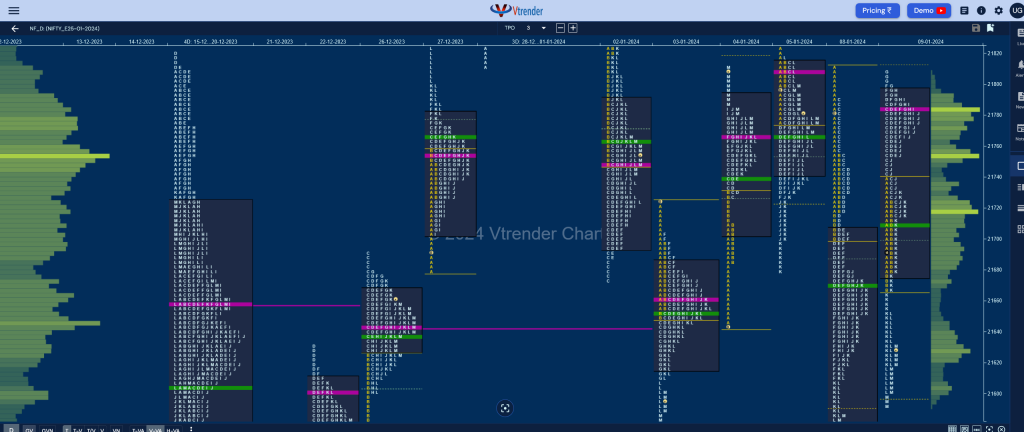

Nifty Jan F: 21616 [ 21807 / 21592 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 19,916 contracts |

| Initial Balance |

|---|

| 75 points (21740 – 21665) |

| Volumes of 43,389 contracts |

| Day Type |

|---|

| Neutral Extreme – 215 points |

| Volumes of 1,58,139 contracts |

NF opened with a gap up of 100 points trapping all the laggard shorts of previous session where the dPOC shifting to 21572 into the close was a clear indication that the big players had booked out as it went on to tag the SOC (Scene Of Crime) of 21729 while making a high of 21740 in the A period and made a quick retracement down to 21665 in the B where it took support at yVWAP mostly facilitating other stuck sellers to exit.

The auction then made a big C side extension to 21787 and followed it up with threee more marginal REs in the D, F & G TPOs where it made a high of 21807 once again stalling right below 05th Jan’s POC of 21809 marking the return of the OTF (Other Time Frame) sellers who then not only negated the extension handle of 21740 along with breaking below day’s VWAP in the J period but went on to leave a fresh sell side extension handle at 21665 and almost completed the 2 IB objective of 21590 while making a low of 21592 leaving a Neutral Extreme Day Down.

The range was completely inside previous day but today’s POC was around the highs at 21784 with the SOC at 21753 which will be the upside references for the coming sessions along with the immediate reference being the VWAP of 21708 whereas on the downside, we have previous session’s VPOC of 21572 along with 26th Dec’s tail from 21550 as the support zone break of which can get a probe lower to the LVN of 21501 from 22nd Dec along with that day’s FA of 21440.

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 21784 F and VWAP of the session was at 21708

- Value zones (volume profile) are at 21677-21784-21797

- HVNs are at 21753** / 21890 (** denotes series POC)

Weekly Zones

- (29 Dec-04 Jan) – NF has formed a Neutral Centre weekly profile as it made a look up above previous highs but got rejected after making new ATH of 22025 and went on to make a low of 21579 taking support right above last week’s lower TPO HVN of 21570 filling up the low volumes zones and forming mostly overlapping Value at 21640-21748-21875 with a point to note that the sellers who had come in forming a base at 21890 had mostly booked profits at lower levels where it saw some short covering and fresh demand coming back.

Monthly Zones

- The settlement day Roll Over point (January 2024) is 21930

- The VWAP & POC of Dec 2023 Series is 21226 & 21377 respectively

- The VWAP & POC of Nov 2023 Series is 19562 & 19806 respectively

- The VWAP & POC of Oct 2023 Series is 19468 & 19537 respectively

Business Areas for 10th Jan 2024

| Up |

| 21631 – M TPO high (09 Jan) 21665 – Ext Handle (09 Jan) 21708 – NeuX VWAP (09 Jan) 21753 – SOC from 09 Jan 21784 – POC from 09 Jan |

| Down |

| 21615 – M TPO VWAP 21579 – Closing LVN (08 Jan) 21550 – Buying Tail (26 Dec) 21501 – LVN from 22 Dec 21440 – FA from 22 Dec |

