Nifty Spot: 24717 [ 25078 / 24686 ] Neutral Extreme (Down)

Previous week’s report ended with this ‘The weekly profile is a Neutral Extreme (NeuX) one to the upside which was forming overlapping to lower value on the first 4 days of the week with the POC also drifting lower on each day as it completed the 2 IB objective of 24129 on the downside which is the reason this week’s Value is completely lower at 24319-24459-24543 but the sequence of leaving a responsive buying tail with couple of initiative ones triggered a massive upmove on the last day with the NeuX reference of 24595 now being a Swing support with the 3 extension handles of 24721, 24656 & 24610 being the immediate references on the downside for the coming week whereas on the upside, Nifty can keep flying in this unchartered territory towards new highs of 25032, 25156 & 25218‘

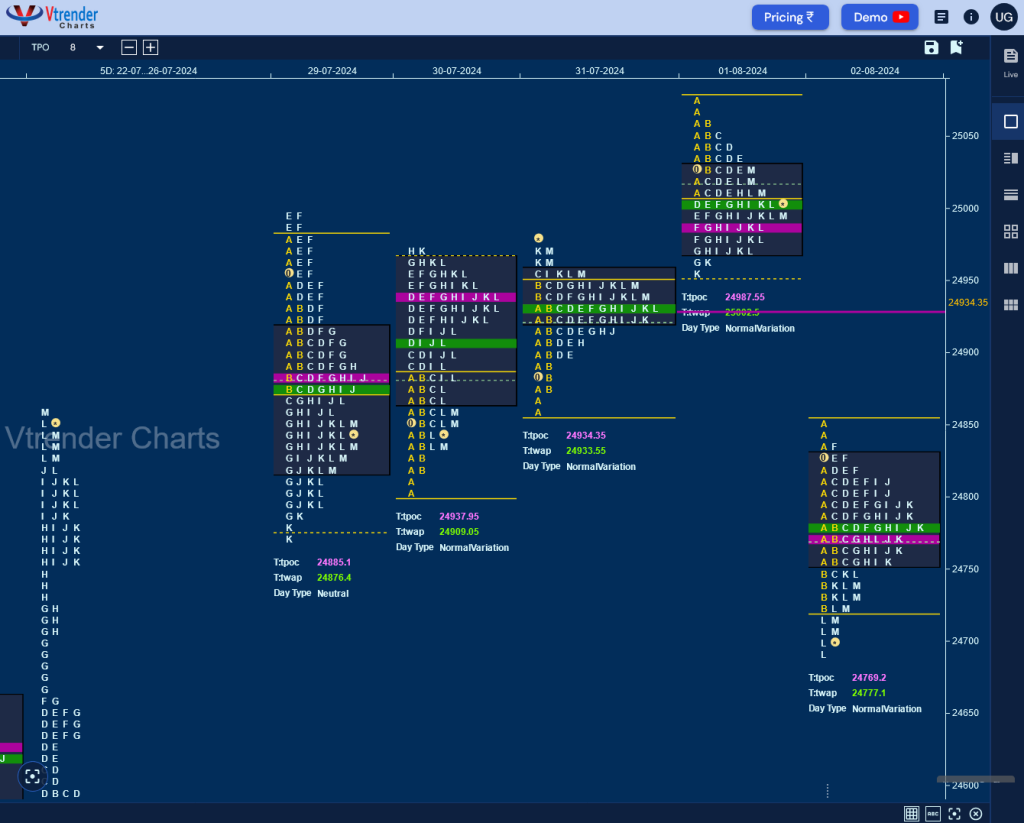

Monday – 24836 [ 24999 / 24774 ] – Neutral Extreme (Down)

Tuesday –24857 [ 24971 / 24798 ] – Normal Variation (Up)

Wednesday – 24951 [ 24984 / 24856 ] – Normal

Thursday – 25010 [ 25078 / 24956 ] – Normal Variation (Down)

Friday – 24717 [ 24851 / 24686 ] – Normal

As expected, previous week elongated range led to a narrow range balance in Nifty for the first 3 days this week after it formed a Neutral Extreme Day Down on Monday leaving similar highs just below the BRN (Big Round Number) of 25000 and the probe lower taking support at last Friday’s POC of 24787 while leaving a responsive buying tail from 24790 to 24774 forming a composite POC at 24935 from where it made an attempt to move away to the upside on Thursday which was also the first day of a new month but the new ATH of 25078 also brought in a special A period selling tail and a narrow range long liquidation profile suggesting poor trade facilitation above the 3-day composite Value.

