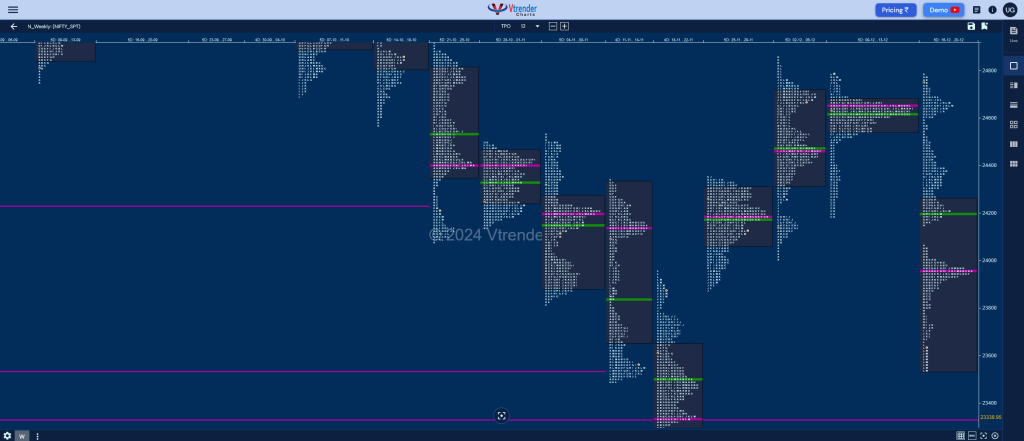

Nifty Spot: 23587 [ 24781 / 23537 ] Trend (Down)

Previous week’s report ended with this ‘The weekly profile is a Neutral Extreme one too which remained inside previous week’s range forming a narrow value area zone of just 140 points (24540-24653-24680) filling the low volume zone of the Trend Up profile which has also tested the buying extension handle of 24190 resulting in a big move of over 600 points with a close around the highs so can expect this upmove to continue in the coming week for a test of the weekly selling tail from 24880 (21-25 Oct) & the higher VPOC of 25064 (14-18 Oct) along with the weekly FA of 25212 (15 Oct) whereas the zone of 24680 to 24705 would act as support‘

