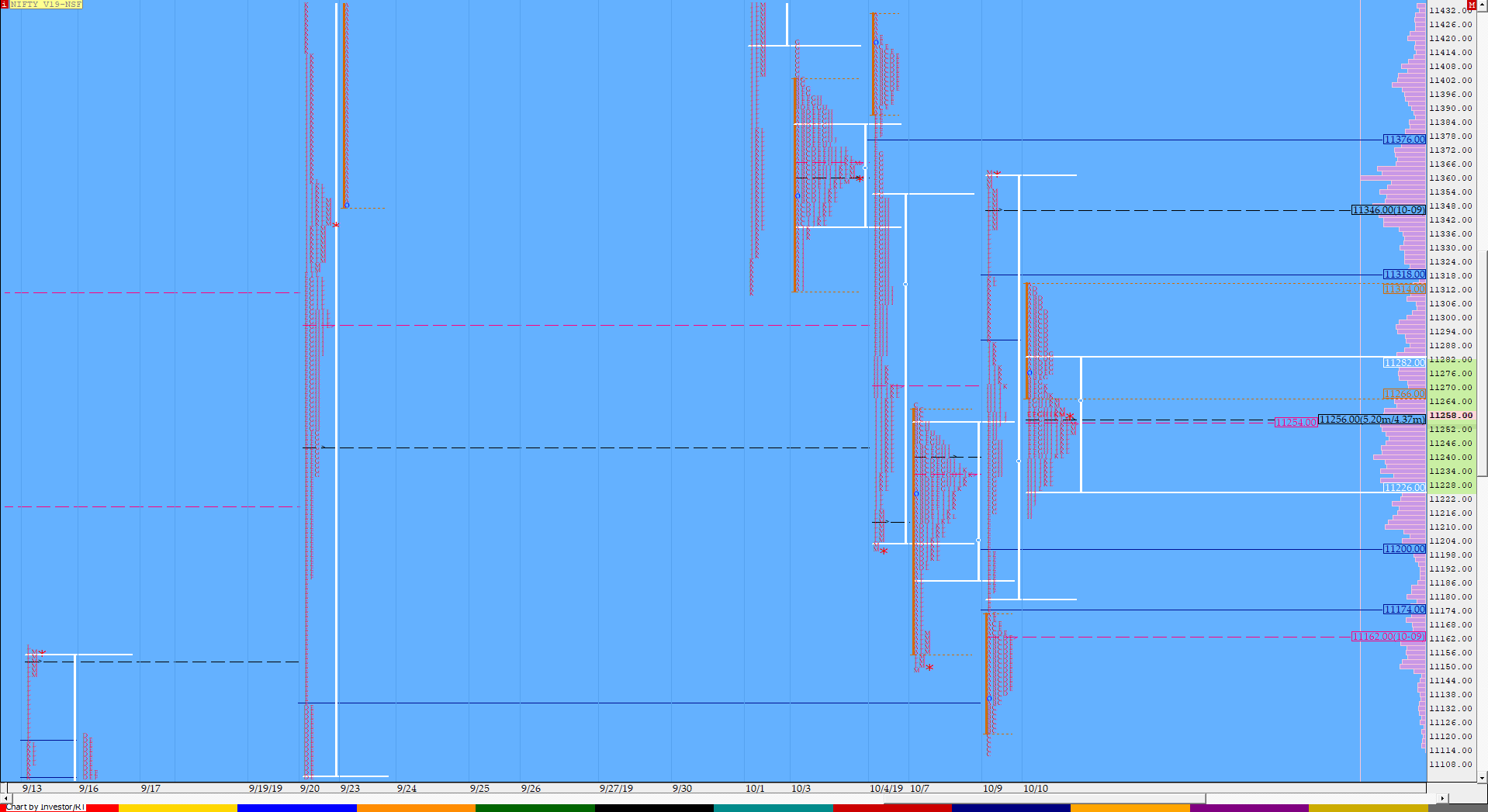

Nifty Oct F: 11254 [ 11314 / 11215 ]

HVNs – 11155 / 11253 / (11282-295) / 11345 / [11362] / 11400 / 11480 / 11550

Previous day was a Neutral Extreme profile which is known not to give any follow through & NF opened below the Neutral Extreme reference of 11316 to 11363 and probed lower giving a 2 IB inside day along with Value also being completely inside previous Value. The auction has been making a balanced profile for the week with a prominent POC developing around 11250 so there is a good chance that the it closes around here today before giving a move away in the coming week. Support for the day would be at 11220 and on the upside 11285 would be the first reference above which we have the selling tail from 11312 to 11363.

