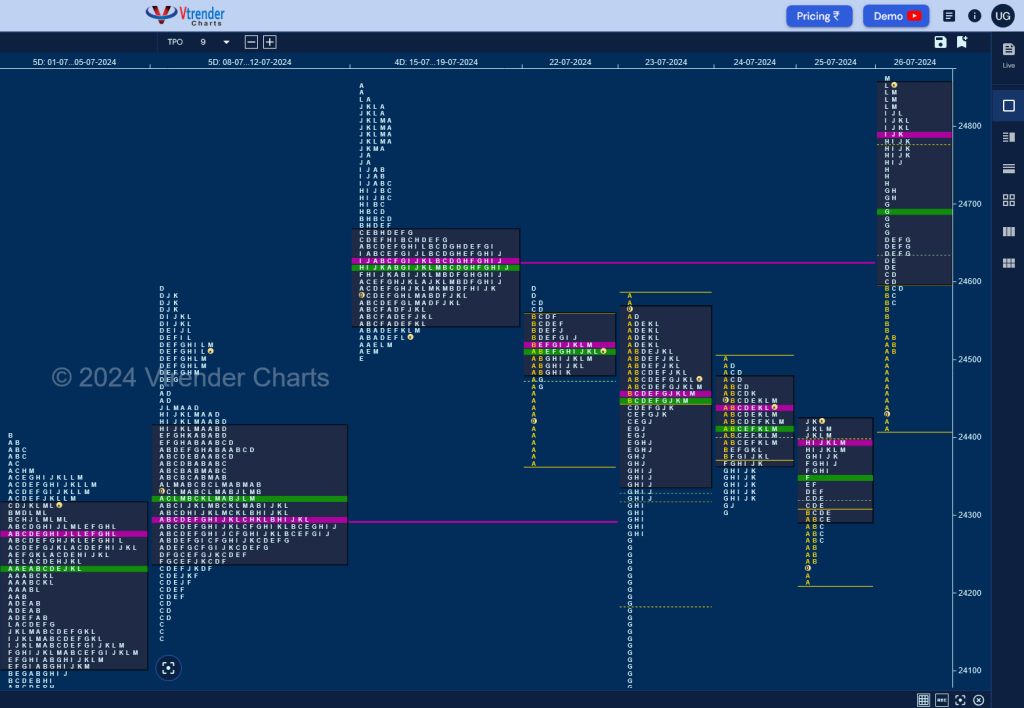

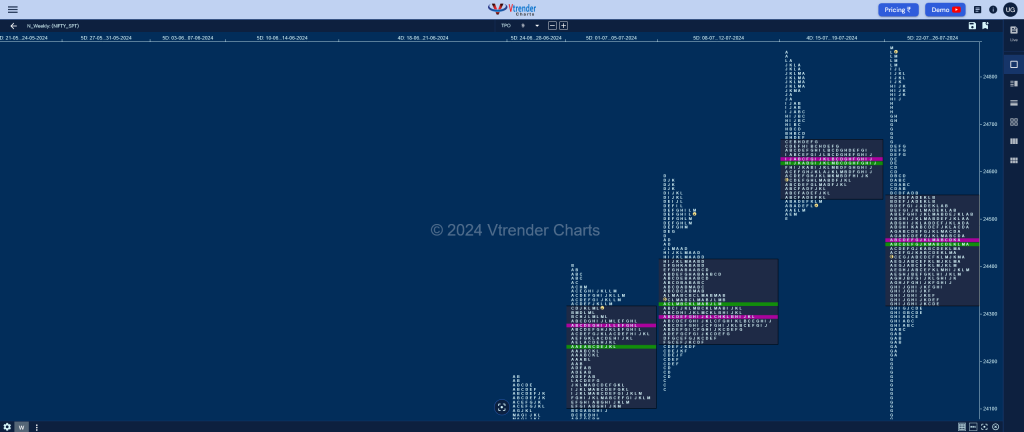

Nifty Spot: 24834 [ 24861 / 24074 ] – Neutral Extreme (Up)

