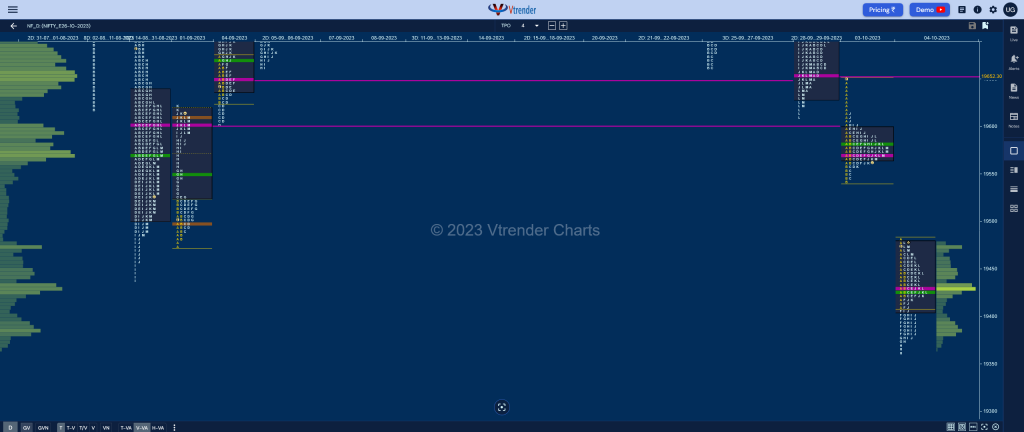

Nifty Oct F: 19469 [ 19481 / 19362 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 18,485 contracts |

| Initial Balance |

|---|

| 71 points (19481 – 19410) |

| Volumes of 34,269 contracts |

| Day Type |

|---|

| Normal Variation (NV) – 118 points |

| Volumes of 1,25,122 contracts |

As expected, NF continued the imbalance to the downside with another gap down open by 97 points as it negated the buying singles of 19481 & 19454 from 01st Sep & 25th Aug respectively and went on to make a low of 19410 in the A period completing the 1 ATR objective of 19417 from previous week’s POC of 19772.

The auction then made a typical contra move with a C side probe into the morning selling tail and left a PBH at 19467 as it formed a narrow 18 point inside bar in the D TPO followed by the break of day’s VWAP in the E period triggering a fresh drop lower with an extension handle at 19410 in the F enabling it to finish the 2 ATR target of 19370 from the 2-day POC (28-29 Sep) of 19652 while making a low of 19362 in the H TPO.

The sellers however began to book profits as the dPOC shifted lower to 19380 and a small responsive buying tail took shape at the lows after which NF made a probe higher in the J period negating the extension handle of 19410 & getting back above day’s VWAP resulting in a short covering squeeze into the close back to 19478 narrowly missing out on a Neutral Extreme Day.

Value however was once again completely lower though the close has been near the VAH of 19476 above which if it sustains in the coming session can go for the gap mid-point of 19523 & 03rd Oct’s VPOC of 19570 respectively whereas on the downside, the LVN of 19460 & the SOC at 19410 will be the levels to watch out for below which a test of today’s buying tail from 19375 could come.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19428 F and VWAP of the session was at 19426

- Value zones (volume profile) are at 19406-19428-19476

- HVNs are at 19570 / 19750 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (October 2023) is 19635

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

Business Areas for 05th Oct 2023

| Up |

| 19478 – Selling Tail (04 Oct) 19523 – Gap mid (04 Oct) 19570 – VPOC from 03 Oct 19615 – Selling Tail (03 Oct) 19652 – 2-day POC (28-29 Sep) |

| Down |

| 19460 – LVN from 04 Oct 19410 – SOC from 04 Oct 19375 – Buy tail (04 Oct) 19326 – Weekly 3 IB 19288 – 2 ATR (yPOC 19570) |