(Click here to view this week’s action in NF)

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (2 IB)

- Largest volume was traded at 11253 F

- Vwap of the session was at 11261 with volumes of 101.4 L and range of 99 points as it made a High-Low of 11314-11215

- NF confirmed a FA at 11113 on 09/10 and completed the 1 ATR move up of 11309. The 2 ATR objective comes to 11505

- NF visited the FA of 11262 on 09/10 at T+1 Days negating it.

- The Trend Day VWAP of 09/10 at 11224 will be important support and this held on 10/10.

- The higher Trend Day VWAP of 05/07 at 11965 is an important reference higher.

- The settlement day Roll Over point (Oct) is 11630

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11226-11253-11283

Hypos / Estimates for the next session:

a) Sustaining above 11253, NF can probe higher to 11270-282 / 11298-316 & 11345

b) Staying below 11250, the auction could test 11235-220 / 11200-173 & 11155-150

c) Above 11345, NF can probe higher to 11362-372 / 11400-406 & 11430

d) Below 11150, auction becomes weak for 11125-120 / 11092-90 & 11068

e) If 11430 is taken out, the auction go up to to 11450-456 / 11473-480 & 11505-510

f) Break of 11068 can trigger a move lower to 11022 / 10985-974 & 10958

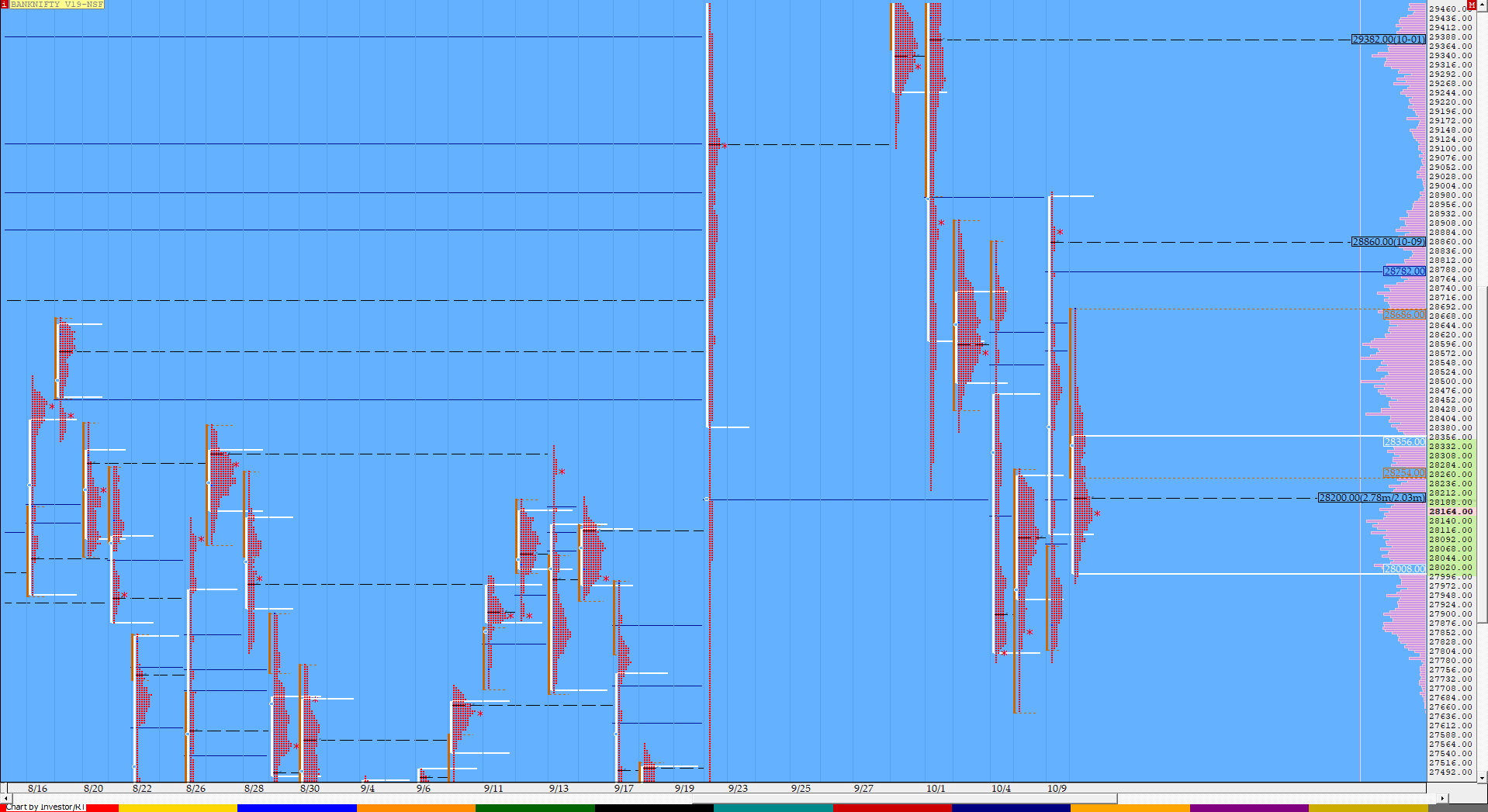

BankNifty Oct F: 28107 [ 28690* / 27980 ]

HVNs – 27940 / 28150 / 28335 / 28400-430 / 28580 / 28860 / 29350-382

BNF gave a more aggressive opening with a OH start of 28690 after which it gave a drive lower to leave a selling tail from 28486 to 28874 as it tested this week’s extension handle of 28277 in the IB while making a low of 28255. The auction then went on to make a RE to the downside in the ‘E’ period as it repaired all the anomalies of previous day’s profile after getting rejected at VWAP in the ‘G’ period where it left a PBH (Pull Back High) of 28357 filling up the low volume zone & went on to tag the main extension handle of 