Previous week’s report ended with this ‘The weekly profile is a Neutral one with completely higher Value at 24546-24625-24662 which completed the 3 IB objective on the upside but has seen rejection in form of an initiative selling tail at new ATH of 24854 and has closed below the weekly VAL so the immediate support will be the FA of 24504 & 12th Jul’s VPOC of 24500 below which we have the extension handle of 24461 and a break of which can script a drop down to the weekly VPOC of 24296 and the 11th Jul one of 24261 in the coming week where as on the upside, the trend day extension handles of 24590, 24678 & 24727 will be the hurdles for the bulls to cross for a test of 24801 which is the mid-point of the initiative selling tail of that day‘

Monday – 24509 [ 24595 / 24362 ] – Normal (p shape)

Tuesday –24479 [ 24582 / 24074 ] – Neutral

Wednesday – 24413 [ 24504 / 24307 ] – Normal Variation (Down) – Inside bar

Thursday – 24406 [ 24426 / 24210 ] – Double Distribution (Up)

Friday – 24834 [ 24861 / 24410 ] – Trend (Up)

Nifty opened lower on Monday below the reference of 24504 and went on to make a low of 24362 in the A period taking support just above the 7-day (03-12 Jul) composite VAH of 24354 as it left an initiative buying tail and entered back into previous week’s Value even making couple of REs (Range Extension) higher in the C & D TPOs tagging last Friday’s first extension handle of 24590 while making a high of 24595 but could not sustain resulting in a ‘p’ shape profile for the day with a prominent POC at 24516 which was followed by a trending move lower on the Budget Day (Tuesday) which not only negated Monday’s singles but went on to swipe through the 7-day Value and continued the 80% Rule in another 3-day composite (28Jun-02Jul) breaking below the VPOC of 24137 and making a low of 24074 stopping right at the VAL where it saw demand coming back strongly as could be seen in the long responsive tail till 24277 & huge bounce back to 24544 stalling right at previous week’s VAL before closing around the POC of 24459.

The auction then formed an inside bar on Wednesday both in terms of range & value forming a nice balance with almost overlapping POC at 24440 and opened with a big gap down of 182 points on Thursday where it tested Tuesday’s zone of singles but left a fresh A period tail from 24245 to 24210 re-confirming that buyers were defending this zone who then formed a Double Distribution Trend Day Up getting back into previous range and value and making a high of 24426 and continued this imbalance with an Open Drive Up on Friday where it went on to match Monday’s high of 24595 in the Initial Balance after leaving back to back initiative tails resulting in multiple extension handles at 24610, 24656 & 24721 along with an elongated profile of 450 points as it recorded marginal new ATH of 24861 leaving an ideal Trend Day Up.

The weekly profile is a Neutral Extreme (NeuX) one to the upside which was forming overlapping to lower value on the first 4 days of the week with the POC also drifting lower on each day as it completed the 2 IB objective of 24129 on the downside which is the reason this week’s Value is completely lower at 24319-24459-24543 but the sequence of leaving a responsive buying tail with couple of initiative ones triggered a massive upmove on the last day with the NeuX reference of 24595 now being a Swing support with the 3 extension handles of 24721, 24656 & 24610 being the immediate references on the downside for the coming week whereas on the upside, Nifty can keep flying in this unchartered territory towards new highs of 25032, 25156 & 25218

Click here to view this week’s MarketProfile of Nifty on Vtrender Charts

Hypos for the week 29th July to 02nd August

| Up |

| 24845 – M TPO h/b (26 Jul) 24881 – 2 ATR (VPOC 24391) 24930 – 2 ATR (VPOC 24440) 24991 – 2 ATR (8D_POC 24501) 25032 – 1 ATR (yPOC 24787) 25097 – Weekly ATR (24459) 25156 – Monthly ATR 25218 – Monthly 3 IB 25277 – 2 ATR (yPOC 24787) |

| Down |

| 24824 – L TPO h/b (26 Jul) 24787 – POC (26 Jul) 24721 – Ext Handle (26 Jul) 24656 – Ext Handle (26 Jul) 24610 – Ext Handle (26 Jul) 24552 – B TPO h/b (26 Jul) 24511 – Buy Tail (26 Jul) 24459 – Weekly POC 24391 – VPOC (25 Jul) |

Hypos for 30th Jul – 24836 [ 24999 / 24774 ] – Neutral Extreme (Down)

| Up |

| 24848 – M TPO high (29 Jul) 24885 – POC (29 Jul) 24939 – SOC (29 Jul) 24999 – Weekly IBH 25034 – 1 ATR (VPOC 24787) 25097 – Weekly ATR (24459) |

| Down |

| 24832 – M TPO h/b (29 Jul) 24787 – POC (26 Jul) 24721 – Ext Handle (26 Jul) 24656 – Ext Handle (26 Jul) 24610 – Ext Handle (26 Jul) 24552 – B TPO h/b (26 Jul) |

