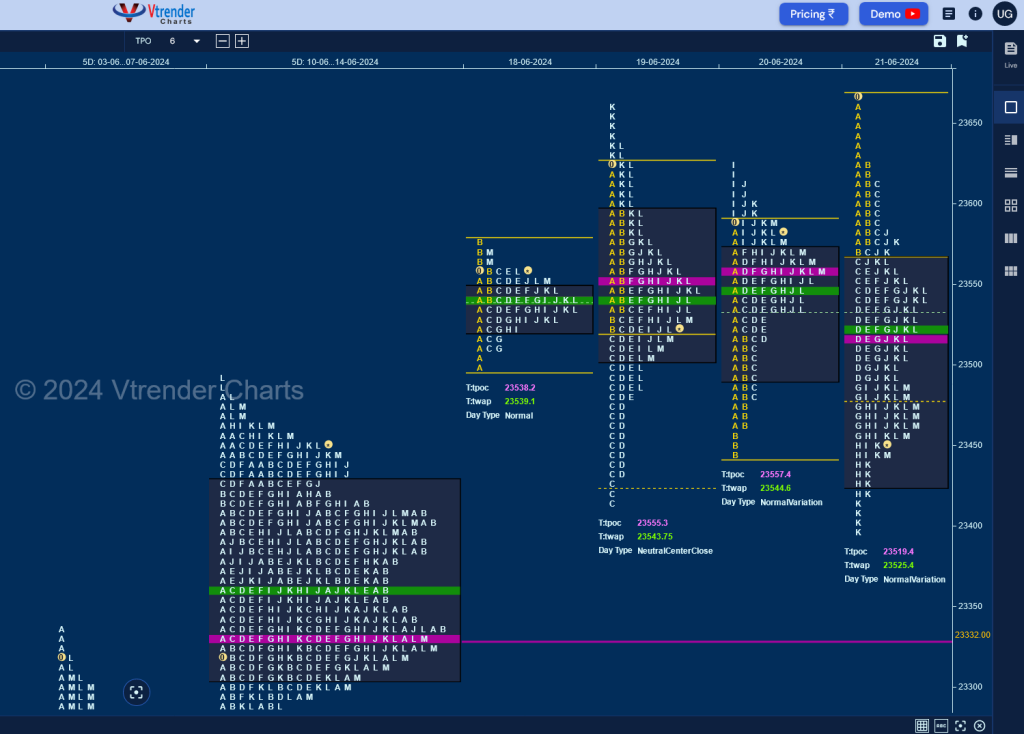

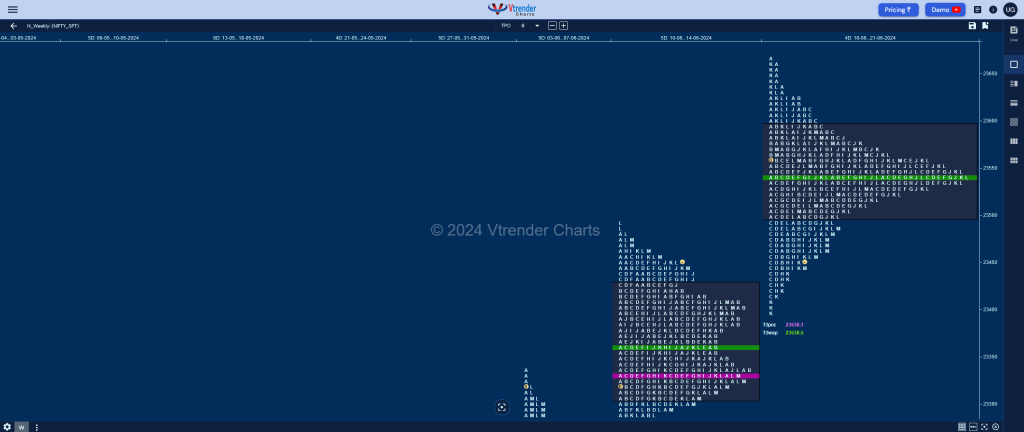

Nifty Spot: 23501 [ 23667 / 23398 ]

