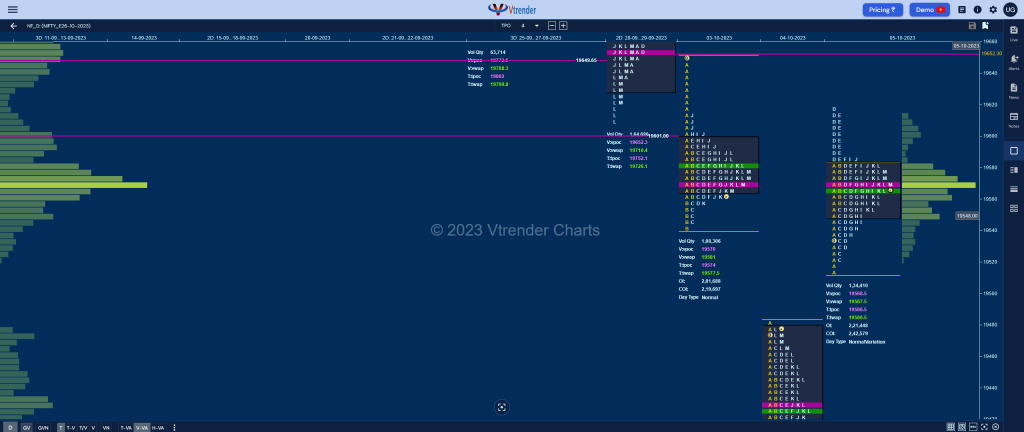

Nifty Oct F: 19568 [ 19616 / 19514 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 15,360 contracts |

| Initial Balance |

|---|

| 67 points (19582 – 19514) |

| Volumes of 31,319 contracts |

| Day Type |

|---|

| Normal Variation (NV) – 102 points |

| Volumes of 1,34,410 contracts |

The close around VAH in the previous session led to a higher open in NF as it went on to tag 03rd Oct’s VPOC of 19570 as expected while making a high of 19580 in the A period and formed a similar high of 19582 in the B stalling at that day’s VWAP which triggered a typical C side dhoka probe lower leaving a PBL at 19522 taking support right at the gap mid-point of 04th Oct.

The auction then made a good Range Extension to the upside in the D TPO completing the 1.5 IB objective of 19616 to the dot and testing the A period selling tail from 03rd Oct leaving poor highs which marked the end of the upside for the day as it got into contraction mode for the rest of the day building volumes at 19568 and closing right there leaving a Normal Variation Day Up with competely higher Value.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19568 F and VWAP of the session was at 19567

- Value zones (volume profile) are at 19548-19568-19580

- HVNs are at 19570 / 19750 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (October 2023) is 19635

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

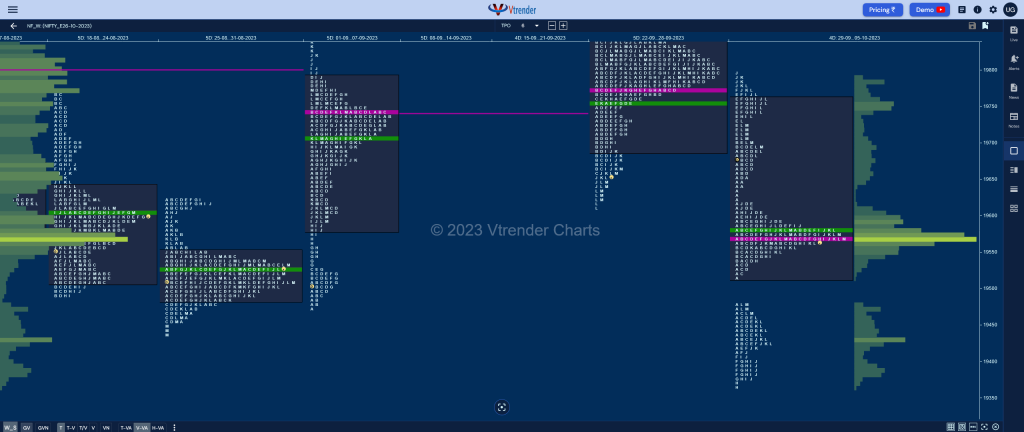

Weekly Settlement (29th Sep to 05th Oct) : 19568 [ 19794 / 19362 ]

NF has formed a Triple Distribution Trend Down profile on the weekly in an above average range of 431 points as it just missed completing the 3 IB objective of 19326 and has formed overlapping to lower Value at 19514-19569-19762 leaving couple of daily VPOCs at either ends at 19750 & 19428 with a close right in the middle and at the ultra prominent POC of 19569 from where it will need initaitive volumes in the coming week to start a fresh imbalance in either direction.

