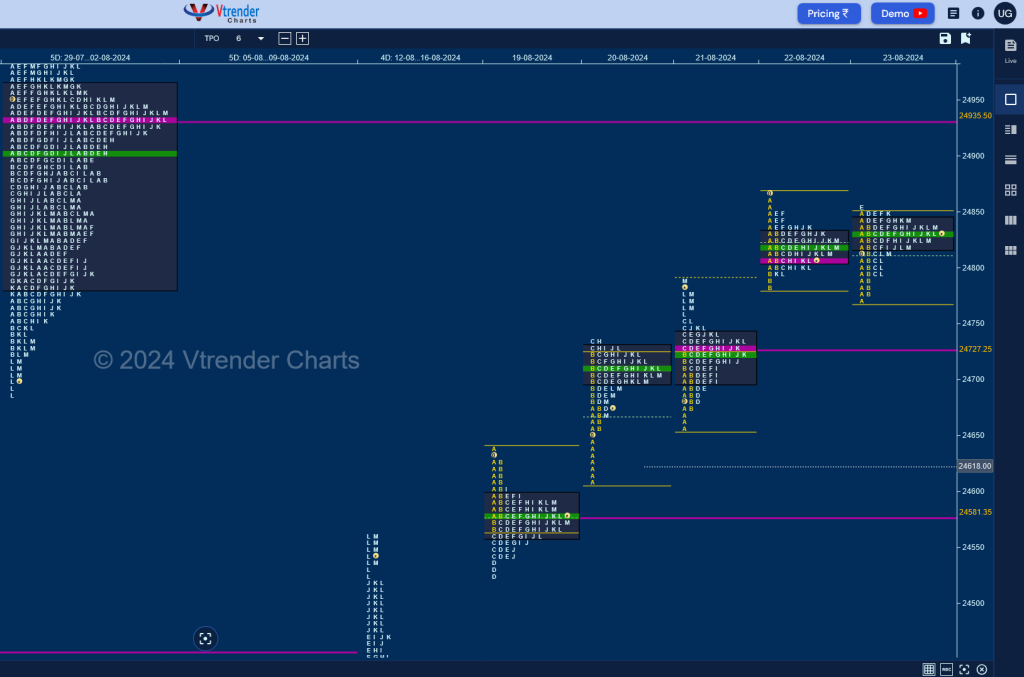

Nifty Spot: 24823 [ 24867 / 24523 ] Triple Distribution (Up)

Previous week’s report ended with this ‘The weekly profile is a Neutral Extreme (NeuX) one to the upside with almost similar value as previous week at 24111-24149-24371 with the NeuX zone being from 24472 to 24564 which will be the support for the coming week for a test of the gap zone of 24696 and an entry into the well balanced weekly value of 24782-24935-24963 (29Jul-02Aug) whereas on the downside, this week’s HVNs of 24420, 24300 & 24157 will be the levels to watch‘

Monday – 24572 [ 24638 / 24523 ] – Normal Variation (Down)

Tuesday – 24698 [ 24734 / 24607 ] – Normal (‘p’ shape)

Wednesday – 24770 [ 24788 / 24654 ] – Normal Variation (Up)

Thursday – 24811 [ 24867 / 24784 ] Normal (3-1-3)

Friday – 24823 [ 24858 / 24771 ] – Normal

Nifty stayed above previous week’s NeuX zone on Monday forming an ideal 3-1-3 profile with a prominent POC at 24581 and confirmed a move away to the upside with an initiative buying tail from 24658 to 24581 on Tuesday where it put up similar highs at 24734 casting a ‘p’ shape profile. The auction then tested the A period singles on Wednesday and took support at 24654 confirming that the buyers were in control as it established overlapping value for most part of the day before leaving an extension handle at 24754 along with a small spike to 24787 into the close signalling a fresh move away from the 2-day POC of 24722.

Thursday saw a higher open as Nifty tested the current month’s initiative selling tail of 24852 to 25078 tagging 24867 marking the return of supply as it left a small A period tail but remained in the IB all day assembling a nice Gaussian Curve in a narrow range of just 83 points and made an attempt to break lower on Friday but could only manage 24771 taking support above that extension handle of 24754 paving way for yet another Normal Day with overlapping value closing right at the 2-day prominent POC of 24824.

The weekly profile is a Triple Distribution one to the upside with completely higher Value at 24689-24824-24853 with the lower HVNs being at 24722 & 24581 and the next week’s auction will be bullish as long as it stays above 24824 for a probe to the VPOCs of 24935 & 24987 as immediate objectives whereas on the downside, 24754 will be the first support below which Nifty can go for a test of that buying tail from 24654.

