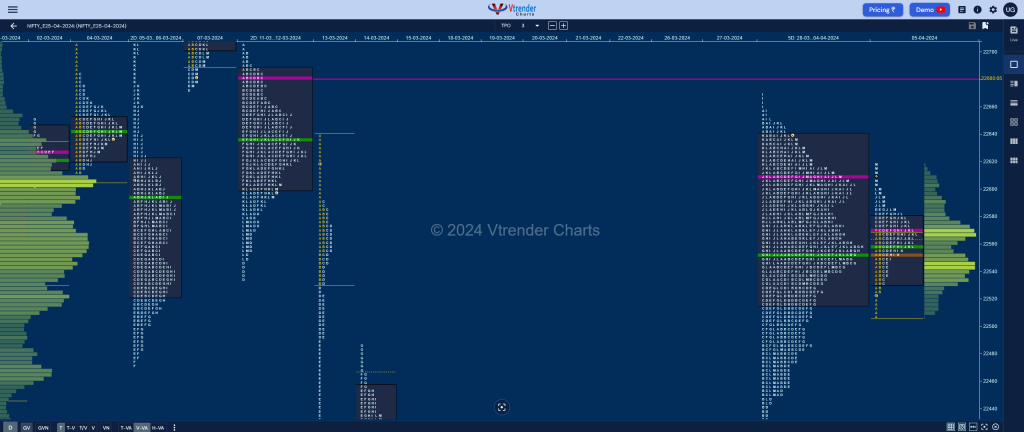

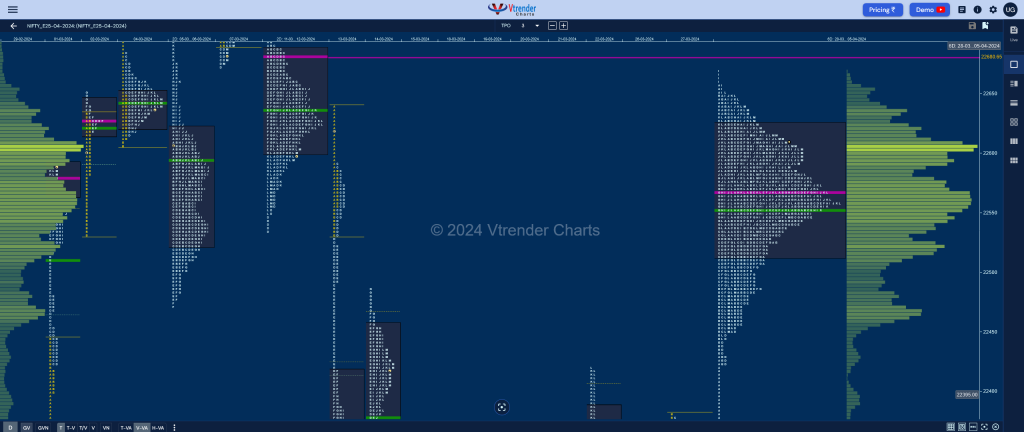

Nifty Apr F: 22595 [ 22618 / 22505 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 19,210 contracts |

| Initial Balance |

|---|

| 68 points (22573 – 22505) |

| Volumes of 45,365 contracts |

| Day Type |

|---|

| NV (3-1-3) – 113 pts |

| Volumes of 86,817 contracts |

NF opened lower making a look down below the 5-day Value but got rejected back into the balance triggering the 80% Rule as it went on to tag the composite POC of 22608 while making a high of 22618 smoothening the Gaussian Curve now leaving a 6-day composite with Value at 22512-22568-22625 with the VWAP at 22552.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22569 F and VWAP of the session was at 22558

- Value zones (volume profile) are at 22530-22569-22580

- HVNs are at 22553 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (01-04Apr) – NF has formed a Neutral Centre weekly profile in a narrow range of just 249 points forming completely higher Value at 22532-22607-22636 with the VWAP at 22566 and has closed right at the prominent POC which is also the Roll Over point of this series and has a good chance of giving an imbalance in the coming week.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 22607

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

Business Areas for 08th Apr 2024

| Up |

| 22601 – M TPO POC (05 Apr) 22636 – VPOC (04 Apr) 22680 – 2-day VPOC (11-12 Mar) 22719 – POC (07 Mar) 22756 – FA (07 Mar) 22784 – 1 ATR (yVWAP 22565) |

| Down |

| 22584 – Spike low (05 Apr) 22552 – 6-day VWAP (28Mar-05Apr) 22512 – 6-day VAL (28Mar-05Apr) 22455 – Buy tail (04 Apr) 22420 – Buy Tail (5-day comp) 22394 – A TPO VWAP (28 Mar) |

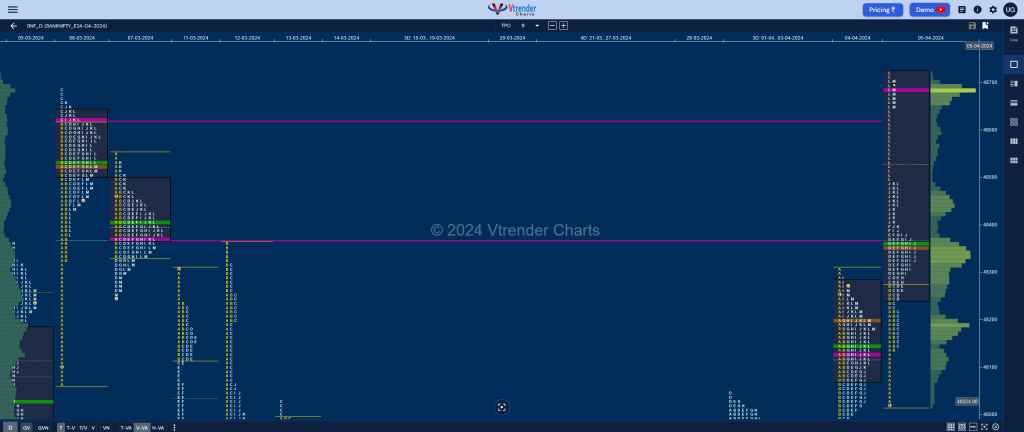

BankNifty Apr F: 48658 [ 48725 / 48014 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 14,654 contracts |

| Initial Balance |

|---|

| 261 points (48275 – 48014) |

| Volumes of 45,977 contracts |

| Day Type |

|---|

| Trend – 711 points |

| Volumes of 1,52,874 contracts |

to be updated…

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48690 F and VWAP of the session was at 48365

- Value zones (volume profile) are at 48245-48690-48720

- HVNs are at 47881 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (28Mar-03Apr) – BNF has formed a composite ‘p’ shape profile for the week with completely higher Value at 47699-47881-48023 leaving a buying tail from 47405 to 47264 and closing around the ultra prominent POC of 47881 which will be the reference for the coming week and would need initiative volumes for a move away from this magnet. This week’s VWAP of 47779 will be the first zone of support whereas on the upside, 13th Mar’s FA of 48024 will need to show buy side activity for a probe towards the higher weekly VPOC of 48152 & HVN of 48368.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 47190

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

Business Areas for 08th Apr 2024

| Up |

| 48690 – POC (05 Apr) 48853 – Monthly 1.5 IB 48974 – 1 ATR (EH 48493) 49090 – 2 ATR (POC 48128) 49171 – 1 ATR (yPOC 48690) |

| Down |

| 48651 – Closing singles (05 Apr) 48582 – L TPO h/b (05 Apr) 48447 – K TPO VWAP (05 Apr) 48365 – VWAP (05 Apr) 48236 – C TPO VWAP (05 Apr) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.