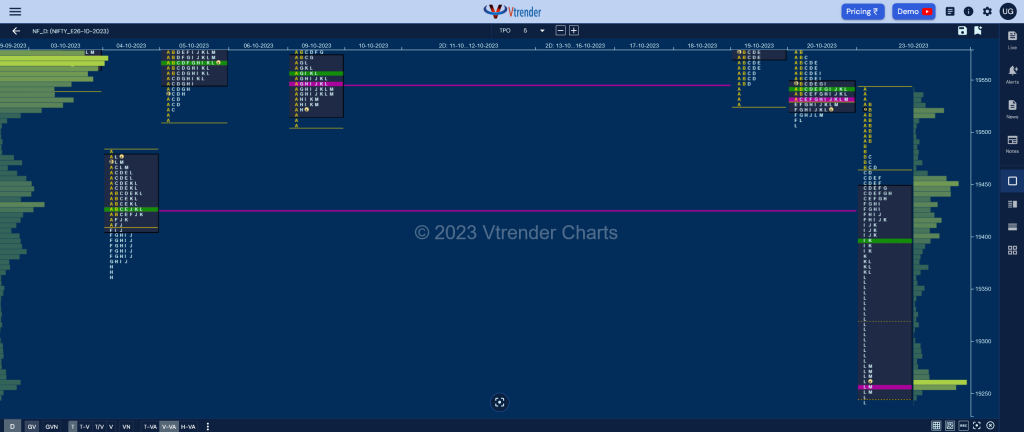

Nifty Oct F: 19267 [ 19543 / 19241 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 6,089 contracts |

| Initial Balance |

|---|

| 75 points (19543 – 19468) |

| Volumes of 18,605 contracts |

| Day Type |

|---|

| Trend Day (TD) – 302 points |

| Volumes of 1,16,098 contracts |

NF made an Open Auction (OA) start with a look down below previous low as it hit 19493 but did not get any fresh supply triggering a probe back into last Friday’s range & value as it went on to tag the yVWAP of 19540 while making a high of 19543 but could not sustain which was an open invitation for the supply to come back and they did so by leaving an extension handle at 19496 in the B period followed by a good C side extension to 19438.

The auction then made a fresh RE lower in the F TPO tagging 04th Oct’s VPOC of 19428 while making a low of 19415 and after a brief pause till the H period recorded new lows of 19386 in the I tagging the HVN from 04th Oct and after a pause in the J TPO, the sellers made another strike leaving a fresh extension handle as the K period began and followed it up with a third one at 19365 resulting in a melt down to 19241 in the L and saw good profit booking coming in as the dPOC shifted lower to 19259 into the close.

Series wise, NF has made a fresh move away to the downside with a Trend Day Down so today’s extension handle of 19365 and VWAP of 19398 will be the new swing references going forward as it can go for a test of the 30th Jun’s Trend Day VWAP of 19210 along with that day’s Initiative Buying Tail from 19167 to 19082 in the coming sessions.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19259 F and VWAP of the session was at 19398

- Value zones (volume profile) are at 19245-19259-19447

- HVNs are at 19569 / 19750 / 19848** (** denotes series POC)

- NF confirmed a FA at 19685 on 13/10 and tagged the 1 ATR objective of 19818 on 17/10. This FA got revisited on 18/10 and has closed below it and has tagged the downside 2 ATR target of 19420 on 23/10

Monthly Zones

- The settlement day Roll Over point (October 2023) is 19635

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

Business Areas for 25th Oct 2023

| Up |

| 19278 – Closing tail (23 Oct) 19321 – Mid-point (23 Oct) 19365 – Ext Handle (23 Oct) 19398 – VWAP from 23 Oct 19449 – HVN from 23 Oct 19493 – Ext Handle (23 Oct) |

| Down |

| 19252 – Tail from 23 Oct 19210 – VWAP from 30 Jun 19167 – Buying Tail (30 Jun) 19124 – IB singles mid (30 Jun) 19074 – VPOC from 28 Jun 19036 – Ext Handle (28 Jun) |

