Edited excerpts from a monthly newsletter sent to Vtrender Trading Room members

A month has already gone since the new year rolled on and the stock markets bumble on.

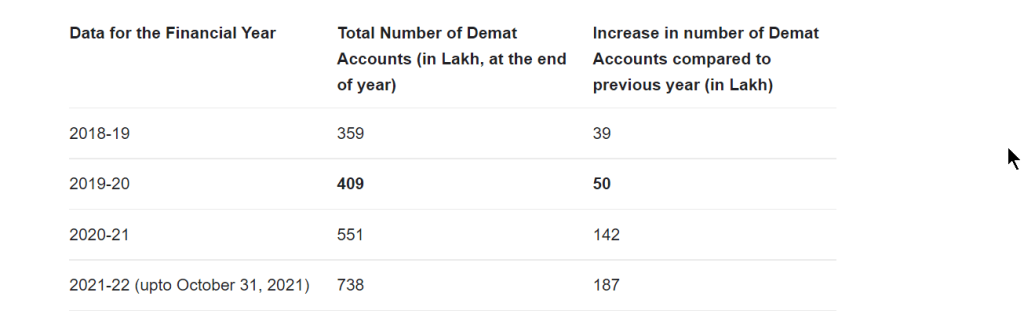

More demat accounts were again opened last year beating the high mark set in 2020, which everyone thought was a high cos of COVID with it’s lockdowns etc ( Nothing better to do, so let’s trade markets 🙂 )

So we have almost doubled trader strength across India in the last 2 years and having seen traders up and close over the past 10 years, I’m excited about how they will respond to the vagaries and the uncertainties of the markets

As many of you are aware, the last few weeks, the markets are throwing tantrums again.

we anticipated this and even warned about it on the twitter handle

We continue to expect the markets to be on the roller coaster for a few weeks more

How do we know?

One way to know is to look at VIX always. Anytime it crosses the high teens, you cannot afford to fall in love with your positions whether they are giving you a high green MTM or a deep red one. What’s bad can get worse quickly and what’s good may not remain that way also.

The best approach then is to be quick, in and out .

How did we do in Jan

Our month of Jan

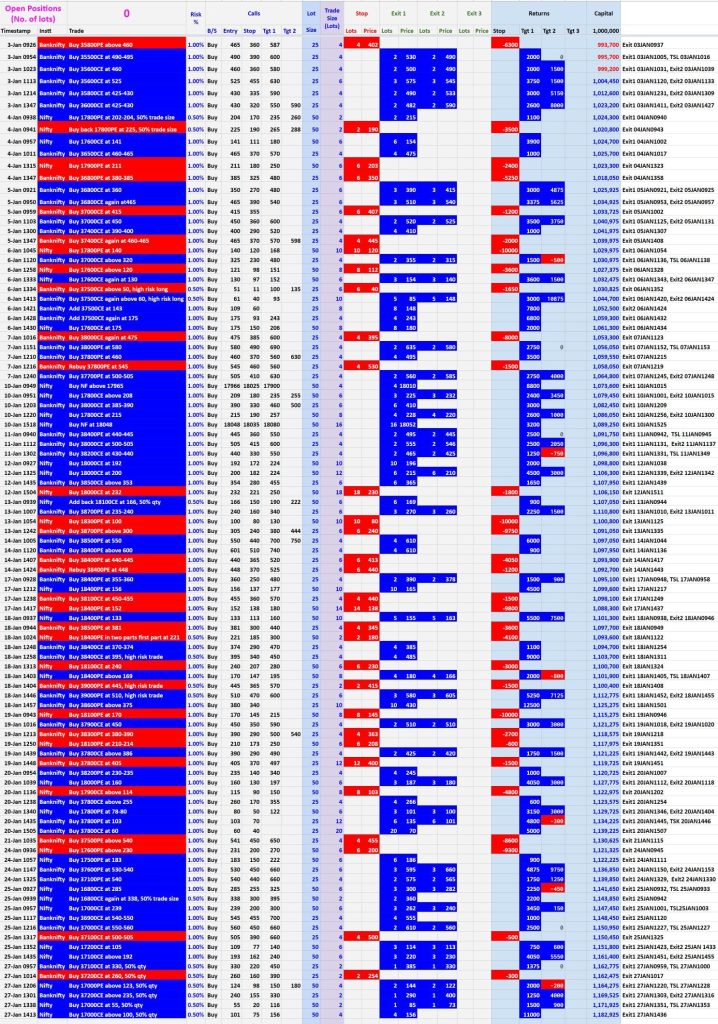

We keep a log of all the trades in the room , more for us to continue to see what edge we generate and whether we are able to add or grow it. Most people call it a performance sheet and ask for copies and we do post them on the blog.

But sending trades is just 10% of what we do. We are about an entire process from planning to execution. we can tell you in advance why we are taking these trades and where we expect them to go to next, all in advance, so that you are never in surprise or unready.

The concept behind the trading room

We are a trading room and we see ourselves as a whole bunch of equal opportunity traders who trade together with the information the market keeps providing to us. And through the common analysis we do and the background videos etc, we hope to learn and master trading as a process , and not just copy trades of each other.

If you want to have a long term career in the markets , then you will get one if you understand the process, the reasoning, the logic and then the execution. WE do all of that together in the room which is why I am so excited to be there every day at the open with all of you.

And on that point of having a process and knowing a process, I haven’t met a single trader in my many years in the markets who has grown rich off the buying and selling mentioned by another.

back to that chart and I looked at all of the trades we took and am happy to report that the machine is well oiled and running well 🙂

we will never get 100/100 trades right but our job is to be near the 70’s and keep driving in that range for the rest of the year. The results will pour.

TIME

Yes and about that factor called time.

When I was putting my early yards in trading derivatives in 2006- 2008 I was fortunate to be mentored and told about staying at the crease and looking long term and at 2020 and 2030 .

I’ll urge the same for you too. Think of it as something you want to do for at least a decade and if you start thinking in that direction , instead of the next one day or the next 1 week or next 1 month, things will start coming together for you

Time in the markets and time to the markets is so underestimated and not talked about as much as it should.

Allow Time to work for you.

This is an edited excerpt from a letter to all Vtrender Trading room members.