Hypos for 31st Jul – 24857 [ 24971 / 24798 ] – Normal Variation (Up)

| Up |

| 24861 – M TPO high (30 Jul) 24902 – L TPO POC (30 Jul) 24949 – SOC (29 Jul) 24999 – Weekly IBH 25038 – 1 ATR (VPOC 24787) 25097 – Weekly ATR (24459) |

| Down |

| 24847 – M TPO h/b (30 Jul) 24816 – Buy Tail (30 Jul) 24787 – POC (26 Jul) 24721 – Ext Handle (26 Jul) 24656 – Ext Handle (26 Jul) 24610 – Ext Handle (26 Jul) |

Hypos for 01st Aug – 24951 [ 24984 / 24856 ] – Normal

| Up |

| 24959 – 3-day VAH (29-31 Jul) 24999 – Weekly IBH 25039 – 1 ATR (VPOC 24787) 25097 – Weekly ATR (24459) 25156 – Monthly ATR 25209 – Weekly 2 IB |

| Down |

| 24934 – POC (31 Jul) 24871 – Buy Tail (31 Jul) 24832 – M TPO low (30 Jul) 24787 – POC (26 Jul) 24746 – H TPO h/b (26 Jul) 24711 – Mid-profile tail (26 Jul) |

Hypos for 02nd Aug – 25010 [ 25078 / 24956 ] – Normal Variation (Down)

| Up |

| 25017 – 01 Aug Halfback 25060 – Sell Tail (01 Aug) 25097 – Weekly ATR (24459) 25132 – 1 ATR (SOC 24893) 25173 – 1 ATR (VPOC 24934) 25226 – 1 ATR (yPOC 24987) |

| Down |

| 24998 – M TPO low (01 Aug) 24959 – 3-day VAH (29-31 Jul) 24920 – 31 Jul Halfback 24871 – Buy Tail (31 Jul) 24832 – M TPO low (30 Jul) 24787 – POC (26 Jul) |

