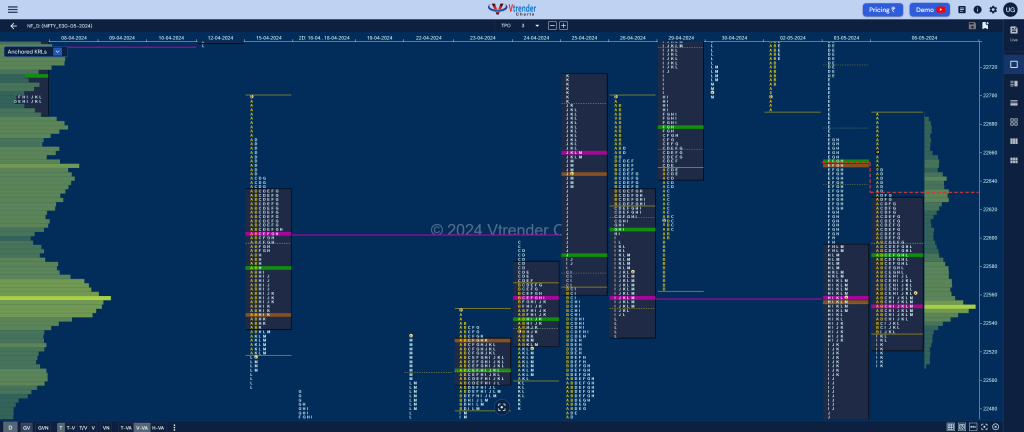

Nifty May F: 22550 [ 22686 / 22510 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 45,869 contracts |

| Initial Balance |

|---|

| 151 points (22686 – 22535) |

| Volumes of 1,04,593 contracts |

| Day Type |

|---|

| Normal – 176 pts |

| Volumes of 2,39,700 contracts |

NF opened higher testing the E TPO singles from 22669 to 22713 previous session’s Trend Day profile and saw supply coming back resulting in an A period selling tail from 22686 to 22648 as it went on to make couple of REs (Range Extension) lower in the I & K TPOs but could only manage simlar lows of 22510 forming an Inside Day both in terms of Value & Range.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22553 F and VWAP of the session was at 22590

- Value zones (volume profile) are at 22522-22553-22626

- NF has swing supports at the Trend Day VWAP of 22679 (29 Apr) and the AVWAP (Anchored VWAP) of 22600 from Swing Low of 19/04. Both these supports were broken on 03/05 and are no longer valid references

- NF has immediate supply point at AVWAP of 22632 from Swing High of 22888 from 03/05

- NF confirmed a FA at 22977 on 09/04 and has not been tagged hence is a postional swing level

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 22648

- The VWAP & POC of Apr 2024 Series is 22386 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

Business Areas for 07th May 2024

| Up |

| 22553 – POC (06 May) 22593 – PBH (06 May) 22648 – Sell Tail (06 May) 22690 – E singles mid (03 May) 22740 – Ext Handle (03 May) |

| Down |

| 22546 – M TPO low (06 May) 22511 – Buy tail (06 May) 22470 – Swing Low (03 May) 22425 – VPOC (22 Apr) 22364 – C TPO h/b (22 Apr) |

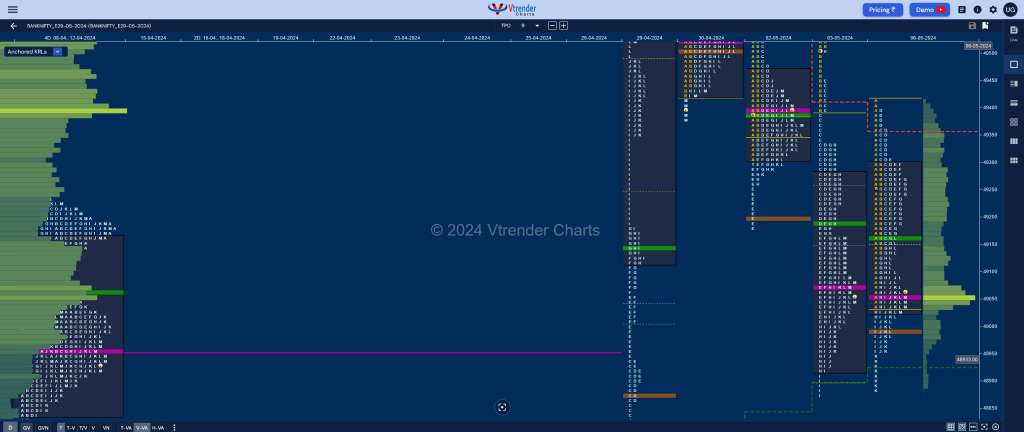

BankNifty May F: 49045 [ 49420 / 48885 ]

| Open Type |

|---|

| OAIR (Open Auction) |

| Volumes of 22,727 contracts |

| Initial Balance |

|---|

| 386 points (49420 – 49034) |

| Volumes of 60,496 contracts |

| Day Type |

|---|

| Normal – 535 points |

| Volumes of 1,49,455 contracts |

BNF also opened higher testing the extension handle of 49400 from previous session and attracted fresh selling seen in the small tail from 49393 to 49420 it left indicating that the PLR (Path of Least Resistance) remained to the downside after which it probed lower testing the buying singles from 03rd May while hitting 48885 in the K period but left another responsive buying tail as the 19th Apr AVWAP was still being defended by the buyers.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 49051 F and VWAP of the session was at 49163

- Value zones (volume profile) are at 49024-49051-49301

- BNF has swing supports at the Trend Day VWAP of 49150 (29 Apr) and the AVWAP (Anchored VWAP) of 48846 from Swing Low of 19th Apr. BNF negated first level on 03/05 whereas the updated AVWAP (Anchored VWAP) is now at 48925

- NF has immediate supply point at AVWAP of 49357 from Swing High of 49927 from 30/04

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (25-30 Apr) – to be updated…

- (18-24 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 48360

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

Business Areas for 07th May 2024

| Up |

| 49051 – POC (06 May) 49180 – G TPO h/b (06 May) 49318 – D TPO h/b (06 May) 49448 – C TPO tail (03 May) 49577 – Selling Tail (03 May) |

| Down |

| 49031 – M TPO low (06 May) 48925 – AVWAP (19 Apr) 48798 – Weekly Ext Handle (25-30 Apr) 48653 – B TPO VWAP (29 Apr) 48494 – VPOC (26 Apr) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.