Click here to view this week’s MarketProfile of Nifty on Vtrender Charts

Hypos for 26th Aug – 24823 [ 24858 / 24771 ] – Normal

| Up |

| 24824 – Weekly POC 24867 – Swing High (22 Aug) 24935 – Weekly POC 24987 – VPOC (01 Aug) 25059 – Sell Tail (01 Aug) |

| Down |

| 24811 – 2-day VAL (22-23 Aug) 24754 – Ext Handle (21 Aug) 24692 – 2-day VAL (20-21 Aug) 24654 – Buy Tail (20-21 Aug) 24581 – VPOC (19 Aug) |

Hypos for 27th Aug – 25010 [ 25043 / 24878 ] – Normal (‘p’ profile)

| Up |

| 25034 – Sell tail (26 Aug) 25078 – Swing High (01 Aug) 25128 – Weekly 1.5 IB 25164 – 1 ATR (H/B 24959) 25213 – 1 ATR (yPOC 25008) 24241 – 2 ATR (VPOC 24831) |

| Down |

| 25008 – POC (26 Aug) 24964 – Buy Tail (26 Aug) 24929 – A TPO H/B 24874 – Weekly IBL 24831 – VPOC (23 Aug) 24794 – PBL (23 Aug) |

Hypos for 28th Aug – 25017 [ 25073 / 24973 ] – Normal Variation (Up)

| Up |

| 25024 – 2-day POC (26-27 Aug) 25067 – Sell tail (27 Aug) 25128 – Weekly 1.5 IB 25172 – 1 ATR (VAL 24991) 25213 – Weekly 2 IB 25259 – 1 ATR (ATH 25078) |

| Down |

| 24991 – 2-day VAL (26-27 Aug) 24959 – 26 Aug Halfback 24929 – A TPO H/B (26 Aug) 24874 – Weekly IBL 24831 – VPOC (23 Aug) 24794 – PBL (23 Aug) |

Hypos for 29th Aug – 25052 [ 25129 / 24964 ] – Double Distribution (Up)

| Up |

| 25051 – M TPO high (28 Aug) 25100 – POC (28 Aug) 25146 – 1 ATR (Buy tail 24982) 25213 – Weekly 2 IB 25264 – 1 ATR (yPOC 25100) 25310 – 2 ATR (Buy tail 24982) |

| Down |

| 25024 – D TPO h/b (28 Aug) 24982 – Buy Tail (28 Aug) 24936 – 1 ATR (yPOC 25100) 24874 – Weekly IBL 24831 – VPOC (23 Aug) 24794 – PBL (23 Aug) |

Hypos for 30th Aug – 25152 [ 25193 / 24998 ] – Neutral Extreme (Up)

| Up |

| 25174 – Sell tail (29 Aug) 25213 – Weekly 2 IB 25265 – 1 ATR (yPOC 25098) 25332 – 2 ATR (FA 24998) 25382 – Weekly 3 IB 25432 – 2 ATR (yPOC 25098) |

| Down |

| 25142 – M TPO h/b (29 Aug) 25098 – POC (29 Aug) 25045 – SOC (29 Aug) 24998 – FA (29 Aug) 24931 – 1 ATR (yPOC 25098) 24874 – Weekly IBL |

