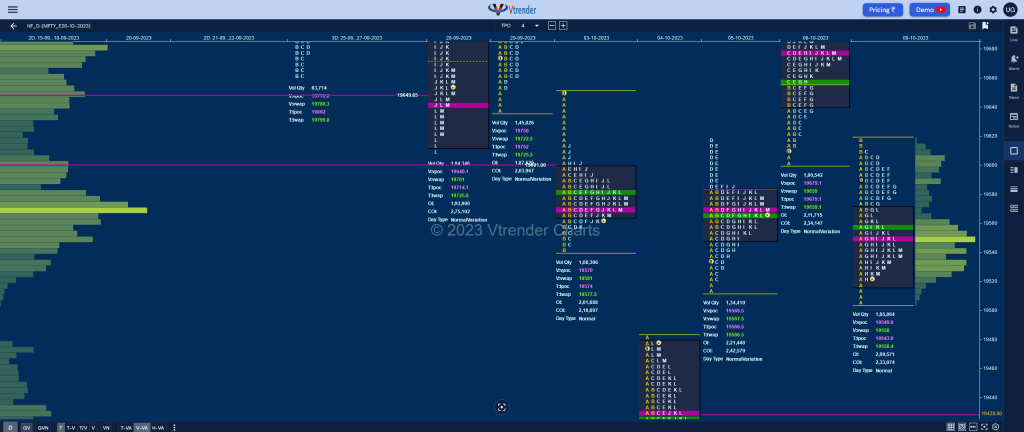

Nifty Oct F: 19539 [ 19616 / 19506 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 26,688 contracts |

| Initial Balance |

|---|

| 111 points (19617 – 19506) |

| Volumes of 51,944 contracts |

| Day Type |

|---|

| Normal (N) – 111 points |

| Volumes of 1,05,864 contracts |

NF opened with a gap down of 88 points negating the previous session’s buying tail from 19614 and continued to probe lower as it even made an entry into the 05th Oct’s singles from 19522 to 19469 but took support just above the gap mid-point of 19502 while making a low of 19506 indicating some demand coming back in this zone.

The auction then not only got back above day’s VWAP negating the advantage of the sellers but went on to make new highs of 19617 in the B period stalling right at previous session’s singles displaying change of polarity after which it remained in a narrow range above the VWAP forming a ‘p’ shape profile for the day till the F TPO.

The G period is known to have a strong connection with OAOR days and this time was no different as it moved away from the mini-balance by breaking below VWAP and retracing most of the A period singles as it made a low of 19520 in the H TPO leaving a PBL in this demand zone.

NF formed another mini-balance but this time below the day’s VWAP building volumes at 19550 and even made an attempt to scale higher in the L period but could only confirm a PBH at 19569 triggering a quick drop back to 19522 into the close leaving a Normal Day with completely lower Value

Click here to view the latest profile in NF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 19550 F and VWAP of the session was at 19558

- Value zones (volume profile) are at 19517-19550-19571

- HVNs are at 19570 / 19750 (** denotes series POC)

Monthly Zones

- The settlement day Roll Over point (October 2023) is 19635

- The VWAP & POC of Sep 2023 Series is 19736 & 19672 respectively

- The VWAP & POC of Aug 2023 Series is 19440 & 19424 respectively

- The VWAP & POC of Jul 2023 Series is 19600 & 19430 respectively

Business Areas for 10th Oct 2023

| Up |

| 19550 – dPOC from 09 Oct 19611 – Selling Tail (09 Oct) 19644 – IB singles mid 19679 – VPOC from 06 Oct 19709 – Singles high (29 Sep) 19750 – VPOC from 29 Sep |

| Down |

| 19522 – Closing PBL (09 Oct) 19460 – LVN from 04 Oct 19428 – VPOC (04 Oct) 19386 – HVN from 04 Oct 19362 – Monthly IBL 19325 – Weekly ATR |

