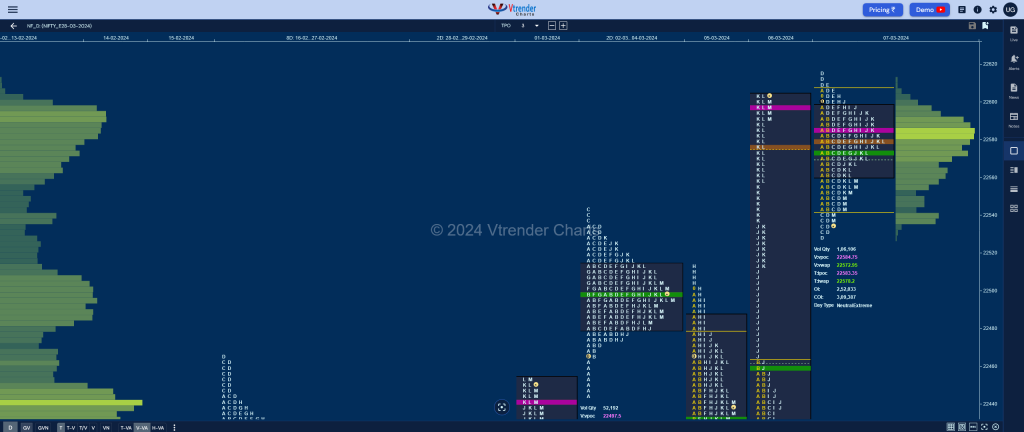

Nifty Mar F: 22552 [ 22620 / 22526 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 11,396 contracts |

| Initial Balance |

|---|

| 77 points (22606 – 22542) |

| Volumes of 24,801 contracts |

| Day Type |

|---|

| Neutral – 88 pts |

| Volumes of 1,06,179 contracts |

NF made a look up above the NeuX (Neutral Extreme) high of 22605 but failed to get fresh demand marking the end of the imbalance and got back into balance mode as it probed lower to 22542 in the A period continued to contract for the rest of the IB (Initial Balance) leaving a very narrow range with similar lows.

The auction repaired the poor lows by making couple of marginal REs to 22530 & 22524 testing the extension handle of 22540 and made a quick swipe above IBH to tag 22614 but once again did not attract any initiative buying triggering a slow probe lower for the rest of the day as it went on to break below IBL in the closing minutes.

NF has left a Neutral Day and a nice Gaussian Curve with completely inside Value and an ultra prominent POC at 22584 from where it would need a strong open in the coming session to make way for a fresh imbalance to begin.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22584 F and VWAP of the session was at 22572

- Value zones (volume profile) are at 22560-22584-22597

- NF confirmed a FA at 22022 on 29/02 and completed the 2 ATR objective of 22456

- HVNs are at 22393 / 22443** / 22497 / 22596 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (01-07 Mar) – NF opened the week with an initiative probe to the upside right from the Mar RO point of 22188 as it left a buying tail from 22259 to 22180 and went on to record similar highs of 22547 & 22545 triggering a round of profit booking as it made a retracement down to 22322 taking support just above previous week’s VAH of 22293 and saw demand coming back resulting in a fresh imbalance and new ATH of 22620 but lack of fresh buying led to another round of profit booking as the auction came down to 22526 before closing the week at 22552 leaving a Normal Variation profile with completely higher Value at 22335-22443-22551 with the VWAP at 22452.