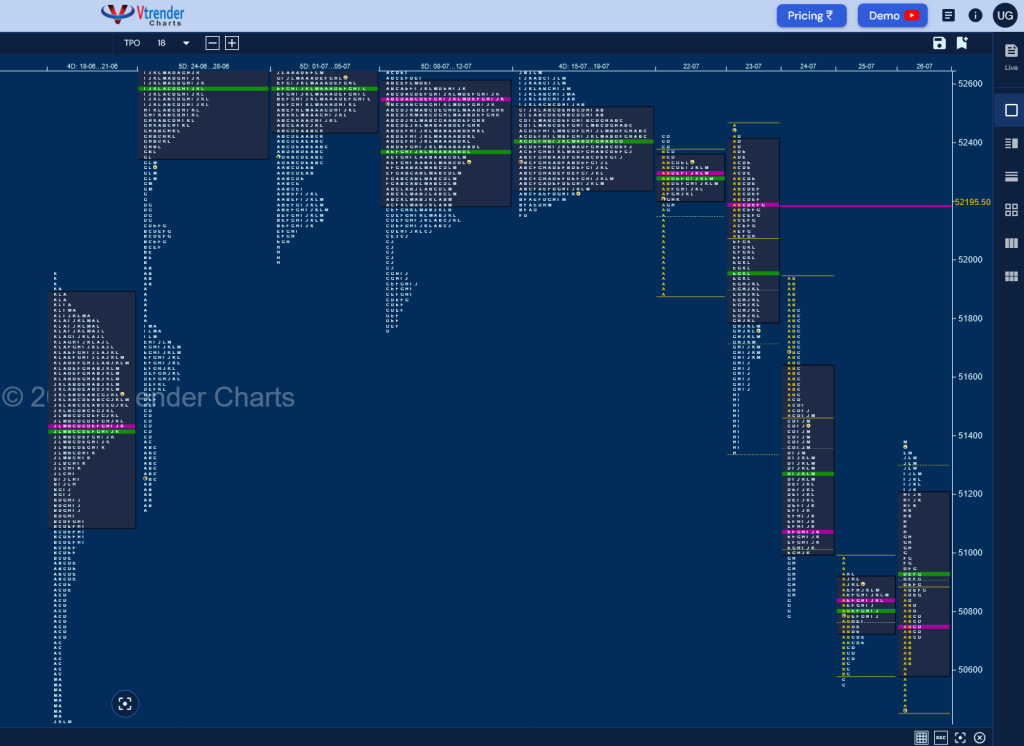

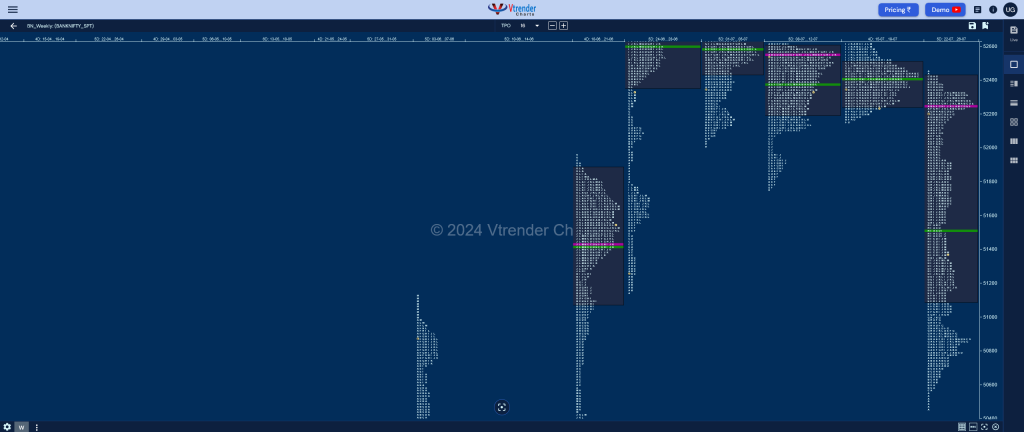

BankNifty Spot: 51296 [ 52547 / 50438 ] – Neutral Extreme (Down)

Previous week’s report ended with this ‘The weekly profile is a Neutral Centre one with both range & value being completely inside the prior week as BankNifty continued the balance it has been forming on the higher timeframe with a clear rejection at top in previous week’s selling tail so the extreme of 52794 will be the new swing reference on the upside above which we can expect a probe higher to daily & weekly VPOCs of 52961 & 53100 respectively along with the ATH of 53357 whereas on the downside, staying below this week’s VAL of 52241 we can for a test of the lower VPOCs of 51923 & 51635 along with the Swing one of 51136 in the coming week‘

Monday – 52280 [ 52427 / 51874 ] Normal (‘p’ shape)

Tuesday – 51778 [ 52547 / 51342 ] – Trend (Down)

Wednesday – 51317 [ 51944 / 50784 ] – Normal Variation (Down)

Thursday – 50888 [ 51006 / 50559 ] – Normal

Friday – 51296 [ 51398 / 50438 ] – Trend (Up)

BankNifty opened the week below 52241 and went on to tag the first lower VPOC of 51923 while making a low of 51874 in the A period on Monday and saw some profit booking by the sellers resulting in a probe back into previous week’s value and a test of the POC of 52408 as it made similar highs of 52427 forming a ‘p’ shape profile for the day with a prominent POC at 52292 and made a higher open on Tuesday repairing the poor highs but was swiftly rejected from 52547 as it left an A period selling tail and made a trending move to the downside not only tagging the lower VPOC of 51635 but dropped further down to 51342 where it left similar lows indicating short term exhaustion triggering a bounce back to 52086 before closing at 51778 confirming a weekly FA (Failed Auction).

The auction went on to complete the 1 ATR objective of 50944 as it continued the downside imbalance on Wednesday breaking below the Swing VPOC of 51136 while making a low of 50784 but left a small responsive buying tail till 50865 triggeing another short covering bounce back to 51515 before settling down at 51317 and opened with a big gap down of 555 points on Thursday confirming that the PLR was very much to the downside as it went on to test 19th Jun’s Buying tail from 50594 while making a low of 50572 in the IB (Initial Balance) but made the dreaded C side extension to 50559 which hit marked the lows for the day as it left a 3-1-3 profile for the day with a prominent POC at 50839. BankNifty opened lower yet again on Friday making new lows for the week at 50438 as it broke below the Jun series VWAP of 50519 & tested the 18th Jun closing extension handle of 50441 and left an A period buying tail making the end of the downmove for the week and went on to make an OTF (One Time Frame) probe higher to 51398 leaving a Trend Day Up and a probable new Swing Low.