The auction then opened with a gap down of 222 points on Friday not only swiping through the 3-day Value but remained below it leaving another initiative tail and went on to break the first of the 26th Jul Trend Day Extension handle of 24721 making a low of 24686 before closing the week at 24717 leaving a Neutral Extreme profile to the downside but with completely higher Value at 24782-24935-24963 and is a rare case when the NeuX is also giving a nice Gaussian Curve so has a very good chance to give a follow down and completing the 80% Rule in previous week’s Value from 24548 to 24319 with the final objective on the downside for the coming week being at 24137 which is the 1 ATR downside objective from the negated weekly FA of 24774 which is now a Swing supply point.

Click here to view this week’s MarketProfile of Nifty on Vtrender Charts

Hypos for 05th Aug – 24717 [ 24851 / 24686 ] – Normal

| Up |

| 24716 – M TPO halfback 24769 – POC (02 Aug) 24835 – Sell Tail (02 Aug) 24862 – 3-day VAL (29-31 Jul) 24935 – Weekly POC 24987 – VPOC (01 Aug) |

| Down |

| 24696 – Buy tail (02 Aug) 24656 – Ext Handle (26 Jul) 24610 – Ext Handle (26 Jul) 24552 – B TPO h/b (26 Jul) 24511 – Buy Tail (26 Jul) 24459 – Weekly VPOC |

Hypos for 06th Aug – 24055 [ 24350 / 23893 ] – Trend (Down)

| Up |

| NA |

| Down |

| NA |

Hypos for 07th Aug – 23992 [ 24382 / 23960 ] – Trend (Down)

| Up |

| 24012 – 2-day POC (05-06 Aug) 24057 – J TPO h/b (06 Aug) 24122 – I TPO h/b (06 Aug) 24170 – 06 Aug Halfback 24228 – POC (06 Aug) 24266 – POC (06 Aug) |

| Down |

| 23960 – Buy tail (Aug) 23893 – Weekly IBL 23834 – Buy Tail (27 Jun) 23780 – 26 Jun Halfback 23742 – IBH (26 Jun) 23700 – B TPO h/b (26 Jun) |

Hypos for 08th Aug – 24297 [ 24337 / 24185 ] – Normal (Inside Bar)

| Up |

| 24307 – IBH (07 Aug) 24350 – Weekly IBH 24391 – VPOC (25 Jul) 24459 – Weekly VPOC 24502 – 1 ATR (POC 24227) 24549 – 1 ATR (VAH 24274) 24582 – 1 ATR (IBH 24307) |

| Down |

| 24295 – M TPO low (07 Aug) 24261 – 07 Aug Halfback 24227 – 2-day POC (06-07 Aug) 24170 – 06 Aug Halfback 24122 – I TPO h/b (06 Aug) 24057 – J TPO h/b (06 Aug) 24012 – 2-day POC (05-06 Aug) |

Hypos for 09th Aug – 24117 [ 24340 / 24079 ] – Neutral Extreme Up (Outside Bar)

| Up |

| 24139 – 3-day VAH (06-08 Aug) 24196 – PBH (06-08 Aug) 24263 – SOC (08 Aug) 24310 – Sell tail (08 Aug) 24350 – Weekly IBH 24391 – VPOC (25 Jul) |

| Down |

| 24113 – Spike high (08 Aug) 24057 – J TPO h/b (06 Aug) 24012 – 2-day POC (05-06 Aug) 23960 – Buy tail (Aug) 23893 – Weekly IBL 23834 – Buy Tail (27 Jun) |