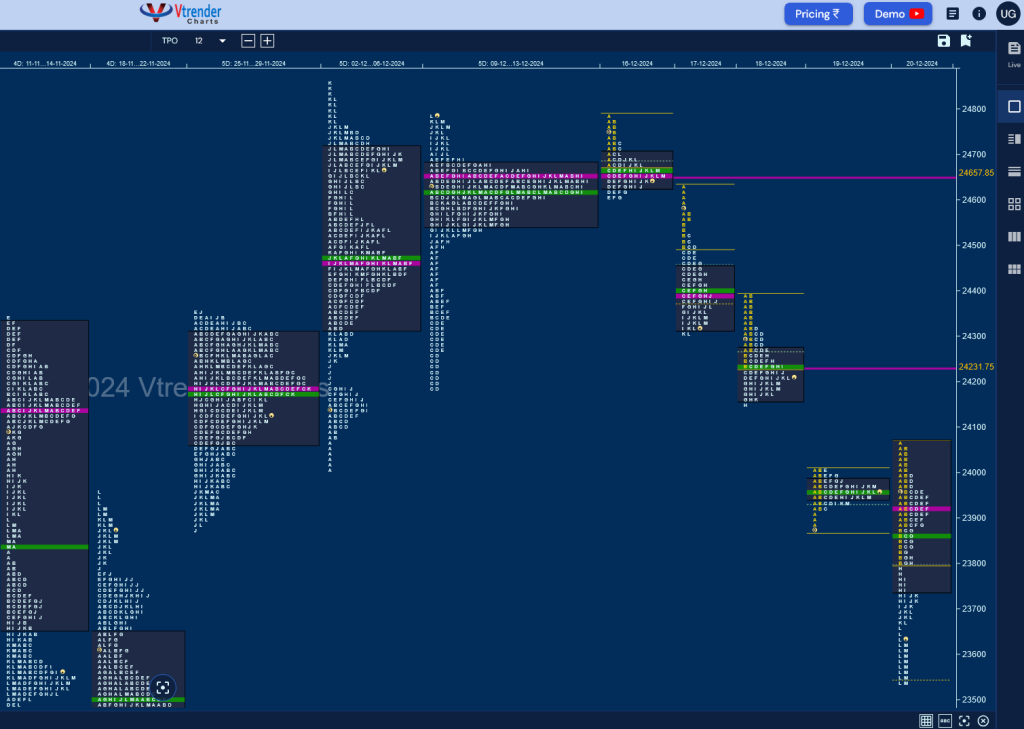

Monday – 24668 [ 24781 / 24601 ] Normal Variation (Down)

Tuesday – 24336 [ 24624 / 24303 ] Trend (Down)

Wednesday – 24198 [ 24394 / 24149 ] Normal Variation (Down)

Thursday – 23951 [ 24005 / 23870 ] Normal

Friday – 23587 [ 24065 / 23537 ] Trend (Down)

Previous week’s NeuX (Neutral Extreme) profile did not give any follow up and in fact started the current week with a ‘b’ shape long liquidation profile with a small but important initiative selling tail just below last week highs as it continued to build at the prominent weekly POC of 24653 on Monday after which it clearly signalled a move away from the balanced value area zone on Tuesday with another A period selling tail along with an extension handle forming a Trend Day Down while making a low of 24303 on Tuesday.

The auction continued the downside imbalance on Wednesday forming completely lower value and negating the important buying extension handle of 24190 indicating that the supply was being very aggressive resulting in a big gap down of 321 points on Thursday where it hit new lows of 23870 at open and saw some profit booking by the shorts forming a ‘p’ shape profile with an ultra prominent POC at 23956 and the subsequent test of the gap down singles in the A period on Friday saw yet another initiative selling tail getting confirmed as the sellers came back to the party and drove it down to form a huge 528 points range Trend Day Down negating the weekly handle of 23780 & getting deep down into the 22 Nov profile almost tagging the VPOC of 23524 while making a low of 23537.

Nifty has formed an elongated 1244 point range Triple Distribution Trend Down weekly profile with extension handles at 24601, 24149 & 23796 and a close with a spike from 23676 to 23537 which will be the immediate zone to watch for in the coming week. Value was completely lower at 23537-23956-24263 with a TPO HVN in the top most balance at 24657 which will now be a Swing Supply point along with nearer HVNs of 24231 & 24394 whereas on the downside, the HVN of 23459 will the the immediate support below which the weekly VPOC of 23339 & June series VWAP of 23247 remain the levels to watch out for return of demand.

Click here to view this week’s MarketProfile of Nifty on Vtrender Charts

Hypos for 23rd Dec – 23587 [ 24065 / 23537 ] Trend (Down)

| Up |

| 23587 – Previous Close 23632 – M TPO high (20 Dec) 23676 – Ext Handle (20 Dec) 23735 – I TPO h/b (20 Dec) 23796 – Ext Handle (20 Dec) 23842 – G TPO h/b (20 Dec) 23870 – Daily Ext Handle |

| Down |

| 23585 – M TPO h/b (20 Dec) 23524 – VPOC (22 Nov) 23459 – TPO HVN (18-22 Nov) 23408 – Buy Tail (22 Nov) 23356 – VAH (21 Nov) 23311 – VAL (21 Nov) 23289 – Buy tail (21 Nov) |

Hypos for 24th Dec – 23753 [ 23869 / 23647 ] Neutral Centre

| Up |

| 23754 – POC (23 Dec) 23794 – VAH (23 Dec) 23831 – SOC (23 Dec) 23870 – Daily Ext Handle 23921 – VPOC (20 Dec) 23994 – PBH (20 Dec) 24051 – Sell Tail (20 Dec) |

| Down |

| 23744 – M TPO low 23694 – VAL (23 Dec) 23647 – Weekly IBL 23585 – M TPO h/b (20 Dec) 23524 – VPOC (22 Nov) 23459 – TPO HVN (18-22 Nov) 23408 – Buy Tail (22 Nov) |

