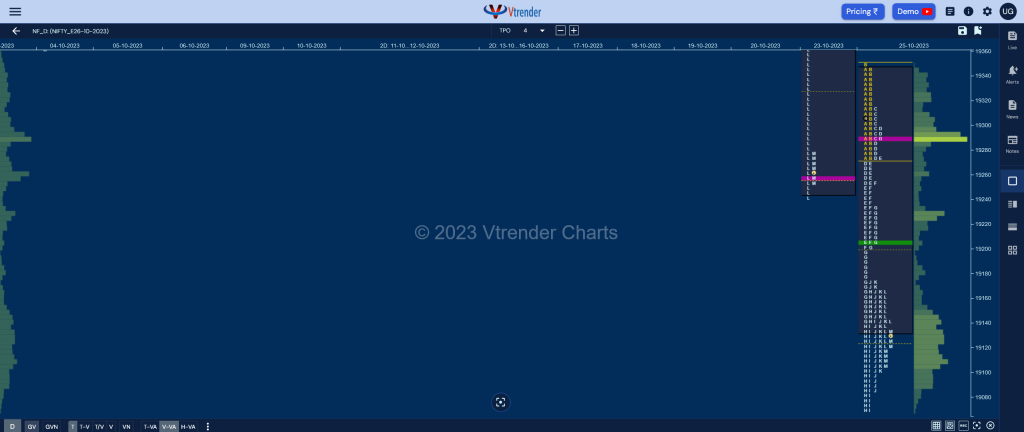

Nifty Oct F: 19128 [ 19350 / 19068 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 14,511 contracts |

| Initial Balance |

|---|

| 78 points (19350 – 19272) |

| Volumes of 33,659 contracts |

| Day Type |

|---|

| Double Distribution (DD) – 281 points |

| Volumes of 1,76,093 contracts |

NF opened slightly higher and took support at the closing tail of 19278 in the A period and went on to make a high of 19350 in the B TPO stalling just below the extension handle of 19365 where the supply came back triggering a fresh drop down to 19272 in the IB after which it made a rare narrow range inside bar in the C side but remained below day’s VWAP.

The auction gave more confirmation of sellers being in complete control as it first made a RE (Range Extension) in the D period which was followed by an extension handle at 19255 in the E TPO where it made a low of 19204 and after another small pause in the F confrimed another extension handle at 19203 as the G period began and this meltdown was carried forward in the H TPO where it not only completed the 3 IB objective of the day at 19118 but also tagged the 28th Jun’s VPOC of 19074 while making a low of 19068.

Having completed an important target, NF then left poor lows in the I period displaying exhaustion to the downside and gave a bounce back to 19175 in the J period and remained inside it’s range for the rest of the day leaving a Double Distribution Trend Day Down with the dPOC at 19291 along with the VWAP at 19206 which will be the important swing references on the upside for the expiry session whereas on the downside, the closing PBL of 19105 & current series low of 19068 will need to show fresh supply for a move towards 28th Jun’s extension handles of 19036 & 18996.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19291 F and VWAP of the session was at 19206

- Value zones (volume profile) are at 19134-19291-19346

- HVNs are at 19569 / 19750 / 19848** (** denotes series POC)

- NF confirmed a FA at 19685 on 13/10 and tagged the 1 ATR objective of 19818 on 17/10. This FA got revisited on 18/10 and has closed below it and has tagged the downside 2 ATR target of 19420 on 23/10

Monthly Zones

- The settlement day Roll Over point (October 2023) is 19635

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

Business Areas for 26th Oct 2023

| Up |

| 19142 – L TPO POC (25 Oct) 19175 – PBH from 25 Oct 19206 – DD VWAP (25 Oct) 19255 – Ext Handle (25 Oct) 19291 – dPOC from 25 Oct 19345 – Selling Tail (25 Oct) 19398 – VWAP from 23 Oct 19449 – HVN from 23 Oct |

| Down |

| 19119 – M TPO VWAP (25 Oct) 19068 – PDL 19036 – Ext Handle (28 Jun) 18996 – Ext Handle (28 Jun) 18947 – Gap mid (28 Jun) 18906 – Ext Handle (27 Jun) 18857 – VPOC from 27 Jun 18824 – Poor low FA (27 Jun) |