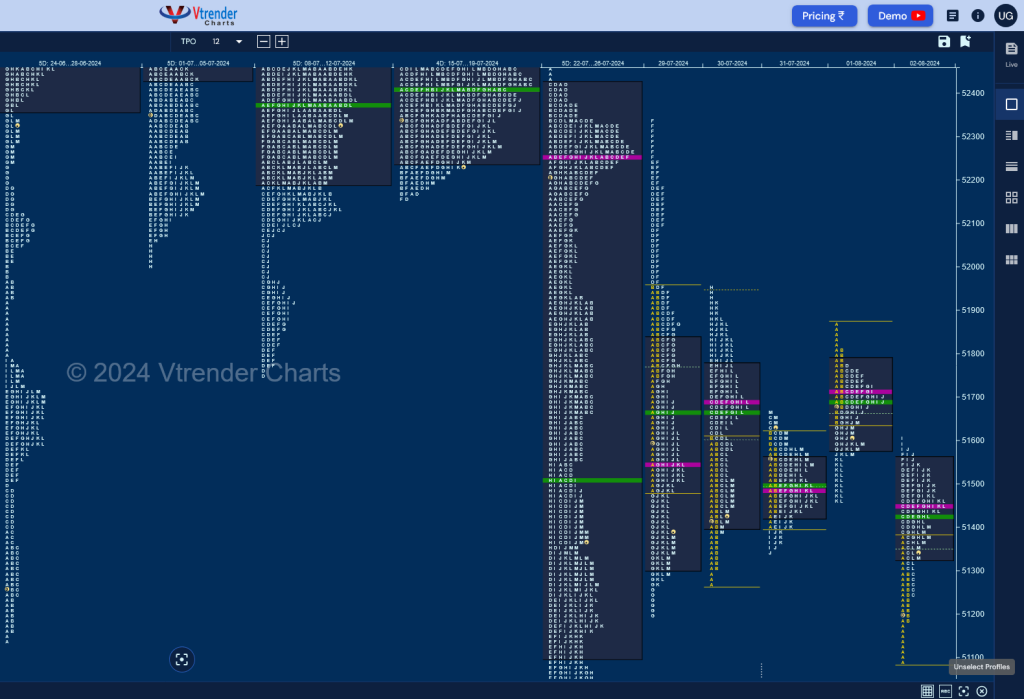

BankNifty Spot: 51350 [ 52340 / 51087 ] Inside Bar (3-1-3 profile)

Previous week’s report ended with this ‘The weekly profile is an elongated 2109 point range one which was not totally unexpected given the multi-week balance it was forming and the narrow 636 point range last week and is a Neutral Extreme One to the downside with overlapping to lower Value at 51098-52249-52416 but has left lower HVNs at 51078 & 50750 which will act as support levels for the coming week whereas on the upside, the auction will need to sustain above 24th Jul’s halfback of 51361 for a probe towards 51515 and the NeuX reference of 51784 which if taken out can give a probe higher towards the Trend Day VPOC of 52195 from 23rd Jul‘

Monday – 51406 [ 52340 / 51186 ] Neutral

Tuesday – 51499 [ 51957 / 51260 ] – Normal Variation (Up)

Wednesday – 51553 [ 51663 / 51335 ] – Neutral

Thursday – 51564 [ 51877 / 51456 ] – Normal Variation (Down)

Friday – 51350 [ 51608 / 51087 ] – Normal Variation (Up)

BankNifty confirmed the move away from the multi-week balance it had been forming since last week of June 2024 as it got accepted in previous week’s Value forming a nice balanced 3-1-3 profile in the current week where it first showed signs of rejection on the upside on Monday from previous week’s POC of 52249 in form of a responsive selling tail from 52244 to 52340 leaving an elongated 1153 point Neutral Day with a small buying tail at lows and coiled for the next 2 sessions forming a Double Inside Bar on Wednesday as it closed the month of July.

