Welcome to 2025!

First and foremost, I want to wish you all a very happy and prosperous 2025. We’re beginning a brand-new calendar year, and with it comes a lot of hope, promise, and the expectations of doing bigger and better things—bigger than what we achieved in 2024. As we set off on this journey from January to December, I wish you the very best.

The Markets Stay the Same—But We Adapt

The calendars have changed, but the markets remain the same—the Nifty, the Bank Nifty—with all the changes that have come through in October, November, and December posing additional challenges for us. However, we will overcome all of that. Today, we’ll talk about the need for a proper working process and how, with such a process in place, you can negotiate the challenges presented by the markets.

Why a Working Process Matters

n trading, there are days when the bias and the way of working are exceptionally clear, making the market easier to navigate, particularly in bullish conditions. However, tougher days are always part of the journey, bringing challenges that test our strategies and resilience. Regardless of the challenges the markets present, having a valid working process in place—a process you believe in, built on knowledge and experience—will enable you to achieve consistent results over time.

Consistency Is the Key

Experience comes as you trade more and delve deeper into the process. If you combine that knowledge with experience, you’ll achieve consistency in your trading results. Consistency is the hallmark of a successful trader. We are not here to chase one big win in a month or adopt a mindset that celebrates a single large trade while overlooking subsequent losses. Instead, the goal is to secure small, consistent wins over time. This approach always translates into a healthier account.

Adapting to Market Dynamics

To achieve this, as many successful traders will tell you, a lot of work is involved. Every successful trader operates with a strategy, a plan, and a defined way of approaching the markets. I speak to you through the medium of Market Profile and Orderflow because it’s something I deeply understand and use in my daily trading. While there are many ways to trade the market, I share what I know—a process that has worked for me and for many in our community.

Recognizing Market Signals

If something works consistently for a large group of people, it is a valid process worth attention. We have been refining our trading methods, and as we step into 2025, we are excited. Over the past few months, we’ve witnessed some super-clear signals in the markets. Although volumes have reduced, the remaining volumes have provided clean, definitive trading signals, which makes us optimistic about the year ahead.

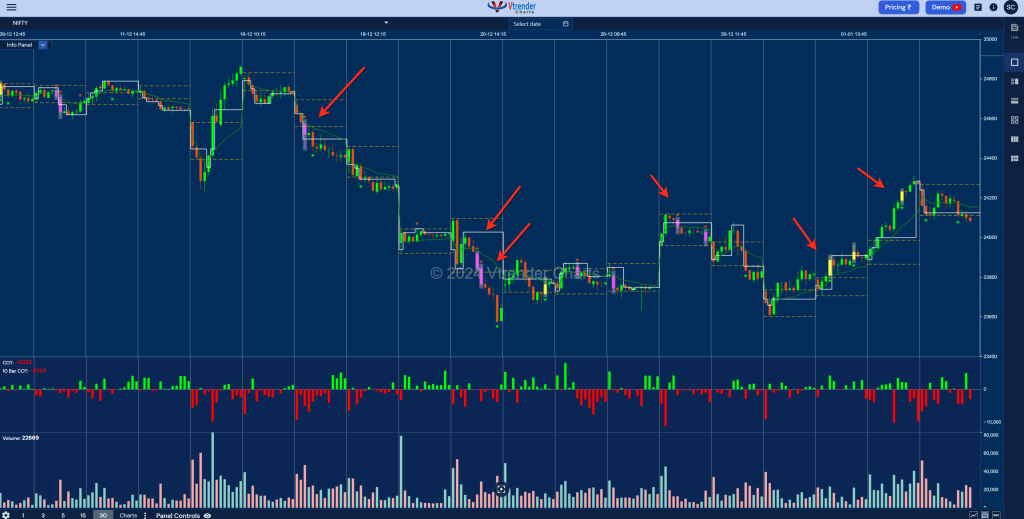

A Look at the Charts

Let’s take a quick look at the charts, followed by a discussion on the proper process to trade in these markets. Here’s a Nifty Futures chart on the screen. Some of you may have noticed that it has moved down from the 24,800 zone, encountering significant supply along the way. The pink areas on the chart represent initiative sellers from earlier down moves. However, in the past two sessions, we’ve seen significant initiative buying, indicated by the yellow areas. The market has consistently held the lows of those IB (Initiative Buying) bars, driving the upward movement we’re witnessing

Understanding Market Movements

Markets constantly change—they move up, down, or sideways. Recognizing when the market stops falling, when it consolidates, and when it starts to turn around is the core job of a trader. By doing this better each trading day, we improve our ability to align with the market’s bias and place trades accordingly.

The Power of Orderflow Signals

Next, let’s explore the concept of signaling in Orderflow, focusing on the IB (Initiative Buying) signals. These signals are crucial for understanding changes in market dynamics. When an IB bar forms, it signifies aggressive market orders from big players, making it an important signal to trade.

Tools to Aid Your Trading Journey

The journey to becoming a consistently profitable trader involves gaining knowledge, acquiring experience, and learning from mistakes. It requires tools like Market Profile and Orderflow charts, which we provide through our platform. To support your journey, we’re offering a 25% discount on annual plans until January 5, 2025. This includes access to stocks, indices, and essential trading tools.

Make 2025 Your Year of Change

Change begins with you. If you want different results, you must change your approach. By improving your knowledge, tools, and mindset, you’ll set yourself on a path to success. I wish you all the best for a happy and prosperous 2025. Let’s make this year count!

a full recording of this webinar is at –https://youtu.be/KP-TYCs7auM