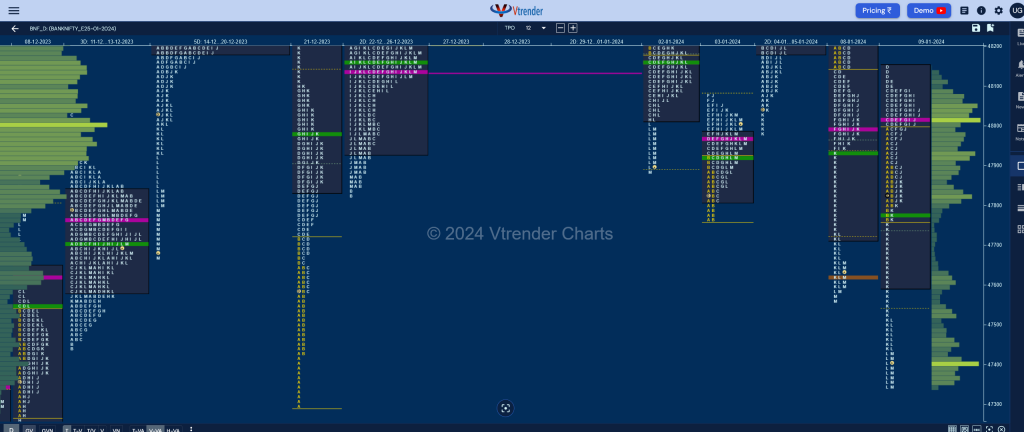

BankNifty Jan F: 47391 [ 48147 / 47341 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 22,577 contracts |

| Initial Balance |

|---|

| 233 points (47999 – 47766) |

| Volumes of 43,866 contracts |

| Day Type |

|---|

| Neutral Extreme – 806 points |

| Volumes of 1,96,049 contracts |

BNF also opened higher by 190 points and went on to tag the yPOC of 47998 while making a high of 47999 in the A period from where it gave a sharp retracment lower in the B TPO as it went on to make new lows for the day at 47766 taking support right at the business area reference of 47765 as it left a small buying tail at lows and went on to make that mandotary C side extension higher to 48099 which was followed by new highs of 48147 in the D as it tested previous session’s SOC but could only leave a small responsive selling tail indicating suppy being active.

The auction then formed a narrow range balance till the I period with a test of IBH in the F where it left a PBL (Pull Back Low) at 47972 but the inability to take out the small tail at top triggered yet another liquidation break in the closing 4 TPOs starting with the J where it broke below day’s VWAP followed by an extension handle at the important 47765 level resulting in a drop of over 300 points as it made a low of 47341 stopping just above the December 2023 series VWAP of 47337 leaving a Neutral Extreme Day Down.

BNF is at an important support here and the failure of buyers to defend the same can lead to more downside in the coming session(s) towards 04th Dec’s Trend Day VPOC of 46750 whereas on the upside, the K period singles zone from 47508 to 47766 would be the zone to be taken out for a probe towards the developing series POC of 48005.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 48017 F and VWAP of the session was at 47778

- Value zones (volume profile) are at 47594-48017-48146

- HVNs are at 47956 / 48005** / 48555 (** denotes series POC)

Weekly Zones

- (29 Dec-03 Jan) – BNF has formed a Neutral Extreme which also reresents a Double Distribution Trend Down profile which got stalled right below previous week’s POC of 48879 on the upside and went on to fill the low volume zone till 48446 and made an initiative move with a small selling tail from 48346 to 48256 as it went on to make poor lows at 47763 forming a lower balance with the POC also shifting down to 47956. Value for the week was at 47765-47956-48542 with the important DD VWAP being at 48278 which will be the swing reference for the coming settlement.

Monthly Zones

- The settlement day Roll Over point (January 2024) is 48900

- The VWAP & POC of Dec 2023 Series is 47337 & 47918 respectively

- The VWAP & POC of Nov 2023 Series is 43837 & 43619 respectively

- The VWAP & POC of Oct 2023 Series is 43718 & 44346 respectively

Business Areas for 10th Jan 2024

| Up |

| 47403 – Closing HVN (09 Jan) 47508 – K TPO singles (09 Jan) 47649 – Halfback (K TPO) 47778 – NeuX VWAP (09 Jan) 47915 – J TPO VWAP (09 Jan) |

| Down |

| 47337 – Dec Series VWAP 47238 – FA from 08 Dec 47085 – C TPO POC (07 Dec) 46950 – A TPO POC (07 Dec) 46821 – Ext Handle (04 Dec) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.