Monday – Holiday

Tuesday – 23558 [ 23579 / 23499 ] – Normal Day

Wednesday – 23516 [ 23664 / 23412 ] – Neutral Extreme

Thursday – 23567 [ 23624 / 23354 ] – Normal Variation

Friday – 23501 [ 23667 / 23398 ] – Normal Variation

The weekly profile is yet again a well-balanced one along with being a Neutral Centre with completely higher Value at 23496-23538-23592 but has closed below the Value and needs an initiative move away from the ultra-prominent POC of 23536 for a fresh imbalance to begin in the coming week whereas on the downside it has taken support at previous reference of 23412 which will continue to remain as immediate support.

Click here to view this week’s MarketProfile of Nifty on Vtrender Charts

Hypos for 24th June – 23501 [ 23667 / 23398 ] – Normal Variation

| Up |

| 23538 – Weekly POC 23592 – Weekly VAH 23622 – Sell Tail (21 Jun) 23667 – ATH (21 Jun) 23713 – 1 ATR (Buy tail 23338) 23768 – 1 ATR (SOC 23393) |

| Down |

| 23496 – Weekly VAL 23445 – M TPO low (21 Jun) 23393 – SOC (14 Jun) 23338 – Buy Tail (14 Jun) 23288 – 2-day VAL (10-11 Jun) 23250 – M TPO h/b (11 Jun) |

Hypos for 25th June – 23538 [ 23558 / 23350 ] – Double Distribution

| Up |

| 23555 – Sell tail (24 Jun) 23593 – 5-day VAH (18-24 Jun) 23622 – Sell Tail (21 Jun) 23667 – ATH (21 Jun) 23714 – 1 ATR (Buy tail 23338) 23766 – Weekly 2 IB |

| Down |

| 23536 – 5-day POC (18-24 Jun) 23492 – 5-day VAL (18-24 Jun) 23454 – Ext Handle (24 Jun) 23418 – B TPO h/b (24 Jun) 23383 – Buy Tail (24 Jun) 23338 – Buy Tail (14 Jun) |

Hypos for 26th June – 23721 [ 23754 / 23562 ] – Neutral Extreme

| Up |

| 23733 – Sell tail (25 Jun) 23766 – Weekly 2 IB 23827 – Weekly ATR (FA 23206) 23862 – 1 ATR (23492) 23903 – 1 ATR (VPOC 23533) 23950 – Weekly ATR |

| Down |

| 23710 – Ext Handle (25 Jun) 23657 – 25 Jun Halfback 23618 – Ext Handle (25 Jun) 23562 – FA (25 Jun) 23533 – VPOC (24 Jun) 23492 – 5-day VAL (18-24 Jun) |

Hypos for 27th June – 23868 [ 23890 / 23670 ] – Trend Day

| Up |

| 23887 – Sell tail (26 Jun) 23938 – 1 ATR (FA 23562) 23974 – Weekly 3 IB 24030 – 1 ATR (FA 23664) 24085 – 24138 – 1 ATR (WPOC 23538) |

| Down |

| 23844 – POC (26 Jun) 23799 – E TPO h/b (26 Jun) 23751 – Ext Handle (26 Jun) 23700 – B TPO h/b (26 Jun) 23657 – 25 Jun Halfback 23618 – Ext Handle (25 Jun) |

Hypos for 28th June – 24044 [ 24087 / 23805 ] – Normal Variation

| Up |

| 24049 – Sell tail (27 Jun) 24087 – Spike high (27 Jun) 24138 – 1 ATR (WPOC 23538) 24169 – 1 ATR (yPOC 23950) 24228 – 1 ATR (SOC 24009) 24263 – 1 ATR (24044) |

| Down |

| 24036 – Spike low (27 Jun) 23983 – SOC (27 Jun) 23913 – PBL (27 Jun) 23879 – D TPO h/b (27 Jun) 23834 – Buy Tail (27 Jun) 23799 – E TPO h/b (26 Jun) |

