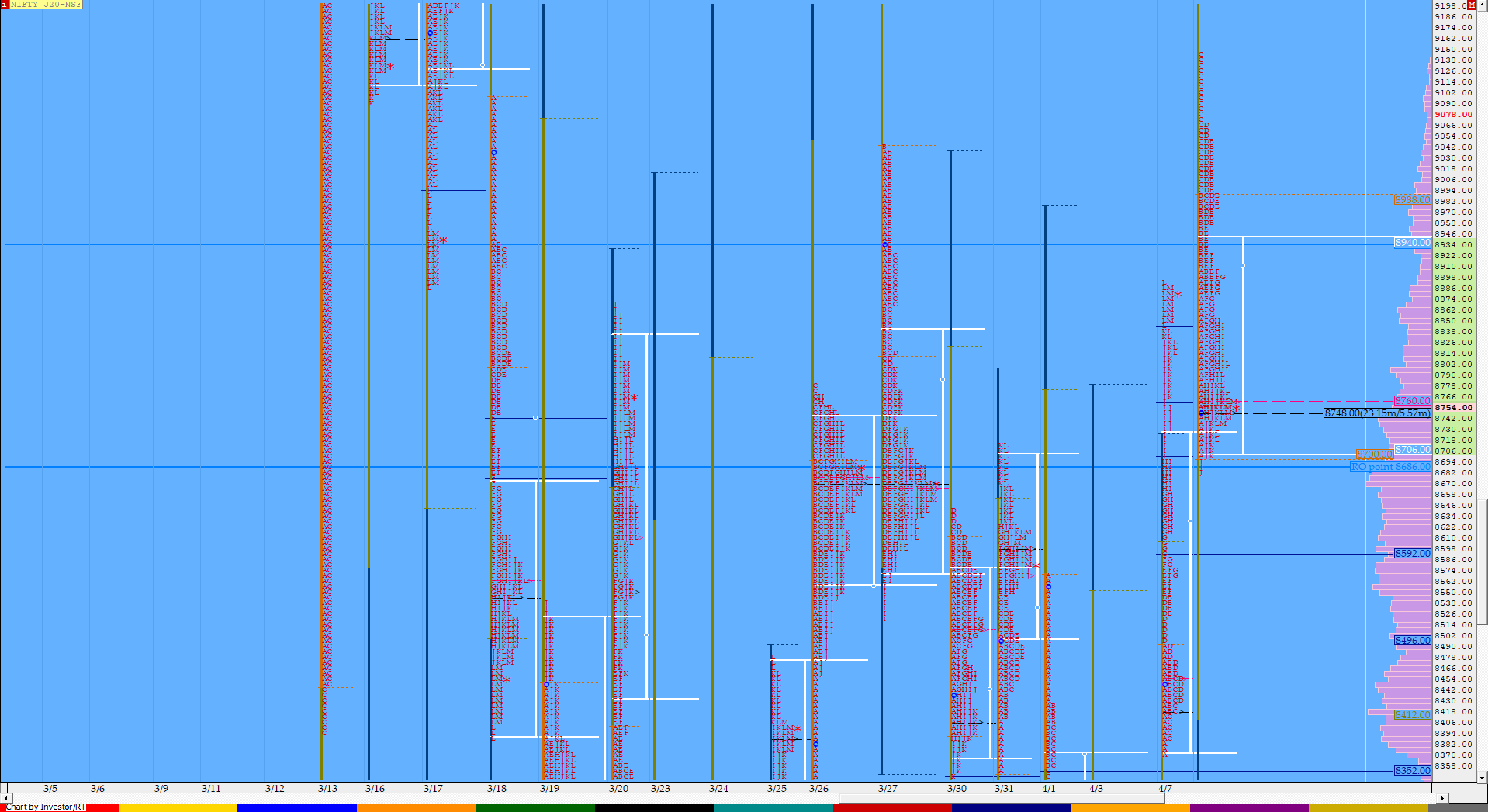

Nifty Apr F: 8750 [ 9145 / 8686 ]

HVNs – 7900 / 8130 / 8259 / 8305-35 / 8420-55 / 8555 / 8604 / 8670 / 8750 / 8800 / (8865)

NF opened lower not just below the previous day’s spike of 8840 to 8893 but also the extension handle of 8759 and took support just above the lower extension handle of 8695 as it made lows of 8702 in the opening minutes indicating that the demand was coming back here. The auction then made a sharp rally over the next 60 minutes as it scaled above PDH in the A period itself & went on to tag 8990 in the ‘B’ period leaving a contrasting 288 point IB range which was the biggest of this series and yet made a huge ‘C’ side extension as it went past the previous high of 9044 by a good 100 points as it made highs of 9145 at 10:30 AM. This imbalance of 444 points then led to a retracement in the ‘D’ period as NF came down to test VWAP and took support at 8962 but had also left a big selling tail from 9069 to 9145. The auction then broke below 8962 in the ‘E’ period which triggered a big OTF move on the downside till the ‘J’ period as it retraced the entire move of the day and even went on to make new lows of 8686 but was not able to sustain below the IBL. NF then left a PBH at 8804 in the ‘L’ period before closing at the dPOC of 8750 leaving a Neutral Centre profile with mostly higher Value but also a excess at top from 9069 to 9145. On the downside, NF would need to take out the remaining extension handle of 8662 and the Trend Day VWAP of 8620 for a probable test of 8455 & 8139 and on the upside, today’s VWAP of 8870 would be the first reference above which the important level of 8962 would come into play for a test of today’s selling tail and a probe towards 9211 & 9365.

- The NF Open was a Open Auction In Range (OAIR)

- The day type was a Neutral Centre Day (NeuD)

- Largest volume was traded at 8750 F

- Vwap of the session was at 8870 with volumes of 299 L and range of 459 points as it made a High-Low of 9145-8686

- NF confirmed a FA at 7521 on 24/03 and tagged the 2 ATR objective of 8595 on 26/03. This FA has not been tagged and is now positional support.

- NF confirmed a FA at 9384 on 17/03 and tagged the 2 ATR move of 8613 on 18/03. This FA has not been tagged and is positional supply point.

- The Trend Day VWAP of 8620 would be important support level.

- The settlement day Roll Over point (Apr) is 8686

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 8699-8750-8934

Main Hypos for the next session:

a) NF needs to sustain above 8756 for a rise to 8775-8804 / 8828-50 / 8870-95 / 8932 & 8960

b) The auction gets weak below 8732 for a move to 8709-00 / 8667-62 / *8620* / 8590 & 8559-45

Extended Hypos:

c) Above 8960, NF can probe higher to 8990 / 9025 / 9048-64 / 9100-25 & 9150-60

d) Below 8545, the auction can fall further to 8525 / 8490 / 8455-45 / 8420 & 8376-30

-Additional Hypos*-

e) Sustaining above 9160* could take NF to 9200-25 / 9270-95 / 9325 / 9358-65 & 9385

f) If 8330* is taken out, NF can start a new leg down to 8304-8290 / 8268-59 / 8238-05 / 8181 & 8139-30*