Hypos for 26th Dec – 23727 [ 23867 / 23685 ] Neutral (Double Inside Day)

| Up |

| 23733 – M TPO h/b (24 Dec) 23782 – POC (24 Dec) 23822 – IBH (24 Dec) 23870 – Daily Ext Handle 23921 – VPOC (20 Dec) 23994 – PBH (20 Dec) 24051 – Sell Tail (20 Dec) |

| Down |

| 23711 – 2-day VAL (23-24 Dec) 23685 – M TPO low (24 Dec) 23647 – Weekly IBL 23585 – M TPO h/b (20 Dec) 23524 – VPOC (22 Nov) 23459 – TPO HVN (18-22 Nov) 23408 – Buy Tail (22 Nov) |

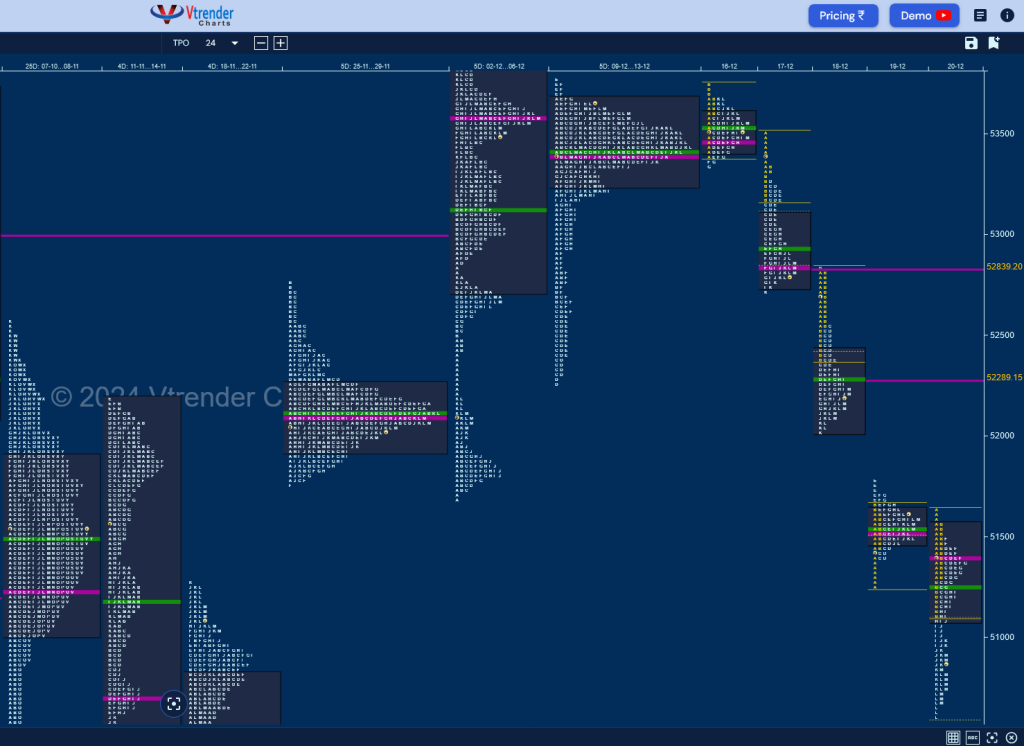

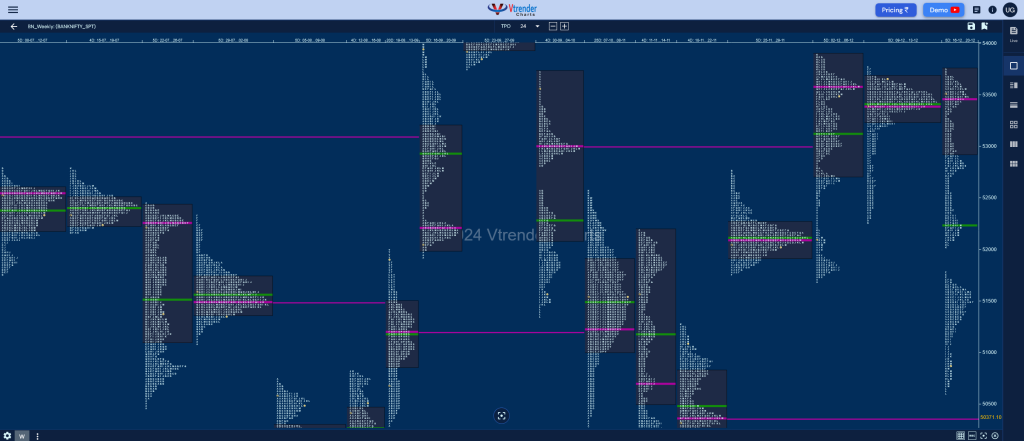

BankNifty Spot: 53583 [ 53775 / 52264 ] Inside Bar

Previous week’s report ended with this ‘The weekly profile has formed an Inside Bar both in terms of range and value (53247-53397-53666) implementing phase 2 of the IPM (Initial Price Movement) testing the important buy side extension handles and finding evidence of strong demand as they built a base at 53397 which is this week’s POC so as long as BankNifty can sustain above it can look to resume the upmove towards the weekly VPOC of 54071 & ATH of 54467 in the coming week‘

Monday – 53581 [ 53738 / 53335 ] Normal

Tuesday – 52834 [ 53515 / 52709 ] – Trend (Down)

Wednesday – 52139 [ 52827 / 52010 ] – Normal Variation (Down)

Thursday – 51575 [ 51789 / 51263 ] – Normal (3-1-3)

Friday – 50759 [ 51629 / 50609 ] – Trend (Down)