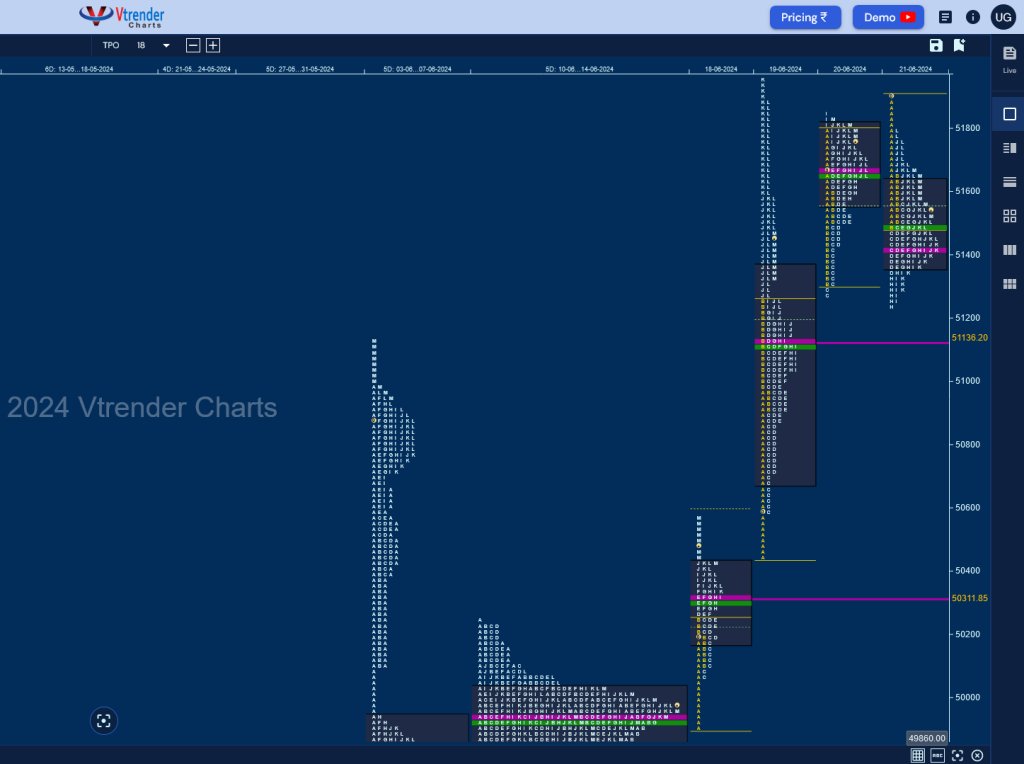

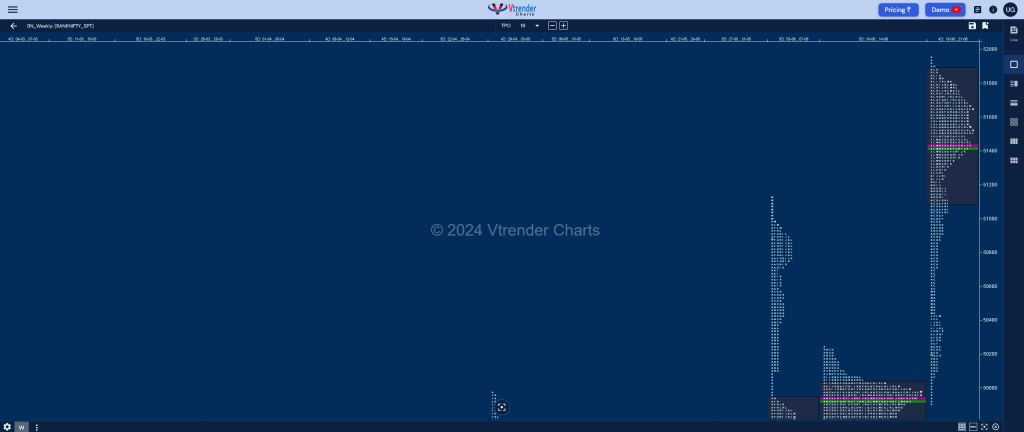

BankNifty Spot: 51661 [ 51957 / 49900 ]

