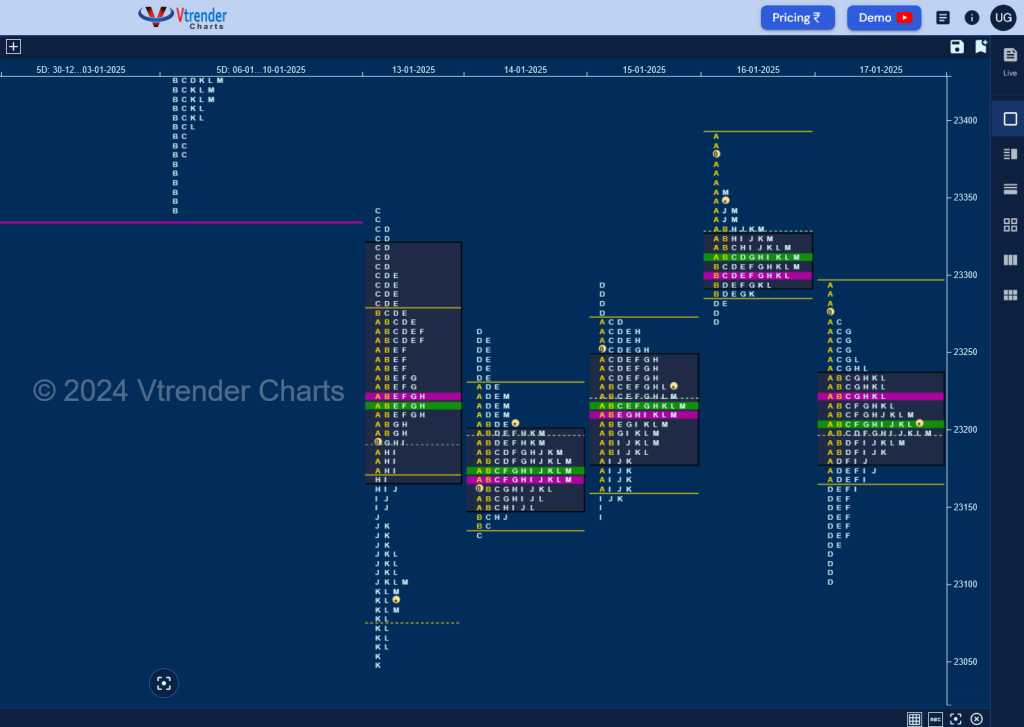

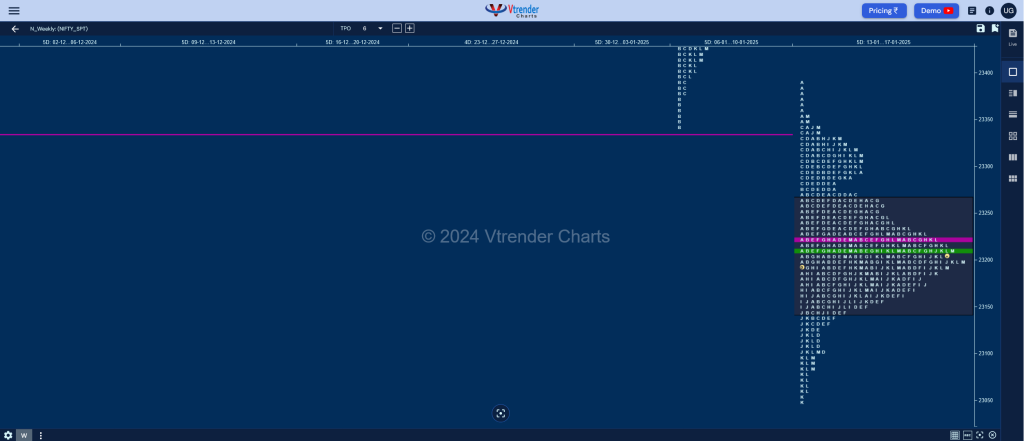

Nifty Spot: 23203 [ 23391 / 23047 ] Neutral Centre

Previous week’s report ended with this ‘The weekly profile resembles a Long Liquidation one with an initiative selling tail from 24054 to 24090 along another zone of singles from 23911 to 23800 which will now be an important supply zone for the rest of the month whereas we have a nice balance in the lower part of this profile with Value at 23503-23538-23735 which will be a good candidate for the 80% Rule to play out in the coming week provided Nifty can get back above 23503 & sustain whereas on the downside, June series VWAP of 23247 will be the support below weekly VPOC of 23339 below which Nifty could go in for a test of the daily VPOC of 23199 (07th June) and the weekly one of 22745 in the coming week(s)‘

