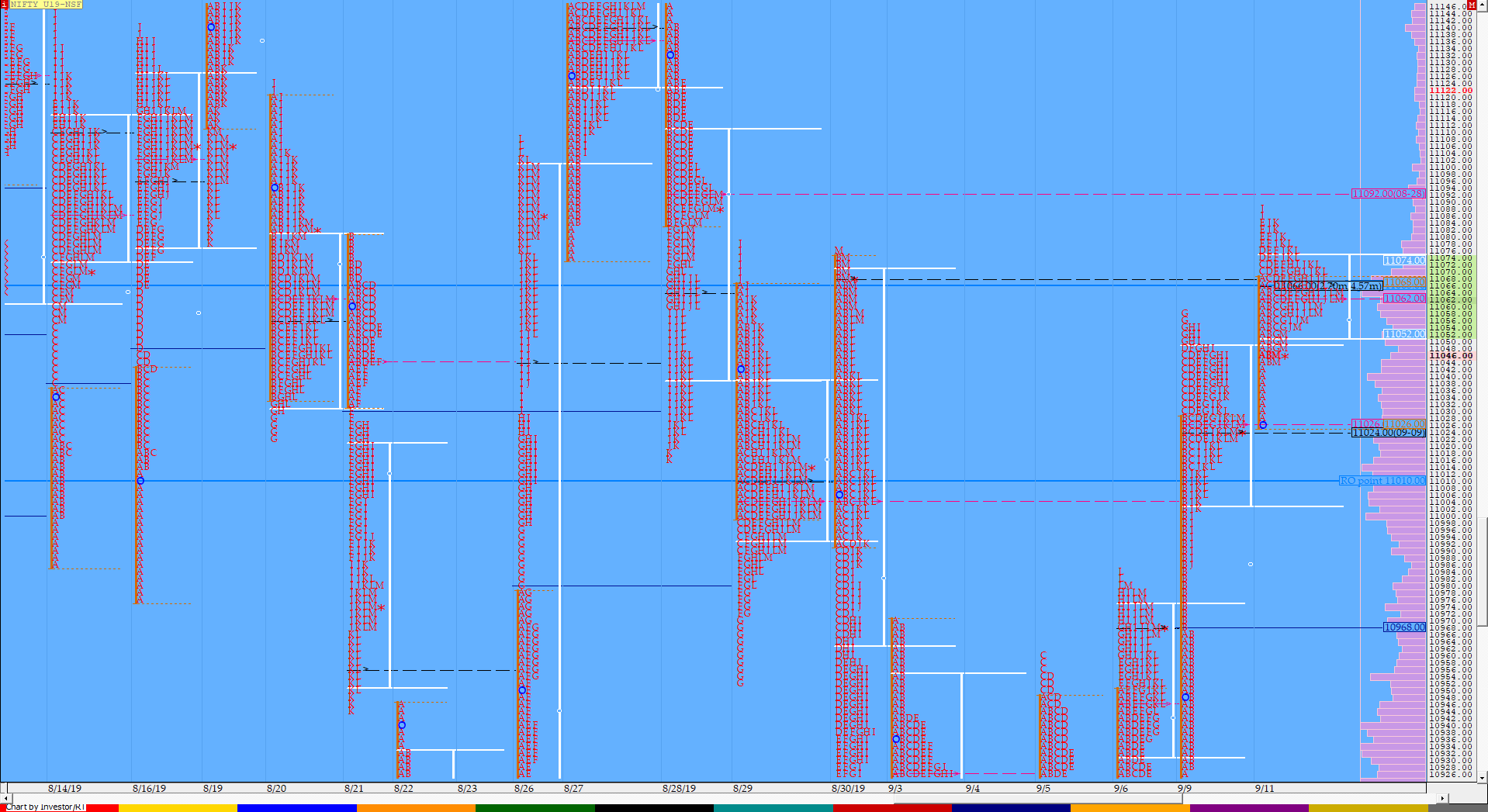

Nifty Sep F: 11061 [ 11088 / 11026 ]