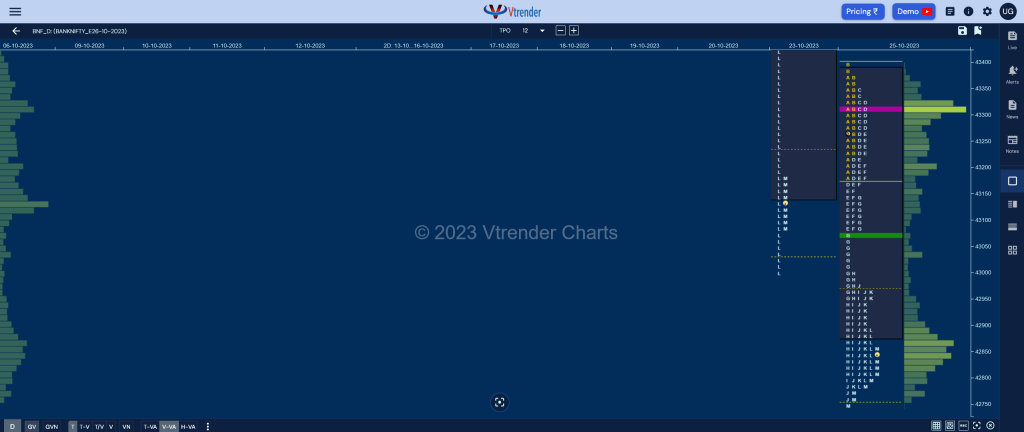

BankNifty Oct F: 42811 [ 43399 / 42755 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 14,401 contracts |

| Initial Balance |

|---|

| 213 points (43399 – 43185) |

| Volumes of 32,502 contracts |

| Day Type |

|---|

| Double Distribution (DD) – 644 points |

| Volumes of 1,36,306 contracts |

BNF also made an OAIR start filling up previous profile’s L TPO singles from 43178 to 43454 in the IB where it made a low of 43185 and a high of 43399 leaving tails at both the ends as it contracted in the C period forming an inside bar and building volumes at 43310.

The auction then made a RE lower in the D TPO initiating a fresh imbalance which gained momentum in the G period where it left an extension handle at 43083 and went on to make lower lows till the J almost completing the 3 IB target of 43759 which saw some profit booking resulting in the only bounce of the day back to 43972.

However, BNF got back lower even making new lows of 43755 into the close indicating that the downside imbalance is yet to get over leaving a Double Distribution Trend Down Day with the PBH of 43972 along with DD extension handle of 43082 being the upside references for the expiry session whereas on the downside, 42750 will be the immediate level below which we get into the April profile with the final objective being the monthly VPOC of 42190 and VWAP of 42011.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 43309 F and VWAP of the session was at 43070

- Value zones (volume profile) are at 42879-43309-43385

- HVNs are at 44413** / 44535 / 44611 / 44849 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (October 2023) is 44595

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

Business Areas for 26th Oct 2023

| Up |

| 42850 – Closing HVN (25 Oct) 42972 – PBH from 25 Oct 43082 – DD Ext Handle (25 Oct) 43309 – dPOC from 25 Oct 43454 – Ext Handle (23 Oct) 43567 – Ext Handle (23 Oct) 43648 – dPOC from 23 Oct 43794 – Selling Tail (23 Oct) |

| Down |

| 42745 – Closing tail (05 May) 42585 – Buying Tail (26 Apr) 42462 – HVN from 24 Apr 42291 – 5-day comp VPOC (17-21 Apr) 42190 – April VPOC 42011 – VWAP from 13 Apr 41930 – April series VWAP 41827 – SOC from 13 Apr |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.