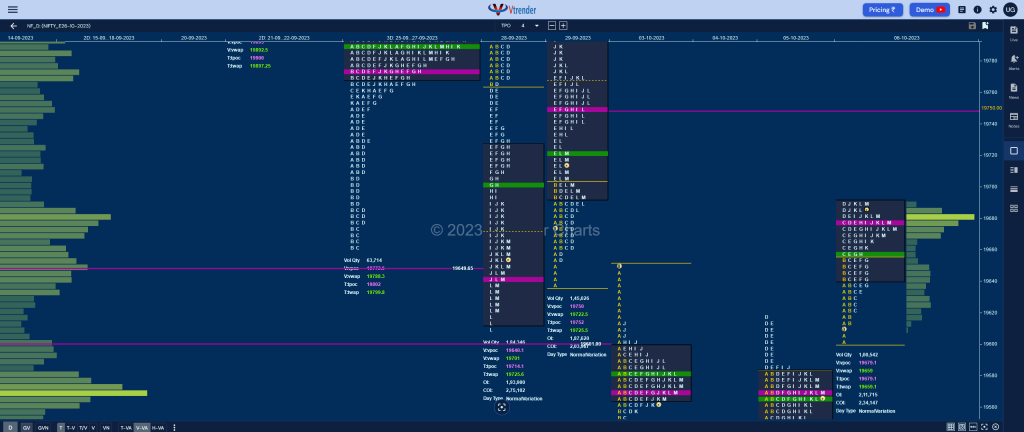

Nifty Oct F: 19680 [ 19692 / 19601 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 10,383 contracts |

| Initial Balance |

|---|

| 54 points (19655 – 19601) |

| Volumes of 27,940 contracts |

| Day Type |

|---|

| Normal Variation (NV) – 91 points |

| Volumes of 1,00,542 contracts |

NF opened slightly higher and negated the selling tail of 03rd Oct from 19615 and tagged the tail from 29th Sep at 19655 to the dot in the B period after which it made a big C side extension to 19678 followed by new highs of 19691 in the D TPO completing the 1.5 IB objective of 19682.

The auction then made a quick drop in the E period breaking below day’s VWAP but took support at the RO point of 19635 as it left a PBL at 19632 and made a slow grind back to the day’s high but ended up leaving similar highs in all of the last 4 TPOs from J to M leaving a ledge and a Normal Variation Day Up with completely higher Value for the second consecutive session.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19679 F and VWAP of the session was at 19659

- Value zones (volume profile) are at 19643-19679-19689

- HVNs are at 19570 / 19750 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (October 2023) is 19635

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

Business Areas for 09th Oct 2023

| Up |

| 19692 – Weekly IBH 19750 – VPOC from 29 Sep 19785 – K TPO POC (29 Sep) 19833 – Selling Tail (28 Sep) 19893 – 2-day VPOC (21-22 Sep) 19943 – 2-day VAH (21-22 Sep) |

| Down |

| 19659 – VWAP from 06 Oct 19614 – Buying Tail (06 Oct) 19568 – VPOC (05 Oct) 19522 – Buying Tail (05 Oct) 19460 – LVN from 04 Oct 19428 – VPOC (04 Oct) |

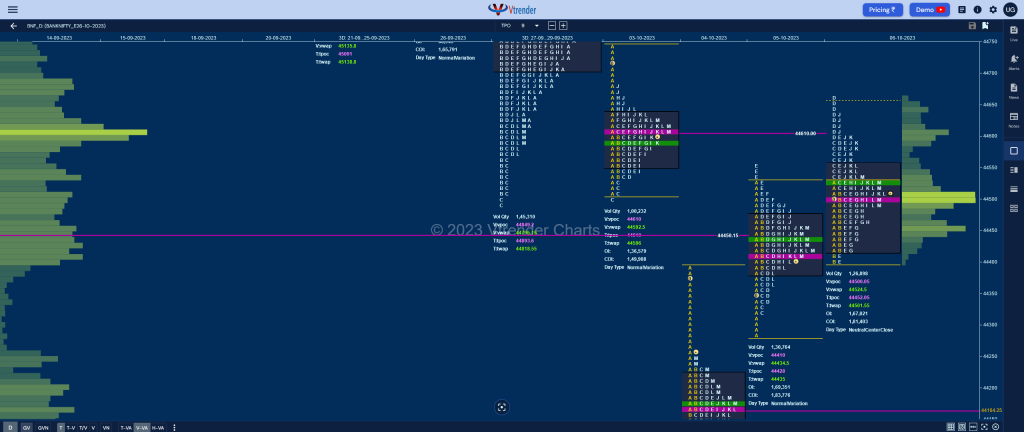

BankNifty Oct F: 44510 [ 44664 / 44400 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 6,840 contracts |

| Initial Balance |

|---|

| 125 points (44530 – 44405) |

| Volumes of 19,820 contracts |

| Day Type |

|---|

| Neutral Centre (NeuC) – 265 points |

| Volumes of 1,26,898 contracts |

BNF made a higher open but settled down into an OAIR as it stalled at previous session’s selling tail from 44524-44550 while making a high of 44530 and got back into previous Value triggering the 80% Rule as it promptly hit the yPOC of 44410 while making a low of 44405 in the B period.

The auction left a small buying tail displaying rejection from 44410 which led to a quick upmove in the C & D TPOs not only tagging 03rd Oct’s VPOC of 44610 but completing the 80% Rule in that day’s Value as it hit 44664 but could not sustain resulting in a liquidation drop in the E period swiping through previous value once again and even making marginal new lows of 44400.

For the second time in the day, BNF rejected from the yPOC of 44410 making a fresh probe higher till the J period even confirming a FA (Failed Auction) at lows as it tagged 44635 and failed to get fresh demand in the morning responsive selling tail triggering a move lower to 44491 into the close as even the dPOC shifted lower to 44500 forming a Neutral Centre Day with overlapping to higher value.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44500 F and VWAP of the session was at 44524

- Value zones (volume profile) are at 44416-44500-44558

- HVNs are at 44413 / 44611** / 44849 (** denotes series POC)

- BNF has confirmed a FA at 44400 on 06/10 and the 1 ATR objective comes to 44815

- BNF confirmed a FA at 44491 on 27/09 and tagged the 1 ATR objective of 44928 on the same day. This FA got negated on 04/10 and went on to tag the 1 ATR downside target of 44054

Monthly Zones

- The settlement day Roll Over point (October 2023) is 44595

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

Business Areas for 09th Oct 2023

| Up |

| 44524 – VWAP (06 Oct) 44635 – Selling tail (06 Oct) 44750 – 1 ATR from 44319 44849 – 2-day VPOC (28-29 Sep) 44998 – Swing High (28 Sep) 45091 – 3-day POC (21-25 Sep) |

| Down |

| 44500 – dPOC (06 Oct) 44400 – FA from 06 Oct 44319 – Buying Tail (05 Oct) 44164 – VPOC from 04 Oct 44050 – Swing Low (04 Oct) 43964 – 1 ATR (wFA 44998) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.