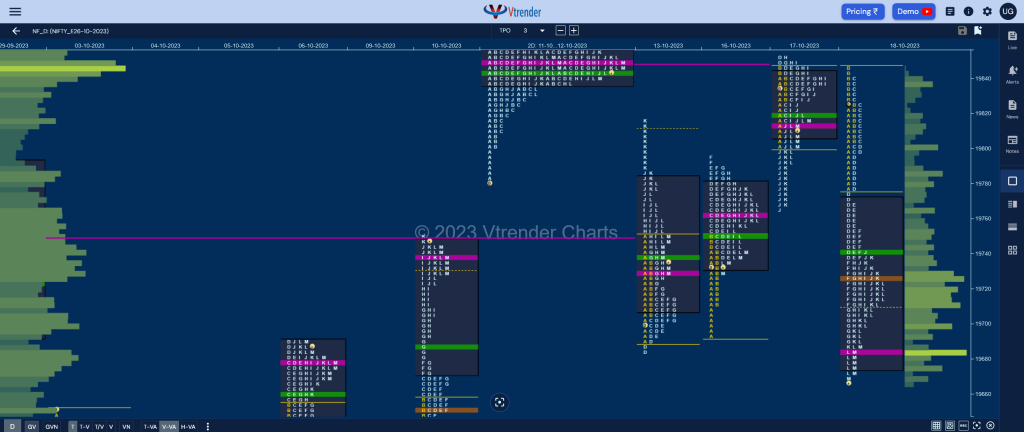

Nifty Oct F: 19683 [ 19845 / 19665 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 6,031 contracts |

| Initial Balance |

|---|

| 68 points (19845 – 19777) |

| Volumes of 15,952 contracts |

| Day Type |

|---|

| Double Distribution (DD) – 180 points |

| Volumes of 1,00,198 contracts |

NF made an OAIR start making a low of 19777 as it took support just above 16th Oct’s VPOC of 19761 after which it reversed the probe to the upside getting back into previous Value triggering the 80% Rule which it completed to the dot while making new highs of 19845 in the B period and the failure to get fresh demand resulted in the reverse 80% Rule playing out in the C side where it made a low of 19799.

The auction then signalled entry of aggresive sellers in the D period where it not only negated the morning singles but left an extension handle at 19777 and continued to make lower lows till the G TPO completing the 2 IB objective of 19710 while making a low of 19691 after which it gave a small bounce back to 19742 in the J period confirming a PBH there.

NF then made a fresh RE (Range Extension) lower in the K period and followed it with a spike down to 19665 into the close leaving a Double Distribution Trend Day Down but saw the dPOC shift lower to 19685 which will be the immediate reference for the next open with today’s VWAP of 19742 now being a strong supply point for the rest of the series.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19685 F and VWAP of the session was at 19742

- Value zones (volume profile) are at 19675-19685-19771

- HVNs are at 19569 / 19750 / 19848** (** denotes series POC)

- NF confirmed a FA at 19685 on 13/10 and tagged the 1 ATR objective of 19818 on 17/10. This FA got revisited on 18/10 and has closed below so the 1 ATR target lower comes to 19552

Monthly Zones

- The settlement day Roll Over point (October 2023) is 19635

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

Business Areas for 19th Oct 2023

| Up |

| 19685 – dPOC from 18 Oct 19742 – DD VWAP (18 Oct) 19777 – Ext Handle (18 Oct) 19828 – SOC (18 Oct) 19852 – Selling tail (17 Oct) 19893 – 2-day VPOC (21-22 Sep) |

| Down |

| 19673 – Buying tail (18 Oct) 19646 – PBL from 10 Oct 19611 – IB singles mid (10 Oct) 19584 – Singles mid (10 Oct) 19550 – VPOC from 09 Oct 19505 – Swing Low (09 Oct) |

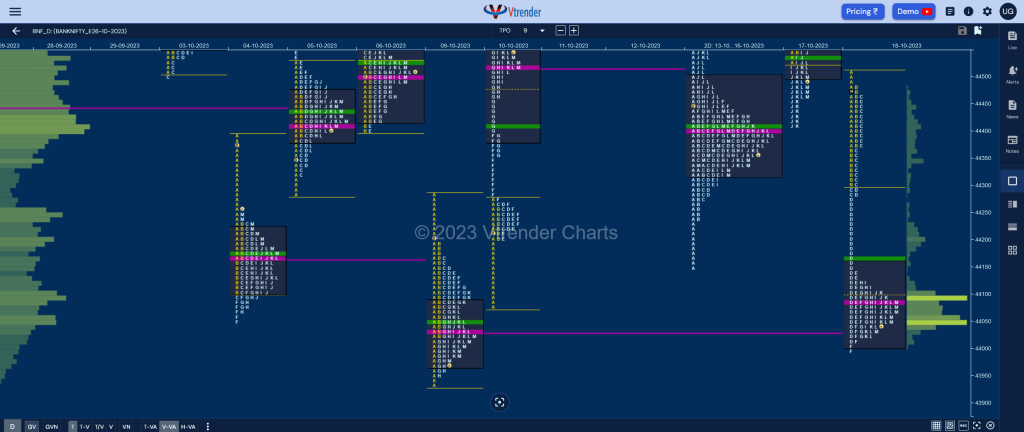

BankNifty Oct F: 44053 [ 44510 / 44000 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 9,368 contracts |