28079 as it made a low of 28040 in the ‘J’ period completing the 1.5 IB objective for the day. The ‘K’ period made an attempt to move higher but left another PBH at 28220 before it making new lows for the day at 27980 but found some demand coming in as it made a 45 degree move to the dPOC of 28150 into the close. BNF has also made an inside day and similar to NF is forming a balanced weekly profile so could remain in the range of 27820 to 28366 with 28220 being the immediate reference on the upside and support at 28066.

(Click here to view this week’s DD profile in BNF)

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (1.5 IB)

- Largest volume was traded at 28150 F

- Vwap of the session was at 28247 with volumes of 49.3 L and range of 710 points as it made a High-Low of 28690-27980

- BNF confirmed a FA at 27774 on 09/10 and completed the 1 ATR move up of 28713. The 2 ATR objective comes to 29653

- The higher Trend Day VWAP of 08/07 at 30995 remains important reference going forward

- The settlement day Roll Over point (Oct) is 30230

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 28007-28150-28353

Hypos / Estimates for the next session:

a) BNF needs to sustain above 28130-151 for a probe higher to 28225-290 / 28335-366 & 28425-430

b) Immediate support is at 28080-66 below which the auction could test 28000-27980 / 27920 & 27873-820

c) Above 28430, BNF can probe higher to 28486-525 / 28565-590 & 28650-700

d) Below 27820, lower levels of 27774 / 27675-650 & 27570 could come into play

e) Sustaining above 28700, BNF can give a fresh move up to 28805 / 28875 & 28954-990

f) Break of 27570 could trigger a move down 27495-420 / 27352-340 & 27157-135

Additional Hypos

g) Above 28990, higher levels of 29069-140 / 29222-283 & 29350-382 could get tagged

h) If 27135 is broken, BNF could fall to 27065-027 / 26976-925 & 26840-830

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout