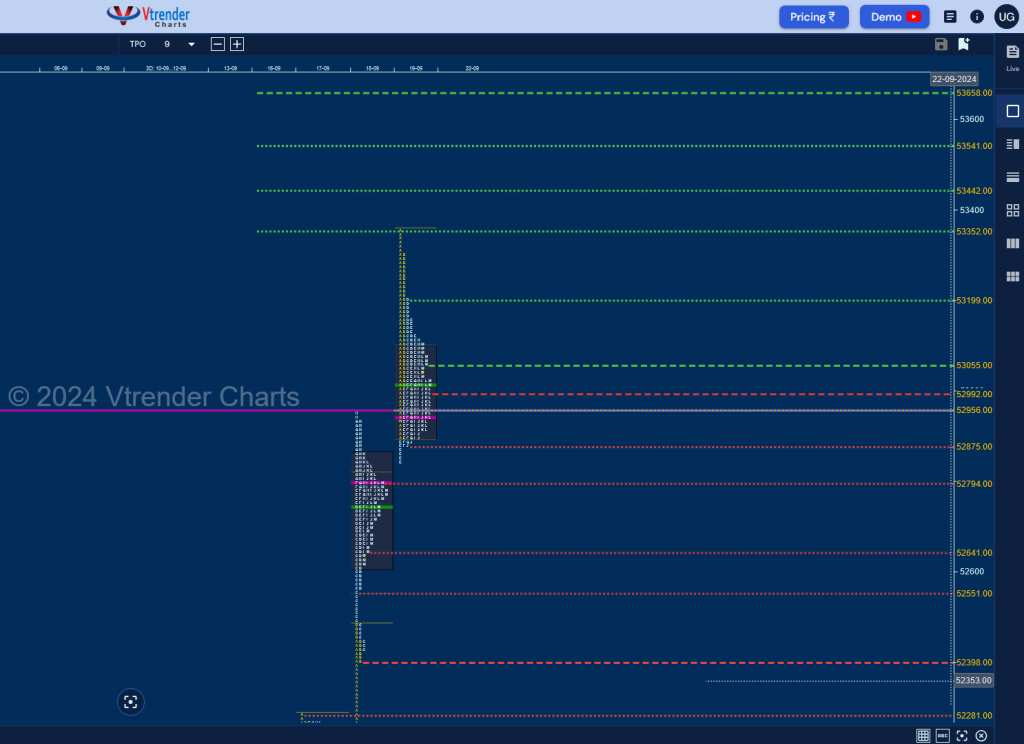

Hypos for 19th Sep – 52750 [ 52954 / 52154 ] – Double Distribution (Up)

| Up |

| 52770 – Monthly 3 IB 52859 – PBH (18 Sep) 52961 – VPOC (04 Jul) 53100 – Weekly VPOC (01-05 Jul) 53256 – Jul Sell tail 53444 – Weekly ATR |

| Down |

| 52708 – M TPO h/b (18 Sep) 52554 – 18 Sep Halfback 52403 – Buy Tail (18 Sep) 52284 – Daily Ext Handle 52185 – 17 Sep Halfback 52065 – 16 Sep Halfback |

Hypos for 20th Sep – 53037 [ 53353 / 52847 ] – Normal

| Up |

| 53057 – M TPO h/b (19 Sep) 53203 – PBH (19 Sep) 53357 – ATH 53444 – Weekly ATR 53546 – PWR target 53658 – 2 ATR (52708) |

| Down |

| 52999 – L TPO h/b (19 Sep) 52876 – Buy tail (19 Sep) 52798 – VPOC (18 Sep) 52647 – I TPO low (18 Sep) 52554 – 18 Sep Halfback 52403 – Buy Tail (18 Sep) |