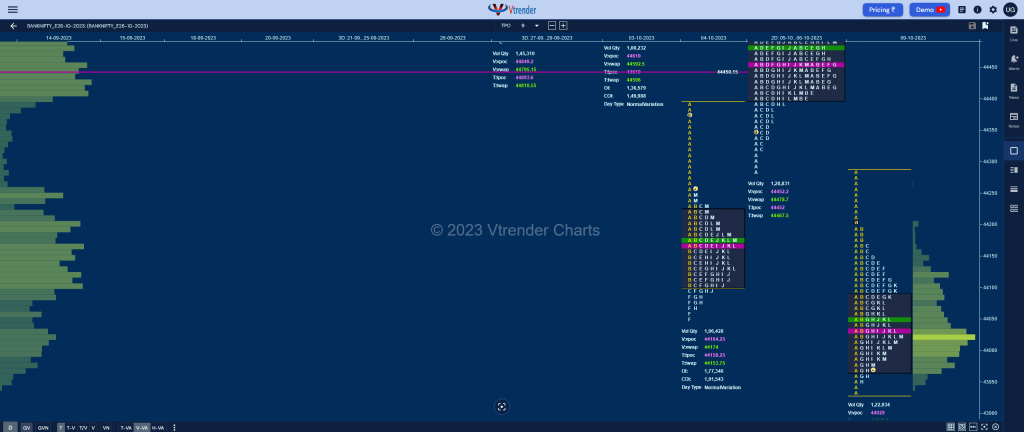

BankNifty Oct F: 44010 [ 44288 / 43935 ]

| Open Type |

|---|

| OAOR (Open Auction Out of Range) |

| Volumes of 31,382 contracts |

| Initial Balance |

|---|

| 353 points (44288 – 43955) |

| Volumes of 56,071 contracts |

| Day Type |

|---|

| Normal (b shape) – 353 points |

| Volumes of 1,22,934 contracts |

BNF also opened lower by 305 points not only negating the FA of 44400 but went on to complete the 1 ATR objective of 43986 to the downside along with the 1 ATR target of 43964 from the weekly FA of 44998 in the first 15 minutes itself while making a low of 43935 which saw profit booking by the shorts as the dPOC moved down to 44009 as the close of the A period.

The auction then began to coil above 44009 forming inside bars building volumes at 44124 till the F TPO where it remained in a range of just 41 points and made a move away to the downside in the G period breaking below 44009 as it made a low of 43964 but could not find any more supply which was seen in the marginal new low it put in at 43955 in the H triggering a bounce back above day’s VWAP which got stalled in the K TPO where it left a PBH at 44107 as the HVN of 44124 held.

BNF made another rotation down into the close as it hit 43970 and closed exactly around the 44009 level although the volume POC had shifted slightly higher to 44029 leaving a ‘b’ shape profile for the day with completely lower value and a little bit of filling needed in the zone from 44029 to 44124.

Click here to view the latest profile in BNF on Vtrender Charts

Daily Zones

- Largest volume (POC) was traded at 44029 F and VWAP of the session was at 44049

- Value zones (volume profile) are at 43965-44029-44085

- HVNs are at 44413 / 44611** / 44849 (** denotes series POC)

- BNF has confirmed a FA at 44400 on 06/10 and the 1 ATR objective comes to 44815. This FA got negated on 09/10 and hit the 1 ATR target of 43986 on the downside. The 2 ATR marker comes to 43571

- BNF confirmed a FA at 44491 on 27/09 and tagged the 1 ATR objective of 44928 on the same day. This FA got negated on 04/10 and went on to tag the 1 ATR downside target of 44054

Monthly Zones

- The settlement day Roll Over point (October 2023) is 44595

- The VWAP & POC of Sep 2023 Series is 44808 & 44438 respectively

- The VWAP & POC of Aug 2023 Series is 44493 & 44550 respectively

- The VWAP & POC of Jul 2023 Series is 45414 & 45075 respectively

Business Areas for 10th Oct 2023

| Up |

| 44049 – VWAP (09 Oct) 44124 – HVN from 09 Oct 44242 – IB singles mid (09 Oct) 44358 – Gap mid point (09 Oct) 44452 – 2-day VPOC (05-06 Oct) 44524 – 2-day VAH (05-06 Oct) |

| Down |

| 43970 – Closing PBL (09 Oct) 43888 – 1 ATR from 44318 43740 – Weekly 3 IB 43635 – 1 ATR (yPOC 44029) 43505 – Weekly ATR – |

You can check the monthly charts & other swing levels for both Nifty & BankNifty here & for the weekly charts & analysis, please click here.