NF opened above the yPOC of 11025 with a OL (Open=Low) start at 11026 and drove higher though on low volumes to get above PDH (Previous Day High) and making a high of 11069 in the A period after which it made an inside bar in the B period while confirming a small buying tail from 11044 to 11025 in the IB (Initial Balance) which had a narrow range of just 43 points. (Click here to view the profile chart for September NF for better understanding) The auction then made multiple REs (Range Extension) to the upside over the next 3 periods as it finally tagged that FA of 11079 but as mentioned in yesterday’s report, this was a strong supply zone which needed big initiative volumes to be taken out which was missing as NF left a pull back high of 11085 in the ‘E’ period and gave a dip below VWAP in the ‘G’ period to tag 11048. There was another probe higher as NF got above VWAP and went on to make marginal new highs of 11088 in the ‘J’ period but once again got stalled indicating that the supply is still persisting and the failure of NF to even tag the 1.5 IB move led to a liquidation break in the last 3 periods as the auction made lows of 11045 taking support right at the morning tail to leave a nice balanced profile for the day and closing at the prominent POC of 11060. Value was once again higher for the day but the range contracted and in fact was the lowest in the past 2.5 months suggesting poor trade facilitation. NF needs to take out the vPOC of 11091 for more upside in the coming session(s) and has immediate support at 11040-25 below which it could get weaker for a visit to the vPOC of 10886.

- The NF Open was an Open Drive Up (OD) on low volumes

- The day type was a Normal Variation Day (Up)

- Largest volume was traded at 11060 F

- Vwap of the session was at 11065 with volumes of 79.9 L and range of 62 points as it made a High-Low of 11088-11026

- NF confirmed a FA at 10960 on 05/09 which was negated on 06/09 as NF closed above it. This FA got revisited again on 09/09 but closed above yet again so the 1 ATR move of 11124 is still open till 10960 is held.

- NF confirmed a FA at 10785 on 04/09 & tagged the 1 ATR objective of 10958. The 2 ATR move up comes to 11131

- NF confirmed a FA at 11079 on 29/08 & tagged the 1 ATR objective of 10906 on 30/08. This FA got tagged today on ‘T+7’ Days

- The Trend Day POC & VWAP of 26/08 at 10886 & 10951 would be important references on the downside.

- The Trend Day POC & VWAP of 19/07 at 11478 & 11523 are now positional references on the upside.

- The higher Trend Day VWAP of 05/07 at 11965 is another important reference higher.

- The settlement day Roll Over point is 11010

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

- The VWAP & POC of Jun Series is 11833 & 11714 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11056-11060-11078

Hypos / Estimates for the next session:

