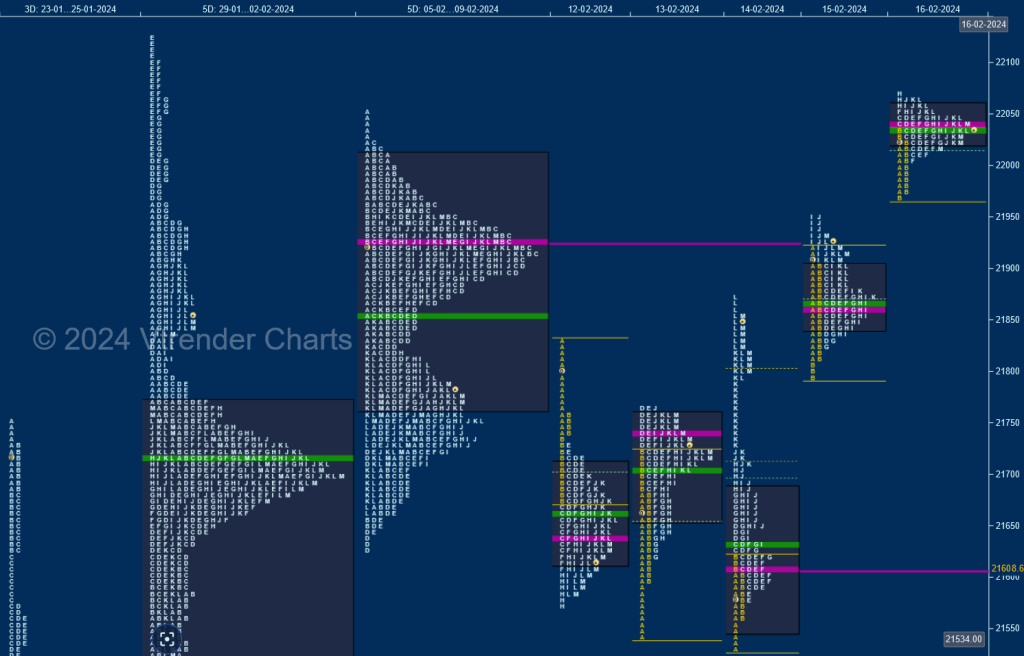

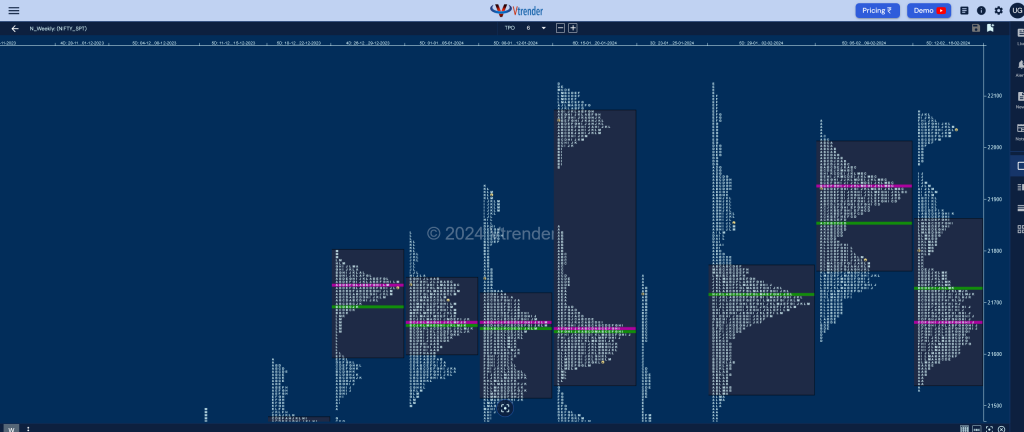

Nifty Spot: 22040 [ 22068 / 21530 ]

Previous week’s report ended with this ‘The weekly profile is a Neutral Extreme to the downside with clear rejection at 22053 which is now a swing reference as it made a trending move down of 423 points to 21629 but has left a FA there to indicate strong presence of demand in this zone as even the weekly Value was mostly higher at 21764-21926-22009 with a low volume zone between 21730 to 21930 which could get filled in the coming session(s) before making a move away from here‘

Nifty moved away from previous week’s Value with an A period selling tail on Monday from 21757 to 21831 negating the daily FA of 21629 as it went on to hit 21574 but ended up forming a ‘b’ shape profile for the day indicating exhaustion on the sell side and a lower open on Tuesday where it completed an important 1 ATR objective of 21544 from the weekly FA of 22053 re-confirmed the same as it resulted in a short covering profile with a small A period buying tail right from 21595 to 21543 where the upside was getting stalled right at Monday’s selling tail from 21757 where it left multiple highs signalling the inability of the buyers to take it further.