Monthly Zones

- The settlement day Roll Over point (March 2024) is 22188

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

Business Areas for 11th Mar 2024

| Up |

| 22572 – VWAP (07 Mar) 22611 – 1 ATR (WVPOC 22113) 22650 – 1 ATR (NeuX VWAP 22460) 22687 – 1 ATR (HVN 22497) 22731 – 1.5 MIB |

| Down |

| 22542 – IBL (07 Mar) 22514 – Mid-profile tail 22460 – NeuX VWAP (06 Mar) 22412 – I TPO halfback 22365 – SOC (06 Mar) |

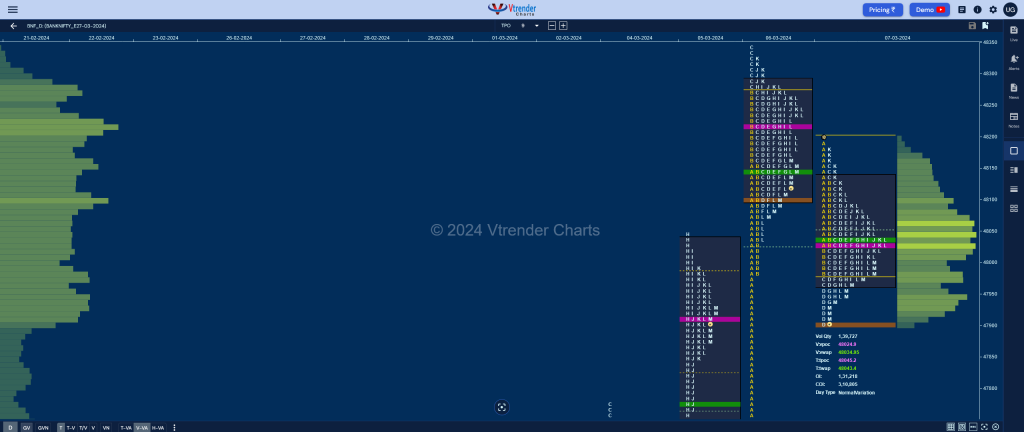

BankNifty Mar F: 47958 [ 48202 / 47880 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 13,581 contracts |

| Initial Balance |

|---|

| 221 points (48202 – 47981) |

| Volumes of 35,033 contracts |

| Day Type |

|---|

| Normal Variation – 322 points |

| Volumes of 1,39,746 contracts |

BNF opened and stayed below previous day’s prominent POC of 48217 indicating supply being active as it went on to make a low of 47981 in the IB taking support right above the A period buying singles of 47980 and gave a small bounce above VWAP but could only manage to tag 48150 stalling at previous day’s VWAP re-confriming that the sellers were in control.

The auction then not only made new lows in the C side but went on to make a RE in the D scaling into the buying singles from 06th Mar but found support at 47905 which was also the POC from 05th Mar which marked the end of the downmove after which it began to coil in the D period range till the J TPO.

BNF then made an attempt to move away in the K period even scaling above C highs but could only manage to tag 48182 where it got swiftly rejected triggering a liquidation break for the rest of the day even resulting in new lows of 47880 into the close leaving a Gaussian Curve with overlapping to lower Value and a prominent POC at 48025.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48025 F and VWAP of the session was at 48035

- Value zones (volume profile) are at 47963-480252-48137

- BNF confirmed a FA at 47487 on 05/03 and completed 1 ATR objective comes of 48170 on 06/03. The 2 ATR target comes to 48853

- HVNs are at 47584** / 48217 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (01-06 Mar) – BNF left a Trend Up weekly profile hitting the 2 IB target of 48343 forming completely higher value at 47444-47567-48229 with a closing HVN at 48217 which will be the immediate reference on the upside in the coming week staying above which it could go for the higher VPOC of 48480 and HVN of 48864 from the weekly profile of 11th to 17th Jan whereas on the downside, this week’s VWAP of 47694 will be an important swing support.

Monthly Zones

- The settlement day Roll Over point (March 2024) is 46610

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

Business Areas for 11th Mar 2024

| Up |

| 47951 – M TPO halfback 48035 – VWAP (07 Mar) 48182 – Sell Tail (07 Mar) 48324 – Sell tail (06 Mar) 48480 – VPOC (12 Jan) |

| Down |

| 47940 – M TPO VWAP 47815 – A TPO POC (06 Mar) 47694 – Weekly VWAP 47567 – Weekly POC 47465 – Buy tail (04 Mar) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.