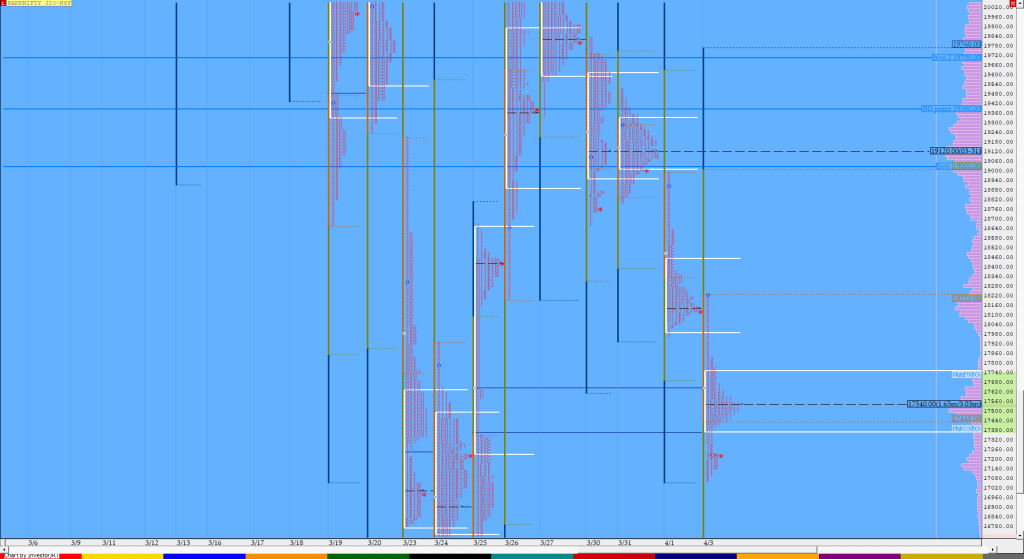

Order Flow charts dated 7th Apr 2020 (5 mins)

The way we see it is that Order Flow trading is a mindset. Well, instead of just looking for technical patterns, Trader should go a step further and think about what other market participants might do. NF BNF

Market Profile Analysis dated 03rd Apr 2020

Nifty Apr F: 8084 [ 8330 / 8045 ] HVNs -7900 / 8130 / (8220) / 8259 / 8304 / 8408 / 8460 / 8540-60 / 8604 / 8670 NF for the second consecutive day gave an initiative move away at open as it moved away from the YPOC of 8250 and went on to […]

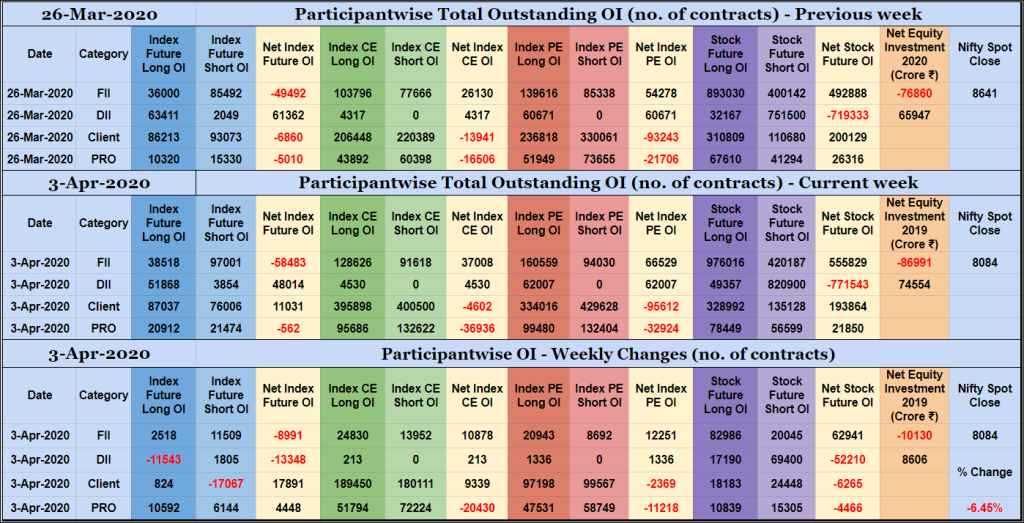

Participantwise Open Interest – 3rd APR 2020

Weekly view FIIs have added net 9K short Index Futures, net 10K long Index CE, net 12K long Index PE and net 62K long Stocks Futures contracts this week. They have been net sellers in equity segment for ₹10130 crore during the week. Clients have added net 9K long Index CE, net 2K short Index PE […]