The weekly profile is an elongated 2109 point range one which was not totally unexpected given the multi-week balance it was forming and the narrow 636 point range last week and is a Neutral Extreme One to the downside with overlapping to lower Value at 51098-52249-52416 but has left lower HVNs at 51078 & 50850 which will act as support levels for the coming week whereas on the upside, the auction will need to sustain above 24th Jul’s halfback of 51361 for a probe towards the NeuX reference of 51784 which if taken out can give a probe higher towards the Trend Day VPOC of 52195 from 23rd Jul.

Click here to view this week’s MarketProfile of BankNifty on Vtrender Charts

Hypos for the week 29th July to 02nd August

| Up |

| 51361 – 24 Jul Halfback 51477 – IBL (24 Jul) 51597 – C TPO h/b (24 Jul) 51743 – B TPO h/b (24 Jul) 51874 – NeuX zone (22-26 Jul) 51996 – Monthly IBL 52086 – PBH (23 Jul) 52195 – VPOC (23 Jul) 52284 – 12-day VPOC (05-23 Jul) |

| Down |

| 51264 – M TPO low (26 Jul) 51111 – H TPO h/b (26 Jul) 50987 – Ext Handle (26 Jul) 50863 – PBL (26 Jul) 50750 – POC (26 Jul) 50665 – A TPO POC (26 Jul) 50559 – Monthly tail (Jul) 50441 – Ext Handle (18 Jun) 50311 – VPOC (18 Jun) |

Hypos for 30th Jul – 51406 [ 52340 / 51186 ] Neutral

| Up |

| 51433 – IBL (29 Jul) 51618 – PBH (29 Jul) 51768 – 29 Jul Halfback 51874 – NeuX zone (22-26 Jul) 51996 – Monthly IBL 52102 – SOC (29 Jul) |

| Down |

| 51395 – M TPO high (29 Jul) 51264 – Buy tail (29 Jul) 51111 – H TPO h/b (26 Jul) 50987 – Ext Handle (26 Jul) 50863 – PBL (26 Jul) 50750 – VPOC (26 Jul) |

Hypos for 31st Jul – 51499 [ 51957 / 51260 ] Normal Variation (Up)

| Up |

| 51510 – M TPO high (30 Jul) 51645 – L TPO POC (30 Jul) 51768 – SOC (30 Jul) 51888 – 2-day VAH (29-30 Jul) 51996 – Monthly IBL 52102 – SOC (29 Jul) |

| Down |

| 51449 – 2-day VAL (29-30 Jul) 51305 – Buy Tail (30 Jul) 51186 – Weekly IBL 51064 – Ext Handle (26 Jul) 50930 – SOC (26 Jul) 50826 – D TPO POC (26 Jul) |

Hypos for 01st Aug – 51553 [ 51663 / 51335 ] – Neutral

| Up |

| 51567 – Monthly VAL (Jul) 51687 – VPOC (31 Jul) 51845 – RO Point (Aug) 51958 – SOC (29 Jul) 52102 – SOC (29 Jul) 52244 – Sell tail (29 Jul) |

| Down |

| 51542 – M TPO low (31 Jul) 51392 – IBL (31 Jul) 51264 – Buy Tail (29 Jul) 51111 – H TPO h/b (26 Jul) 50987 – SOC (26 Jul) 50863 – PBL (26 Jul) |

Hypos for 02nd Aug – 51564 [ 51877 / 51456 ] – Normal Variation (Down)

| Up |

| 51570 – M TPO low (01 Aug) 51708 – POC (01 Aug) 51845 – RO Point (Aug) 51958 – SOC (29 Jul) 52102 – SOC (29 Jul) 52244 – Sell tail (29 Jul) |

| Down |

| 51524 – L TPO h/b (01 Aug) 51406 – 3-day VAL (29Jul-01Aug) 51264 – Buy Tail (29 Jul) 51111 – H TPO h/b (26 Jul) 50987 – SOC (26 Jul) 50863 – PBL (26 Jul) |