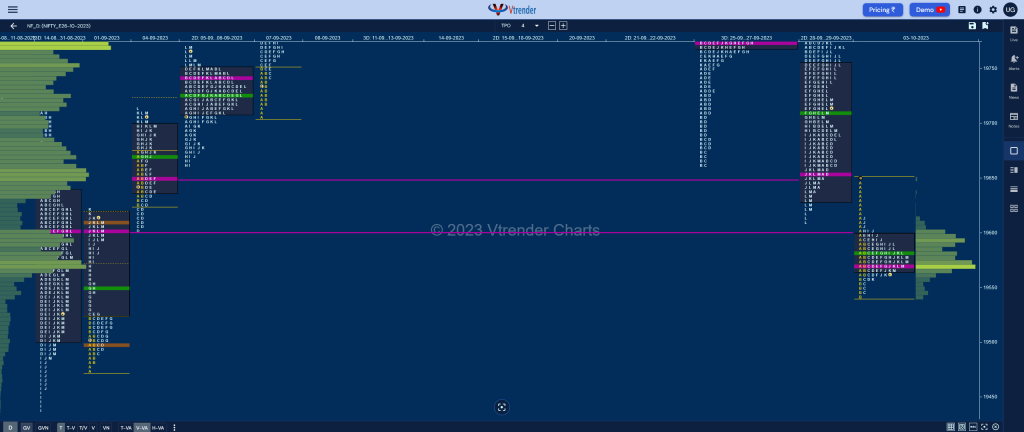

Nifty Oct F: 19571 [ 19659 / 19539 ]

| Open Type |

|---|

| ORR (Open Rejection Reverse) |

| Volumes of 19,063 contracts |

| Initial Balance |

|---|

| 120 points (19659 – 19539) |

| Volumes of 41,586 contracts |

| Day Type |

|---|

| Normal (‘b’ shape) – 120 points |

| Volumes of 1,08,306 contracts |

NF opened lower and remained below 28th Sep’s dPOC of 19640 and the Sep RO point of 19635 not only negating previous session’s buying tail but went on to tag 01st Sep’s VPOC of 19601 and even entered that day’s DD singles which was from 19575 to 19526 as it made a low of 19540 in the Initial Balance (IB) leaving an initiative selling tail from 19591 to 19659.

The auction however did not find much supply at the DD VWAP of 19550 and made a slow probe higher getting into the A period singles but the attempt to get back into previous day’s range in the J TPO brought back the sellers at 19612 which stalled the upside and gave a small retracement back to 19557 before closing the day around the prominent dPOC of 19570 leaving a ‘b’ shape profile & a Normal Day with completely lower Value and looks set to test 01st Sep’s extension handle of 19526 along with the 2 swing lows of 19475 & 19436 in the coming session(s).

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19570 F and VWAP of the session was at 19581

- Value zones (volume profile) are at 19564-19570-19596

- HVNs are at 19570 / 19750 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (October 2023) is 19635

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

Business Areas for 04th Oct 2023

| Up |

| 19570 – dPOC from 03 Oct 19615 – Selling Tail (03 Oct) 19652 – 2-day POC (28-29 Sep) 19710 – 2-day VWAP (28-29 Sep) 19750 – VPOC from 29 Sep 19785 – K TPO POC (29 Sep) |

| Down |

| 19557 – PBL from 03 Oct 19526 – Ext Handle (01 Sep) 19480 – Buying Tail (01 Sep) 19454 – Buying Tail (25 Aug) 19417 – 1 ATR (Weekly POC 19772) 19370 – 2 ATR from 19652 |

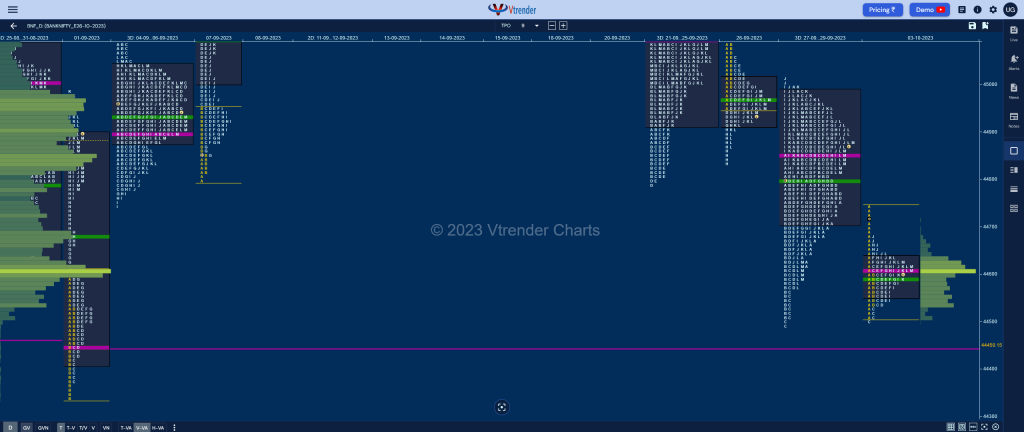

BankNifty Oct F: 44621 [ 44747 / 44500 ]

| Open Type |

|---|

| ORR (Open Rejection Reverse) |

| Volumes of 20,886 contracts |

| Initial Balance |

|---|

| 237 points (44747 – 44510) |

| Volumes of 36,758 contracts |

| Day Type |

|---|

| Normal (b shape) – 247 points |

| Volumes of 1,00,232 contracts |

BNF opened lower & remained below the buying tail of 44759 from previous session negating the entire zone of singles till 44620 and went on to make a low of 44510 in the A period getting some demand just above the FA of 44491 after which it remained in a narrow 60 point range in the B followed by a typical C side extension lower to 44500 where once again it got responsive buyers.

The auction then made a slow probe higher getting into the morning selling singles making higher highs in the F, H & J TPOs but stopped just short of the prominent weekly POC of 44687 leaving a PBH at 44683 indicating supply being active in this zone as it then closed around the day’s prominent POC of 44610 leaving a ‘b’ shape profile with completely lower Value moving away from the 3-day balance it was forming and seems to have started a fresh imbalance.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44610 F and VWAP of the session was at 44592

- Value zones (volume profile) are at 44552-44610-44634

- HVNs are at 44849 (** denotes series POC)

- BNF confirmed a FA at 44491 on 27/09 and tagged the 1 ATR objective of 44928 on the same day. The 2 ATR target comes to 45365

Monthly Zones

- The settlement day Roll Over point (October 2023) is 44595

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

Business Areas for 04th Oct 2023

| Up |

| 44683 – Selling Tail (03-Oct) 44759 – Buying Tail (29-Sep) 44849 – 2-day VPOC (28-29 Sep) 44998 – Swing High (28 Sep) 45091 – 3-day POC (21-25 Sep) 45198 – 3-day HVN (21-25 Sep) |

| Down |

| 44610 – POC from03 Oct 44491 – FA from 27 Sep 44375 – Buying Tail (01 Sep) 44259 – Weekly 2 IB 44174 – 1 ATR (yPOC 44610) 44054 – 1 ATR (FA 44491) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.