Monday – 23086 [ 23341 / 23047 ] Neutral Extreme (Down)

Tuesday – 23176 [ 23265 / 23134 ] Neutral Centre (Inside Bar)

Wednesday – 23213 [ 23293 / 23146 ] Neutral Centre

Thursday – 23311 [ 23391 / 23272 ] Normal (‘b’ shape)

Friday – 23203 [ 23292 / 23100 ] Normal Variation (Down)

The closing imbalance of previous week continued as Nifty opened with a big 236 point gap down on Monday well below the 23339 & 23247 support levels mentioned above while making a low of 23172 in the A period where it saw some profit booking by the sellers triggering the dreaded C side extension to 23341 where it got rejected right from that weekly VPOC of 23339 which was now displaying change of polarity triggering a fresh trending move lower for the rest of the day to tag 23047 in the K TPO testing an important monthly reference from June 2024 of 23054 and leaving a Neutral Extreme (NeuX) Day.

The auction as expected did not give any follow through to the NeuX profile as it opened higher but formed a narrow range Initial Balance (IB) and remained in the same for most part of the day with failed attempts to extend either side resulting in a Failed Auction (FA) being confirmed at lows of 23134 giving a perfect Neutral Centre close right at the prominent POC of 23212 and continued this two-way balance move on Wednesday with another Neutral Centre plus a 3-1-3 profile hinting at an imbalance coming soon which came in form of a gap up on Thursday almost tagging the 1 ATR objective of 23396 while opening at 23391 but was swiftly rejected as seen in the A period selling tail with a narrow range balance for rest of the day forming a long liquidation profile which was followed buy another initiative selling tail on Friday as Nifty swiped through the 2-day composite of Tuesday & Wednesday re-visiting the FA of 23134 while making a low of 23100 where it left a responsive buying tail in the D TPO and formed an ideal 3-1-3 profile for the day.

The weekly profile is a Neutral Centre one in a very narrow range of 344 points with completely lower Value at 23144-23221-23265 with a very good chance that this balance could lead to an imbalance in the coming week provided Nifty shows initiative sellers below 23100 for a probe towards the weekly VPOC of 22745 & May’s POC of 22481 on the downside whereas in case of buyers stepping in above the daily selling singles of 23269 & 23353, we can look at tagging the weekly VPOC of 23538 and a test of the selling zone from 23800 to 23911 on the upside.

Click here to view this week’s MarketProfile of Nifty on Vtrender Charts

Hypos for 20th Jan – 23203 [ 23292 / 23100 ] Normal Variation (Down)

| Up |

| 23221 – Weekly POC 23265 – Weekly VAH 23300 – VPOC (16 Jan) 23341 – Weekly IBH (13-17 Jan) 23391 – Swing High (16 Jan) 23440 – TPO HVN (10 Jan) |

| Down |

| 23194 – M TPO low (17 Jan) 23144 – Weekly VAL 23100 – Weekly IBL (13-17 Jan) 23063 – Buy tail (13 Jan) 23004 – Ext Handle (07 Jun) 22954 – B TPO h/b (07 Jun) |

Hypos for 21st Jan – 23344 [ 23391 / 23170 ] Double Distribution (Up)

| Up |

| 23345 – POC (20 Jan) 23391 – Swing High (16 Jan) 23440 – TPO HVN (10 Jan) 23485 – J TPO h/b (10 Jan) 23538 – Weekly VPOC (06-10 Jan) 23596 – 09 Jan Halfback |

| Down |

| 23341 – M TPO h/b (20 Jan) 23308 – Ext Handle (20 Jan) 23265 – D TPO h/b (20 Jan) 23215 – B TPO h/b (20 Jan) 23170 – Weekly IBL 23100 – Swing Low (17 Jan) |

Hypos for 22nd Jan – 23024 [ 23426 / 22976 ] Trend (Down)

| Up |

| 23047 – Daily Ext Handle 23092 – K TPO h/b (21 Jan) 23134 – 7-day VAL (13-21 Jan) 23170 – Weekly IBL 23220 – 7-day POC (13-21 Jan) 23260 – 7-day HVN (13-21 Jan) 23300 – 7-day VAH (13-21 Jan) |

| Down |

| 23022 – M TPO low (21 Jan) 22989 – Buy tail (21 Jan) 22949 – Weekly 2 IB 22904 – Buy Tail (07 Jun) 22846 – IB tail mid (07 Jun) 22805 – VAH (06 Jun) 22745 – VPOC (06 Jun) |

Hypos for 23rd Jan – 23155 [ 23169 / 22981 ] Neutral Extreme (Up)

| Up |

| 23170 – Weekly IBL 23220 – 7-day POC (13-21 Jan) 23260 – 7-day HVN (13-21 Jan) 23300 – 7-day VAH (13-21 Jan) 23348 – SOC (21 Jan) 23404 – 1 ATR (FA 23144) |

| Down |

| 23135 – M TPO low (22 Jan) 23095 – POC (22 Jan) 23035 – J TPO h/b (22 Jan) 22986 – Buy tail (22 Jan) 22949 – Weekly 2 IB 22904 – Buy Tail (07 Jun) |