The auction then made an unexpected gap down open of 165 points on Wednesday negating Tuesday’s singles as it made new lows for the week at 21530 but confirmed an ORR (Open Rejection Reverse) start to the upside which was taken advantage of by the buyers who then formed a Trend Day Up and an elongated profile of 341 points as it left an extension handle at 21708 & hit new highs for the week at 21870 and continued this imbalance forming higher value on Thursday where it tagged the previous week’s POC of 21926 and made a high of 21954 and followed it up with another higher open on Friday but settled down into an OAOR (Open Auction Out of Range) forming a narrow 100 point balance as it tagged the Swing reference of 22053 but could not close above it forming a prominent POC at 22042 where it eventually closed.

The weekly profile is another Neutral Extreme one but this time to the upside forming an outside bar range wise though Value was mostly lower at 21543-21665-21859 as it remained below previous week’s Value for majority of the week also seen in the initiative selling tail from 21757 to 21831 which got negated in the closing TPOs of Wednesday resulting in a trending move higher for the rest of the week as it made a look up above the weekly FA of 22053 while making a high of 22068 but could not close above it forming a prominent daily POC at 22042 which will be the opening reference for the coming week with an immediate low volume zone between 21976 to 21861 on the downside.

Click here to view this week’s MarketProfile of Nifty on Vtrender Charts

Hypos for 19th Feb 2024

| Up |

| 22067 – Sell tail (16 Feb) 22106 – 1 ATR (VPOC 21861) 22168 – 1 ATR (WPOC 21665) 22221 – 1 ATR from 21976 22287 – 1 ATR (yPOC 22042) |

| Down |

| 22018 – PBL from 16 Feb 21976 – Buy Tail (16 Feb) 21926 – Monthly HVN 21861 – VPOC (15 Feb) 21813 – Buy Tail (15 Feb) |

Hypos for 20th Feb 2024

| Up |

| 22127 – Monthly IBH 22171 – Sell tail (19 Feb) 22221 – 1 ATR from 21976 22276 – 1 ATR (VPOC 22042) 22322 – Weekly 2 IB |

| Down |

| 22103 – 19th Feb halfback 22069 – SOC from 19 Feb 22018 – PBL from 16 Feb 21976 – Buy Tail (16 Feb) 21926 – Monthly HVN |

Hypos for 21st Feb 2024

| Up |

| 22204 – Sell tail (20 Feb) 22247 – 1.5 Weekly IB 22276 – 1 ATR (VPOC 22042) 22322 – Weekly 2 IB 22381 – 1 ATR (yPOC 22156) |

| Down |

| 22177 – Ext Handle (20 Feb) 22130 – 20th Feb Halfback 22083 – PBL from 20 Feb 22042 – VPOC (16 Feb) 22006 – PBL from 16 Feb |