BankNifty opened the week with a Normal Day & a Gaussian Curve but left an important selling tail at top displaying rejection at previous week’s VAH as it yet again closed at the magnet of 53580 but the failure of buyers on Monday brought in aggressive sellers at open on Tuesday who not only took out the base of 53397 with an initiative tail but went on to form a Trend Day Down while making a low of 52709 and continued the imbalance with another 800+ point drop from just below Tuesday’s POC of 52840 hitting new lows for the week at 52010.

The auction not surprisingly then made a big gap down of 711 points on Thursday breaking the Swing level of 51694 & recording a low of 51263 but took support right in the 22nd Nov closing singles as it saw some good profit booking by the sellers which led to a pull back to 51789 forming a 3-1-3 profile for the day signalling supply being active at higher levels which got bigger on Friday as was seen in yet another A period selling tail followed by a Trend Day Down forcing an entry into the weekly value from 18-22 Nov after breaking below the HVN of 50900 and making a low of 50609.

The weekly profile was expected to be a Trending One but the magnitude of the fall was huge as BankNifty formed an elongated 3130 points range which is the largest one after 11th March 2022 (except for the June 2024 one which was due to the big election results day range) with completely overlapping Value at 52939-53453-53738 and has left extension handles at 53355 & 52010 along with a zone of singles till 51718 & a HVN at 51480 which will be the start of the main supply zone for the coming week whereas if the imbalance on the downside continues, it could go for the test of the weekly VPOCs of 50371 & 49732.