| Initial Balance |

|---|

| 211 points (44510 – 44299) |

| Volumes of 29,438 contracts |

| Day Type |

|---|

| Double Distribution (DD) – 510 points |

| Volumes of 1,75,845 contracts |

BNF made an Open Auction (OA) start and remained below previous Value as it first repaired previous session’s poor lows by hitting 44375 in the A period and followed it with new lows of 44299 in the B TPO which got swiftly rejected triggering a bounce back to 44479 in the B TPO stalling just below previous Value leaving a buying tail from 44375 to 44299.

The auction then got some fresh selling in the C side as it negated the A period tail and went on to make new lows of 44283 and followed it with an extension handle in the D period where it made a big range of over 200 points tagging the 09th Oct VPOC of 44029 while making a low of 44018.

BNF then got back to balance for the rest of the day as it remained in a very narrow range from 44138 to 44000 bringing the dPOC also down to 44090 leaving a Double Distribution Trend Day Down with completely lower Value and has a strong chance of continuing the probe lower with today’s VWAP of 44166 being the swing reference.

Click here to view the latest profile in BNF on Vtrender Charts

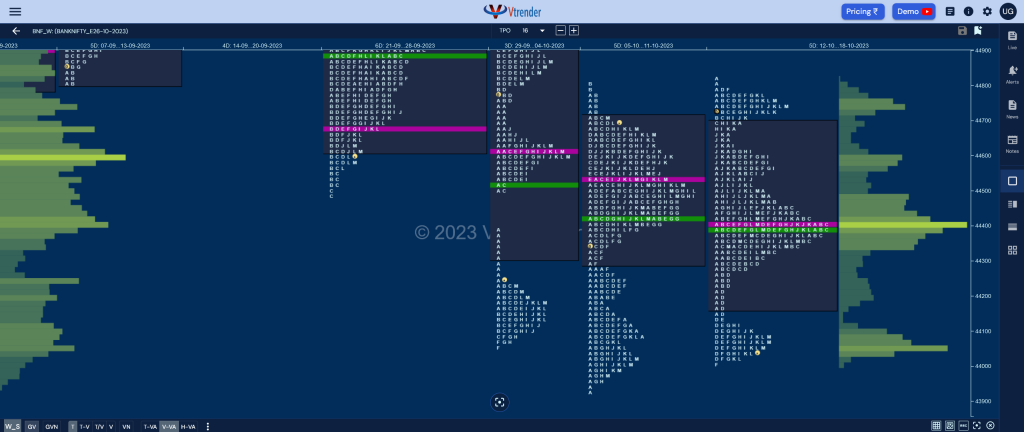

Weekly Settlement (12th to 18th Oct) : 44053 [ 44821 / 44000 ]

BNF gave a rare follow through to previous week’s Neutral Extreme profile as it made a look up above highs of 44808 but could only manage to tag 44821 finding no fresh demand coming in which resulted in a Triple Distribution Trend Down profile with a daily VPOC right near the top at 44750 after which it formed a 3-day balance building the prominent POC for the current week at 44409 from where it gave an initiative move down to make new lows on the last day of this settlement at 44000 accumalating good volumes at 44090 which will be the immediate reference on the upside for the coming settlement. Value for the week was mostly overlapping at 44167-44409-44694 and the VWAP of 44400 which coincides with the series POC of 44413 will be the swing reference going forward as sellers could continue to drive this lower.

Daily Zones

- Largest volume (POC) was traded at 44090 F and VWAP of the session was at 44166

- Value zones (volume profile) are at 44002-44090-44160

- HVNs are at 44413** / 44535 / 44611 / 44849 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (October 2023) is 44595

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

Business Areas for 19th Oct 2023

| Up |

| 44053 – M TPO VWAP 44166 – VWAP from 18 Oct 44283 – Ext Handle (18 Oct) 44365 – SOC from 18 Oct 44479 – Selling Tail (18 Oct) 44600 – VPOC from 17 Oct |

| Down |

| 44018 – Buying tail (18 Oct) 43935 – Swing Low (09 Oct) 43805 – 1 ATR (HVN 44487) 43693 – 2 ATR (3-day POC 44405) 43576 – Monthly 1.5 IB 43454 – 1 ATR (VWAP 44166) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.