Options: A powerful tool for managing risk and generating profit

Options are a powerful tool that can be used to manage risk and generate profit. They give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specified date. This means that options can be used to hedge against downside risk, speculate on future price movements, or simply generate income.

The Greeks are a set of measures that describe the sensitivity of an option’s price to changes in various factors, such as the underlying asset price, implied volatility, time to expiration, and interest rates. By understanding the Greeks, you can better understand how options prices behave and make more informed trading decisions.

The Greeks: A must-know for any options trader

As the ancient Greeks invented the theater, the modern Greeks have given us a performance of their own – the dramatic play of options pricing. In the world of finance, the Greeks have taken center stage, starring Delta, Gamma, Vega, and Theta, along with their supporting cast members like Vanna and Charm. These Greeks are not clad in togas but rather they govern the dynamic world of options trading. They might not serve you a delicious gyro, but they can give you insight into the mechanics of option prices that can make or break your trading strategies.

Act I: The Ensemble

Options trading is a powerful way to make money, a tool that gives the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. Sounds exciting, right? But don’t leap just yet! It’s crucial to understand how option prices behave before you step on the trading floor. This is where our Greeks enter the stage.

Delta is the diva of the options world. It measures how much an option’s price is expected to change when the price of the underlying asset changes by one point. A high Delta suggests that the option moves significantly with the price of the underlying asset, while a low Delta indicates less sensitivity.

Gamma, the enigma, measures the rate at which Delta changes for every one-point change in the price of the underlying asset. A high Gamma means that the option’s Delta is volatile and will react strongly to movements in the underlying asset, whereas a low Gamma suggests a more stable Delta.

Vega, the soothsayer, foresees the changes in the option’s price with respect to a 1% change in implied volatility. High Vega options are more sensitive to changes in volatility, while low Vega options are less affected.

Theta, often seen as Father Time himself, quantifies the time decay of options, representing how much an option’s price will decrease for each day that passes.

Act II: The Play Unfolds

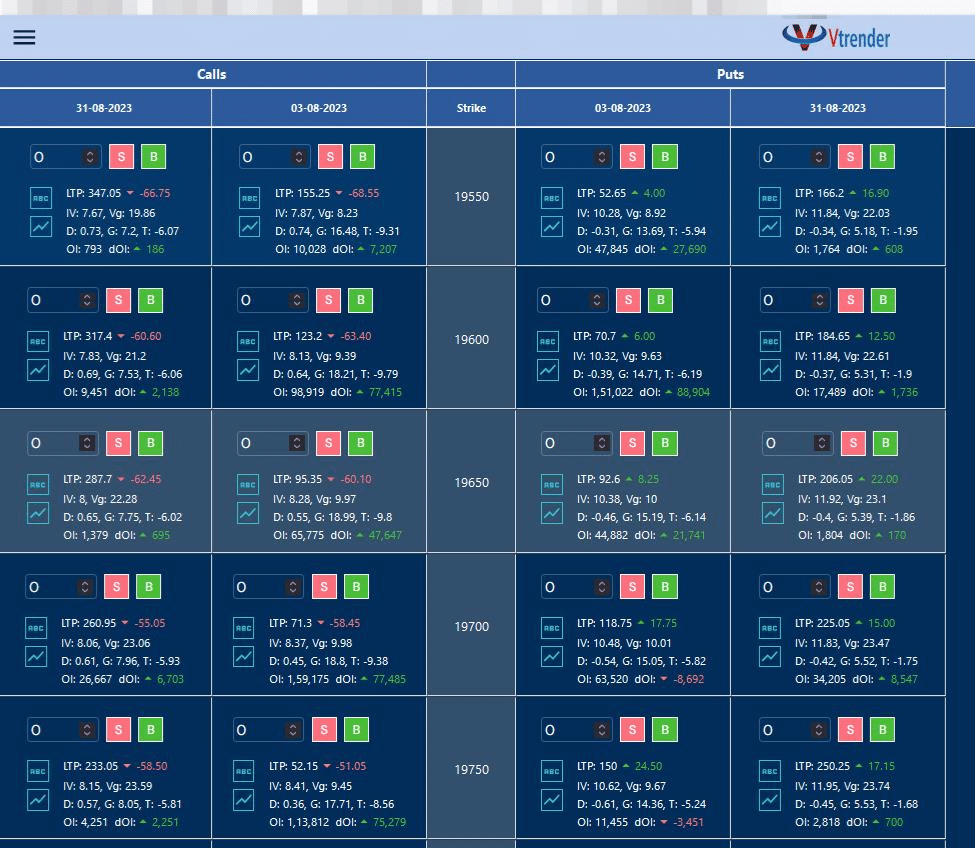

Let’s take a look at the Nifty which is closed now at a price of 19635. The image above is the option prices closest to where the Nifty is currently.