Business Areas for 06th Oct 2023

| Up |

| 19572 – M TPO VWAP (05 Oct) 19615 – Selling tail (05 Oct) 19655 – Tail from 29 Sep 19704 – LVN from 29 Sep 19750 – VPOC from 29 Sep 19785 – K TPO POC (29 Sep) |

| Down |

| 19553 – PBL from 05 Oct 19502 – Gap mid (05 Oct) 19460 – LVN from 04 Oct 19428 – VPOC (04 Oct) 19386 – HVN from 04 Oct 19362 – Monthly IBL |

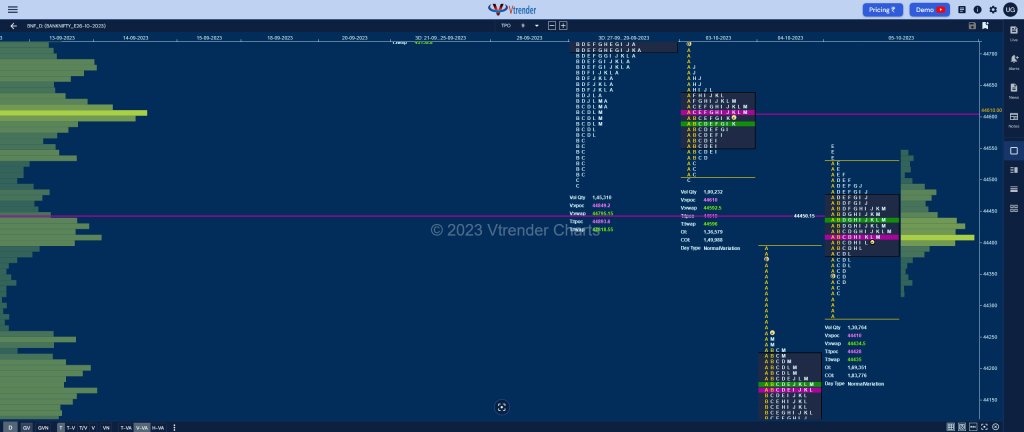

BankNifty Oct F: 44411 [ 44390 / 44050 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 17,928 contracts |

| Initial Balance |

|---|

| 244 points (44524 – 44280) |

| Volumes of 34,426 contracts |

| Day Type |

|---|

| Normal (3-1-3) – 270 points |

| Volumes of 1,30,764 contracts |

BNF opened higher but settled down into an OAOR as it negated yesterday’s selling singles even closing the gap while making freak ticks at both ends at 44280 & 44524 respectively in the first minute after which it contracted within a narrow range of just 70 points in the B period staying above PDH.

The auction then probed lower in the C taking suppport right above the weekly VAL of 44318 leaving a PBL there and went on to get above the B TPO highs even making a Range Extension in the E as it made new highs for the day at 44550 but could not enter 03rd Oct’s Value leaving a small responsive selling tail at the top triggering a retracement back to 44365 into the close.

The day’s profile is a nice 3-1-3 Gaussian Curve with completely higher Value which lies between the 2 VPOCs of 44164 & 44610 with an RBI policy day coming up so can expect a move away from this balance post event as fresh inventory enters the market as the current series POC has also aligned with today’s POC of 44410.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44410 F and VWAP of the session was at 44434

- Value zones (volume profile) are at 44384-44410-44470

- HVNs are at 44413** / 44610 / 44849 (** denotes series POC)

- BNF confirmed a FA at 44491 on 27/09 and tagged the 1 ATR objective of 44928 on the same day. This FA got negated on 04/10 and went on to tag the 1 ATR downside target of 44054.

Monthly Zones

- The settlement day Roll Over point (October 2023) is 44595

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

Business Areas for 06th Oct 2023

| Up |

| 44413 – Series POC (Oct) 44524 – Selling tail (05 Oct) 44610 – VPOC from 03-Oct 44750 – 1 ATR from 44319 44849 – 2-day VPOC (28-29 Sep) 44998 – Swing High (28 Sep) |

| Down |

| 44365 – PBL from 05 Oct 44255 – Tail from 04 Oct 44164 – VPOC from 04 Oct 44072 – Buying tail (04 Oct) 43964 – 1 ATR (wFA 44998) 43888 – 1 ATR from 44318 |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.