The auction made an attempt to move away from the 3-day balance on Thursday which was also the first day of August but left an initiative selling tail from 51814 to 51877 getting rejected from the RO point of 51845 and went on get back into the composite value forming poor lows of 51456 and completed the 80% Rule with a gap down on Friday where it hit new lows for the week at 51087 making a look down below previous week’s value but saw some demand coming back as seen in the A period tail till 51189 as it went on to give multiple REs higher to 51608 stalling right in the middle of what was now a 4-day composite before closing the week at 51350. The weekly range & value was completely inside previous week at 51406-51486-51762 and the close below value suggests that the PLR would be to the downside but the sellers will need to negated the singles from 51189 to 51087 for a probe towards the TPO HVN of 50856 & weekly tail from 50559 to 50438 (22-26 Jul) in the coming week.

Click here to view this week’s MarketProfile of BankNifty on Vtrender Charts

Hypos for 05th August – 51350 [ 51608 / 51087 ] – Normal Variation (Up)

| Up |

| 51350 – 02 Aug Halfback 51453 – 02 Aug POC 51586 – Sell tail (02 Aug) 51708 – VPOC (31 Jul) 51845 – RO Point (Aug) 51958 – SOC (29 Jul) 52102 – SOC (29 Jul) |

| Down |

| 51309 – Closing PBL (02 Aug) 51189 – Buy Tail (02 Aug) 51064 – Ext Handle (26 Jul) 50963 – G TPO h/b (26 Jul) 50856 – Weekly HVN (22-26 Jul) 50750 – VPOC (26 Jul) 50616 – Buy Tail (26 Jul) |

Hypos for 06th August – 50095 [ 50747 / 49719 ] Trend (Down)

| Up |

| NA |

| Down |

| NA |

Hypos for 07th August – 49748 [ 50688 / 49659 ] – Trend (Down)

| Up |

| 49752 – M TPO h/b (06 Aug) 49875 – Ext Handle (06 Aug) 50005 – I TPO h/b (06 Aug) 50174 – 06 Aug Halfback 50361 – B TPO h/b (06 Aug) 50484 – Sell Tail (06 Aug) |

| Down |

| 49719 – Buy tail (Aug) 49615 – Weekly Buy tail (10-14 Jun) 49513 – 07 Jun Halfback 49326 – Weekly VPOC (03-06 Jun) 49193 – L TPO h/b (06 Jun) 49047 – Jun RO point |

Hypos for 08th August – 50119 [ 50292 / 49782 ] – Normal (Inside Bar)

| Up |

| 50191 – 3-day VAH (05-07 Aug) 50361 – B TPO h/b (06 Aug) 50484 – Sell Tail (06 Aug) 50627 – IB tail mid (05 Aug) 50747 – Weekly IBH 50856 – Weekly HVN (22-26 Jul) 50968 – Gap mid (05 Aug) |

| Down |

| 50123 – M TPO low (07 Aug) 50037 – 07 Aug Halfback 49918 – POC (07 Aug) 49794 – Buy tail (07 Aug) 49615 – Weekly Buy tail (10-14 Jun) 49513 – 07 Jun Halfback 49326 – Weekly VPOC (03-06 Jun) |

Hypos for 09th August – 50156 [ 50440 / 49826 ] – Normal Variation Up (3-1-3)

| Up |

| 50185 – 2-day VAH (07-08 Aug) 50350 – SOC (08 Aug) 50484 – Sell Tail (06 Aug) 50627 – IB tail mid (05 Aug) 50747 – Weekly IBH 50856 – Weekly HVN (22-26 Jul) 50968 – Gap mid (05 Aug) |

| Down |

| 50134 – 08 Aug Halfback 50037 – 07 Aug Halfback 49918 – 2-day POC (07-08 Aug) 49794 – Buy tail (07 Aug) 49615 – Weekly Buy tail (10-14 Jun) 49513 – 07 Jun Halfback 49326 – Weekly VPOC (03-06 Jun) |