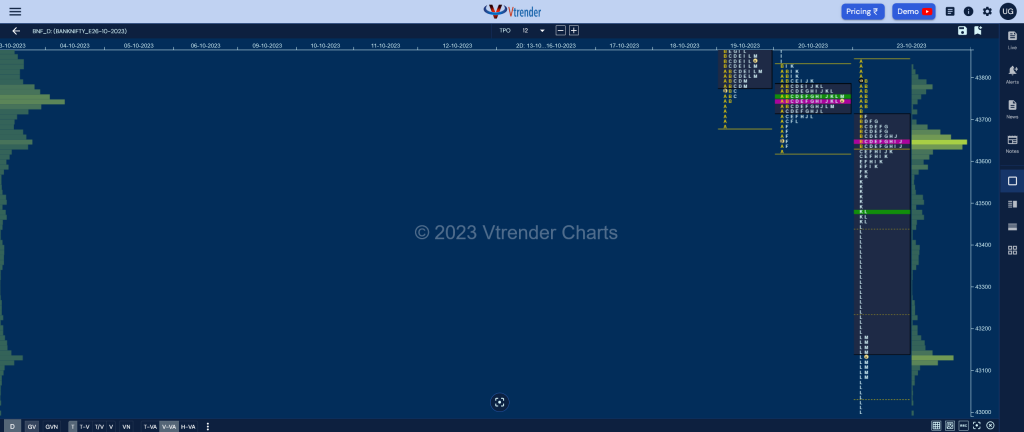

BankNifty Oct F: 43141 [ 43839 / 42996 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 8,816 contracts |

| Initial Balance |

|---|

| 204 points (43839 – 43635) |

| Volumes of 22,863 contracts |

| Day Type |

|---|

| Trend Day (TD) – 843 points |

| Volumes of 1,56,523 contracts |

BNF made an OAIR start testing previous day’s selling tail from 43830 to 43920 but got rejected from 43839 as it left a small but important selling tail till 43794 in the IB while leaving an extension handle at 43735 in the B period as it swiped through previous Value and range even making a look down below PDL of 43622 but with a typical C side extension to 43611 which immediately have a bounce back to the day’s VWAP.

The auction however could not sustain above VWAP and made a fresh RE lower in the E & F TPOs where it made new lows of 43567 but once again made a small retracment back to day’s VWAP even getting above it but stalled just below previous VAL of 43716 as it confirmed a PBH at 43705 clearly indicating that the morning sellers were in complete control.

BNF continued to remain in a narrow range forming a short term balance till the J period but started a killer move in the K where it not only left a fresh extension handle but followed it up with another one at 43454 as the L TPO saw a huge meltdown falling by more than 500 points completing the Monthly 2 IB objective of 43102 while making a low of 42996 and saw good profit booking by the sellers resulting in a bounce back to 43178 into the close.

The day’s profile was an elongated 843 point range Trend Down One with a big zone of singles from 43178 to 43454 which would remain an important supply zone for the rest of this series along with the selling extension handles of 43567 & 43735 whereas on the downside, the initiative buying handles of 42941 & 42750 will be the immediate levels to watch for and a break of which could bring in a drop lower to the Monthly VPOC of 42190 from Apr 2023 in the coming sessions.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43648 F and VWAP of the session was at 43485

- Value zones (volume profile) are at 43146-43648-43706

- HVNs are at 44413** / 44535 / 44611 / 44849 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (October 2023) is 44595

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

Business Areas for 25th Oct 2023

| Up |

| 43178 – Closing tail (23 Oct) 43316 – Mid-point (23 Oct) 43454 – Ext Handle (23 Oct) 43567 – Ext Handle (23 Oct) 43648 – dPOC from 23 Oct 43794 – Selling Tail (23 Oct) |

| Down |

| 43128 – Closing HVN (23 Oct) 42996 – PDL (Series Low) 42849 – Buying Tail Low (10 May) 42745 – Closing tail (05 May) 42585 – Buying Tail (26 Apr) 42462 – HVN from 24 Apr |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.