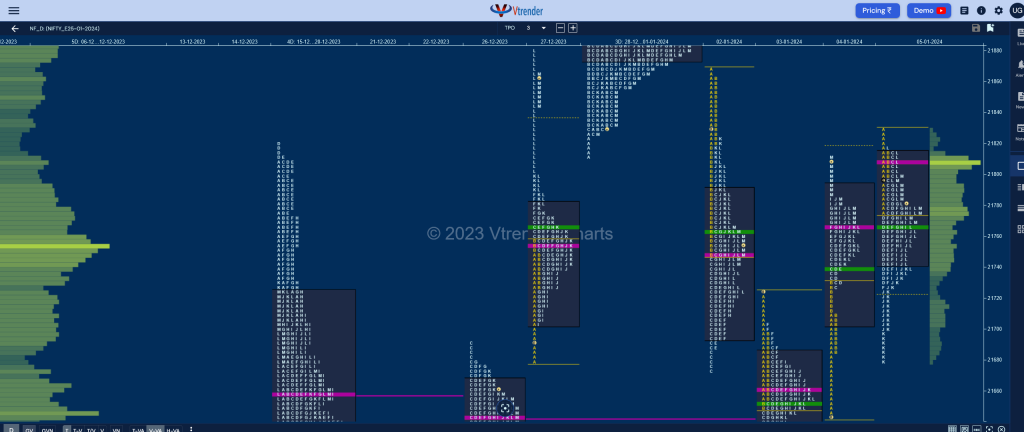

Nifty Jan F: 21793 [ 21831 / 21677 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 11,300 contracts |

| Initial Balance |

|---|

| 57 points (21831 – 21773) |

| Volumes of 23,071 contracts |

| Day Type |

|---|

| Normal Variation – 154 points |

| Volumes of 1,35,030 contracts |

NF opened with a look up above previous session’s spike high as it hit 21831 but got rejected forming a narrow 57 point range A period taking suport just above the spike lows of 21770 and coiled even further in the B TPO forming a mere 15 point range between 21800 to 21815 but more importantly displaying lack of demand at PDH.

The auction then saw the C side matching the ‘B’ highs of 21815 but yet again did not see any fresh buying coming in triggering a probe lower along with a RE (Range Extension) in the D period to 21730 after which it formed another narrow range inside bar in the E TPO followed by marginal new lows of 21725 in the F as the buying zone from 21728 to 21708 from previous session was defended and gave a bounce back above day’s VWAP to 21793 in the G TPO.

NF however was swiftly rejected from this VWAP tag and went on to make couple of fresh REs as it not only completed the 2 IB mark of 21717 in the J period but went on to test previous session’s A period buying tail from 21685 to 21616 while making a low of 21677 where it saw some good responsive buying coming back forcing a probe back above VWAP and another test of the ‘B” highs as it hit 21816 but made a quick retracement back to day’s VWAP into the close leaving a 3-1-3 profile with overlapping to higher Value.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21809 F and VWAP of the session was at 21765

- Value zones (volume profile) are at 21743-21809-21813

- HVNs are at 21748** / 21890 (** denotes series POC)

Weekly Zones

- (29 Dec-04 Jan) – NF has formed a Neutral Centre weekly profile as it made a look up above previous highs but got rejected after making new ATH of 22025 and went on to make a low of 21579 taking support right above last week’s lower TPO HVN of 21570 filling up the low volumes zones and forming mostly overlapping Value at 21640-21748-21875 with a point to note that the sellers who had come in forming a base at 21890 had mostly booked profits at lower levels where it saw some short covering and fresh demand coming back.

Monthly Zones

- The settlement day Roll Over point (January 2024) is 21930

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

Business Areas for 08th Jan 2024

| Up |

| 21809 – dPOC from 05 Jan 21844 – A TPO VWAP (02 Jan) 21874 – 3-day VAL (28Dec-01Jan) 21931 – 3-day VPOC (28Dec-01Jan) 21966 – 1 ATR (yVWAP 21765) |

| Down |

| 21778 – M TPO POC (05 Jan) 21726 – LVN from 05 Jan 21685 – Buying Tail (04 Jan) 21643 – IB tail mid (04 Jan) 21598 – Closing HVN (03 Jan) |

