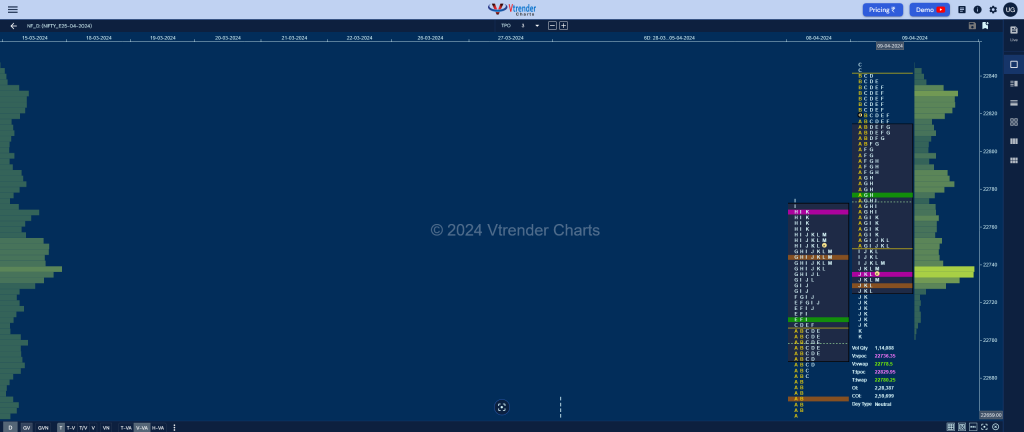

Nifty Apr F: 22735 [ 22845 / 22702 ]

| Open Type |

|---|

| OA (Open Auction) |

| Volumes of 12,656 contracts |

| Initial Balance |

|---|

| 89 points (22840 – 22751) |

| Volumes of 32,362 contracts |

| Day Type |

|---|

| Neutral Centre – 143 pts |

| Volumes of 1,14,493 contracts |

NF opened higher for the second successive session this week and went on to hit new ATH of 22840 in the IB (Initial Balance) but made the dreaded C side extension to 22845 which was swiftly rejected and started to coil inside the B TPO range indicating inventory getting too long which in turn triggered a liquidation break from the F period onwards.

The auction went on to make couple of REs (Range Extension) lower in the J & K TPOs confirming a FA (Failed Auction) at highs but also saw the dPOC shifting down to 22736 into the close leaving a Neutral Centre Day with overlapping to higher Value.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22736 F and VWAP of the session was at 22778

- Value zones (volume profile) are at 22726-22736-22812

- NF confirmed a FA at 22845 on 09/04 and the 1 ATR downside objective comes to 22660

- HVNs are at 22553 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (01-04Apr) – NF has formed a Neutral Centre weekly profile in a narrow range of just 249 points forming completely higher Value at 22532-22607-22636 with the VWAP at 22566 and has closed right at the prominent POC which is also the Roll Over point of this series and has a good chance of giving an imbalance in the coming week.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 22607

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

- The VWAP & POC of Jan 2024 Series is 21581 & 21635 respectively

Business Areas for 10th Apr 2024

| Up |

| 22751 – IBL (09 Apr) 22816 – SOC (09 Apr) 22845 – FA (09 Apr) 22874 – Monthly 2 IB 22917 – 1 ATR (yPOC 22736) |

| Down |

| 22730 – Closing HVN 22670 – IB HVN (08 Apr) 22648 – A TPO POC (08 Apr) 22607 – RO point (Apr) 22552 – 6-day VWAP (28Mar-05Apr) |

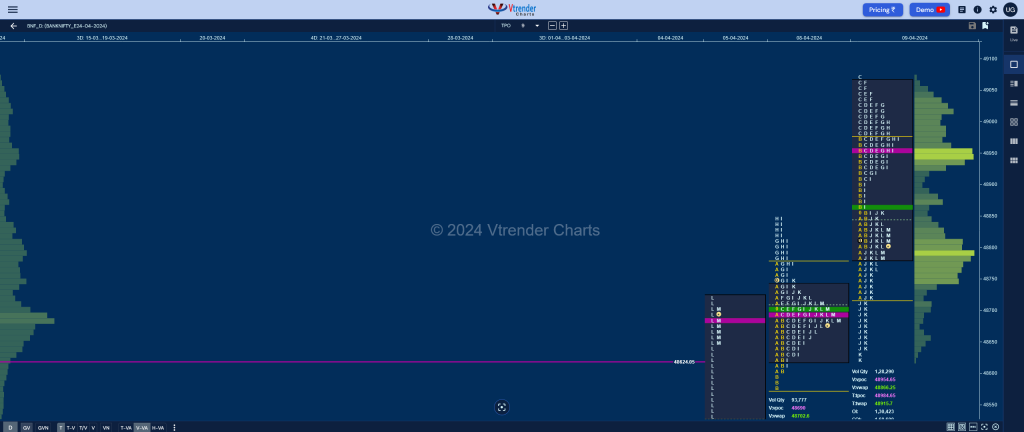

BankNifty Apr F: 48800 [ 49075 / 48622 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 8,176 contracts |

| Initial Balance |

|---|

| 260 points (48975 – 48715) |

| Volumes of 32,450 contracts |

| Day Type |

|---|

| Neutral – 453 points |

| Volumes of 1,28,733 contracts |

BNF also opened higher and took support just above the 2-day overlapping POC of 48690 while making a low of 48715 re-confirming that the PLR (Path of Least Resistance) was to the upside and drove higher for the first 3 TPOs leaving an extension handle at 48857 in the B followed by another one at 48975 in the C side where it made new ATH of 49075.

The auction once again gave evidence why a C side it called the ‘dhoka’ or Con period as it could not extend any further which led to profit booking by the longs as it first negated the higher extension handle of 48975 with the dPOC shifted higher to 48954 and then went on to nullify the lower one of 48857 also triggering the 80% Rule in previous Value which was completed to the ‘T’ as it made a low of 48622 in the K before bouncing back to 48855 and closing around the HVN of 48789 leaving a Neutral Day with completely higher Value.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48954 F and VWAP of the session was at 48866

- Value zones (volume profile) are at 48788-48954-49062

- HVNs are at 47881 (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (28Mar-03Apr) – BNF has formed a composite ‘p’ shape profile for the week with completely higher Value at 47699-47881-48023 leaving a buying tail from 47405 to 47264 and closing around the ultra prominent POC of 47881 which will be the reference for the coming week and would need initiative volumes for a move away from this magnet. This week’s VWAP of 47779 will be the first zone of support whereas on the upside, 13th Mar’s FA of 48024 will need to show buy side activity for a probe towards the higher weekly VPOC of 48152 & HVN of 48368.

Monthly Zones

- The settlement day Roll Over point (April 2024) is 47190

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

- The VWAP & POC of Jan 2024 Series is 46353 & 48119 respectively

Business Areas for 10th Apr 2024

| Up |

| 48809 – M TPO VWAP 48954 – POC (09 Apr) 49064 – Selling tail (09 Apr) 49131 – Weekly 3 IB 49238 – 1 ATR (HVN 48789) 49355 – Weekly ATR (47881) |

| Down |

| 48789 – Closing HVN 48672 – LVN (09 Apr) 48582 – L TPO h/b (05 Apr) 48447 – K TPO VWAP (05 Apr) 48365 – VWAP (05 Apr) 48236 – C TPO VWAP (05 Apr) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.