Hypos for 22nd Feb 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

Hypos for 23rd Feb 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

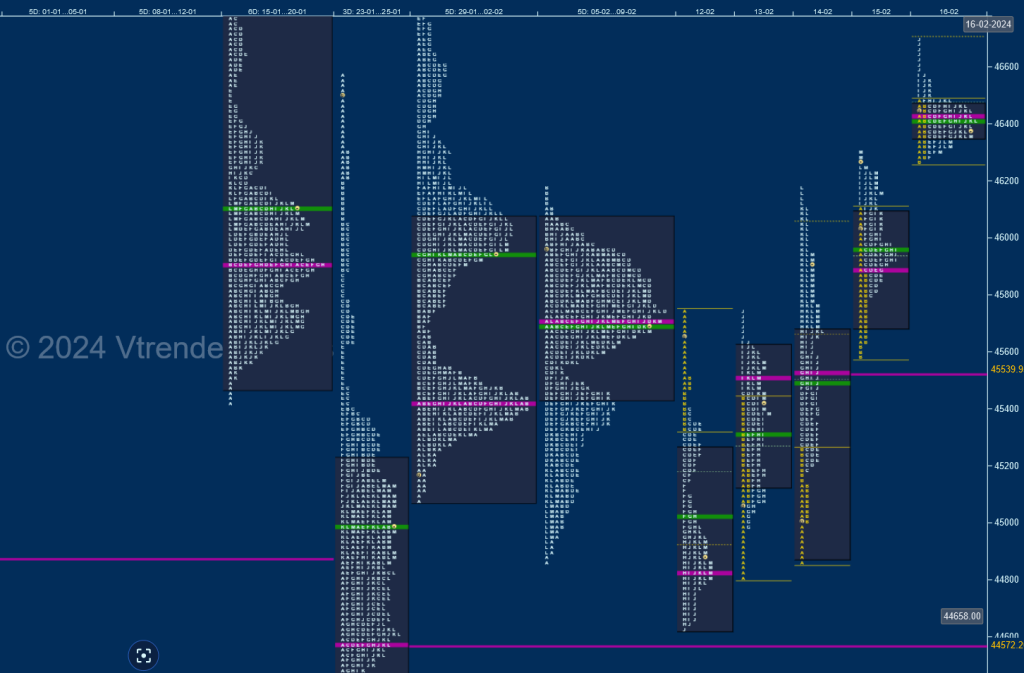

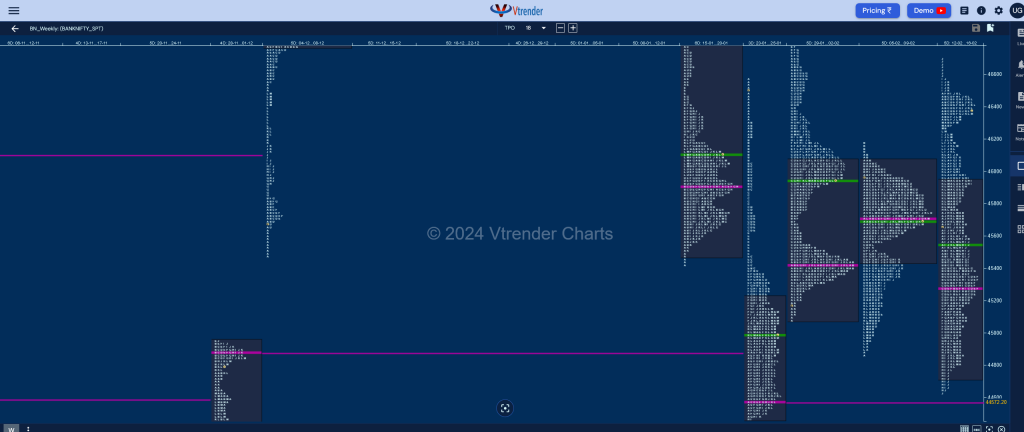

BankNifty Spot: 46384 [ 46693 / 44633 ]

Previous week’s report ended with this ‘BankNifty has formed a Neutral Centre weekly profile with completely inside Value at 45447-45719-46062 with the auction doing a good job of filling up previous week’s low volume zone and could give a move away from here provided it either negates this week’s selling tail from 46109 to 46181 on the upside and has immediate support at the TPO LVN (Low Volume Node) of 45540 below which it turns weak for a probe lower towards 44995 and a break of which could result in a further drop down to the VPOC of 44572 from 22nd to 26th Jan‘

BankNifty opened on Monday with a probe above previous week’s POC of 45719 but got rejected confirming an ORR start resulting in a trending move lower for most part of the day as it broke the support of 45540 and saw the sellers leaving couple of extension handles at 45473 & 45146 before breaking below previous week’s low as it hit 44633 taking support just above the weekly VPOC of 44572 (22-26 Jan) as the dPOC shifted lower to 44830 indicating profit booking by the shorts.

The auction then signalled demand coming back strongly around the 44830 zone as could be seen in the A period tails on Tuesday & Wednesday in fact even hitting new highs for the week at 46170 while forming a Trend Day Up and continued this imbalance forming higher value on Thursday and Friday leaving couple of daily VPOCs at 45540 & 45890 on the downside but at the same time saw some profit booking coming as it left a responsive selling tail from 46575 to 46693 before closing around the TPO HVN of 46400.

BankNifty has formed an elongated 2060 point range Outside Bar on the this week with Value being overlapping to lower at 44723-45272-45951 making it a hat-trick of almost similar values but in the current profile has taken support just above the weekly VPOC of 44572 and closed above January series VWAP of 46354 for the first time so as long as it sustains above it can continue to probe higher with this week’s selling tail from 46575 to 46693 being the immediate zone which needs to be taken out with the weekly swing high of 46892 and the big zone of singles from 47115 to 47826 being the higher objectives.

Click here to view this week’s MarketProfile of BankNifty on Vtrender Charts

Hypos for 19th Feb 2024

| Up |

| 46439 – POC from 16 Feb 46575 – Selling tail (16 Feb) 46726 – SOC from 02 Feb 46892 – Swing High (02 Feb) 47010 – Daily Ext Handle |

| Down |

| 46353 – January VWAP 46168 – Spike Low (15 Feb) 46027 – PBL from 15 Feb 45890 – POC from 15 Feb 45727 – B TPO halfback |

Hypos for 20th Feb 2024

| Up |

| 46554 – Closing SOC (19 Feb) 46726 – SOC from 02 Feb 46892 – Swing High (02 Feb) 47010 – Daily Ext Handle 47115 – Selling Tail (17 Jan) |

| Down |

| 46517 – 19th Feb halfback 46398 – B TPO halfback (19 Feb) 46290 – Buy Tail (16 Feb) 46168 – Spike Low (15 Feb) 46027 – PBL from 15 Feb |

Hypos for 21st Feb 2024

| Up |

| 47128 – Sell tail (20 Feb) 47350 – Gap mid (17 Jan) 47492 – Weekly HVN (08-12 Jan) 47586 – Ext Handle (12 Jan) 47729 – VPOC (12 Jan) |

| Down |

| 47069 – Ext Handle (20 Feb) 46940 – dPOC (20 Feb) 46802 – PBL from 20 Feb 46660 – Ext Handle (20 Feb) 46525 – Buy Tail (20 Feb) |

Hypos for 22nd Feb 2024

| Up |

| to be updated… |

| Down |

| to be updated… |

Hypos for 23rd Feb 2024

| Up |

| to be updated… |

| Down |

| to be updated… |