Click here to view this week’s MarketProfile of BankNifty on Vtrender Charts

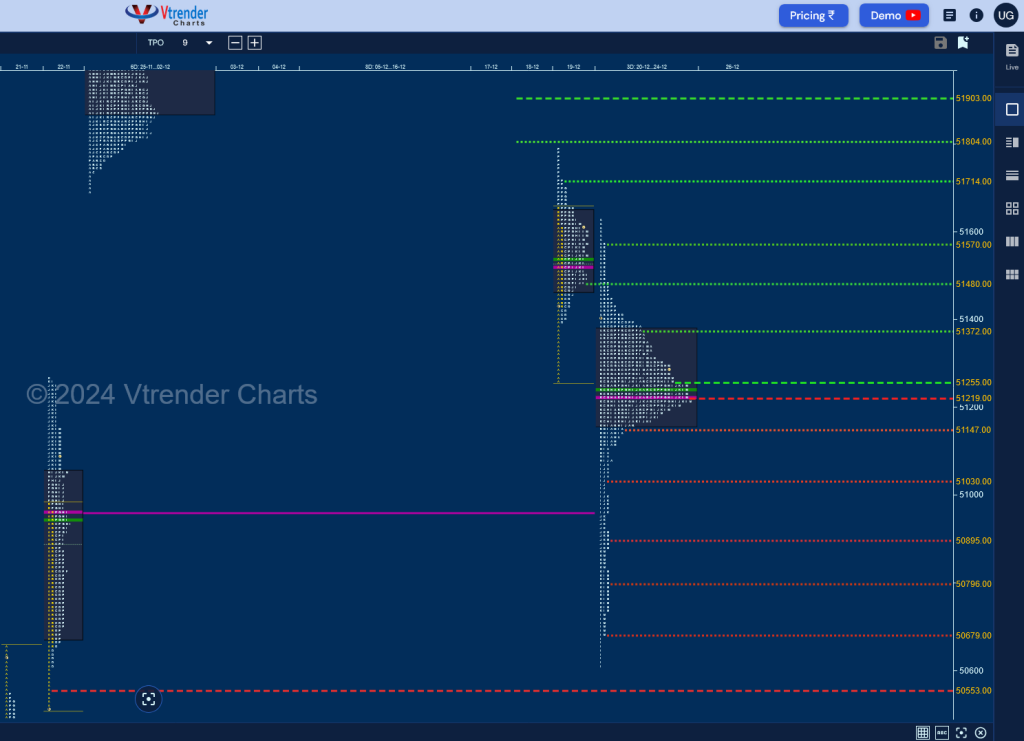

Hypos for 23rd Dec – 50759 [ 51629 / 50609 ] – Trend (Down)

| Up |

| 50801 – M TPO h/b (20 Dec) 50978 – J TPO h/b (20 Dec) 51119 – 20 Dec Halfback 51263 – Ext Handle 51384 – POC (20 Dec) 51480 – Weekly HVN 51573 – Sell Tail (20 Dec) |

| Down |

| 50720 – L TPO h/b (20 Dec) 50608 – Buy Tail (22 Nov) 50479 – VAH (21 Nov) 50371 – Weekly POC 50219 – 21 Nov Halfback 50100 – D TPO h/b (21 Nov) 49981 – PBL (21 Nov) |

Hypos for 24th Dec – 51317 [ 51417 / 51030 ] Normal (Inside Bar)

| Up |

| 51283 – 2-day POC (20-23 Dec) 51417 – 2-day VAH (20-23 Dec) 51573 – Sell Tail (20 Dec) 51718 – Sell Tail (19 Dec) 51804 – Weekly 2 IB 51906 – Sell Tail mid (19 Dec) 52044 – Closing tail (18 Dec) |

| Down |

| 51279 – POC (23 Dec) 51149 – 2-day VAL (20-23 Dec) 51030 – Weekly IBL 50902 – Gap mid (23 Dec) 50801 – M TPO h/b (20 Dec) 50686 – Buy Tail (20 Dec) 50558 – IB tail mid (22 Nov) |

Hypos for 26th Dec – 51233 [ 51382 / 51137 ] – Normal (Double Inside)

| Up |

| 51259 – 24 Dec Halfback 51376 – 3-day VAH (20-24 Dec) 51480 – Weekly HVN (16-20 Dec) 51573 – Sell Tail (20 Dec) 51718 – Sell Tail (19 Dec) 51804 – Weekly 2 IB 51906 – Sell Tail mid (19 Dec) |

| Down |

| 51224 – 3-day POC (20-24 Dec) 51137 – PDL 51030 – Weekly IBL 50902 – Gap mid (23 Dec) 50801 – M TPO h/b (20 Dec) 50686 – Buy Tail (20 Dec) 50558 – IB tail mid (22 Nov) |