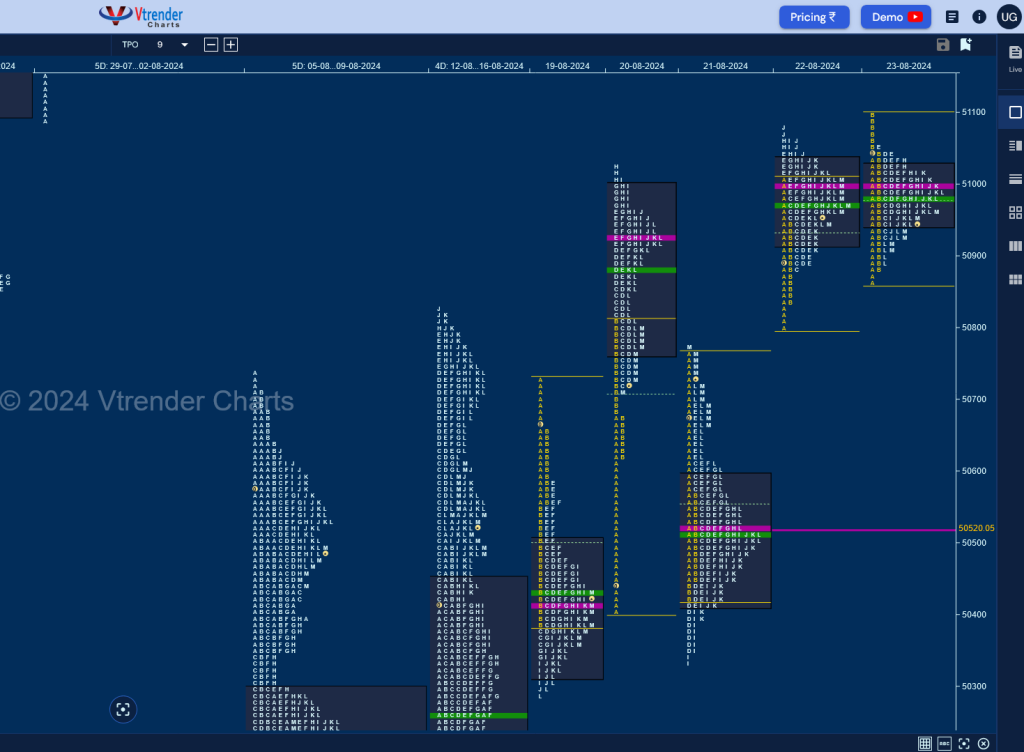

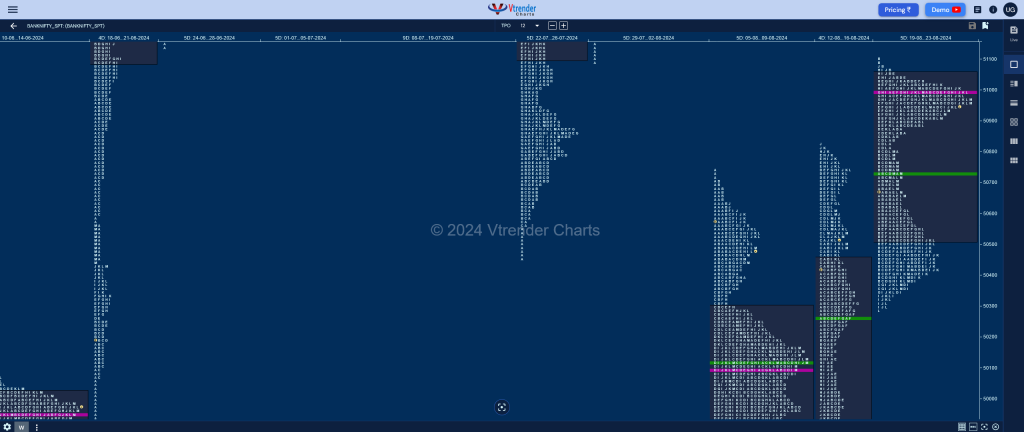

BankNifty Spot: 50933 [ 51118 / 50283 ] Neutral Extreme (Up)

Previous week’s report ended with this ‘The weekly profile is a Normal Variation one to the downside but has formed an Outside Bar both in terms of range & value thanks to the rejection it saw at the break of previous extremes so can make another attempt to tag that VPOC of 50839 in the coming week as long as it remains above the current Value of 49691-49733-50451‘

Monday – 50368 [ 50728 / 50283 ] Normal (‘b’ shape)

Tuesday – 50803 [ 51025 / 50398 ] – Normal Variation (Up)

Wednesday – 50685 [ 50772 / 50333 ] – Neutral

Thursday – 50985 [ 51080 / 50794 ] – Normal

Friday – 50933 [ 51117 / 50856 ] – Normal

BankNifty opened higher on Monday but got stopped just below previous Monday’s (12 Aug) VPOC of 50732 making a high of 50728 and reversing the probe to the downside leaving an A period tail till 50660 & making multiple REs till the L TPO but all of them were marginal ones as the entry back into previous week’s value was only able to drop till 50283 leaving a ‘b’ shape profile for the day signalling exhaustion of supply at the lows and more confirmation of this came via an Open Drive Up on Tuesday with an initiative buying tail helping the auction not only to scale above the immediate VPOC of 50732 but also the higher one of 50839 (25-26 Jul) as it went make new highs for the week at 51025 confirming a weekly FA at 50283 but saw the longs booking out in the second half of the day triggering a retracement back to day’s halfback of 50712 into the close leaving a ‘p’ shape profile.