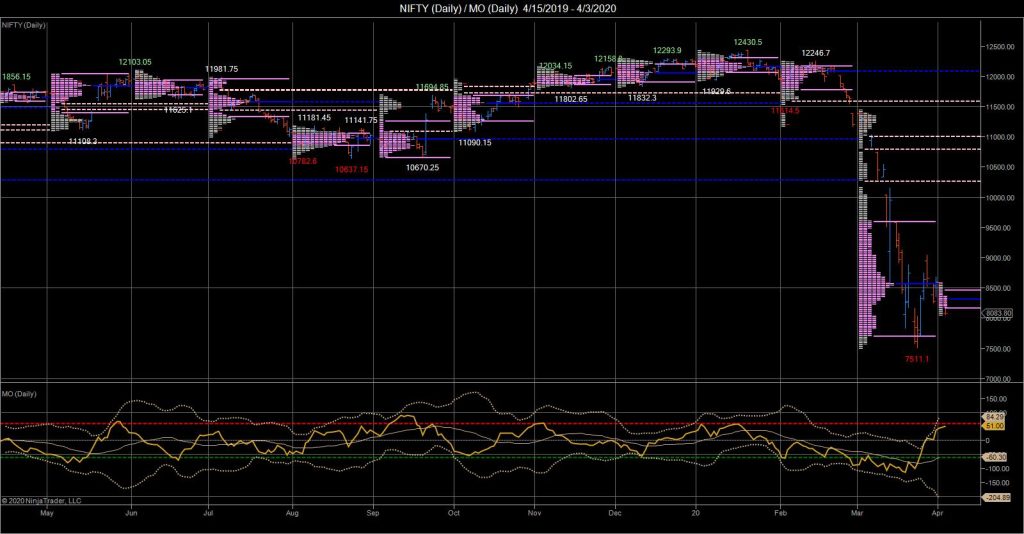

Desi MO (McClellans Oscillator For NSE) – 3rd APR 2020

MO at 51

Weekly charts (30th Mar to 3rd Apr 2020) and Market Profile Analysis

Nifty Spot Weekly Profile (30th Mar to 3rd Apr 2020) Spot Weekly – 8084 [ 8678/ 8055 ] Previous week’s report ended with this ‘The weekly Value is at 7850-8660-9030 with the close being around the POC which would be the important reference in the coming week. Staying below this POC, Nifty could fill up […]

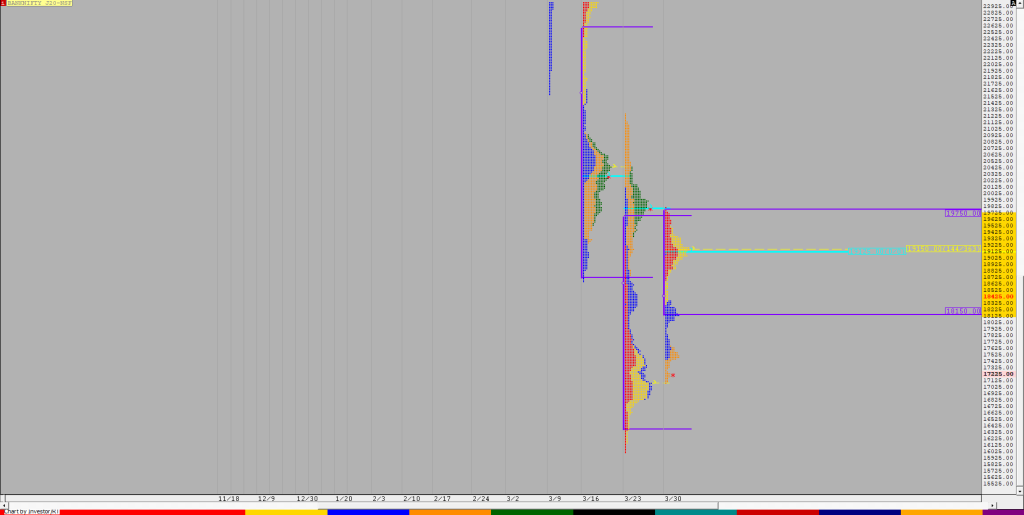

Order Flow charts dated 3rd Apr 2020

Trading Order Flow allows a trader to see the specific price where a trade has hit the market, along with the volume of that trade. This information is extremely valuable and allows a trader to generate substantial revenue by using this information to trade. The way we see it is that Order Flow trading is […]