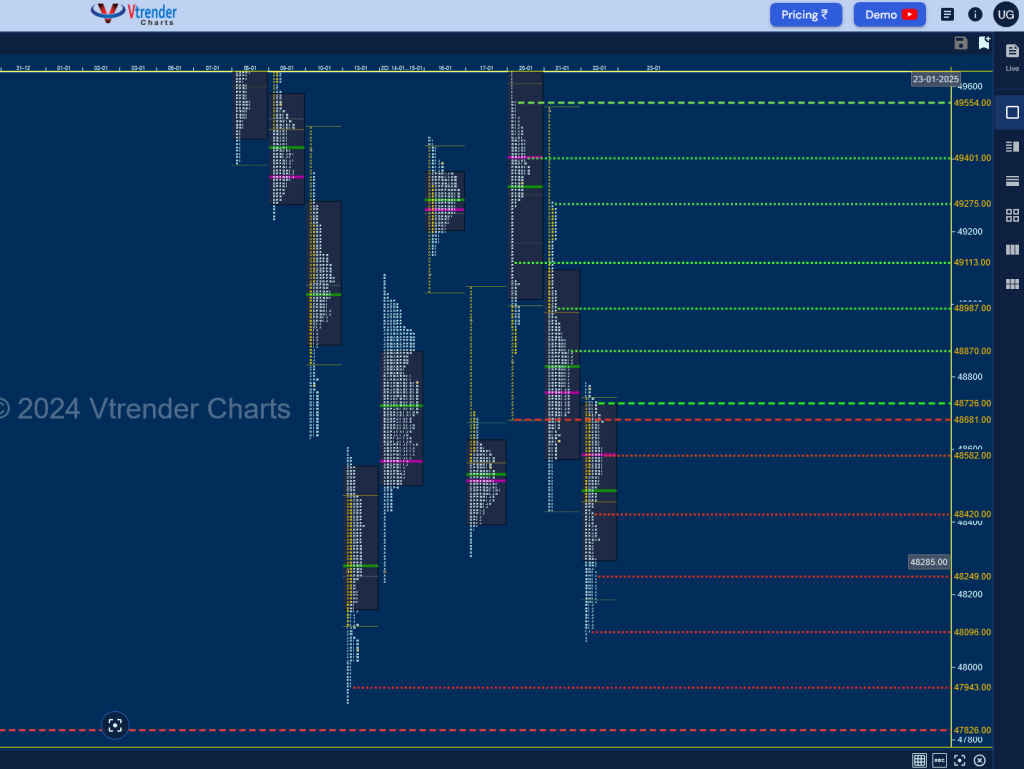

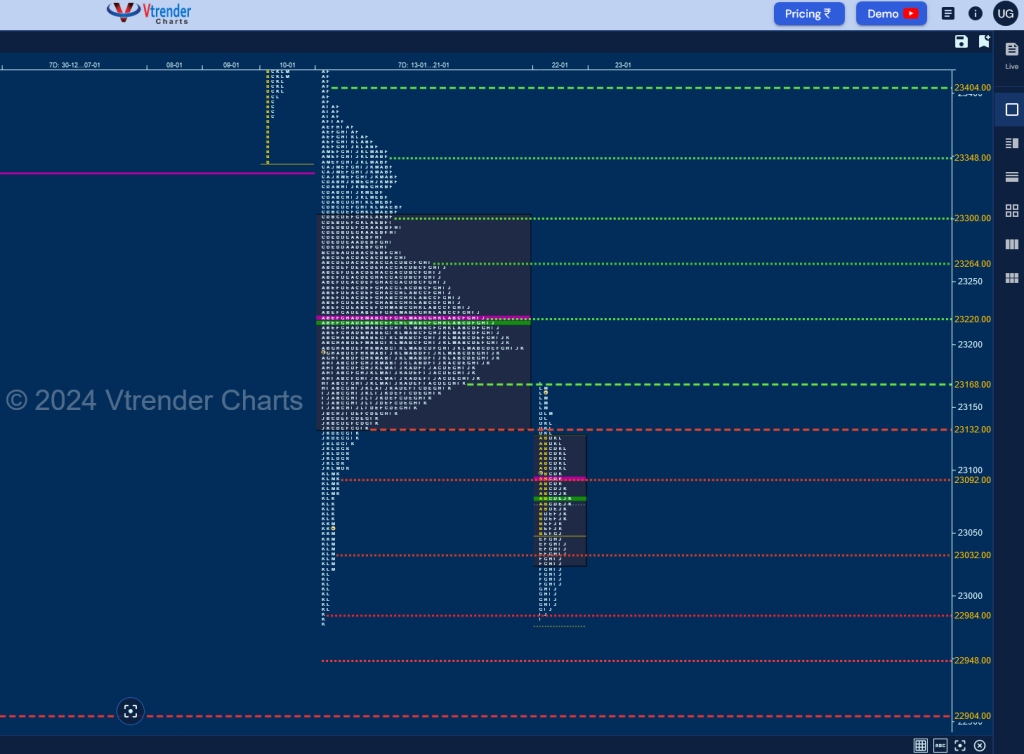

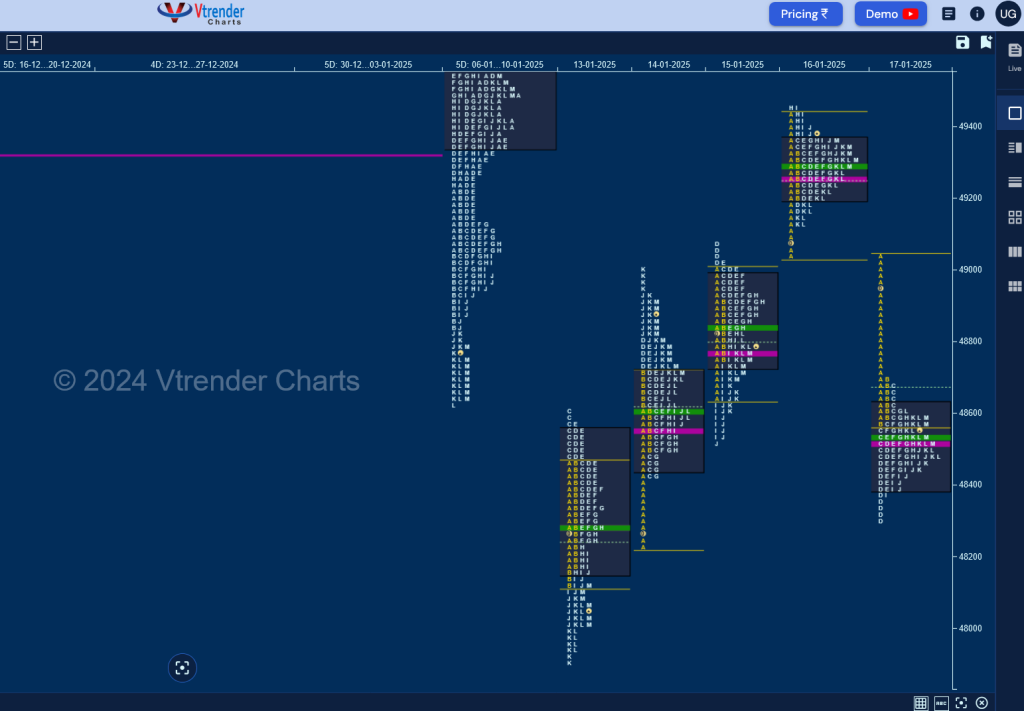

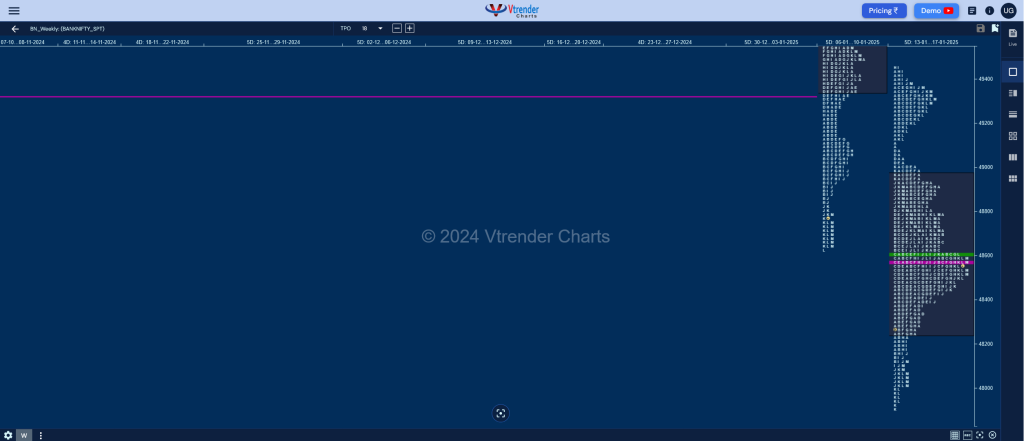

BankNifty Spot: 48540 [ 49459 / 47898 ] Neutral Centre

Previous week’s report ended with this ‘BankNifty was the weaker of the 2 indicies as it confirmed an initiative selling tail from 50813 to 51026 right at previous week’s POC of 50851 and went on to form a Trend Down weekly profile breaking below all of the 3 weekly VPOCS mentioned above and continued the imbalance into the close while making a low of 48631 on Friday indicating that the downmove is still not over and can continue in the coming week towards May 2024 POC of 47726 & the 2 ATR objective of 47472 from December’s FA of 53888‘

Monday – 48041 [ 48606 / 47898 ] Neutral Extreme (Down)

Tuesday – 48729 [ 49007 / 48403 ] – Normal Variation (Up)

Wednesday – 48751 [ 49083 / 48522 ] – Neutral Centre

Thursday – 49278 [ 49459 / 49038 ] – Normal (‘p’ shape)

Friday – 48540 [ 49047 / 48309 ] – Normal Variation (Down)

BankNifty also continued the imbalance close of previous week with a lower open as it hit 48116 almost completing the Monthly 3 IB target of 48111 from where it gave a good bounce of almost 500 points which got stalled just below previous week’s low of 48631 with a C side extension to 48606 getting back the sellers in action who then made a OTF (One Time Frame) probe lower till the K TPO tagging 47898 & looked set to test May 2024 POC of 47726 but could not extend any further triggering a bounce back to the IBL of 48116 hinting at profit booking at this important monthly objective. More evidence of supply cutting off came at open on Tuesday where the auction remained above yPOC of 48278 and saw some initiative buying which took it back into previous week’s range thereby confirming a weekly FA (Failed Auction) at 47898 and setting up a probe towards the 1 ATR goal of 49672.