Monday – Holiday

Tuesday – 50441 [ 50562 / 49900 ] – Trend Day

Wednesday – 51398 [ 51957 / 50441 ] – Trend Day

Thursday – 51783 [ 51842 / 51281 ] – Neutral

Friday – 51661 [ 51927 / 51224 ] – Normal Variation

BankNifty gave a move away from previous week’s balance with back to back Trend Days to the upside along with couple of A period singles from 50068 to 49900 & 50594 to 50441 on Tuesday & Wednesday respectively as it went on to record new ATH of 51957 but left a small responsive selling tail marking the end of the imbalance and closed the week with a 2-day balance on Thursday & Friday with the latter leaving an initiative selling tail from 51797 to 51934. This week’s profile is an elongated 2057 point range one with completely higher Value at 51087-51439-51879 and resembles a composite ‘p’ shape so can consolidate further in the coming days.

Click here to view this week’s MarketProfile of BankNifty on Vtrender Charts

Hypos for 24th June – 51664 [ 51934 / 51225 ] – Normal Variation

| Up |

| 51684 – 2-day VAH (20-21 Jun) 51797 – Sell Tail (21 Jun) 51957 – Swing High (19 Jun) 52058 – 1 ATR (SOC 50951) 52241 – 1 ATR (VPOC 51136) 52392 – 1 ATR (FA 51281) |

| Down |

| 51596 – M TPO h/b (21 jUN) 51439 – Weekly POC 51281 – PBL (21 Jun) 51136 – VPOC (19 Jun) 51031 – PBL (19 Jun) 50951 – SOC (19 Jun) |

Hypos for 25th June – 51704 [ 51784 / 51139 ] Double Distribution

| Up |

| 51727 – M TPO h/b (24 Jun)00 51884 – Sell Tail (19 Jun) 51957 – Swing High (19 Jun) 52062 – 1 ATR (SOC 50951) 52247 – 1 ATR (VPOC 51136) 52392 – 1 ATR (FA 51281) |

| Down |

| 51662 – L TPO h/b (24 Jun) 51506 – D TPO h/b (24 Jun) 51394 – Ext Handle (24 Jun) 51259 – B TPO h/b (24 Jun) 51136 – VPOC (19 Jun) 51031 – PBL (19 Jun) |

Hypos for 26th June – 52606 [ 52746 / 51747 ] – Trend Day

| Up |

| 52669 – Sell tail (25 Jun) 52746 – ATH 52855 – 1 ATR (PDL 51747) 52970 – 1 ATR (51862) 53074 – Weekly 3 IB 53196 – PWR |

| Down |

| 52585 – L TPO h/b (25 Jun) 52457 – PBL (25 Jun) 52275 – G TPO h/b (25 Jun) 52188 – Ext Handle (25 Jun) 52071 – POC (25 Jun) 51957 – Daily Ext Handle |

Hypos for 27th June – 52870 [ 52988 / 52373 ] – Normal Variation

| Up |

| 52879 – POC (26 Jun) 52970 – 1 ATR (51862) 53074 – Weekly 3 IB 53196 – PWR 53357 – 1 ATR (52249) 53491 – 1 ATR (52383) |

| Down |

| 52797 – M TPO h/b (26 Jun) 52680 – 26 Jun H/B 52543 – SOC (26 Jun) 52398 – Buy Tail (26 Jun) 52275 – G TPO h/b (25 Jun) 52188 – Ext Handle (25 Jun) |

Hypos for 28th June – 52811 [ 53180 / 52639 ] – Normal

| Up |

| 52849 – POC (27 Jun) 52964 – PBH (27 Jun) 53074 – Weekly 3 IB 53196 – PWR 53357 – 1 ATR (52249) 53491 – 1 ATR (52383) |

| Down |

| 52753 – VAL (27 Jun) 52668 – Buy Tail (27 Jun) 52543 – SOC (26 Jun) 52398 – Buy Tail (26 Jun) 52275 – G TPO h/b (25 Jun) 52188 – Ext Handle (25 Jun) |