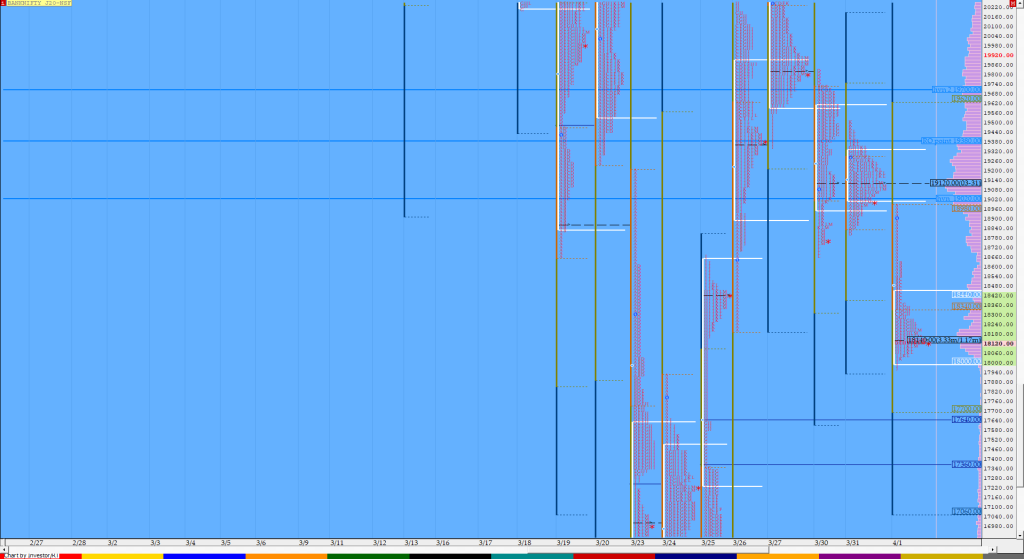

Order Flow charts dated 3rd Apr 2020 (5 mins)

Order Flow trading is thinking about what order market participants do and when you think along this, you can anticipate what kind of action they will be taking in the market. This is a very important concept in Order Flow. NF BNF

Market Profile Analysis dated 01st Apr 2020

Nifty Apr F: 8257 [ 8569 / 8181 ] HVNs – 7900 / (8220) / 8259 / 8304 / 8408 / 8460 / 8540-60 / 8604 / 8670 NF opened lower below the YPOC of 8600 & moved away from the 4-day composite Value as it left an initiative tail from 8426 to 8569 in […]

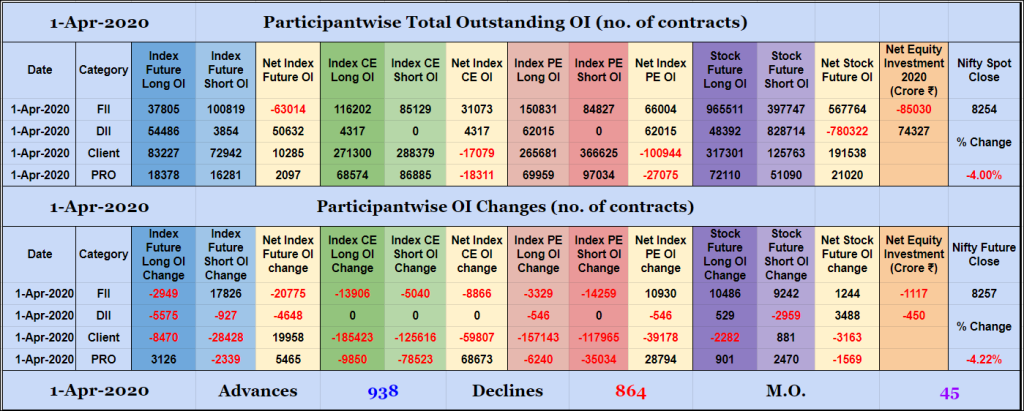

Participantwise Open Interest – 1st APR 2020

FIIs added 17K short Index Futures and net 1K long Stocks Futures contracts, liquidated 2K long Index Futures contracts and reduced exposure in Index Options. They were net sellers in equity segment for ₹1117 crore. Clients reduced exposure in Index Futures as well as Index Options. Nifty APR shed 3665 contracts in Open Interest, even […]

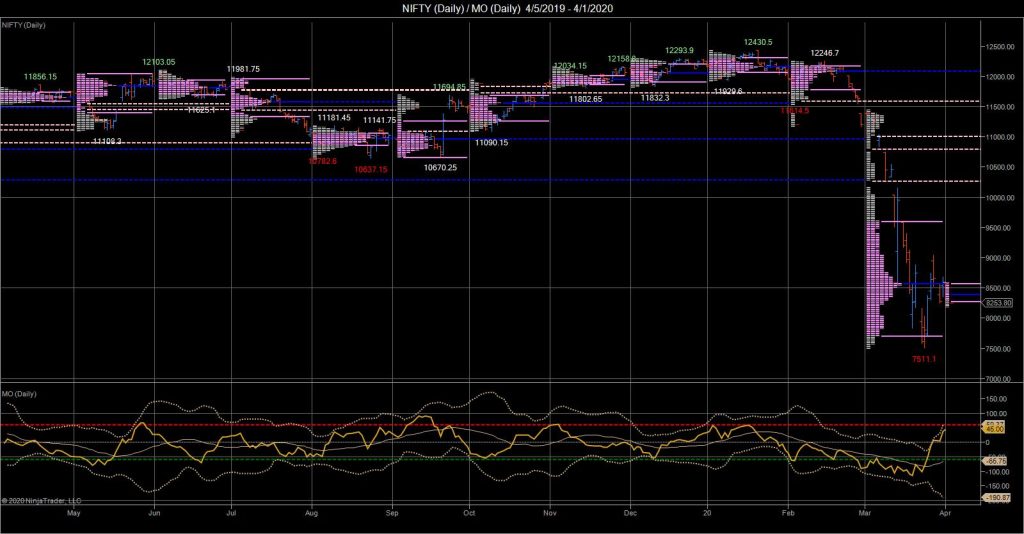

Desi MO (McClellans Oscillator For NSE) – 1st APR 2020

MO at 45