Wednesday then saw the auction form Value and a nice Gaussian Curve if previous day’s buying tail with couple of downside RE attempts being rejected as it left similar lows of 50543 & 50333 enabling the buyers to come back and make marginal new highs of 50772 into the close and continue the imbalance to the upside on Thursday with a higher open and a small A period buying tail setting up new highs for the week at 51080 as it took a pause just below the extension handle of 51087 forming the first of the narrow range Normal Days as it did a repeat of the same on Friday where it did look up above 51087 and tagged 51117 completing the 2 ATR objective of 51111 from the FA of 49806 but left a small selling tail in the B TPO and formed an inside bar in terms of value with overlapping POC at 50995.

The weekly profile is a Neutral Extreme one to the upside with completely higher Value at 50511-50995-51050 with the prominent POC of 50995 being the immediate upside reference for the coming week if it wants to continue the imbalance towards the weekly VPOC of 51484 & the 2 ATR objective of 51929 from the weekly FA of 50283 whereas on the downside, 50856 to 50728 will be the support zone and a break of it could get a drop towards the daily VPOCs of 50520 & 49950.

Click here to view this week’s MarketProfile of BankNifty on Vtrender Charts

Hypos for 26th Aug – 50933 [ 51117 / 50856 ] – Normal

| Up |

| 50937 – 2-day VAL (22-23 Aug) 51034 – 2-day VAH (22-23 Aug) 51189 – Weekly Tail (05-09 Aug) 51308 – PBL (02 Aug) 51453 – VPOC (02 Aug) 51586 – Sell tail (02 Aug) |

| Down |

| 50856 – Buy Tail (22-23 Aug) 50728 – Weekly SOC (19-23 Aug) 50610 – L TPO h/b (21 Aug) 50520 – VPOC (21 Aug) 50411 – VAL (21 Aug) 50283 – Weekly FA (19 Aug) |

Hypos for 27th Aug -51148 [ 51318 / 51061 ] Normal (‘p’ shape)

| Up |

| 51190 – 26 Aug Halfback 51318 – Weekly IBH 51453 – VPOC (02 Aug) 51586 – Sell tail (02 Aug) 51708 – VPOC (31 Jul) 51845 – RO Point (Aug) |

| Down |

| 51106 – Buy Tail (26 Aug) 50995 – VPOC (23 Aug) 50856 – Buy Tail (22-23 Aug) 50728 – Weekly SOC (19-23 Aug) 50610 – L TPO h/b (21 Aug) 50520 – VPOC (21 Aug) |

Hypos for 28th Aug -51278 [ 51404 / 50938 ] – Normal Variation (Up)

| Up |

| 51321 – 2-day VAH (26-27 Aug) 51453 – VPOC (02 Aug) 51586 – Sell tail (02 Aug) 51708 – VPOC (31 Jul) 51845 – RO Point (Aug) 51958 – SOC (29 Jul) |

| Down |

| 51266 – IBH (27 Aug) 51139 – 2-day VAL (26-27 Aug) 50980 – Buy Tail (27 Aug) 50856 – Buy Tail (22-23 Aug) 50728 – Weekly SOC (19-23 Aug) 50610 – L TPO h/b (21 Aug) |

Hypos for 29th Aug -51143 [ 51260 / 51033 ] – Neutral Extreme (Down)

| Up |

| 51158 – M TPO high 51260 – FA (28 Aug) 51392 – Sell tail (27 Aug) 51484 – Weekly VPOC (29Jul-02Aug) 51586 – Sell tail (02 Aug) 51708 – VPOC (31 Jul) |

| Down |

| 51107 – 3-day VAL (26-27 Aug) 50980 – Buy Tail (27 Aug) 50856 – Buy Tail (22-23 Aug) 50728 – Weekly SOC (19-23 Aug) 50610 – L TPO h/b (21 Aug) 50520 – VPOC (21 Aug) |

Hypos for 30th Aug -51152 [ 51369 / 50984 ] – Neutral Centre (Outside Bar)

| Up |

| 51214 – 4-day POC (26-29 Aug) 51369 – FA (29 Aug) 51484 – Weekly VPOC (29Jul-02Aug) 51586 – Sell tail (02 Aug) 51708 – VPOC (31 Jul) 51845 – Sell Tail mid (01 Aug) |

| Down |

| 51147 – M TPO h/b (29 Aug) 51018 – Buy Tail (29 Aug) 50856 – Buy Tail (22-23 Aug) 50728 – Weekly SOC (19-23 Aug) 50610 – L TPO h/b (21 Aug) 50520 – VPOC (21 Aug) |