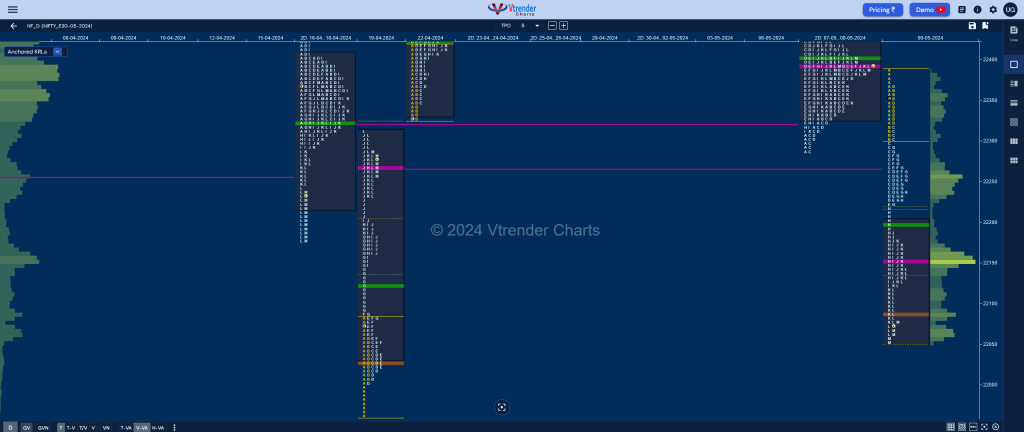

Nifty May F: 22075 [ 22388 / 22051 ]

| Open Type |

|---|

| OAIR (Open Auction In Range) |

| Volumes of 31,370 contracts |

| Initial Balance |

|---|

| 88 points (22388 – 22051) |

| Volumes of 77,990 contracts |

| Day Type |

|---|

| ‘Trend‘ – 337 pts |

| Volumes of 4,65,931 contracts |

to be updated…

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 22154 F and VWAP of the session was at 22199

- Value zones (volume profile) are at 22052-22154-22203

- NF has immediate supply point at AVWAP of 22437 from Swing High of 22888 from 03/05

- NF confirmed a FA at 22977 on 09/04 and has not been tagged hence is a postional swing level

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (19-25 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 22648

- The VWAP & POC of Apr 2024 Series is 22386 & 22457 respectively

- The VWAP & POC of Mar 2024 Series is 22168 & 22001 respectively

- The VWAP & POC of Feb 2024 Series is 21956 & 21930 respectively

Business Areas for 10th May 2024

| Up |

| 22086 – HVN (09 May) 22121 – SOC (09 May) 22154 – POC (09 May) 22213 – Ext Handle (09 May) 22260 – G TPO VWAP (09 May) 22315 – Ext Handle (09 May) |

| Down |

| 22063 – Buy tail (09 May) 22027 – HVN (19 Apr) 21963 – Swing Low (19 Apr) 21924 – 1 ATR (yPOC 22154) 21856 – 2 ATR (08 May low) 21829 – Monthly ATR |

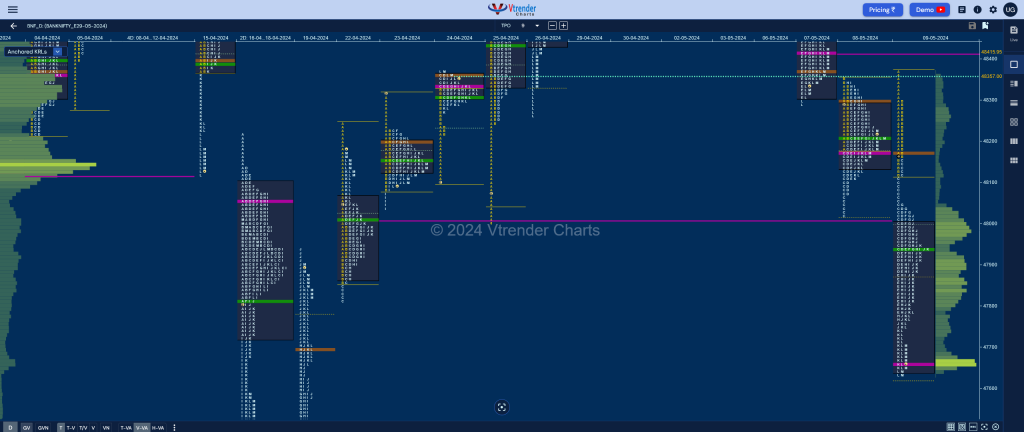

BankNifty May F: 47669 [ 48367 / 47636 ]

| Open Type |

|---|

| ORR (Open Rejection Reverse) |

| Volumes of 13,513 contracts |

| Initial Balance |

|---|

| 262 points (48367 – 48105) |

| Volumes of 27,647 contracts |

| Day Type |

|---|

| DD Trend- 731 points |

| Volumes of 1,63,792 contracts |

to be updated…

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 47658 F and VWAP of the session was at 47934

- Value zones (volume profile) are at 47640-47658-48000

- NF has immediate supply point at AVWAP of 48888 from Swing High of 49927 from 30/04

- HVNs are at NA (** denotes series POC)

Weekly Zones

- Weekly Charts can be viewed here

- (25-30 Apr) – to be updated…

- (18-24 Apr) – to be updated…

Monthly Zones

- The settlement day Roll Over point (May 2024) is 48360

- The VWAP & POC of Apr 2024 Series is 47971 & 47994 respectively

- The VWAP & POC of Mar 2024 Series is 47051 & 47300 respectively

- The VWAP & POC of Feb 2024 Series is 46119 & 45700 respectively

Business Areas for 10th May 2024

| Up |

| 47702 – M TPO high (09 May) 47811 – K TPO VWAP (09 May) 47934 – VWAP (09 May) 48050 – PBH (09 May) 48171 – HVN (09 May) 48300 – Sell Tail (09 May) |

| Down |

| 47658 – POC (09 May) 47560 – I TPO POC (19 Apr) 47456 – VWAP (19 Apr) 47338 – G TPO POC (19 Apr) 47209 – VPOC (19 Apr) 47084 – A TPO VWAP (19 Apr) |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.