a) NF needs to sustain above 11060 for a probe higher to 11078 & 11092-107

b) Staying below 11044-40 at open, the auction can test 11025 & 11010-04

c) Above 11107, NF can probe higher to 11129-131 & 11157

d) Below 11004, auction becomes weak for 10984-967 & 10954-940

e) If 11157 is taken out, the auction can rise to 11175 / 11195-215 & 11233-238

f) Break of 10940 can trigger a move lower to 10926-900 & 10881-870

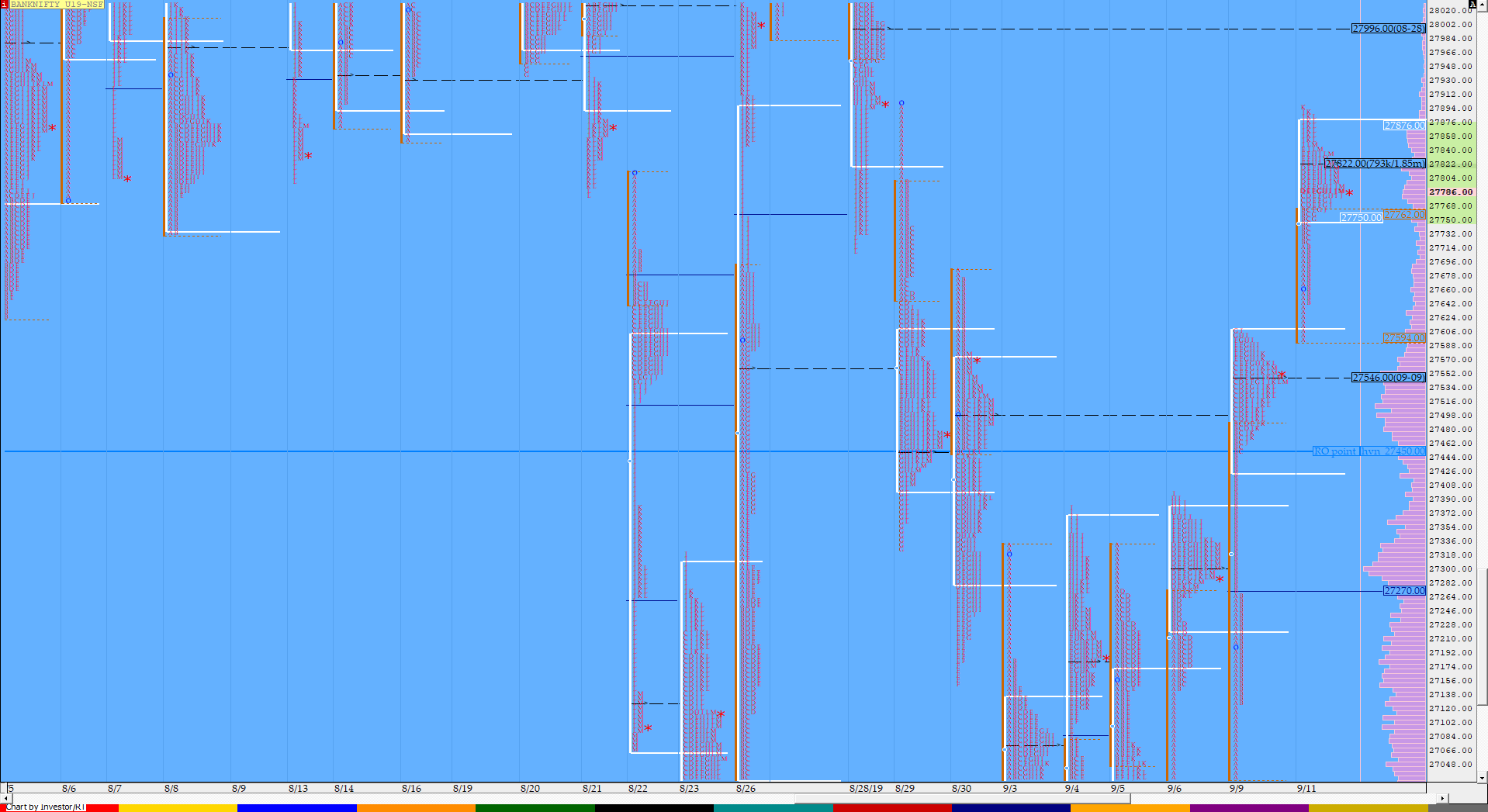

BankNifty Sep F: 27830 [ 27897 / 27594 ]

BNF opened with a gap up above PDH at 27681 and made a dip in the opening minutes as it briefly entered the previous day’s range but was rejected immediately leaving a low of 27594 which was a confirmation that the auction has not yet completed it’s probe to the upside. The auction then made a OTF (One Time Frame) move higher over the next 4 periods making multiple REs (Range Extension) as it made a high of 27843 in the ‘E’ period almost tagging the 1.5 IB after which it gave a dip to VWAP which was also coinciding with the IBH (Initial Balance High) as it left a pull back low of 27751 and resumed the probe higher as it went on to make fresh REs in the ‘J’ & ‘K’ periods where it made new highs of 27897 falling just short of the 2 IB objective. The last 2 periods saw another retracement to VWAP as BNF gave a dip of 100 points before closing around the developing POC of 27820 giving yet another ‘p’ shape profile with higher Value but contracting range of just 303 points which is the lowest in over a month. The PLR (Path of Least Resistance) however remains to the upside with immediate support in BNF at 27750 below which we have the buying tail from 27646 to the vPOC of 27550 as reference points in the coming session(s).

(Click here to view the profile chart for September BNF for better understanding)

- The BNF Open was an Open Rejection Reverse – Up (ORR)

- The day type was a Normal Variation Day (Up)

- Largest volume was traded at 27820 F

- Vwap of the session was also at 27779 with volumes of 27.9 L in a session which traded in a range of 303 points making a High-Low of 27897-27594

- The Trend Day VWAP of 19/07 at 30085 is now positional supply point.

- The higher Trend Day VWAP of 18/07 & 08/07 at 30598 & 30995 remain important references going forward

- The settlement day Roll Over point is 27450

- The VWAP & POC of August Series 27858 & 27960 respectively

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

- The VWAP & POC of Jun Series is 30914 & 30961 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 27750-27820-27874

Hypos / Estimates for the next session:

a) BNF needs to stay above 27824-835 & sustain for a rise to 27890-915 & 27996-28000

b) Immediate support is at 27760-735 below which the auction could test 27685-645 & 27576-551

c) Above 28000, BNF can probe higher to 28063-75 / 28120 & 28176-183

d) Below 27551, lower levels of 27472-448 & 27398-350 could come into play

e) Sustaining above 28183, BNF can give a fresh move up to 28237 / 28280-291 & 28346-365

f) Break of 27350 could trigger a move down 27300-295 / 27240 & 27184

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout