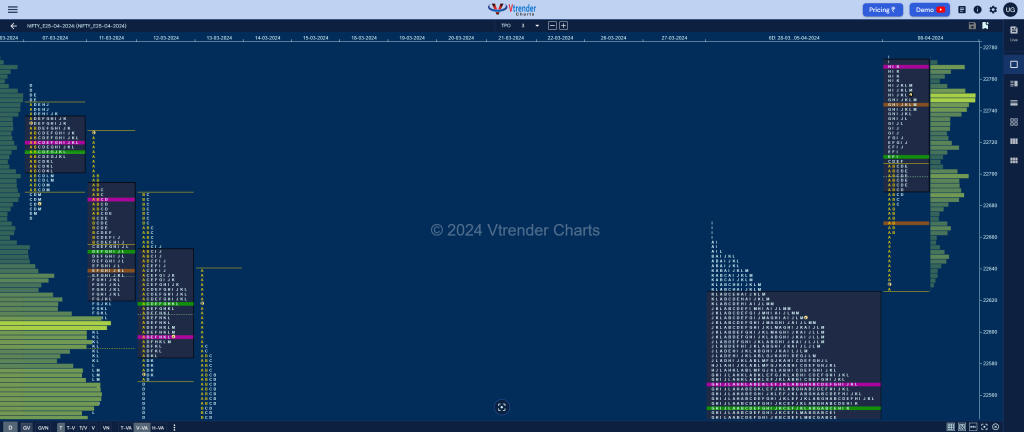

Nifty Apr F: 22748 [ 22773 / 22625 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 16,256 contracts |

| Initial Balance |

|---|

| 80 points (22705 – 22625) |

| Volumes of 38,572 contracts |

| Day Type |

|---|

| NV – 280 pts |

| Volumes of 1,09,833 contracts |

NF opened higher and left a buying tail from 22625 to 22662 confirming a move away from the 6-day balance it was forming and went on to re-visit the FA of 22756 from 07th Mar as it made a high of 22773 but saw profit booking by the longs as the POC shifted higher to 22768 leaving a Normal Variation Day Up with completely higher Value

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22768 F and VWAP of the session was at 22712

- Value zones (volume profile) are at 22690-22768-22770

- HVNs are at 22553 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (01-04Apr) – NF has formed a Neutral Centre weekly profile in a narrow range of just 249 points forming completely higher Value at 22532-22607-22636 with the VWAP at 22566 and has closed right at the prominent POC which is also the Roll Over point of this series and has a good chance of giving an imbalance in the coming week.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 22607

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

Business Areas for 09th Apr 2024

| Up |

| 22756 – Closing PBH 22792 – 1 ATR (RO point 22607) 22833 – 1 ATR (A TPO POC 22648) 22874 – Monthly 2 IB 22910 – 1 ATR (J TPO POC 22725) |

| Down |

| 22745 – Closing HVN 22712 – VWAP (08 Apr) 22670 – IB HVN (08 Apr) 22648 – A TPO POC (08 Apr) 22607 – RO point (Apr) |

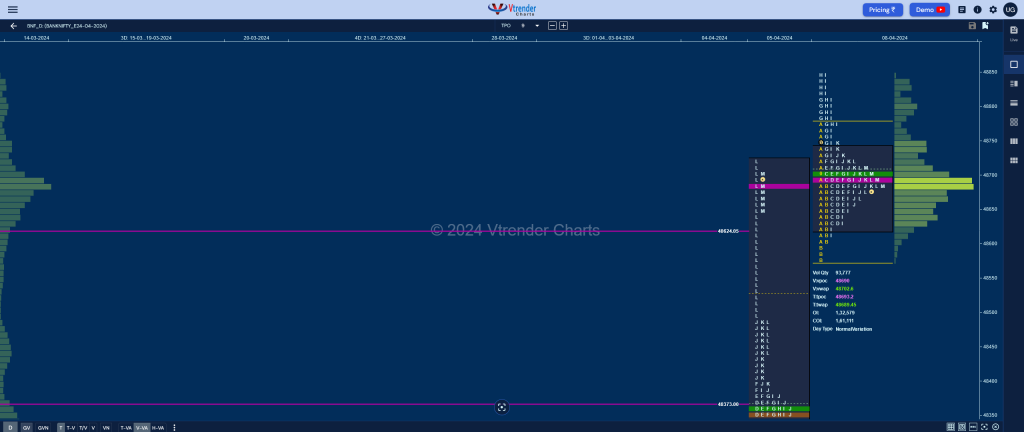

BankNifty Apr F: 48691 [ 48847 / 48567 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 16,233 contracts |

| Initial Balance |

|---|

| 217 points (48784 – 48567) |

| Volumes of 34,920 contracts |

| Day Type |

|---|

| Normal – 280 points |

| Volumes of 94,123 contracts |

As expected, previous session’s imbalance in BNF led to a narrow range balance as it formed a Normal Day in a range of just 280 points between 48567 to 48847 forming an overlapping & prominent POC at 48690 with coiling Value hence will need initiative volumes at 48690 for a fresh move away from this zone.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48690 F and VWAP of the session was at 48702

- Value zones (volume profile) are at 48623-48690-48736

- HVNs are at 47881 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (28Mar-03Apr) – BNF has formed a composite ‘p’ shape profile for the week with completely higher Value at 47699-47881-48023 leaving a buying tail from 47405 to 47264 and closing around the ultra prominent POC of 47881 which will be the reference for the coming week and would need initiative volumes for a move away from this magnet. This week’s VWAP of 47779 will be the first zone of support whereas on the upside, 13th Mar’s FA of 48024 will need to show buy side activity for a probe towards the higher weekly VPOC of 48152 & HVN of 48368.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 47190

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

Business Areas for 09th Apr 2024

| Up |

| 48745 – PBH (08 Apr) 48853 – Monthly 1.5 IB 48974 – 1 ATR (EH 48493) 49090 – 2 ATR (POC 48128) 49171 – 1 ATR (yPOC 48690) |

| Down |

| 48690 – POC (08 Apr) 48582 – L TPO h/b (05 Apr) 48447 – K TPO VWAP (05 Apr) 48365 – VWAP (05 Apr) 48236 – C TPO VWAP (05 Apr) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.