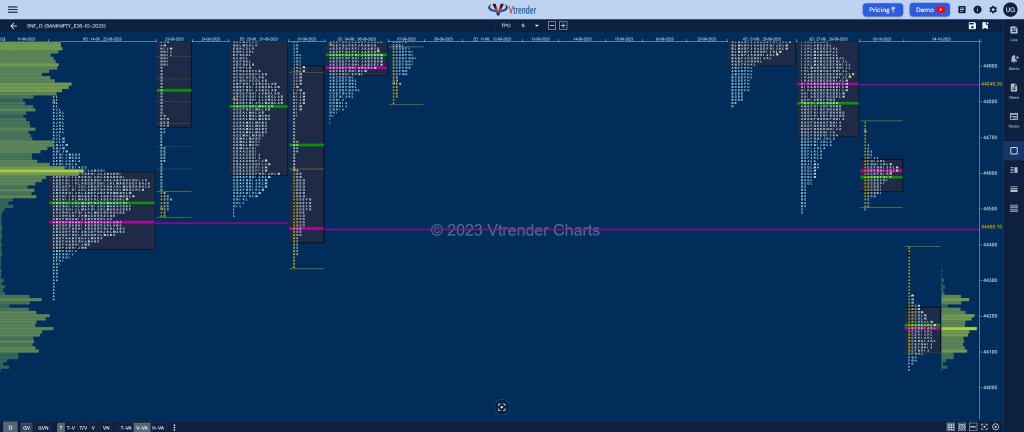

BankNifty Oct F: 44214 [ 44390 / 44050 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 24,532 contracts |

| Initial Balance |

|---|

| 287 points (44390 – 44103) |

| Volumes of 57,181 contracts |

| Day Type |

|---|

| Normal (b shape) – 340 points |

| Volumes of 1,96,428 contracts |

BNF resumed the probe lower it began the previous session with a gap down plus drive open of 249 points as it negated the FA of 44491 from 27th Sep and continued to drop for the rest of the Initial Balance breaking below the Swing Lows of 44336 & 44250 from 01st Sep & 18th Aug respectively making a low of 44103 after which it made a typical C side extension to 44093 which saw some profit booking by the sellers giving a bounce back to day’s VWAP which got stalled right at the base of the A period selling tail from 44232.

The auction got back below VWAP in the D TPO and went on to make a fresh Range Extension in the F making a low of 44050 completing the 1 ATR target on the downside from 44491 and left a small Responsive Buying pattern indicating another round of profit booking which led to a slow grind back above day’s VWAP into the close.

BNF saw a combo of short covering and fresh buying coming in the M period taking it into the A singles while hitting 44255 leaving a ‘b’ shape profile for the day which is in contrast to the previous one as has closed above Value and shown the initiative sellers booking profit so staying above today’s POC of 44164 it can look for a bounce back to the gap mid-point of 44497 & the higher VPOC at 44610 in the coming session(s) whereas on the downside, it will need fresh supply below 44164 for a probe towards 43964 which is the 1 ATR objective from the weekly FA of 44998.

Weekly Settlement (29th Sep to 04th Oct) : 44214 [ 44998 / 44050 ]

BNF has formed a Neutral Extreme Down profile with overlapping to lower Value at 44318-44610-44997 with a weekly FA at 44498 and also resembles a Triple Distribution one with HVNs at 44164, 44610 & 44849 and could fill up the low volume zones between them with this week’s VWAP of 44517 being an important reference.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44164 F and VWAP of the session was at 44174

- Value zones (volume profile) are at 44108-44164-44224

- HVNs are at 44610 / 44849 (** denotes series POC)

- BNF confirmed a FA at 44491 on 27/09 and tagged the 1 ATR objective of 44928 on the same day. This FA got negated on 04/10 and went on to tag the 1 ATR downside target of 44054.

Monthly Zones

- The settlement day Roll Over point (October 2023) is 44595

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

Business Areas for 05th Oct 2023

| Up |

| 44255 – Selling Tail (04 Oct) 44390 – PDH 44497 – Gap mid (04 Oct) 44610 – VPOC from 03-Oct 44759 – Buying Tail (29-Sep) |

| Down |

| 44164 – dPOC from 04 Oct 44072 – Buying tail (04 Oct) 43964 – 1 ATR (wFA 44998) 43742 – 2 ATR (VPOC 44610) 43617 – 2 ATR (FA 44491) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.