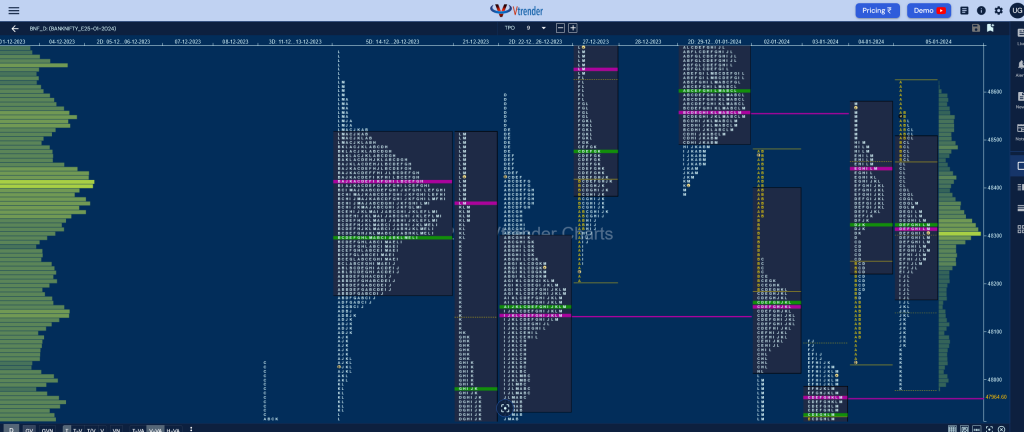

BankNifty Jan F: 48388 [ 48625 / 47982 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 11,399 contracts |

| Initial Balance |

|---|

| 167 points (48625 – 48458) |

| Volumes of 23,330 contracts |

| Day Type |

|---|

| Trend Day – 643 points |

| Volumes of 1,76,646 contracts |

BNF continued previous session’s imbalance close with a probe above PDH as it tagged 48625 but got rejected at 01st Jan’s VWAP of 48622 as the supply came back which could be seen in the initiative selling tail from 48560 to 48625 in the IB (Initial Balance) where it made a low of 48458 taking support just above the spike low of 48440.

The auction however broke below 48440 with a big C side extension resulting in a trending move lower as it made fresh REs in the D & E periods completing the 2 IB target of 48291 while making a low of 48222 and gave a bounce higher in the G TPO getting stalled just below day’s VWAP leaving a PBH at 48389 which started the next leg down with new REs in the I, J & K periods taking it down to 47982 halting just above 03rd Jan’s VPOC of 47964.

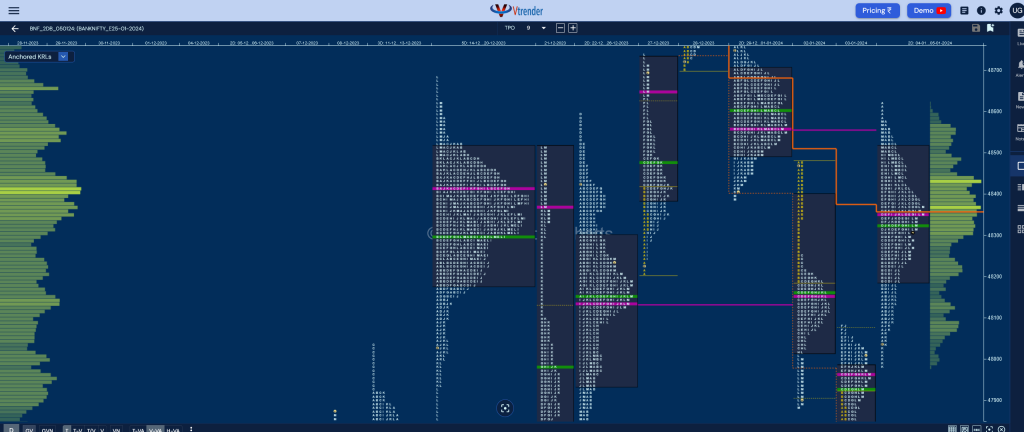

The defence of this VPOC brought about a quick short covering move in the L TPO as BNF got back above day’s VWAP and negated the extension handle of 48458 while making a high of 48538 and made an equally good retracement back to 48242 in the M period before closing around day’s VWAP of 48323 leaving an outside bar on the daily timeframe both in terms of Value & Range with a small zone of singles at both ends and a nice 2-day composite with value at 48188-48353-48516. (Click here to view the MarketProfile composite only on Vtrender Charts)

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48431 F and VWAP of the session was at 48323

- Value zones (volume profile) are at 48175-48431-48511

- HVNs are at 47956 / 48555** (** denotes series POC)

Weekly Zones

- (29 Dec-03 Jan) – BNF has formed a Neutral Extreme which also reresents a Double Distribution Trend Down profile which got stalled right below previous week’s POC of 48879 on the upside and went on to fill the low volume zone till 48446 and made an initiative move with a small selling tail from 48346 to 48256 as it went on to make poor lows at 47763 forming a lower balance with the POC also shifting down to 47956. Value for the week was at 47765-47956-48542 with the important DD VWAP being at 48278 which will be the swing reference for the coming settlement.

Monthly Zones

- The settlement day Roll Over point (January 2024) is 48900

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

Business Areas for 08th Jan 2024

| Up |

| 48388 – L TPO VWAP (05-Jan) 48516 – 2-day VAH (04-05 Jan) 48625 – PDH 48740 – SOC from 01 Jan 48900 – VPOC from 28 Dec |

| Down |

| 48353 – 2-day POC (04-05 Jan) 48188 – 2-day VAL (04-05 Jan) 48073 – Buying tail (05 Jan) 47964 – VPOC from 03 Jan 47844 – PBL from 03 Jan |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.