The auction then made a higher open on Wednesday but failed in the attempt to extend higher getting rejected around 10th Jan’s VPOC of 49031 as it confirmed a FA at 49083 on the daily timeframe as sellers took control and pushed it down to 48522 as some demand came back at Tuesday’s POC of 48550 resulting in a Neutral Centre close around the POC of 48770 after which it opened higher on Thursday negating the FA of 49083 with an A period buying tail but remained in a narrow range of 390 points for most part of the day with an attempt to extend higher displaying exhaustion via poor highs of 49459 & 49450 showing that the buyers were unable do a good job after which Friday saw a lower open forcing long liquidation as BankNifty swiped through the Value area zone of last 2 sessions even entering Tuesday’s initiative buying tail but took support right above Monday’s VPOC of 48278 leaving a ‘b’ shape profile for the day.

The weekly profile is a Neutral Centre one with completely lower Value at 48254-48564-48976 which has a good chance of moving back into imbalance mode in the coming week provided it gets some initiative move away from this week’s prominent POC of 48564 with this week’s SOC of 49134 & daily VPOC of 49258 being minor hurdles on the upside as it can aim to probe towards the higher weekly VPOC of 50193 whereas on the downside, the daily VPOC of 48278 & Swing Low of 47898 will be the support levels to watch out for below which we can have a drop down towards the VPOC of 47833 & SOC of 46899 from the important game changer profile of 05th Jun 2024

Click here to view this week’s MarketProfile of BankNifty on Vtrender Charts

Hypos for 20th Jan – 48734 [ 49483 / 48631 ] – Normal Variation (Down)

| Up |

| 48564 – Weekly POC 48678 – 17 Jan Halfback 48820 – A TPO h/b (17 Jan) 48976 – Weekly VAH 49134 – Weekly SOC 49258 – VPOC (16 Jan) |

| Down |

| 48516 – POC (17 Jan) 48375 – Buy tail (17 Jan) 48278 – VPOC (13 Jan) 48161 – I TPO h/b (13 Jan) 48011 – L TPO h/b (13 Jan) 47833 – VPOC (05 Jun) |

Hypos for 21st Jan – 49350 [ 49650 / 48683 ] Trend (Up)

| Up |

| 49409 – POC (20 Jan) 49559 – I TPO h/b (20 Jan) 49672 – 1 ATR (WFA 47898) 49776 – Sell Tail (09 Jan) 49898 – K TPO h/b (08 Jan) 50024 – Ext Handle (08 Jan) 50193 – Weekly VPOC (06-10 Jan) |

| Down |

| 49342 – M TPO h/b (20 Jan) 49210 – E TPO h/b (20 jan) 49064 – Ext Handle (20 Jan) 48931 – B TPO h/b (20 Jan) 48806 – A TPO h/b (20 Jan) 48683 – Weekly IBL 48516 – VPOC (17 Jan) |

Hypos for 22nd Jan – 48571 [ 49543 / 48431 ] – Trend (Down)

| Up |

| 48608 – M TPO h/b (21 Jan) 48755 – POC (21 Jan) 48877 – J TPO high (21 Jan) 48987 – 21 Jan Halfback 49121 – B TPO h/b (21 Jan) 49280 – Sell Tail (21 Jan) 49409 – POC (20 Jan) |

| Down |

| 48564 – Monthly HVN 48437 – Buy tail (21 Jan) 48278 – VPOC (13 Jan) 48161 – I TPO h/b (13 Jan) 48011 – L TPO h/b (13 Jan) 47833 – VPOC (05 Jun) 47716 – Weekly 2 IB |

Hypos for 23rd Jan – 48724 [ 48781 / 48074 ] – Neutral

| Up |

| 48726 – M TPO h/b (22 Jan) 48877 – J TPO high (21 Jan) 48987 – 21 Jan Halfback 49121 – B TPO h/b (21 Jan) 49280 – Sell Tail (21 Jan) 49409 – POC (20 Jan) 49559 – I TPO h/b (20 Jan) |

| Down |

| 48683 – Weekly IBL 48588 – POC (22 Jan) 48428 – 22 Jan Halfback 48249 – J TPO h/n (22 Jan) 48100 – Buy tail (22 Jan) 47950 – Buy tail (13 Jan) 47833 – VPOC (05 Jun) |