Our story takes a twist when the Nifty index changes. Let’s say the Nifty moves 130 points lower to 19500. The 19600 strike put, with a Delta of 0.39, suggests that the price of this put option should increase by approximately 50 points. The Gamma, at 0.018, forecasts the Delta to rise to about 0.60

Ah, the plot thickens

You can get a look at any price in the future from our Greeks chart at – https://charts.vtrender.com/greek-chart. All you need to do is input your expected price and the date and the time.

But if you want to know how it got there, happy to indulge you

The put option's Delta and Gamma have taken on new roles

let’s revisit the unfolding drama of our options trading theater.

In the spotlight, we have a put option with a strike price of 19600. Its Delta, the leading protagonist in our narrative, stands at -0.39 and its companion, Gamma, makes an entrance at 0.01483.

Part 1: The Capricious Delta

Remember, Delta is akin to a volatile performer. It reflects the change in our option’s price with each movement of the underlying asset, the Nifty. For a put option, Delta, being the contrarian, flourishes when the Nifty dwindles. It’s negative, signifying an inverse relationship.

Suppose the Nifty takes a bow, descending 130 points. Our Delta, eager to seize the scene, multiplies this change:

130 points * -0.39 = -50.7 points

Such is the charm of the theater that a drop in the Nifty translates to a rise in our put option’s price. An increase of 50.7 points is expected, as our Delta takes a curtain call.

Part 2: The Nimble Gamma

Gamma, our supporting actor, measures the pace of change in Delta for each one-point change in the underlying asset. The subtlety of the role, performed here at 0.01483, sets the tone for how Delta will evolve with the plot.

The Nifty’s descent of 130 points prompts Gamma to guide Delta’s transformation:

Original Delta (-0.39) + Gamma (0.01483) * change in Nifty’s price (130)

This calculation unveils the new Delta: 0.39 + (0.01483 * 130) = -0.39 + 1.928 = 0.21

Ah, such drama! Our Delta, originally at -0.39, has become now -0.61

Remember, our thespian Greeks offer a glimpse into the complex world of options trading, serving as guides, but not absolute predictors. They are part of the larger ensemble that includes the market, the traders, and the capricious whims of economic forces. Take a bow, Greeks, for your performance in the theater of finance is truly a spectacle to behold!

Act III: The Play Unfolds on the other side

Conversely, if the Nifty ascends to 19800, the 19700 strike call, with a Delta of 0.42, would expect the call option price to increase by about 76 points, and the Gamma would lead the Delta to increase to approximately 0.64.

You can use the same calculations as described above.

170 points * 0.45 = 76.5 points

And voila! With every rise and fall, every cheer and sigh from the market audience, our call option’s price dances to Delta’s tune. As the Nifty ascends by 170 points, Delta predicts that the call option’s price will rise by 76.5 points

Ah, there we have it! The show goes on in the exciting theatre of options trading, a world filled with intrigue, unpredictability, and the never-ending dance of numbers. Bravo, Greeks, for keeping us engaged in this financial drama!

Act V: Enter Second Order Greeks

As our plot thickens, the second-order Greeks, like Vanna and Charm, enter the stage. Vanna measures how Delta and Vega change as the price of the underlying asset moves, and Charm measures the rate at which Delta changes over time. These are the subtleties in the plot, telling us about the higher-order sensitivities of an options position.

Explore more at – https://www.vtrender.com/gamma-dynamics-in-options-trading-a-deep-dive-into-long-and-short-gamma/

Curtain Call

From the pulsating opening bell to the closing gavel, the theatre of options trading comes alive with the rhythmic dance of Delta and the sophisticated pirouettes of Gamma. Every rise, every fall, is but a carefully choreographed ballet of numbers. The very air in this theatre is laden with the intoxicating drama of finance.

As the curtain falls and the audience is left in awe of the spectacle, the spirit of the trading floor pulses with life. The Greeks, in all their complexity and charm, have etched their narrative into the heart of every spectator.

Yet, as the spotlight dims and the applause fades, the Greeks take a bow, leaving behind an echo of their enigmatic dance. For every trader, every spectator, the enchantment of the Greek drama lingers, whispering tales of potential fortunes and echoing lessons of wise caution.

Thus, the show goes on, day after day, in the riveting theatre of options trading. Amid the roar of the market, the whispers of the Greeks continue to guide, to intrigue, and to entertain. Long after the curtain falls, their spectacle reverberates, captivating every market player’s heart.

Bravo, Greeks, for your mesmerizing performance in the grand theatre of finance! Today’s play may have concluded, but the anticipation of tomorrow’s drama keeps us on the edge of our seats. So, until the curtain rises again, we bid adieu, already eager for the next unfolding of the compelling drama of trading.