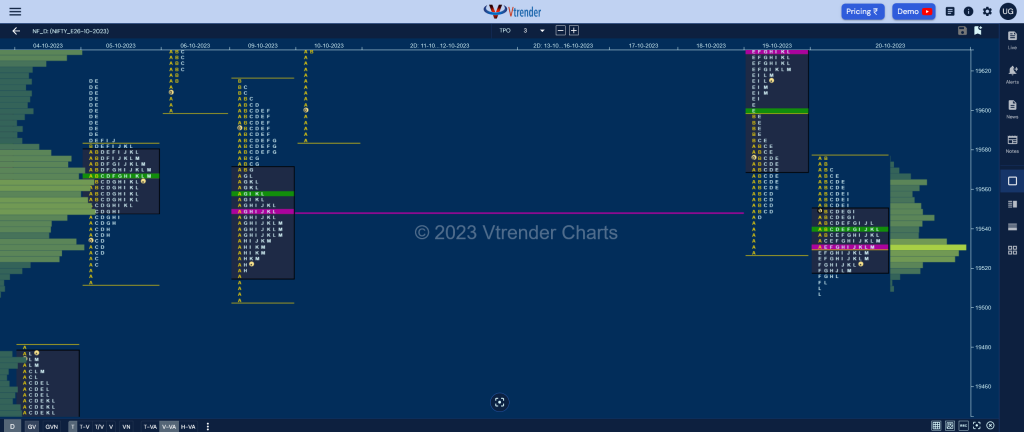

Nifty Oct F: 19527 [ 19576 / 19508 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 10,392 contracts |

| Initial Balance |

|---|

| 45 points (19576 – 19531) |

| Volumes of 20,015 contracts |

| Day Type |

|---|

| Normal Variation (Gaussian) – 68 points |

| Volumes of 75,889 contracts |

NF opened lower but took support just above PDL of 19527 as it made a low of 19531 in the A period and remained in a narrow 45 point range for the first couple of hours leaving similar highs of 19575 & 19576 in the Initial Balance (IB) after which it made couple of extensions lower in the E & F TPOs but could only manage to hit 19512 indicating lack of fresh supply in this zone.

The auction then made a slow probe higher scaling above day’s VWAP in the G & I periods but only managed to leave a PBH at 19558 and made another fresh RE (Range Extension) in the L TPO raising a possibility of a spike but could only tag marginal new lows of 19508 taking support just above 09th Oct’s Swing Low of 19505 and made a retracement back to the day’s POC of 19530 into the close leaving a Gaussian Curve with completely lower Value.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19530 F and VWAP of the session was at 19540

- Value zones (volume profile) are at 19520-19530-19548

- HVNs are at 19569 / 19750 / 19848** (** denotes series POC)

- NF confirmed a FA at 19685 on 13/10 and tagged the 1 ATR objective of 19818 on 17/10. This FA got revisited on 18/10 and has closed tagging the downside 1 ATR target of 19552

Monthly Zones

- The settlement day Roll Over point (October 2023) is 19635

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

Business Areas for 23rd Oct 2023

| Up |

| 19540 – VWAP from 20 Oct 19575 – Selling Tail (20 Oct) 19629 – VPOC from 19 Oct 19657 – PBH from 19 Oct 19685 – VPOC from 18 Oct 19719 – NeuX Weekly VWAP |

| Down |

| 19512 – Weekly IBL 19460 – LVN from 04 Oct 19428 – VPOC (04 Oct) 19386 – HVN from 04 Oct 19362 – Monthly IBL 19325 – Weekly ATR |

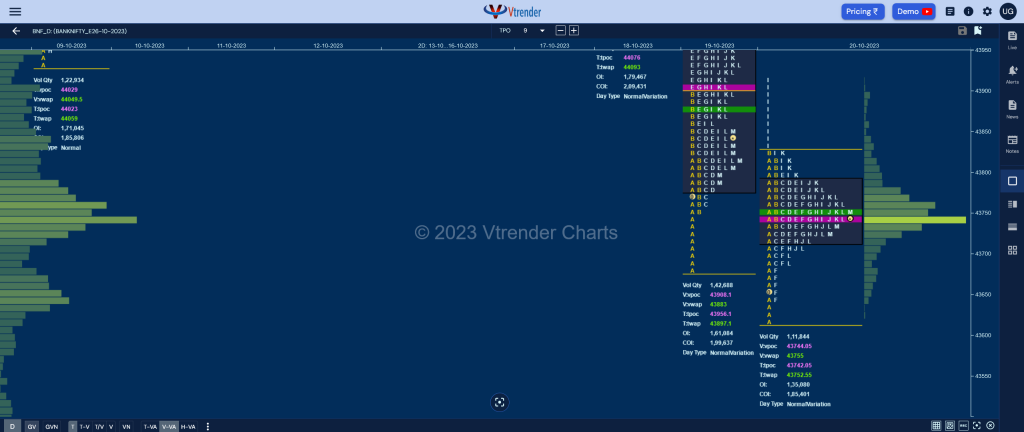

BankNifty Oct F: 43738 [ 43920 / 43622 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 14,250 contracts |

| Initial Balance |

|---|

| 208 points (43830 – 43622) |

| Volumes of 25,966 contracts |

| Day Type |

|---|

| 3-1-3 (Normal) – 433 points |

| Volumes of 1,11,844 contracts |

BNF made a 195 point gap down open making a look down below PDL as it hit 43622 and saw profit booking by the shorts as it got back into previous day’s range & value while making a high of 43830 in the B period and remained locked in this narrow 208 point range for most part of the day leaving a small buying tail at lows from 43642 to 43622.

The auction made an attempt to extend higher in the I TPO making a 90 point swipe tagging the yPOC of 43908 but was swiftly rejected back into the IB (Initial Balance) indicating return of supply triggering in a closing PBL at 43692 in the L period before settling down around the prominent dPOC of 43744 leaving an ideal Gaussian Curve plus a 3-1-3 profile looking set for a fresh imbalance to being in the coming session.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43744 F and VWAP of the session was at 43755

- Value zones (volume profile) are at 43716-43744-43786

- HVNs are at 44413** / 44535 / 44611 / 44849 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (October 2023) is 44595

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

Business Areas for 23rd Oct 2023

| Up |

| 43744 – dPOC from 20 Oct 43830 – Selling tail (20 Oct) 43950 – HVN from 19 Oct 44069 – Selling tail (19 Oct) 44166 – VWAP from 18 Oct 44283 – Ext Handle (18 Oct) |

| Down |

| 43692 – Closing PBL (20 Oct) 43576 – Monthly 1.5 IB 43454 – 1 ATR (VWAP 44166) 43378 – 2 ATR (yPOC 44090) 43251 – Weekly 2 IB 43102 – Monthly 2 IB |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.