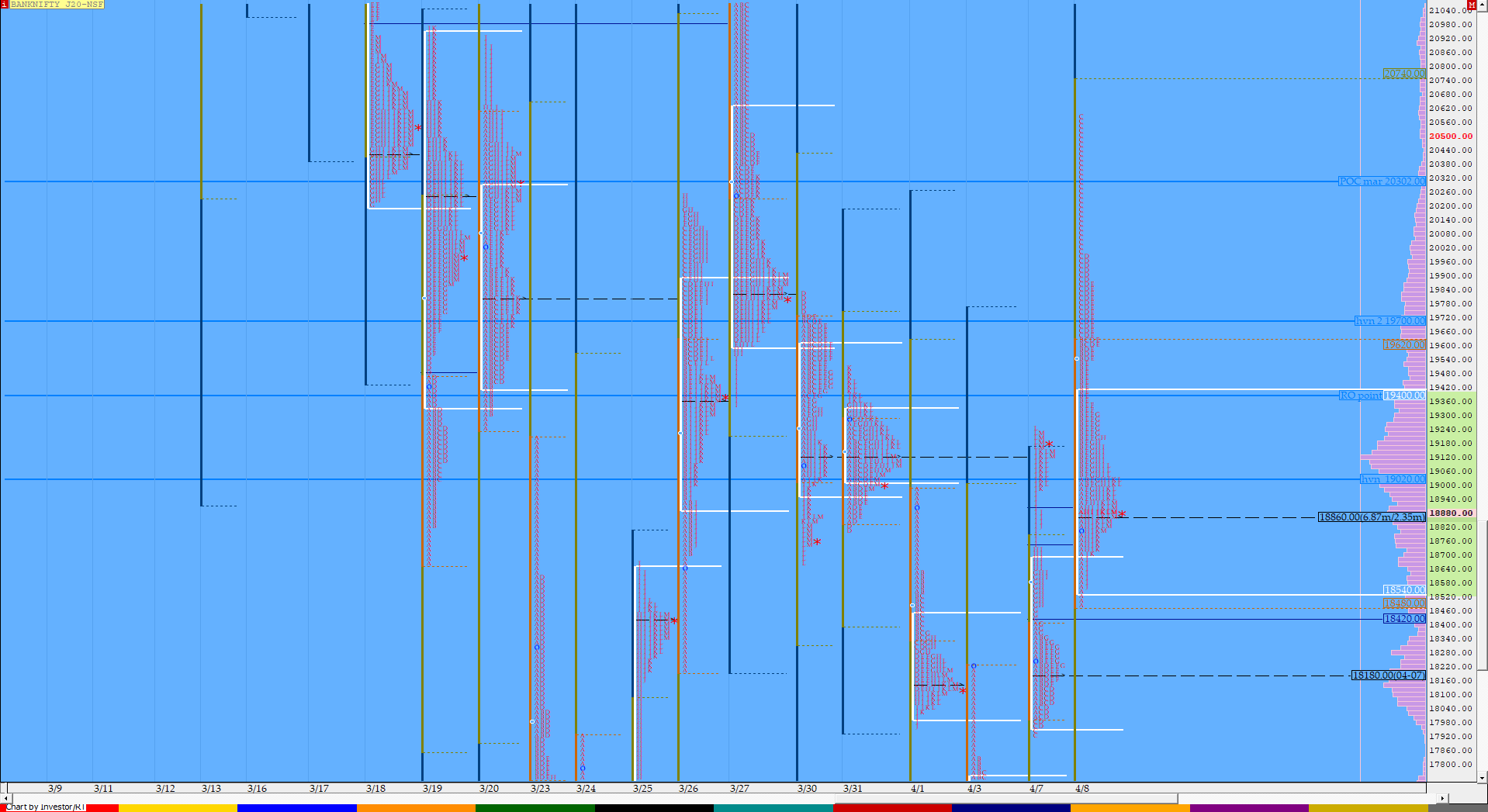

BankNifty Apr F: 18889 [ 20599 / 18495 ]

HVNs – 17540 / 18140-180 / 18790 / 18860 / 18985 / 19020 / 19125 / 19345 / (19550) / 19700 / 19840

Previous day’s report ended with this ‘The Neutral Extreme reference for the coming session would be from 18893 to 19250 below which the other 2 extension handles along with today’s VWAP of 18507 would be the important references as BNF looks to tag that VPOC of 19550.‘

Neutral Extreme profile once again failed to give any follow up at open as BNF gapped down by 350+ points much below the NeuX reference of 18893 and continued to probe lower as it went on to test yesterday’s VWAP of 18507 as it made lows of 18495 and was swiftly rejected from there indicating that the previous day’s initiative buyers were back. The auction then made a stunning probe to the upside as it first scaled above PDH at the start of ‘B’ period and went on to tag the VPOC of 19550 as it made highs of 19623 in the IB leaving a big 1128 point range but what followed in the ‘C’ period was unexpected as BNF almost doubled the IB range in just 10 minutes as it made highs of 20599 and in the process revisiting previous week’s FA of 19820 but was swiftly rejected from day highs as it closed the C period at 19944. The ‘D’ period then made a probe towards VWAP as it took support at 19540 but at the same time left a probable excess at highs from 19981 to 20599 and the break of 19540 followed by the VWAP being taken out in the ‘E’ period which led to an almost 1000 point fall over the next 5 periods as the auction made lows of 18570 from where it left a PBH at 19090 in the ‘L’ period before closing around the dPOC of 18860.

- The BNF Open was a Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (NV)

- Largest volume was traded at 18860 F

- Vwap of the session was at 19174 with volumes of 95.3 L and range of 2104 points as it made a High-Low of 20599-18495

- BNF confirmed a FA at 17921 on 07/04 and tagged the 1 ATR target of 19818 on 08/04. The 2 ATR objective from this FA is at 21715.

- BNF confirmed a FA at 19820 on 30/03 and tagged the 1 ATR objective of 17880 on 03/04. This FA got tagged on 08/04 which was the ‘T+5’ Day.

- The settlement day Roll Over point (Apr) is 19380

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 18583-18860-19440

Main Hypos for the next session:

a) BNF needs to sustain above 18890 for a move to 18940-970 / 19040-90 / 19125-150 / 19201-245 / 19350-412 & 19536

b) The auction gets weak below 18860 for a test of 18800 / 18725-675 / 18570-555 / 18495-480 / 18430-375 & 18300

Extended Hypos:

c) Above 19536, BNF can probe higher to 19623-750 / 19820-850 / 19970-981 / 20040 & 20130-180

d) Below 18300, lower levels of 18225-195* / 18075-60 / 18010 / 17920-826 / 17740 & 17665 could come into play

-Additional Hypos*-

e) BNF sustaining above 20180 could start a new leg up to 20251-295 / 20326-350 / 20450-520 / 20600-666 & 20715-795

f) If 17665 is taken out, BNF could fall further to 17600-540* / 17490-462 / 17415 / 17376-311 / 17225-160 & 17095-22

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout